Top 10 Insurance Software Development Companies

The creation of software for insurance requires unique industry experience, regulatory knowledge, and technical know-how. Choosing the right insurance technology partners is the only fail-proof way to avoid risks, cut costs, and save time while getting a high-quality business solution.

Insurtech is a large and highly demanded market segment valued globally at over one trillion dollars by 2025. Insurance software development companies have a very responsible job of assisting the digitization of insurers’ often confidential operations.

This article highlights a list of insurance software development companies based on their domain expertise, technology stack, team size, hourly rates, and global client impact, offering a diverse mix to fit different business needs.

List of Top 10 Insurance Software Development Companies

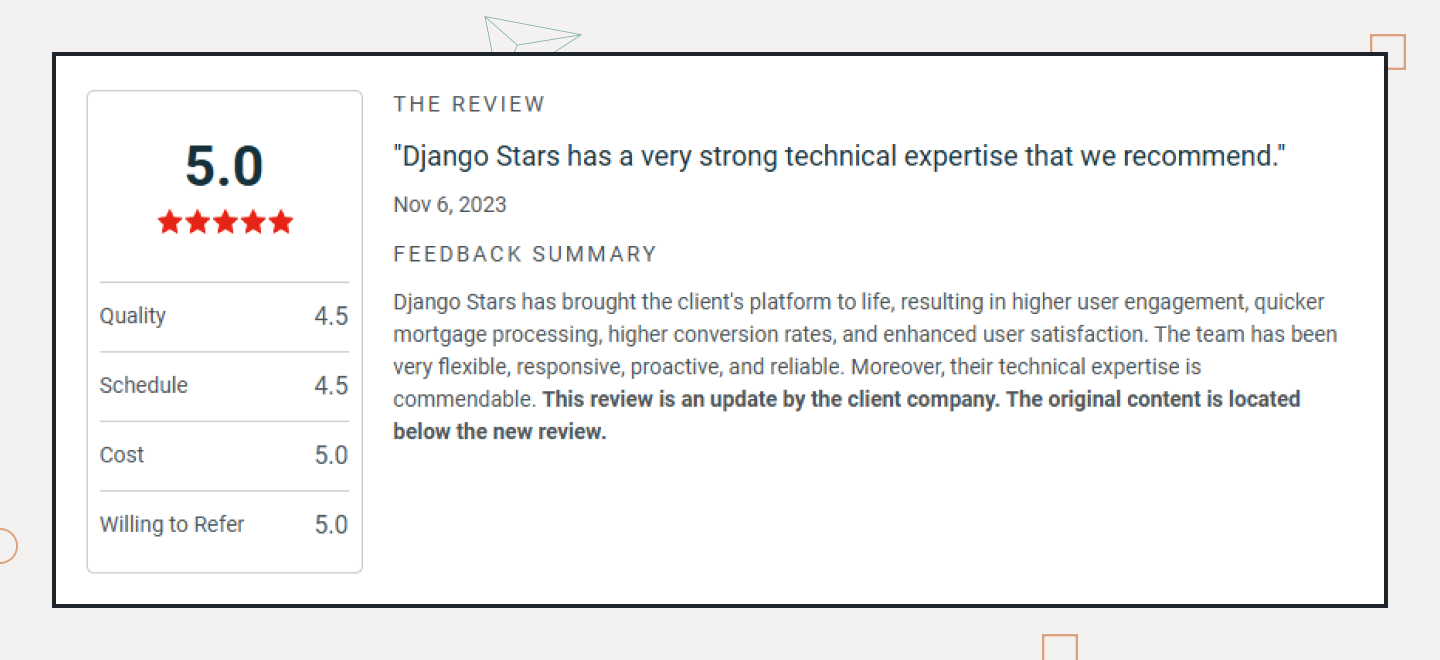

Django Stars

Django Stars is a leading insurance software development firm with a large staff and an extensive stack, with a particular focus on fintech and insurtech. The company specializes in full-cycle, all-purpose bespoke software development, building solutions for policy and claims management, underwriting, billing and commission, regulatory compliance, and more. They also craft mobile insurance apps, analytics and reporting dashboards, and insurance CRM systems honed to streamline and facilitate the insurance pipeline to the maximum. Alongside custom insurtech development, Django Stars provides legacy system modernization and insurtech consulting services to organizations in the domain.

