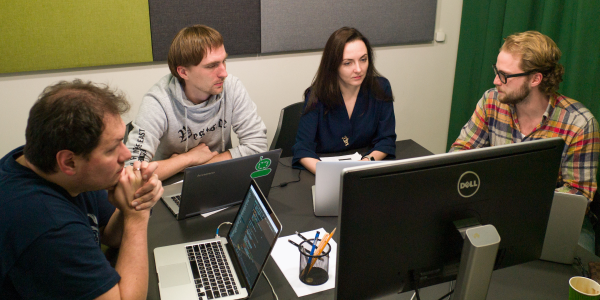

Sanostro chose us for our deep Python expertise and ability to work with complex financial systems — they were aware of it as the CTO of Sanostro previously worked with us on a Swiss investment platform. This expertise and our flexibility in terms of process organization were the key factors to choose us.

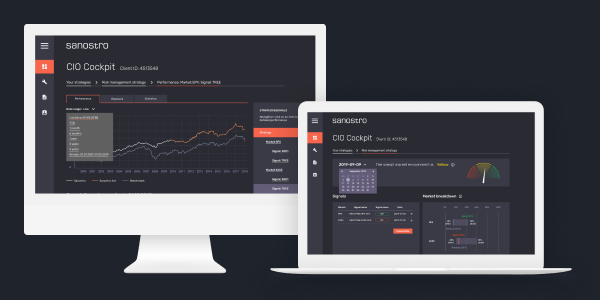

Sanostro enables banks and funds to make smarter investments by conducting investment simulations on historical data, so clients can identify the most efficient ways to diversify their portfolios. By defining the most efficient investment ratios, Sanostro helps clients to maximize profits.

When we partnered in 2018, Sanostro required a company able to help it transform a unique Matlab-based algorithm into a scalable web solution.

- Build a web-based prototype able to conduct investment simulations

- Design a web platform MVP that allows connecting to the simulations system via MVP

- Improve the system performance to accelerate calculations