Banking Software

Development Services

Transform your banking operations with our banking software development company. Boost efficiency, security, and customer experience.

We’ll drive you through the whole process.

We know uncertainties businesses face both when building custom banking solutions from scratch and going through the digital transformation. And we apply that knowledge to help our partners at every stage of the banking software solution development — from initial analysis to post-release support and scaling

We treat our clients’ products like our own and stay to help and make improvements for as long as our partners need.

Digital Banking Development Services

We create digital solutions in a way that makes a difference.

Creating digital banking applications with a bigger picture in mind.

Digital banking makes it easier and faster for end-users to access services, and, simultaneously, reduce human errors and provide more opportunities for banks. Banks went digital-first nowadays, and user expectations increased significantly — core functionalities may not be enough to attract and retain customers.

Our banking software development services start with a deep business needs analysis. We strive to find solutions that are easy for both end-users and our client’s team and cover everything they may need on a daily basis. We also focus on several advanced components that make banking apps stand out:

- Strong encryption system, electronic signatures support, and tools preventing users from creating easy-to-hack passwords.

- AI-based customer support tools that free managers time for more high-level tasks.

- Intuitive onboarding process and smooth user flow that anyone can understand in seconds.

- Wide capabilities for personalization and individual user experience optimization.

We also pay attention to meeting industry standards and complying with respective regulations, and, in case of need, may create functionalities that make it easier to deal with ones.

Banking software features

we implement

- 1. Digital cash management like regular bill payments and money transfers

- 2. Personal finance planning, and easy-to-use reporting and analytics tools

- 3. Comprehensive mobile banking applications that allow management and conducting transactions

- 4. Integrations with third parties like governmental systems that ensure fast and convenient data exchange

- 5. Analytics, reporting and support processes automation

- 6. Fraud detection, secure message notifications and other tools aimed to ensure high data security

Our Fintech Clients Speak

This are how founders and C-level executives appreciate the partnership with our banking software developers

- Molo Finance

- Moneypark

Fintech & Banking Software Development Case Studies

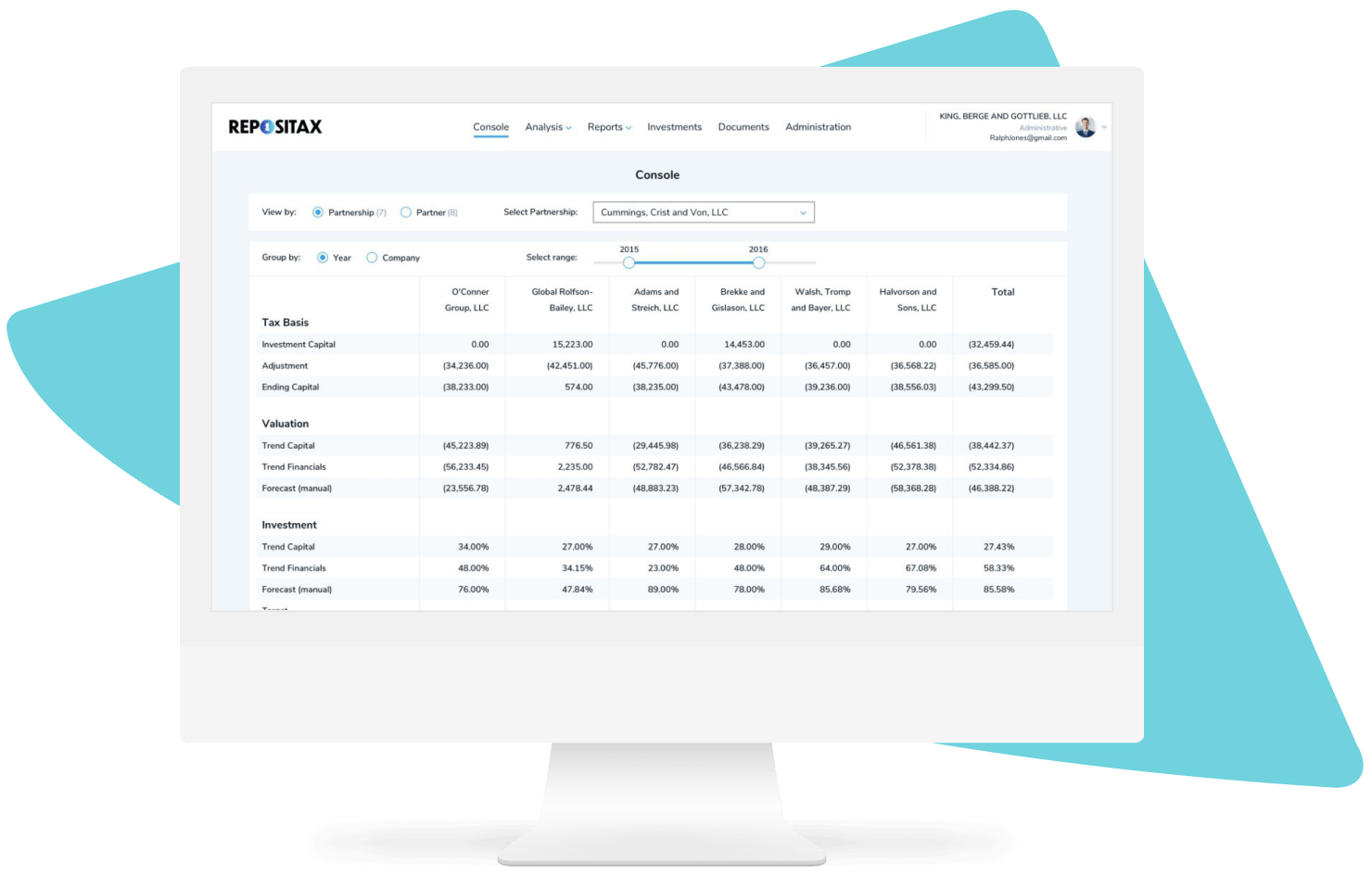

Rapid development, smooth integration with a number of third-party services, a decision engine, document generation tools and the ability to become the UK’s first digital mortgage lender - that’s what our partners got with our Python app development services.

