Top 15 Latest Fintech Trends to Watch in 2024

The year 2023 solidified the preceding trends of 2022 turning them into best practices. After the cryptocurrency market crash, interest in blockchain initiatives dwindled, and the US Federal Reserve interest rates inflation reduced the feasibility of currency exchange projects.

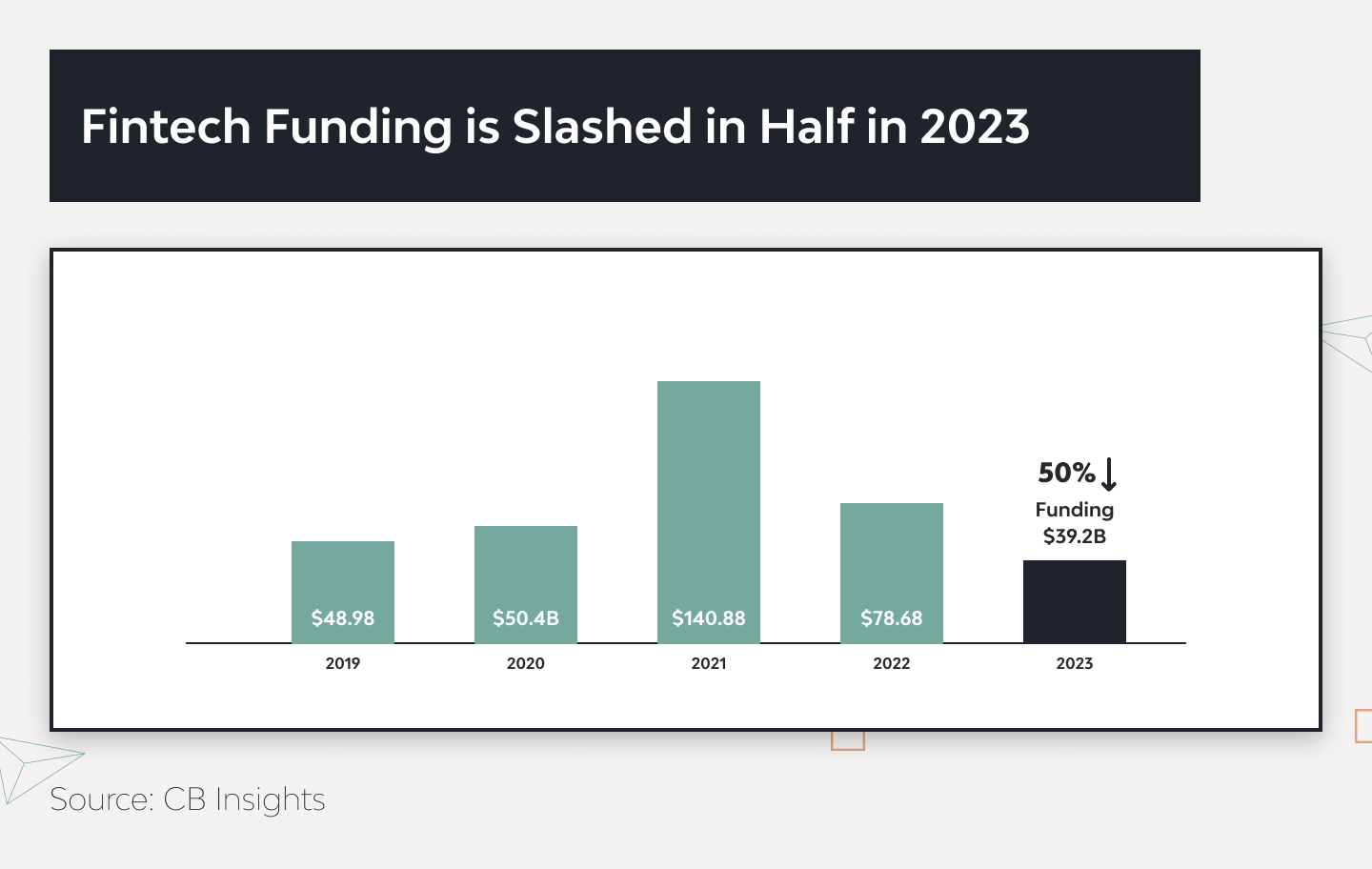

In 2023, the industry experienced a significant downturn in venture market funding, with a more severe drop-off compared to the broader venture funding landscape. Global fintech funding plummeted by 50% year-on-year (YoY) to $39.2 billion, and deal volume fell by 38% to 3,801, marking the lowest levels since 2017. Nonetheless, eight new fintech unicorns emerged in the fourth quarter of 2023. While this was a six-quarter high, it was still far below the quarterly average of 2021.

Yet there’s still plenty of opportunity in fintech for those who care to look. BNPL 2.0 is going strong, virtual bank cards and digital mortgages are growing in demand, and both regtech and AI adoption in fintech are on the rise. The key to raising funding as a fintech startup in 2024 won’t be caution and prudence: it will be developing products people will use in line with the latest global trends of fintech.

For over 16 years, the Django Stars team has been developing successful software products in highly competitive industries, which includes delivering impactful custom fintech solutions. Our clients have raised $1B+ in funding, and our average partnership period is three and a half years. All this gives us the expertise to list the 15 most prominent financial technology trends for 2024 with real-life examples (including our own case studies).

Before we start studying fintech trends, we would like to share with you our guide on banking app development.

Fintech Market Trends for 2024

Some global trends in fintech have been around for a while, and some are just gaining traction. To pinpoint the ones that will form the fintech landscape in 2024, we thoroughly researched numerous disruptive fintech trends. From a development perspective, it would be prudent to build fintech products in a way that allows for the rapid introduction of new features from the trends we’ve included in this list.

1. Virtual bank cards

Virtual bank cards are digital credit/debit cards that live in an e-wallet, not in a pocket. They’re offered by both neobanks (like Revolut, Monzo, Monobank, and N26) and traditional banking institutions like Bank of America or Capital One.

The main benefit of virtual cards is that customers can pay with them in-store via NFC or on any online platform without the risk of losing money to traditional credit/debit card fraud schemes. Every purchase from a virtual credit card is usually authorized through the customer’s banking app, so a compromised virtual card can be voided and replaced with a new one in just a couple of clicks.

Examples

Revolut, Monzo, N26, and other neobanks use virtual cards to let customers make P2P transactions, in-app purchases, and online payments before their physical card arrives. Some challenger banks also offer “disposable” virtual cards which change their details after every transaction, thus reducing the risk of fraudulent use.

2. Embedded finance

While the concept of embedded finance is nothing new, it might just be the next revolution in payments.

Non-financial entities are now offering traditional banking services through the Open Banking API. Tesla offering car insurance for each Tesla car purchased is just one example of the possibilities opening up for customer engagement.