Services and expertise: Custom insurance software development, full-cycle web and mobile app development, startup services (discovery, POC and MVP development), legacy modernization, UI/UX design, support and integrations, and more.

Tech stack: Python, Django, React, Vue, Angular, Swift, Objective-C, Kotlin, Xamarin, React Native, Flutter, GitHub, Kubernetes, Docker, AWS, Azure, and more.

Team size: 100–200 employees

Hourly rates: $50-99

Worldwide: USA, UK, Canada , Europe

Clients: Lendage

Duck Creek Technologies

Duck Creek is a competent insurance software development services company that focuses on in property and casualty (P&C) insurtech solutions honed to grow distribution channels, accelerate time-to-market, and humanize workflows. It excels at crafting cloud-based SaaS core systems and low-code, configurable platforms that help insurers streamline their pipeline and enhance customer experiences.

Services and expertise: Lifecycle insurance agency software development with an emphasis on cloud-native platforms for claims processing, policy administration, billing, and customer interaction, creating dedicated reporting and analytics tools.

Tech stack: Microsoft Azure, Azure SQL, C#, Visual Studio, .NET, Vuetify, RxJS.

Team size: 1,500–1,800 employees

Hourly rates: $57-90

Location: Headquarters in Boston, MA, two branches across the USA, and five branches in Canada, India, Australia, France, and Poland.

Clients: UniGroup, Saxon, Aspen Insurance, AIG, Geico, The Hanover Insurance Group, and more

Damco Solutions

Damco Solutions is a vetted insurtech software development company poised to enable businesses in the sector to unlock efficiency on every stage of the industry pipeline. Its end-to-end, easy-to-deploy digital solutions for enterprises in the vertical benefit insurers, brokers, agents, adjusters, and other stakeholders.

Services and expertise: Bespoke AI-driven and automated solutions, legacy system modernization, digital transformation, property damage estimation, document processing software, and Salesforce for insurance.

Tech stack: WebSockets, Angular, ReactJS, Node.js, Python, PHP, Laravel, Express.js, MySQL, MongoDB

Team size: Around 1,600 employees

Hourly rates: $50-99

Location: New Jersey, USA; Dubai, UAE; Faridabad and Noida, India; Luxembourg.

Clients: Co-Operators General Insurance Barbados, New India Assurance Trinidad & Tobago, and others.

Guidewire Software

Guidewire Software is one of the best insurance software providers, offering an entire professional suite for businesses. This insurance software development firm provides both a comprehensive insurance lifecycle solution and standalone products related to workers’ compensation, excess and surplus, usage-based insurance, embedded insurance, parametric insurance, and more.

Services and expertise: Insurance core platform, analytics and AI products, a system for third-party services and add-ons, digital transformation, and legacy modernization services.

Tech stack: TypeScript, Java, JavaScript, Go, React.js, Spring Boot, AWS, Docker, Kubernetes, Kafka, EMR, Flink, Spark.

Team size: 3,700+ employees

Hourly rates: $80-120

Location: Alabama, Minnesota, Massachusetts, Pennsylvania (all USA), and also in Brazil (Saõ Paolo and Curitiba) and Canada.

Clients: Alfa Insurance, Auto Club Enterprises, Apollo Group, Capital Insurance Group, Beneva, Texas Mutual, Rakuten, Germania Insurance, and more.

Vertafore

Vertafore is this year’s winner of a Globee Award for innovation, given to insurance software developers who excel at simplifying and automating insurance distribution. The vendor reports over 160,000 management system users across 15,000 agencies and 1,200 carriers and positions itself as a wholesale brokerage and binding firm, empowering insurance experts with specialized solutions.

Services and expertise: Agency management systems and compliance software for carriers, agencies, and MGAs, AI and machine learning solutions, rating and quoting tools.

Tech stack: Python, Java, JavaScript, Drupal, CSS 3, AWS, Scala, BootStrap, CloudFlare, Acquia, Modernizr.

Team size: Around 2,500+ employees

Hourly rates: $63+

Location: 7 branches in the eastern and central USA, two branches in India, and one in Canada.

Clients: DUAL Group, MMG Insurance, Connor Insurance, Harbor Brenn, ETA Insurance Group, Marshall & Sterling, Acorn Life, and more.

Clover Dynamics

Clover Dynamics is a type of insurance software developers that provides you with tailored, innovative solutions and revolutionizes the handling of complex insurance tasks, including underwriting, claims management, and fraud detection. Their products are scalable, efficient, and secure.

