Lending Management Software

Development Services

Transforming ideas into elegant lending software solutions..

We design secure and fast p2p lending software to skyrocket the lending industry.

When creating lending software apps, we think ahead and strive to ensure the product will not only launches successfully but finds market fit and easily scales when it is time to. That’s why we pay special attention to the pre-development stages of the project — after our lending app developers drive our clients through them, it’s easy to set up a transparent, predictable, and secure product creation process.

And we believe that only solutions built in that way are able to innovate the lending industry.

Our Lending Software Development Services

We design reliable and scalable lending software solutions with clear user flow and help after the product is released.

Lending management software empowered with ‘think ahead’ approach.

We are about fintech products that are built to last, and our processes and approaches are designed in a way that lets us create ones. Our digital lending platform development company prefers to conduct a comprehensive analysis, make sure that the app finds market fit, create an intuitive user flow, and ensure secure architecture meeting industry standards in the early stages. In a word, we do everything to make the product enter the market successfully and get an audience, and support it as long as needed.

We also focus on several things that are crucial for a lending solution:

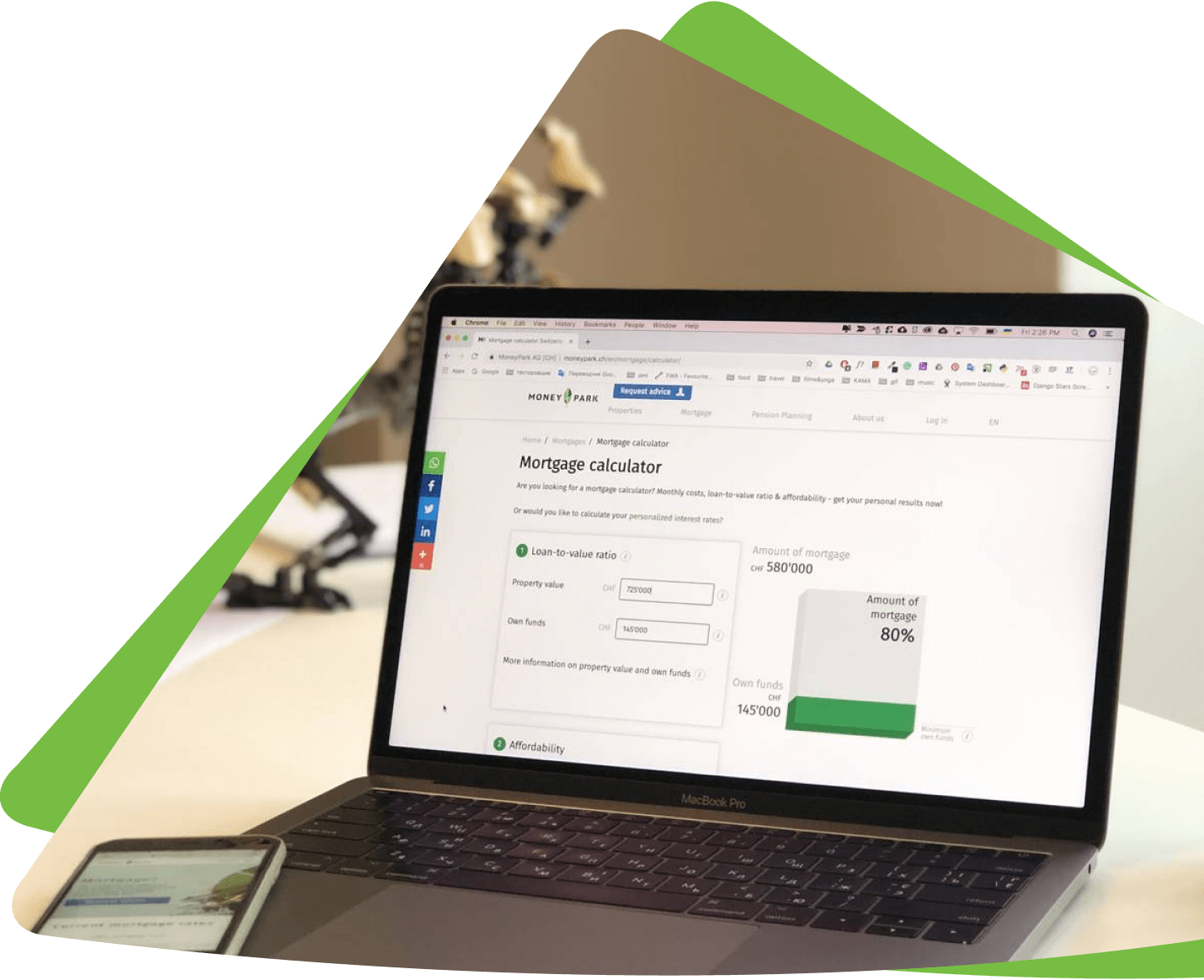

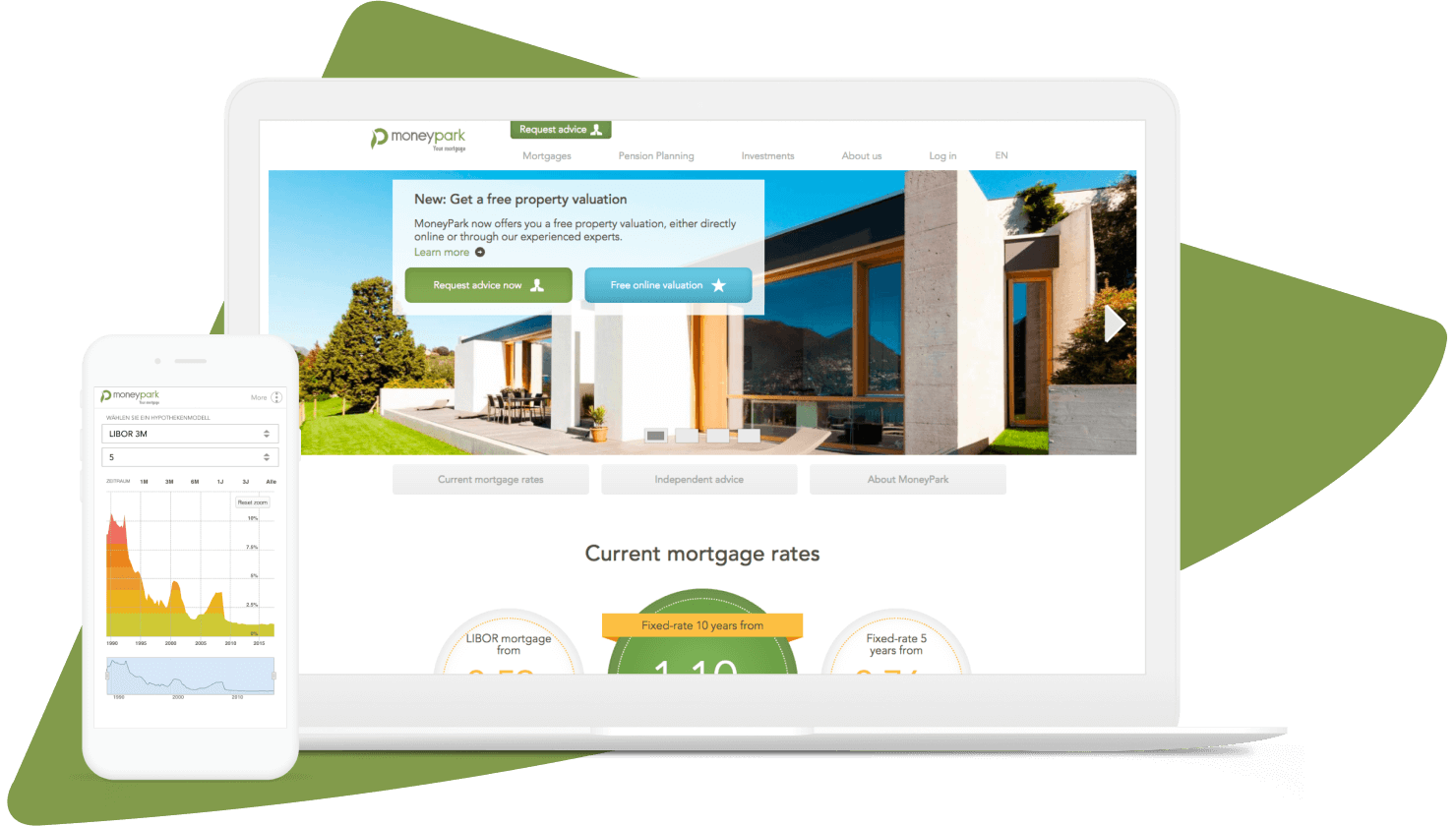

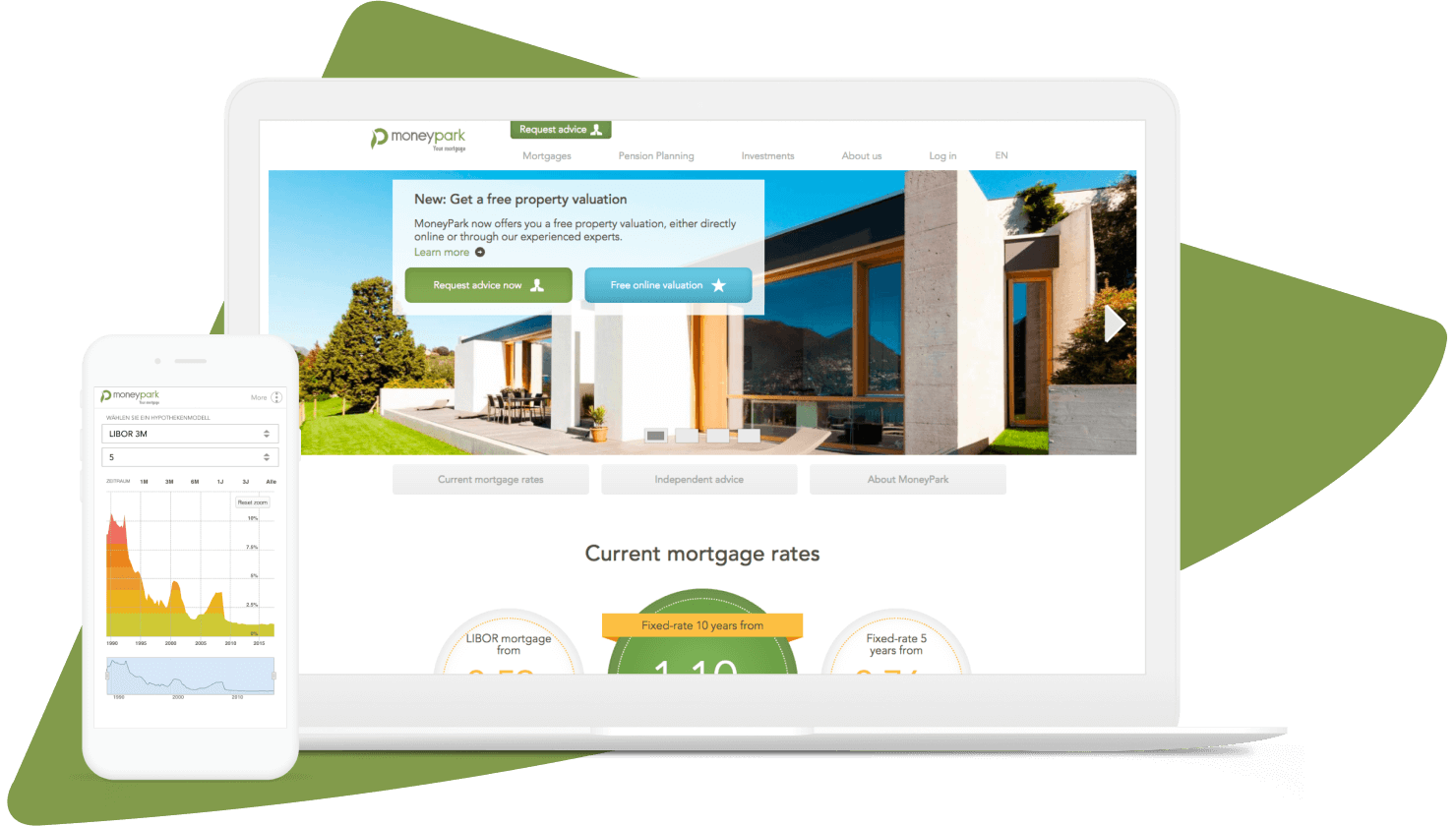