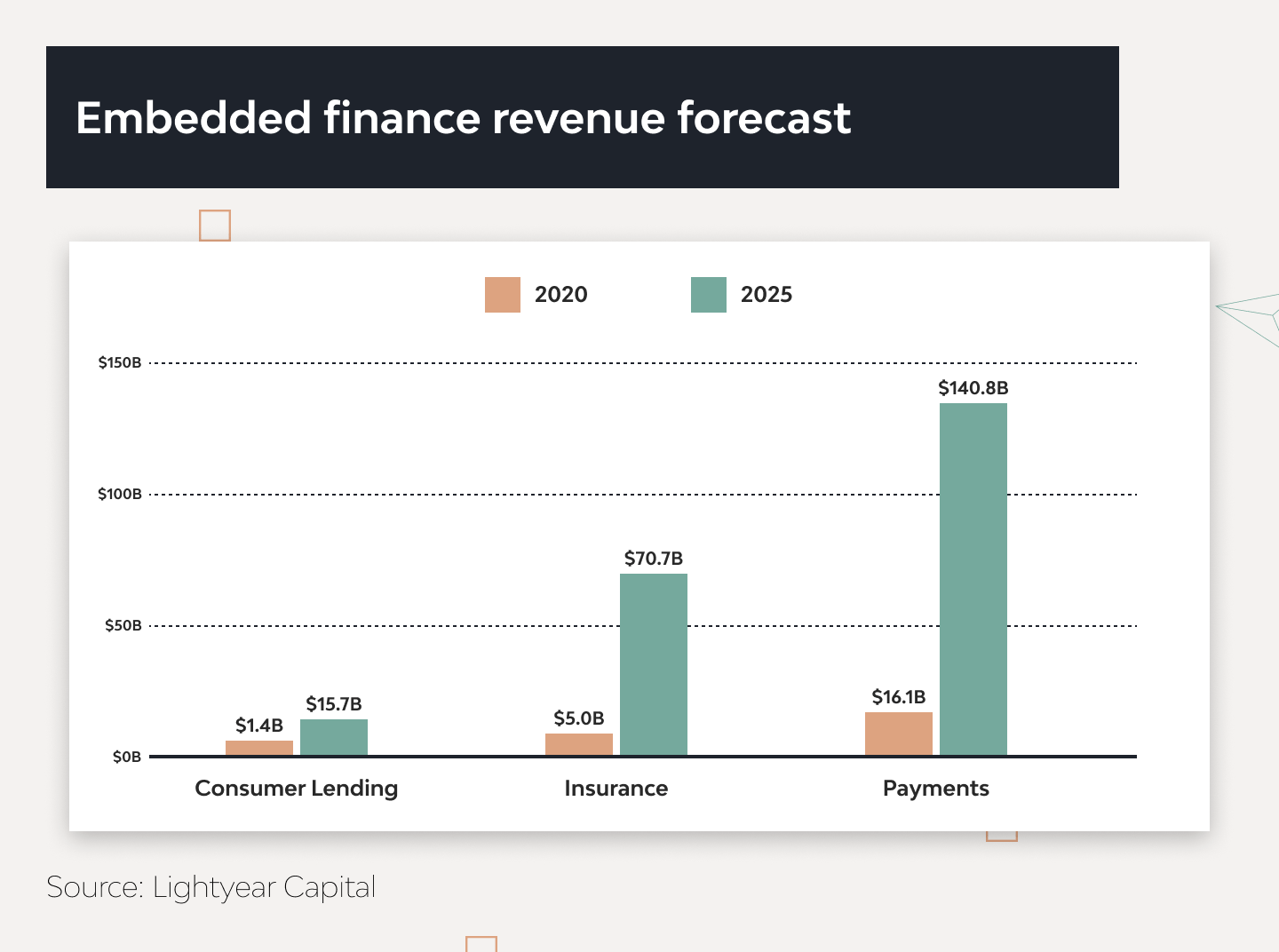

Of all the fintech trends for 2024 on our list, this looks set to be among the most disruptive. It’s no surprise that revenues are expected to skyrocket by 2025.

Examples

Klarna embedded BNPL lending, Lyft direct debit cards for drivers, Google Pay and Apple Pay embedded payments.

3. Buy Now, Pay Later 2.0

BNPL is steadily gaining popularity. This new fintech trend helps drive sales, lets customers use goods while paying for them, and contributes to long-term customer loyalty.

The problem is, with literally nothing stopping people from spending money they don’t yet have, the risk of falling into debt is high. As Juniper Research forecasts the number of BNPL users to grow from 360 million in 2022 to 900 million by 2027, this is a legitimate concern.

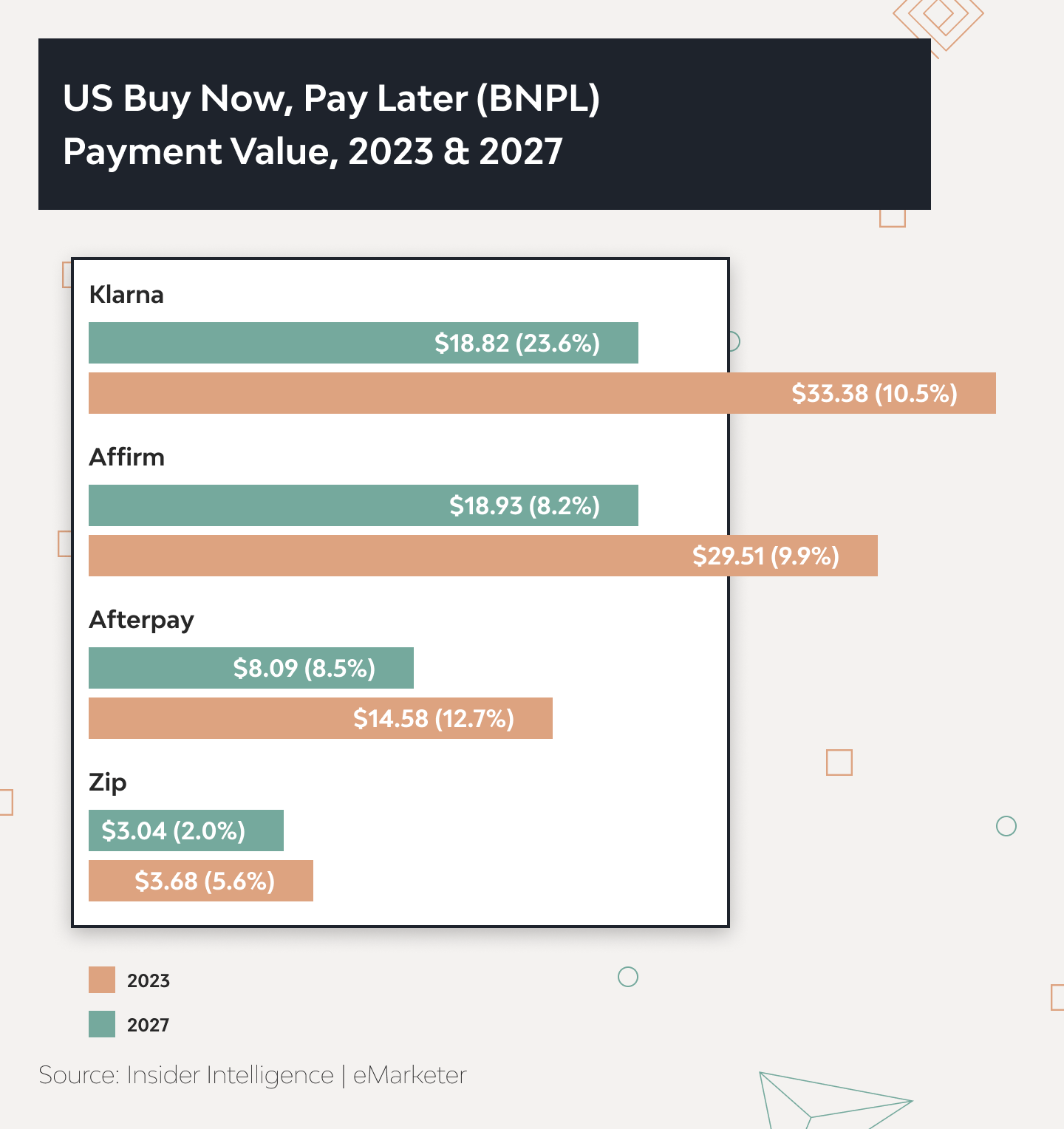

A 2023 LendingTree survey shows that at least 4 out of 10 BNPL customers are one or more payments behind. Nonetheless, the popularity of the service only grows, as shown dynamically in 2022 vs. 2023 statistics by Insider Intelligence.

