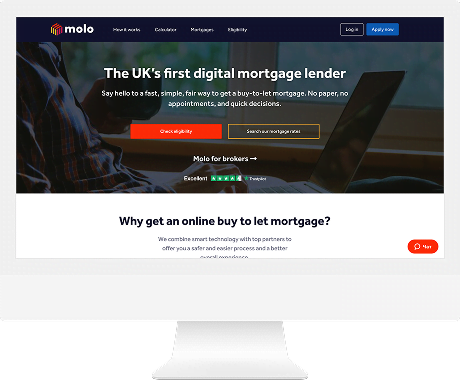

Django Stars delivers end-to-end mortgage software development services, helping lenders build fully digital, scalable mortgage platforms that automate underwriting, valuations, compliance, and customer journeys. Our solutions reduce manual effort, accelerate time to market, ensure regulatory readiness, and support sustainable growth for modern mortgage businesses.

They are deeply invested in the success, which ensures their deliverables are responsive to the need and the work is well-managed.