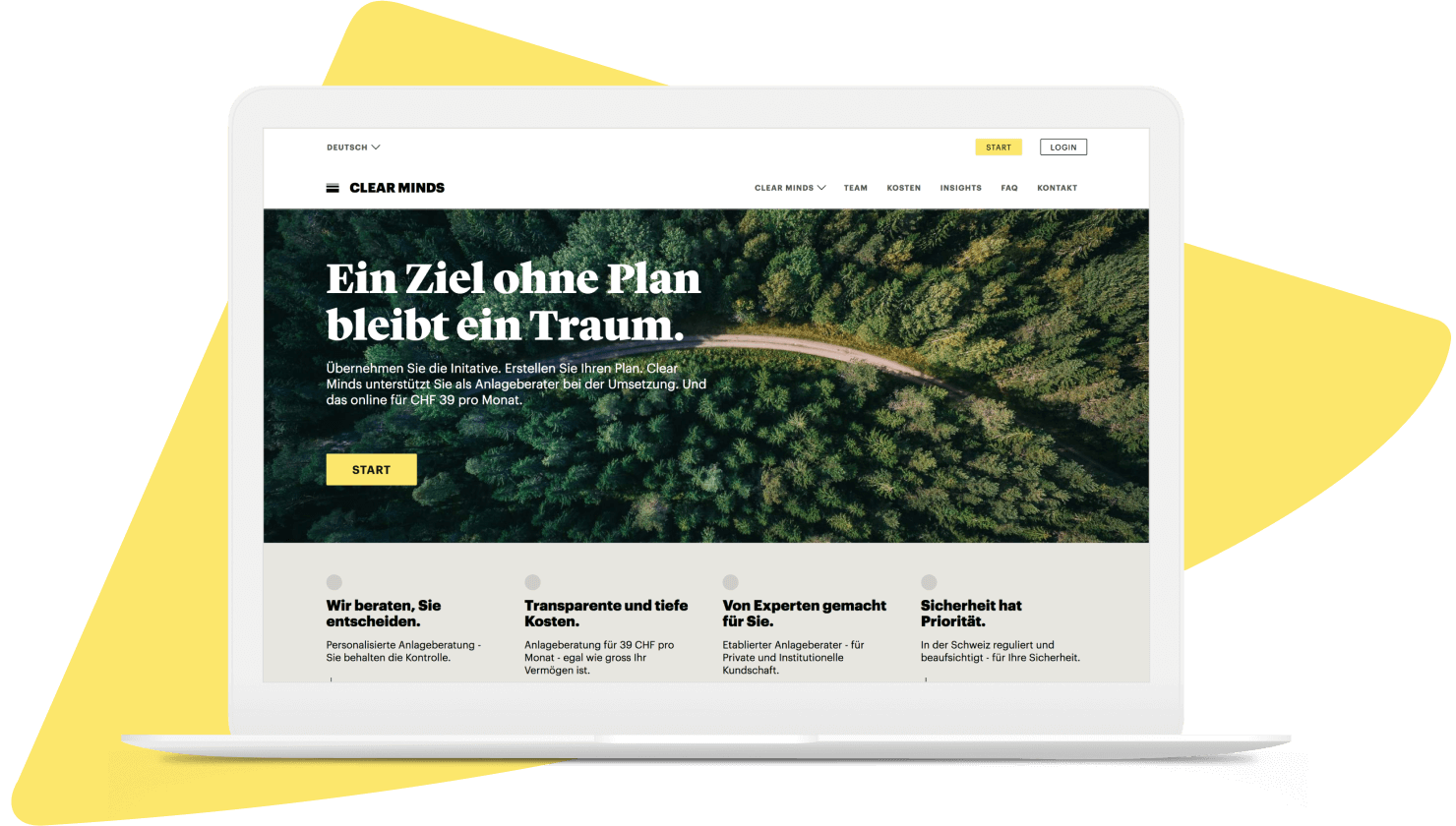

Python allows you to enhance product endlessly and be flexible with every new feature. Python libraries and open APIs helped us to develop powerful technology-based advisory platforms that can be seamlessly updated.

We help our clients with

Partner with us

- Contact Us

- Book a meeting

Your request has been successfully sent.

Your request has been successfully sent.

Frequently Asked Questions

Software development for digital banking offers several benefits, including enhanced convenience for customers with 24/7 access, secure online transactions, personalized financial management tools, streamlined account management, efficient payment processing, real-time notifications, seamless integration with third-party services, and improved customer engagement through personalized experiences.

When choosing a digital banking solutions development partner, consider the expertise in fintech, experience with similar projects, technical proficiency, security measures, ability to customize solutions, agility, robust support and maintenance services, and a collaborative approach to understand and meet your specific business requirements.

With digital banking development services, customization for your business-specific needs can be achieved through tailored user interfaces, integration with existing systems, personalized account features, specialized transaction workflows, custom security measures, API integrations, white-label solutions, and scalable architecture. This ensures that the digital banking solution aligns precisely with your business requirements and enhances customer experience.