Money Park chose us due to our deep expertise across mortgage software development, Python, and Django, and a perfect match of our processes and development cultures.

Money Park reached us in 2012 when they were in the process of designing an intermediary platform aimed to cover mortgage, investment, and retirement planning. The solution they had in mind was quite complex, and Money Park needed additional resources in order to maintain a steady development pace and build a sharp MVP for their fintech mortgage broker platform.

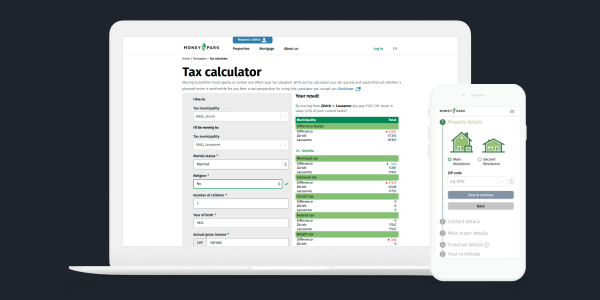

- Build a fully-functional MVP for the online mortgage broker

- Empower Money Park to keep the development pace

- Cover project testing and quality assurance