Services and expertise: Custom insurance software development, policy management systems, AI-fueled underwriting and risk analysis solutions, insurance quote and pricing engines, fraud detection and prevention systems.

Tech stack: Node.js, React, React Native, Angular, Kotlin, Vue.js, Swift, AWS Bedrock, LangChain, TensorFlow, PyTorch, LlamaIndex.

Team size: Around 250 employees

Hourly rates: $25-49

Location: Lviv, Ukraine, Krakow, Poland.

Clients: Undisclosed

Belitsoft

Belitsoft is one of the best insurance software providers, with in-depth expertise in the insurance industries of the USA and Great Britain, and a medical claims management system for a major American agency under its belt. Besides, Belitsoft is among those insurance software development outsourcing companies that also offer software testing, staff augmentation, and IT consulting services to all kinds of businesses.

Services and expertise: Custom software development for life insurance, P&C insurance, and health insurance, software modernization, digital transformation, cloud migration, software testing.

Tech stack: Java, Angular, React, Python, PHP, .NET, iOS, Android, C#, Vue.js, Node.js, Xamarin, Laravel.

Team size: 250+ employees

Hourly rates: Undisclosed

Location: USA, UK, and Poland.

Clients: John Hancock, Insly, and others.

Cognizant

Cognizant is one of the seasoned insurtech software companies that prioritize delivering cutting-edge solutions honed to meet contemporary customers’ demand for risk-free, personalized online experiences. Their disruptive products help automate industry workflows and reduce manual tasks, thus enhancing operational efficiency and reducing costs.

Services and expertise: Insurance platform modernization, life & annuity solutions, P&C insurance, data & AI for insurance, insurance innovation as a service.

Tech stack: Java, JavaScript, HTML5, Python, C++, Spring Boot, React, Kubernetes, Docker, GPT-3, AWS, Kaggle, and various proprietary AI platforms.

Team size: 340,000+ employees worldwide

Hourly rates: $23-30

Location: Headquarters in New Jersey, USA, and a network of branches across all continents (in Argentina, Belgium, Australia, China, Canada, France, Germany, etc.).

Clients: Talcott Resolution, National Insurance Company Limited (India), various US and UK carriers.

eSparkBiz

eSparkBitz is among insurance software vendors seeking to give their customers a sharp competitive edge and tackle their toughest challenges with automation and AI. eSparkBiz’s optimized cost and global delivery make it a number-one choice for companies seeking to harness accelerated digital transformation.

Services and expertise: Insurance comparison platforms, payment processing software, policyholder portals, agent portals, insurance risk management solutions, insurance chatbot development.

Tech stack: JavaScript, HTML, CSS, Angular, React.js, Python, Node.js, AWS, Azure, generative AI, NLP, machine learning.

Team size: 400+ employees

Hourly rates: $25+

Location: Central offices in India and Delaware, US, and branches in Canada, Australia, the UK, Italy, Sweden, and Norway.

Clients: An undisclosed dental insurance startup

Applied Systems

Applied Systems is a vendor whose primary forte is marrying insurance digital roundtrips with AI-driven technologies. It trains its AI models on industry-specific data, enabling their users to obtain tailored insights and facilitate insurance workflows.

Services and expertise: A suite of ready-made featured products (Applied Pay, Applied Book Builder, Applied Mobile, Applied Recon, Applied Epic, and more) that cover every stage of the insurance pipeline and every aspect of insurance routine.

Tech stack: Google Cloud, Cloudflare, AngularJS, JavaScript, Ruby on Rails, Drupal, Workstation, VMware vSphere.

Team size: 2,800+ employees

Hourly rates: $30-45

Location: Multiple offices across the US, Canada, Great Britain, Ireland, India, and Israel.

Clients: Schneider & Associates, Insurance Office of America, Bravera Insurance, HUB International, Romero Insurance Brokers, CalNonprofits Insurance Services, ReNu Insurance Group, and many more.

Conclusion

Your next insurance software project can only rely on the savviest agency to partner with. Make sure insurance software development companies you choose know their thing — this exhaustive article should help. However, it’s essential to find a firm that combines professionalism with the individualized approach and aesthetics you prefer.

If you are looking for ultimate flexibility, consult with the pros at Django Stars before you build a custom insurance platform or embark on any other software project.