The BNPL 2.0 approach — spearheaded by London-based unicorn Zilch — aims to solve the problem. Instead of earning from buyers, Zilch makes a profit from merchant commissions, meaning customers no longer have to pay charges to traditional banking institutions. The aim is to give merchants the tools needed to become firsthand BNPL providers, so customers build relationships with brands instead of just scheduling automated payments.

Examples

Klarna, Afterpay, Zilch, Apple Pay Later

4. Alternative lending

Alternative lending — also known as P2P lending — is another of the disruptive fintech trends that grew in 2022. These are loan services given through online platforms that bring together borrowers underserved by traditional lenders and investors looking to tap into alternative markets.

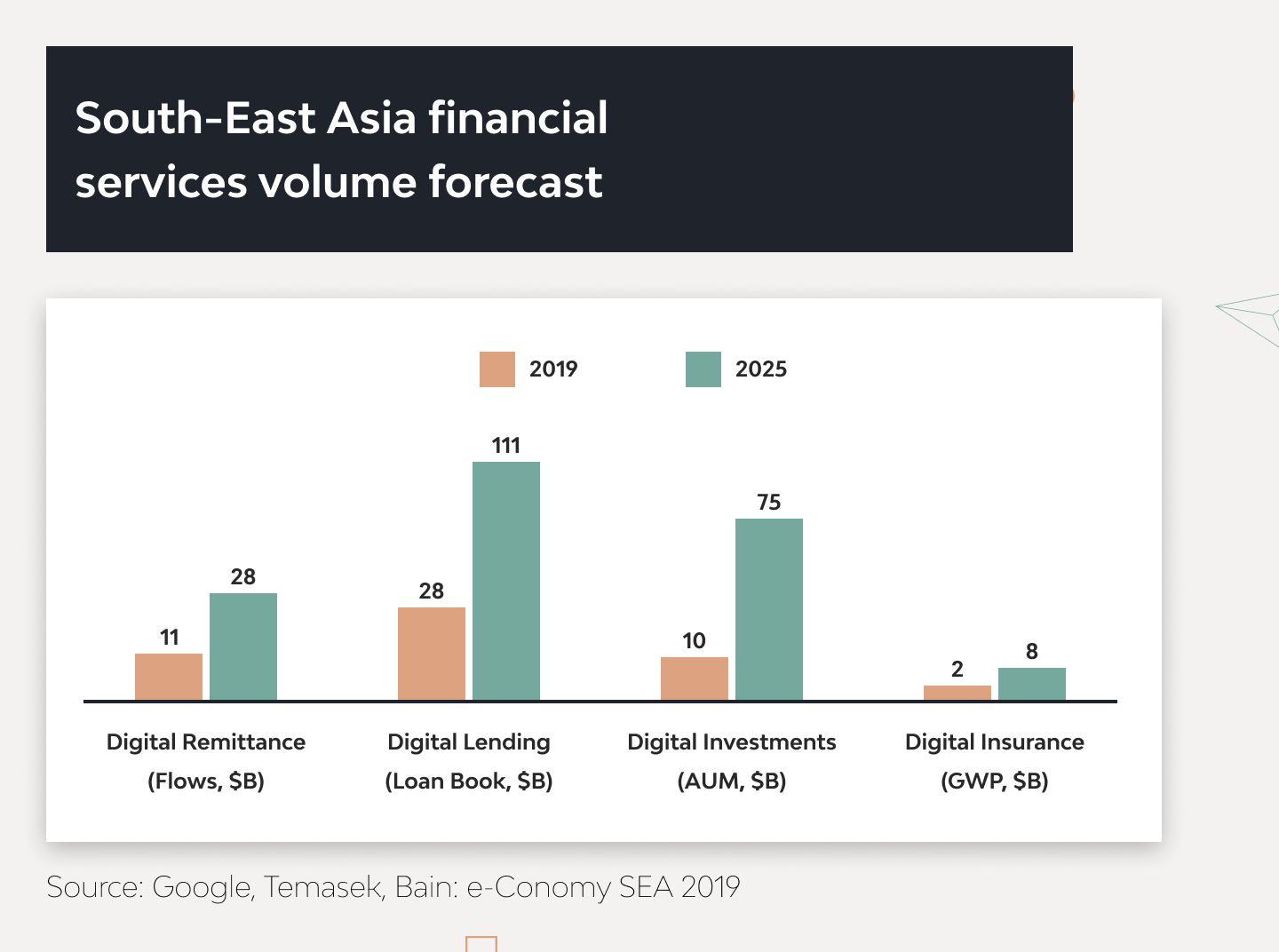

In 2022, alternative lending grew particularly popular in South-East Asia as the region recovered from pandemic-induced losses and started to develop using internal resources rather than international loans.

There are several types of alternative lending:

- Direct lending: Bank-type loans but without a bank.

- Venture debt: An alternative to venture capital for businesses that don’t want to lose equity to funding rounds.

- Structured equity products: Pre-packaged investment options that typically involve the issuance of bonds or other debt securities by the borrowing company.

- Debt financing: Non-bank cash flow lending, home equity loans, recurring revenue lending, etc.

The popularity of alternative lending looks set to continue through 2024. According to the 2024 report by Research and Markets, the alternative lending market will grow from $143.54 billion in 2023 to $190.22 billion in 2024. Thus, its annual growth rate will hit 32.5%. Its growth is marked as a tendency, as the report forecasts an annual growth rate of 31.0%. Indeed, lending startups can offer a variety of services for loan management, thus bridging the gap between borrowers and investors.

Examples

5. Proptech: Real estate ownership through digital mortgages

Mortgages account for nearly 70.21% of all loans issued to US households, which constitutes $12.14 trillion in Q3 2023, according to the Household Debt and Credit report.

Mortgage loans remain heavily bureaucratized, so digital mortgages are among the most attractive fintech trends for entrepreneurs. Proptech helps reduce the time and effort required to apply for a mortgage, get approval, and repay it cost-efficiently while complying with regulatory requirements. (By the way, learn more about how to develop a real estate app.)

At Django Stars, we’ve developed several online platforms for mortgages, including Molo — the UK’s first digital mortgage lender; Lendage — a US online mortgage broker; and Money Park — the biggest mortgage broker in Switzerland. Self-service portals, AI and ML models used for risk mitigation, robotic process automation and fraud prevention are just some of the benefits this disruptive fintech trend has to offer in 2024.

Examples

Molo, Money Park, Lendage, Sindeo

6. Alternative payment flows

People prefer to choose the way they pay for goods and services. Venmo, Stripe, Wise, and other BaaS platforms let people use ACH and wire transfers, debit/credit card transactions, and other means of payment independent of banking limitations. These platforms provide KYC procedures, fraud prevention, virtual cards and e-wallets, banking account management, and APIs for embedding payment capabilities for any business.

In 2022, Stripe and other payment processing platforms were hit hard by FRS interest rate increases and other factors, and Stripe lost 28% of its market value. Nevertheless, alternative payment flows remain among the fintech industry trends worth following in 2024.