- Fast and clear lending and affordability calculators, property valuation tools, and online advisory services (both automated and human). Users go online to save time and efforts, so lending software must ensure it in a flawless way.

- Accessibility and ease of use. Taking into account that the lending industry implies large volumes of data and charts, both web and mobile applications should display everything in a clear and well-structured manner.

- Integrations with third-party services that provide data to make calculations, advising, and speed up the lending process — the ones with banking and governmental institutions.

As a lending software development company, we’ve designed solutions for highly competitive markets, including the Swiss, UK, and US ones, and know well what to pay special attention to. And we never hesitate to explain it in detail to our partners.

Lending software solutions

we implement

- 1. Property valuation tools

- 2. Lend management modules

- 3. Automated advisory tools

- 4. Legal maintenance instruments

- 5. Loan affordability calculators

- 6. CRM systems

Our Fintech Clients Speak

We follow the approach that brings our and the client’s teams closer together. And here’s what C-level executives say after our collaboration.

- Clear Minds

- Molo Finance

Our lending app development portfolio

Rapid development, smooth integration with a number of third-party services, a decision engine, document generation tools and the ability to become the UK’s first digital mortgage lender - that’s what our partners got with our Python app development services.

Python allows you to enhance product endlessly and be flexible with every new feature. Python libraries and open APIs helped us to develop powerful technology-based advisory platforms that can be seamlessly updated.

Partner with us

- Contact Us

- Book a meeting

Your request has been successfully sent.

Your request has been successfully sent.

Frequently Asked Questions

Our process for developing lending software involves several steps: requirement analysis, design and prototyping, development of the lending platform, integration with financial data sources, implementation of loan processing workflows, risk assessment models, testing for functionality and security, deployment, and ongoing support. It includes tasks such as borrower onboarding, loan application processing, underwriting, documentation management, disbursement, and repayment tracking. The process is customized to meet the specific needs of the lending business and regulatory requirements.

We ensure compliance in lending software through various measures. These include incorporating regulatory requirements into the software design, implementing Know Your Customer (KYC) and Anti-Money Laundering (AML) checks, adhering to data protection and privacy regulations, conducting regular audits, monitoring regulatory changes, and collaborating with legal experts to ensure the software meets industry-specific compliance standards.

The development timeline for a lending software solution varies based on factors like complexity, scope, and team size. Typically, it takes several months to a year for development, testing, and deployment. However, the specific duration can be determined by assessing project requirements, desired features, integrations, and customization needs in consultation with a lending software development team.