SAIB chose us due to our expertise in digital mortgage solutions development.

SAIB team was not considering any other vendors — they wanted to work specifically with a team who designed Molo Finance applications.

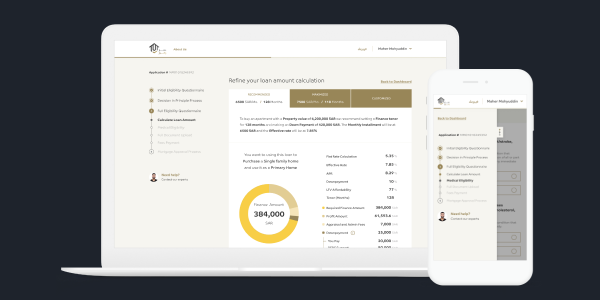

Traditionally, most operations were conducted either by phone or in person, which was inefficient and required designing a digital system from scratch — and that’s why SAIB engaged with us.