Examples

7. Stablecoins: The new breed of cryptocurrency

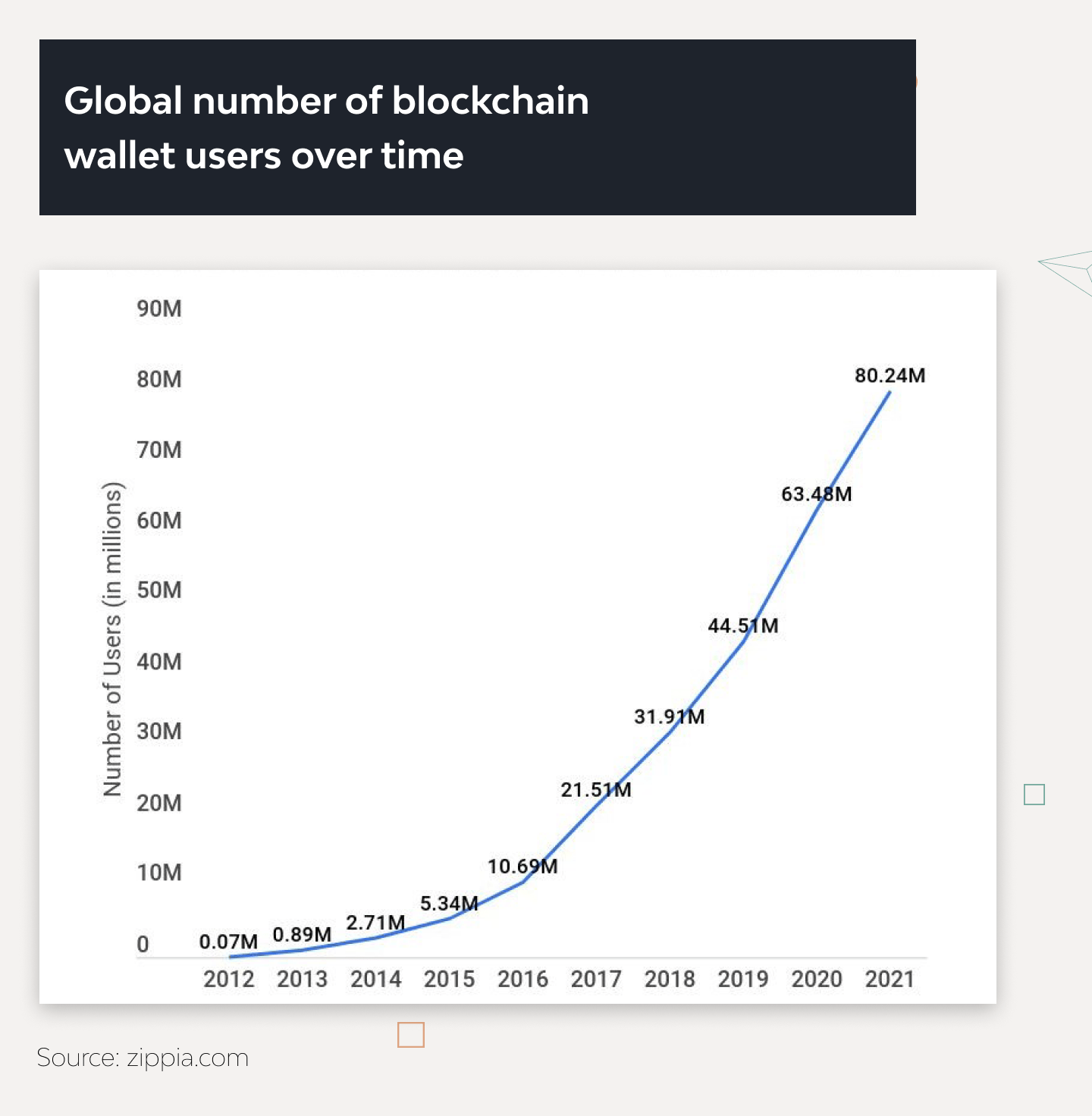

Blockchain technology, in general, is spreading, with the number of blockchain wallet users worldwide surpassing 80 million, and the total market evaluation reaching $11.5B in 2021.

However, investors express severe concerns about the profitability and feasibility of previous prognoses — especially after the catastrophic cryptocurrency cost meltdown of 2022 and the liquidation of Tree Arrows Capital hedge fund.

This is why stablecoins are now gaining traction as one of the global trends for fintech. Stablecoins combine the transparency and decentralization of a blockchain ledger with the stability of gold/dollar-backed fiat currencies, which should reduce the volatility of cryptocurrencies and serve as a reliable basis for building decentralized financial systems.

Endeavors of such scale are currently only available to governments, influential banks, and established cryptocurrency exchanges. Nevertheless, we recommend keeping a close eye on stablecoins and being ready to integrate them into a fintech product to reap the benefits of early adoption.

Examples

Tether (USDT), USD Coin (USDC), Binance USD (BUSD)

8. Capital market digitalization

One of the biggest challenges stock exchanges face is excessive dependence on political factors. Capital market digitalization counters this, as it prioritizes shareholder well-being over political necessities. This helps explain the 99.27% shareholder support at the London Stock Exchange for the LSE’s $27B acquisition of Refinitiv, one of the top financial data providers.

Digitalization will enable the LSE to embrace data and analytics as integral parts of capital management and keep a healthier distance from politically-sensitive matters. The LSE chairman considers this a compelling opportunity that will serve the company’s long-term interests.

In 2024, other stock exchanges and capital markets are expected to follow suit, which presents an excellent opportunity for daring entrepreneurs willing to explore this lucrative fintech trend.

9. AI and ML for financial technologies

Chatbots are among the hottest financial industry trends, as they enable customer self-service while also reducing the workload for customer support. Yet these are only one of many applications of ML and AI in finance.

AI algorithms work great for risk management and fraud prevention. Since the COVID-19 pandemic outbreak, fraud cases have skyrocketed in line with the e-commerce boom. ML models help analyze multiple factors to identify potential fraudsters before they can do any serious harm: one case study reports a 20% reduction in investigative workload when combating fraud using AI.

Examples

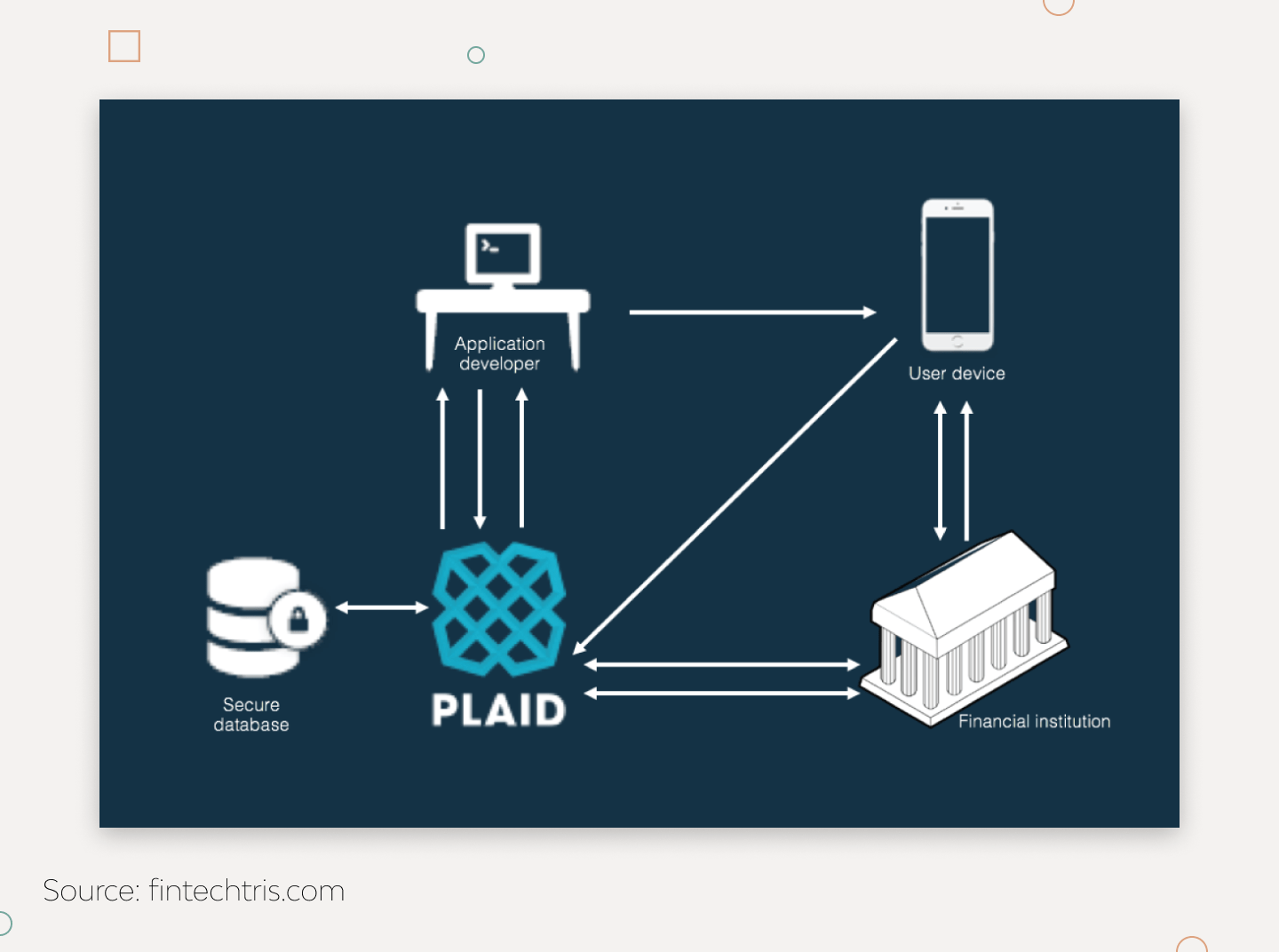

Plaid, a financial data aggregator, uses AI and ML models in risk mitigation and fraud prevention. Acting as a super-connector between fintech app users and banks, Plaid builds real-time fraud detection models with multiple unique patterns that help analyze ongoing transactions and reduce losses from fraud.

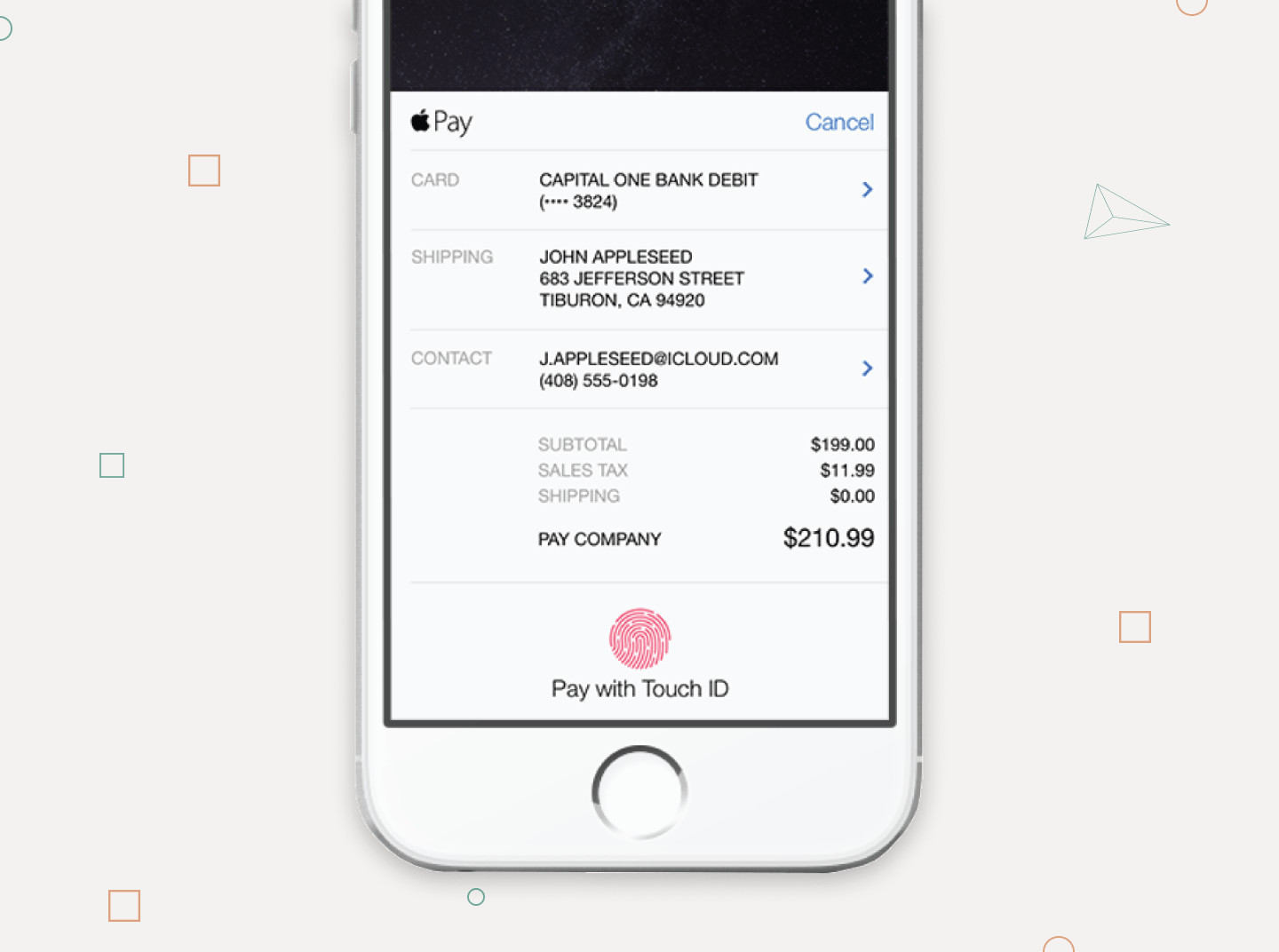

10. Biometrics

Fintech is spearheading the adoption of innovative technologies such as biometrics to improve customer experience compared to traditional banks. What could be easier for a user than to approve a transaction with their fingerprint or a selfie? The current biometrical identification options are listed below:

- Retina scans

- Fingerprints or Touch ID

- Keystroke dynamics

- Facial recognitions

- Voice patterns

- Palm geometry

Naturally, these methods should be used only as a part of two-factor authentication or for whitelisted transactions. Combining several of them will provide much stronger security than simple passwords allow, and that is why biometrics is sure to remain one of the prominent fintech trends for 2024.

Examples

AmEx, Deutsche Bank, Apple, and other world-leading companies have already integrated Touch ID with their apps. Django Stars also has ample experience integrating biometrics with personal finance app development.

11. Gamification

Finances are serious enough — there’s no need to make them more stressful. Gamification is one of the important current trends in fintech, rooted in bonus and loyalty programs from decades ago.

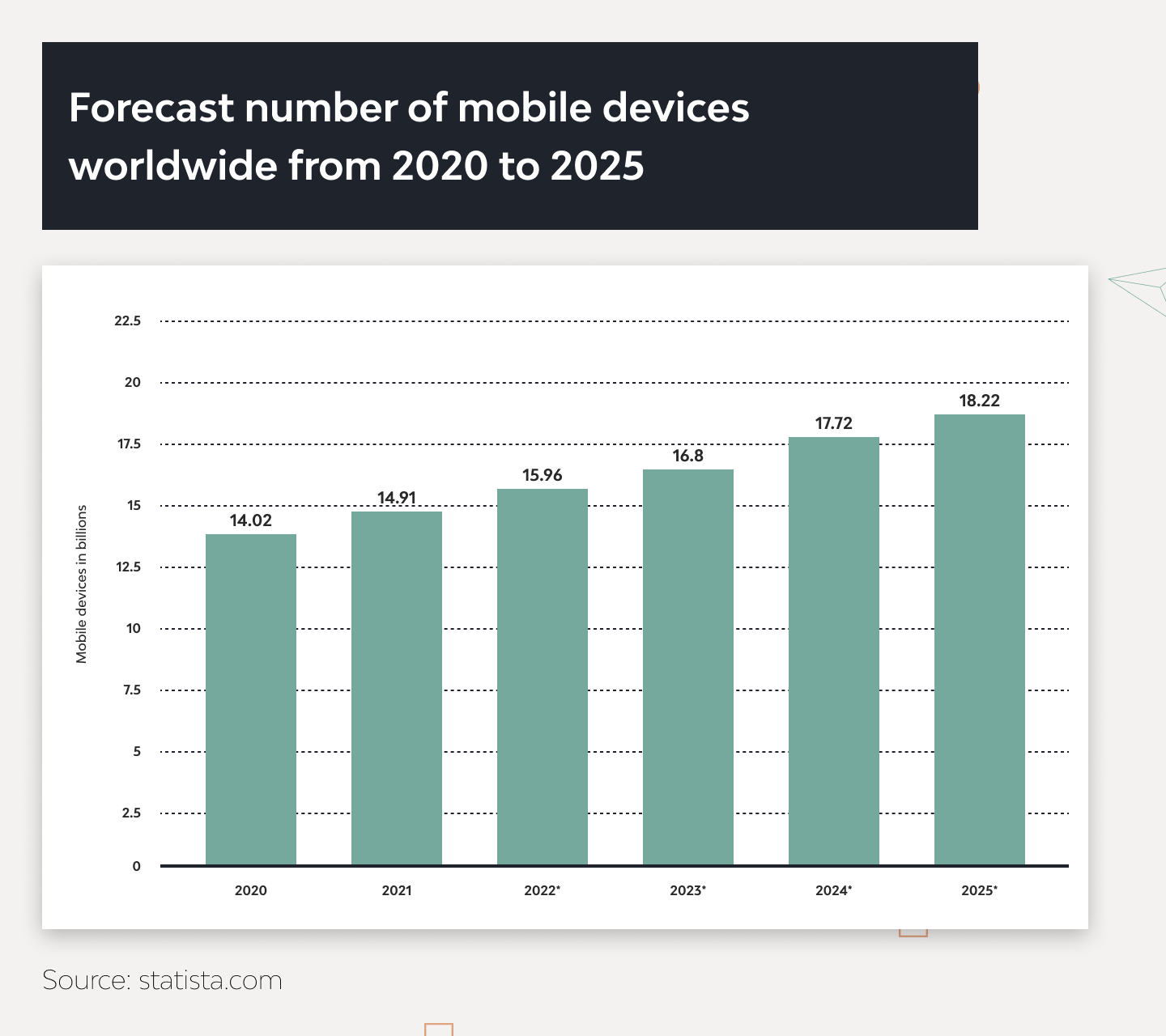

As demographics change (urban populations buy 1 billion new smartphones and tablets yearly, and millennials and Gen Z prefer fintech apps to traditional banking), it’s obvious that accruing loyalty points is not enough to retain a fintech customer. What else can be done?

- Ukraine’s Monobank and many other neobanks like Monzo or N26 provide badges and digital awards for completing certain achievements (booking tickets three times or making five online purchases, etc.).

- FortuneCity helps build good financial habits by turning every expense or earn into a virtual city feature and rewarding frugal actions with in-app coins. This motivates users to record every transaction, track patterns, develop healthy habits, and minimize wasteful spending.

- eToro helps people invest like pros by allowing users to imitate successful investors within the app and paying bonuses to investors based on their number of imitators. This incentivizes investors to execute winning strategies, which benefits both the investors and their following.

Imbuing various gamification techniques helps a fintech app stand out from the crowd, gain word-of-mouth advocacy, and succeed. At Django Stars, we predict that gamification in banking will remain an important fintech trend in 2024.

12. Distributed Ledger Technology (DLT)

Also known as DeFi (Decentralized Finances), distributed ledger technology is where blockchain meets fintech. When a ledger of transactions is maintained by all network participants, transactions are instant, don’t require supervision, can’t be tampered with, and are secure by design. DLT has a myriad of applications in areas such as insurtech software, decentralized payment platforms and cryptocurrency exchanges, and open banking APIs for innovative banking services.

Digital wallets, digital assets, distributed data storage and exchange, zero-knowledge identity proof, and smart contracts are just a few of the technologies that support this latest fintech trend. Digital asset exchanges produced $15B in revenue in 2021, and DLT looks set to thrive in 2024.

13. Regtech

Automating regulatory compliance helps big businesses save big money, promising big revenues for fintech products that can offer this Regtech service.

The EU’s GDPR was among the first attempts to introduce major regulations for data use — companies who fail to comply risk fines of up to 20 million Euros or 4% of annual turnover, whichever is bigger. While there were no recorded cases of GDPR violation of this magnitude, GDPR fines are issued regularly.

2022 brought a new challenge to this field, as the Russian invasion of Ukraine resulted in the EU parliament declaring Russia a sponsor of terrorism. EU and US banks and fintech were required to find and report funds associated with Russia (and avoid participating in Russian money laundering) or risk facing a regulatory backlash.

Since regulatory compliance is essential for all financial entities, automating this process will be among the top priorities for many US and EU-based financial institutions. This opens up a lucrative playing field for regtech startups.

DjangoStars stands ready to provide you with Regtech software development services.

14. Open banking APIs

Open banking (or BaaS, Banking as a Service) has already established itself as one of the cornerstones of fintech as it allows third parties to use banking infrastructure through APIs. Following open banking principles when developing a fintech product ensures ease of customer acquisition, data exchange between apps, analytics, user authentication, and communication. According to Forbes, open banking transactions were estimated at $57 billion in 2023 and are estimated to reach $330 billion by 2027.

Facebook and Instagram are prominent examples of companies providing open APIs that enable in-app shopping, marketing, and other services, but open banking has a lot more to offer.

From government cryptocurrency initiatives to building a proliferating fintech ecosystem, open banking evolved significantly in 2022 and will remain one of the top trends in fintech in 2024 and beyond.

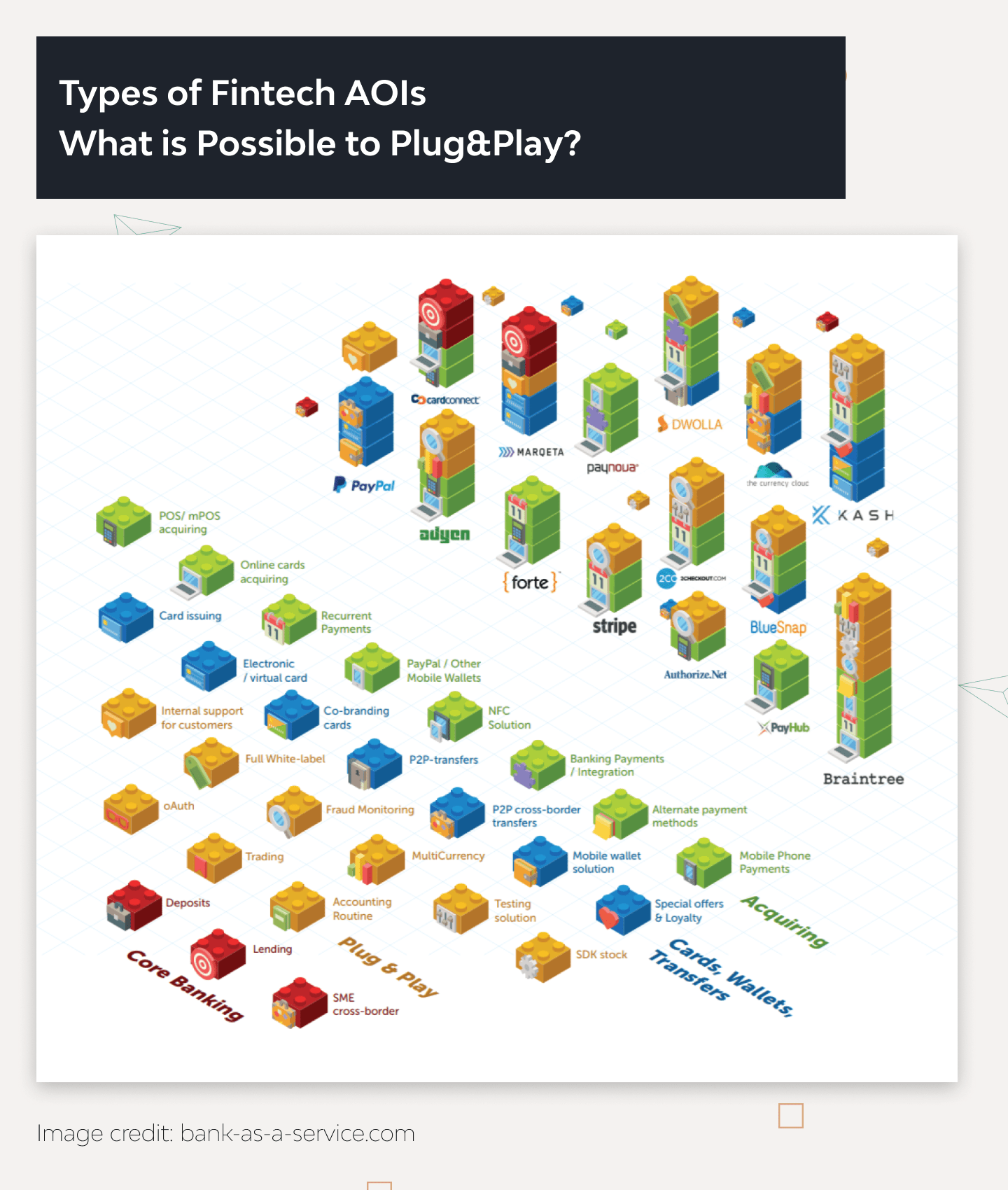

15. Microservices and modularity

A logical continuation of nearly all the fintech trends listed above is the need for a fintech product to be modular, flexible, and easily adjustable. Enter microservices: one way a fintech startup can remain open to integrating any new fintech trend.

Microservices offer seven distinct benefits to any fintech company:

- Agile development: Any component can be developed or updated separately.

- Scalability: Scaling horizontally or vertically is smoother with microservices.

- Reusability: Fintech startups can easily reuse modules from other apps to build or extend their products.

- Easier maintenance: Any individual microservice can be stopped, adjusted, and redeployed without affecting the product’s overall performance.

- High reliability: Due to the above advantages, microservices minimize the risk of product crashes and critically buggy releases.

- Specialization: Fintech startups can concentrate on their key product features, using secondary functionalities from other apps through open APIs.

- Simplified integrations: With open APIs, fintech products can easily interact with each other to enrich customer experience and build flourishing ecosystems.

Django Stars has rich expertise in fintech product architecture engineering. We use DevOps approaches and microservices to ensure rapid development, reliable deployment, and smooth maintenance of fintech products for clients of all sizes.

Fintech Market: 2024 Forecasts

By the end of 2022, the value of the global fintech market had reached $195B, and the market is expected to grow with a CAGR of around 17% till 2030, according to a variety of public sources (BusinessWire, ResearchAndMarkets, KPMG, CB Insights, and others).

Naturally, any long-term forecast should account for a reasonable degree of uncertainty due to current levels of social and political turbulence worldwide. And even mainstream predictions can fall short: forecasts from a year ago stating that China would pioneer the world’s economy have now run aground, given the downturn of China due to its banking, economic, trade, and governmental crises.

Nevertheless, Django Stars offers the following forecasts for fintech in 2023 and beyond, based on the analysis we conducted.

- AI will remain among the top trends in fintech. Many market players have successfully deployed AI in applications as diverse as chatbots, risk mitigation tools, big data analytical systems, stock exchange forecasting algorithms, and investment robo-advisors. 2022 saw a rapid increase in customer satisfaction with AI-powered fintech products, leading to increased revenues.

- Embedded financial services will become a must. Global consultancy Bain reports that customers are less in favor of traditional standalone financial services and are instead moving toward embedded financial experiences.

- There will be a growing need for flexible financial interactions. A McKinsey study shows that almost every American prefers a flexible or fully remote environment to office work, and this flexibility will be expected from all things, fintech included. Fintech products must be easily accessible from any device, integrate with other platforms, and provide a seamless shopping/banking/financial management experience.

- Network effects will become ever more important. Venture capital firm NFX found that 70% of all the value generated in tech in 2022 was due to network effects: the process where every additional customer or player adds value to all other players. As a result, smaller teams and startups should aggregate their efforts and leverage external resources to survive the economic downturn.

- Capital market digitalization is sure to continue. Capital exchanges need to be able to rapidly react to political events in order to minimize losses and maximize revenues in the recession.

- Open banking will continue to evolve into an ecosystem interconnecting traditional banking institutions and fintech companies to further improve end-user experience and loyalty and drive additional revenue streams.

- Cloud deployment and DevOps will remain essential for reducing time-to-market for new products and features, ensuring fintech products remain up-to-date and meeting rapidly changing customer expectations.

- Federal attempts to combat inflation by raising interest rates will hit all industries hard, and online lending will feel the results most acutely. With worsening economic conditions, people will have fewer opportunities to deposit money for long periods, and the delinquency rate for loans will grow dramatically. Neobanks will suffer, and we may see some of them dropping out of the game or consolidating in order to survive.

- BNPL 2.0 will evolve into a merchant enablement platform. Klarna, Afterpay, and Zilch help merchants sell more at the expense of banks, and automating scheduled payments is just a minor part of their value proposition.

- Forbes predicts, and our experience illustrates, that big banks will finally embrace BaaS. While a 70/30 revenue share split model between a fintech and a bank was good enough for smaller banks, large banks like JP Morgan Chase are more accustomed to a 50/50 split. However, amidst the worsening economic situation, they will have to explore BaaS too. Just don’t expect big fish to seek partnerships with fledgling fintech startups — they’re more likely to partner with existing SaaS providers that already have wide customer bases across multiple industries.

All in all, 2023 and beyond will not be years when “things go back to normal.” It will be a time when all businesses, including fintech, will have to learn to allocate their resources best to adapt to the rapidly changing economic situation.

Things Fintech Companies Should Consider in 2024 to Survive

A CB Insights report on the state of the venture market in 2022 reveals that investment in banking startups drastically reduced in 2023, with funding falling by 72%, the most significant YoY decrease across fintech sectors. Funding for payment startups decreased by 30% YoY, but the annual funding total was bolstered by two large funding rounds to Stripe ($6.5 billion) and Metropolis ($1 billion), making payments the most well-funded fintech sector by a considerable margin.

Django Stars suggests using the following tactics to survive the downturn:

- Leveraging open architecture. Product owners should maximize the use of open banking APIs and microservices when building fintech products and features to ensure simple integration with other products as needed.

- Working with skilled employees. With limited funding, things have to be done correctly from the get-go, which is only possible when working with experienced professionals. Outsourcing to top talent or partnering with an established technology provider makes more sense than building a team from scratch.

- Reducing costs by improving legacy systems and adopting AI. 2024 will definitely be the year businesses will have to consider incorporating fintech to improve the performance of legacy systems. AI-based automation and other features will be crucial for reducing expenses and redoubling customer engagement.

In short, the key goal for 2024 will not be to chase the latest fintech trends but to optimally use the technology at hand to solve the hard problems.

Which Fintech Trends Are No Longer Relevant?

Naturally, some trends in fintech are losing traction. For example, cryptocurrency exchanges and projects lost much of their value in 2022. Blockchain technology is still in high demand, but it has to be adapted to solving real-world problems, not promising gold pots at the end of the rainbow.

What current trends in fintech do we expect to become irrelevant soon?

- Coronavirus-related initiatives. The world at large (except Russia and China) has overcome COVID, and the CDC says it will be more like seasonal flu. The need for strict COVID limitations has passed, and many projects focused on fighting COVID are no longer relevant. For example, people will be less obliged to shop online, which could lower e-commerce transaction volumes. The upcoming economic recession will also surely weigh heavily into this outcome. However, the efficiency and comfort offered by embedded finances will enable fintech products to remain afloat.

- Cryptocurrency exchanges. After a spectacular FTX crypto-exchange bankruptcy, which followed a long-overdue correction of inflated cryptocurrency costs, interest in cryptocurrency exchanges has dwindled. Investors are starting to realize that any money invested in pure cryptocurrency will most likely be lost and are shying away from this volatile market. 2023 will likely be the year institutional investors will force crypto exchanges to reevaluate their positioning and reshape the fintech industry.

- (Un)stablecoins. Earlier, we stated that stablecoins are still among the top trends in fintech, but the question is — for how long? The Federal Reserve might continue to raise interest rates, forcing the market to cut on all but the most needed of investments, and stablecoins are definitely not among them. The situation now is fragile, as stablecoins may crash if investors lose trust in them any further. A stablecoin crash could be disastrous for the bonds market and other financial industries.

Long story short, the time for throwing money away is over. In 2023 and beyond, bright ideas with limited applications will have to make way for projects that solve real-world problems. Thus, in order to survive, fintech companies will need access to reliable technical teams which can test the feasibility of an idea and see a project through to completion.

How Django Stars Uses Financial Technology Trends in Software Development

Django Stars relies on 16+ years of expertise in fintech software development and more than 150 completed projects to ensure the success of its partnerships. We combine time-tested technologies like Python & Django with recent trends in fintech, such as digital mortgage brokerage, AI & ML for analytics and user verification, open banking APIs, and microservices to engineer software solutions that meet our clients’ goals. The following projects are just a sample from our wide portfolio.

Sanostro: An SaaS platform for investment portfolios

Django Stars composed a team of software engineers who, in under a month, built a platform able to aggregate customer portfolio data from multiple sources, analyze it, and provide recommendations on the best market position for each separate asset.

Molo: A leading online mortgage platform

As the first digital mortgage broker in the UK, Molo enables customers to avoid paper forms and the traditional mortgage lending process. Django Stars proposed and implemented the business logic, product architecture, integrations, and features that have enabled Molo to dominate the UK digital mortgage market since 2017. From a mortgage calculator to an online user ID verification tool, legal compliance tool, and integration with Experian through open banking APIs, Django Stars placed Molo as the best choice in the market.

Money Park: An online independent mortgage advisor

Money Park is Switzerland’s biggest independent mortgage broker, helping people and banks work out terms that meet each individual mortgage loan best. Django Stars developed the MVP for Money Park in 2012, and since then, it has evolved into a fast, user-friendly platform capable of handling a multitude of calculations. From an internal CRM and mortgage calculator to dedicated interfaces for real estate agencies and property evaluation tools, Money Park provides everything necessary for getting a mortgage in Switzerland.

Conclusion

2023 was a turbulent year for fintech, and 2024 promises to continue this tendency. While everybody hopes that the market will rebound, it makes sense to prepare for a long period of reduced investments. Successful companies will be the ones who act wisely and make the most of rising global trends in fintech.

Based on data from open sources and Django Stars expertise, we forecast an increase in demand for AI-powered fintech product features, interoperability through open banking APIs, embedded finance, and innovative solutions for sme lending software and real estate ownership. BNPL 2.0 will evolve into a merchant enablement approach, while regulatory compliance, personalization, and gamification will continue to distinguish market-leading products from the rest.

However, in order to successfully implement these fintech trends, startups will have to allocate their resources cost-efficiently. Partnering with a reliable technology provider like Django Stars can make a critical difference in a period of reduced investment activity, as we enable fintech startups to deliver high-quality software and win customer attention in an oversaturated market.

- Is there a future for financial technology trends?

- Definitely. People will still have to send money and pay for products and services — it’s just that amidst the recession, the focus will shift to serving more pressing needs such as AI-based customer self-service and risk mitigation, alternate lending and mortgage services, embedded finances, and open banking.

- What are the current fintech trends?

Django Stars considers the following to be the most disruptive fintech trends of 2023:

- Virtual bank cards

- Embedded finance

- Buy-Now-Pay-Later 2.0

- Alternative lending

- Digitalized real estate ownership

- Alternative payments

- Stablecoins

- Capital market digitalization

- AI and ML-based features

- Biometrics

- Gamification

- Distributed ledgers and DeFi

- RegTech

- Open banking APIs

- Microservices and open architecture

- What recent fintech trends are applicable to mobile apps?

- Open banking APIs, microservices, embedded payments, gamification, biometrics, AI & ML-based user verification and risk management, BNPL 2.0, and virtual bank cards.

- What disruptive fintech trends to follow in 2023?

- Rather than blindly following cutting-edge trends in fintech, it’s best to concentrate on applying the technology at hand to solve the problems your customers are facing. Amidst the global recession, investors will prefer products that deliver real value and promise quick ROI to long-term entrepreneurial visions with questionable feasibility.

- Do Django Stars provide individual developers or a dedicated team?

- Both. We can provide individual developers or entire dedicated teams based on product specifics to ensure successful project completion.