A century of thoughtful banking app development has arrived. Investors and startups are learning to navigate challenges like inflation, rising interest rates, and looming recession risks. And today, those entrepreneurs who can create convincing business models receive funding.

Banks can go in two ways and focus on the middle- and back-office functions, providing effective flows, or bet on capturing customers through rich front-office features.

In this article, we focus on the first business model and discuss how to build a banking app that will satisfy the client’s needs and improve their experience.

Django Stars has been developing complex banking app solutions for various business purposes for 15 years.

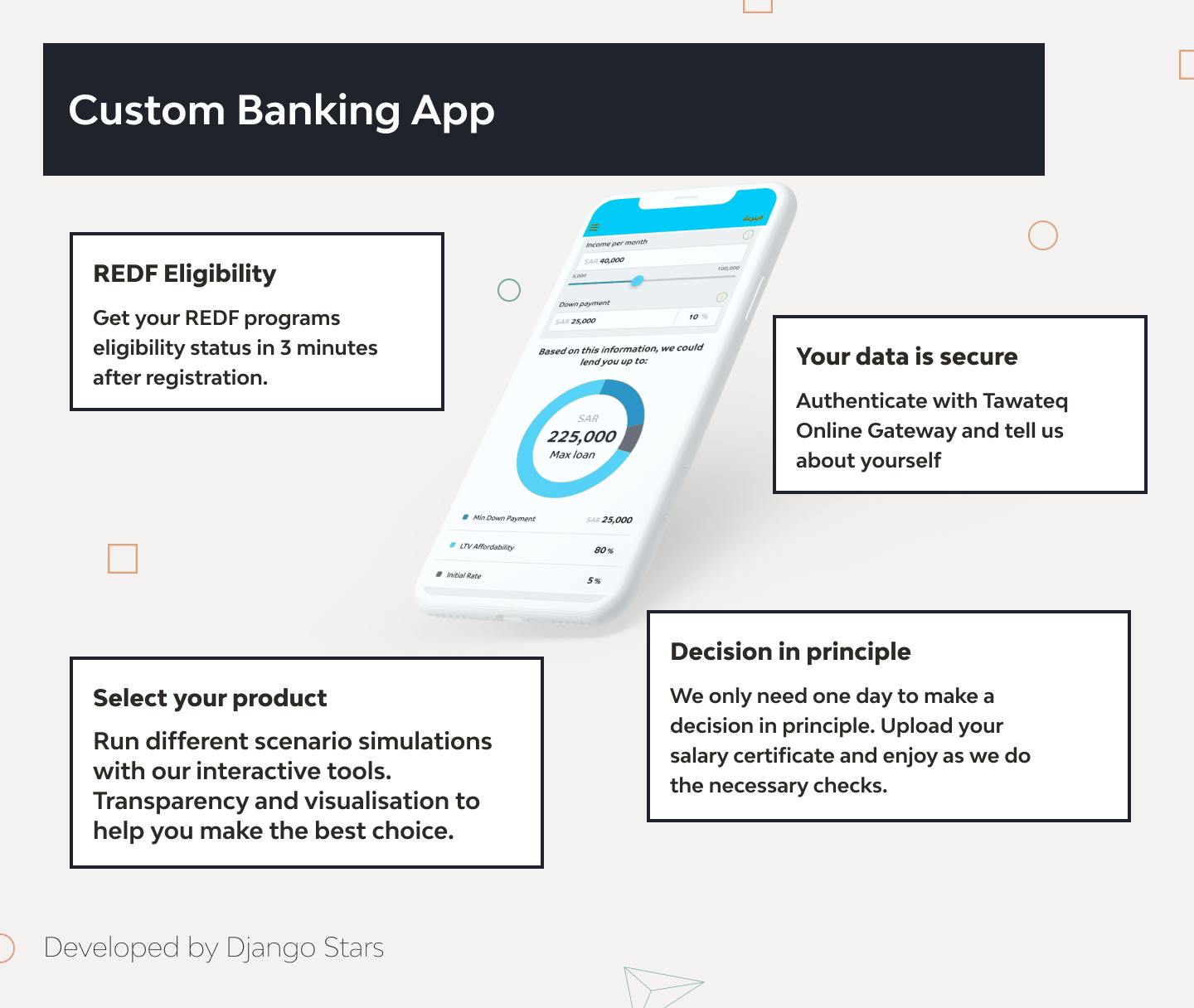

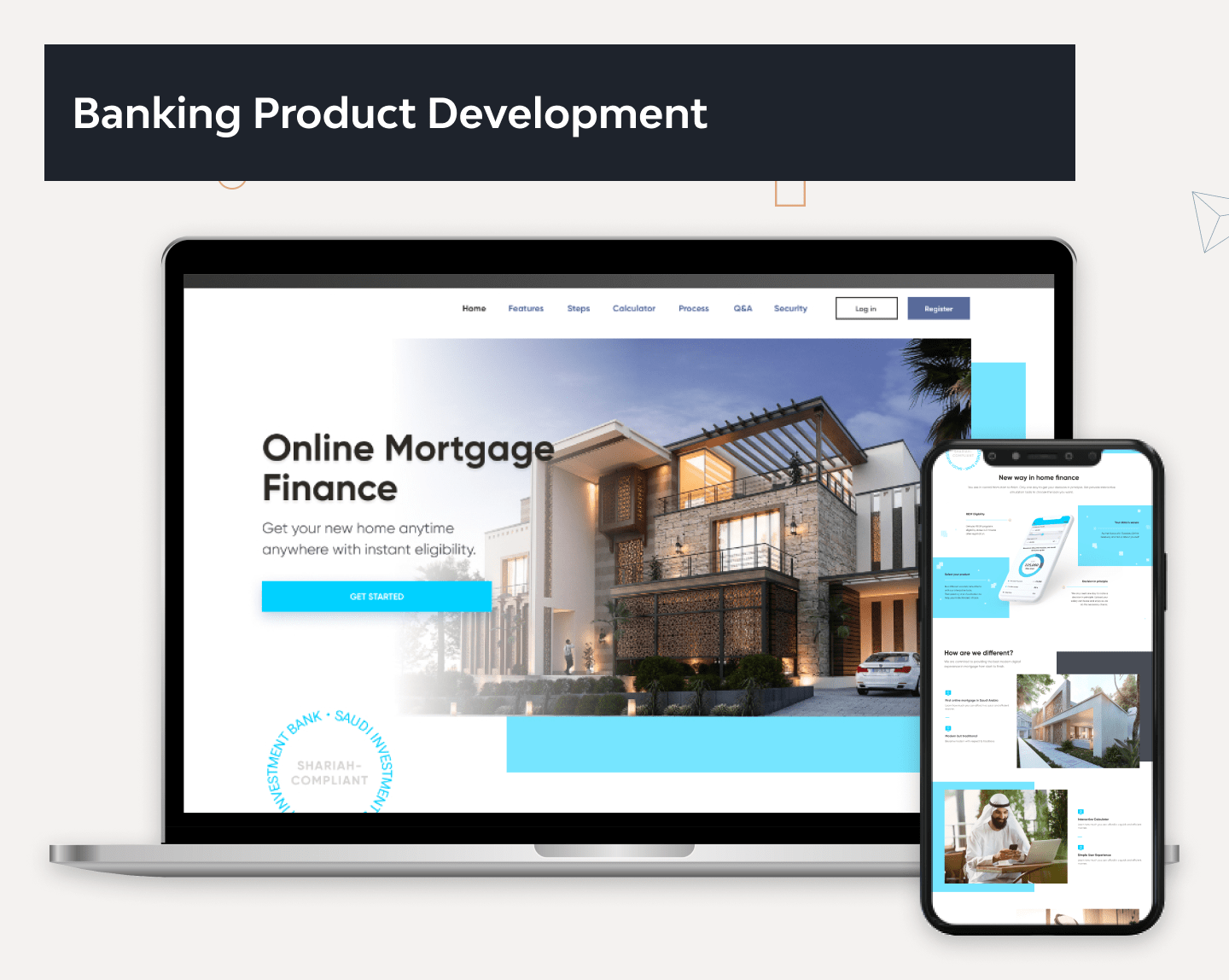

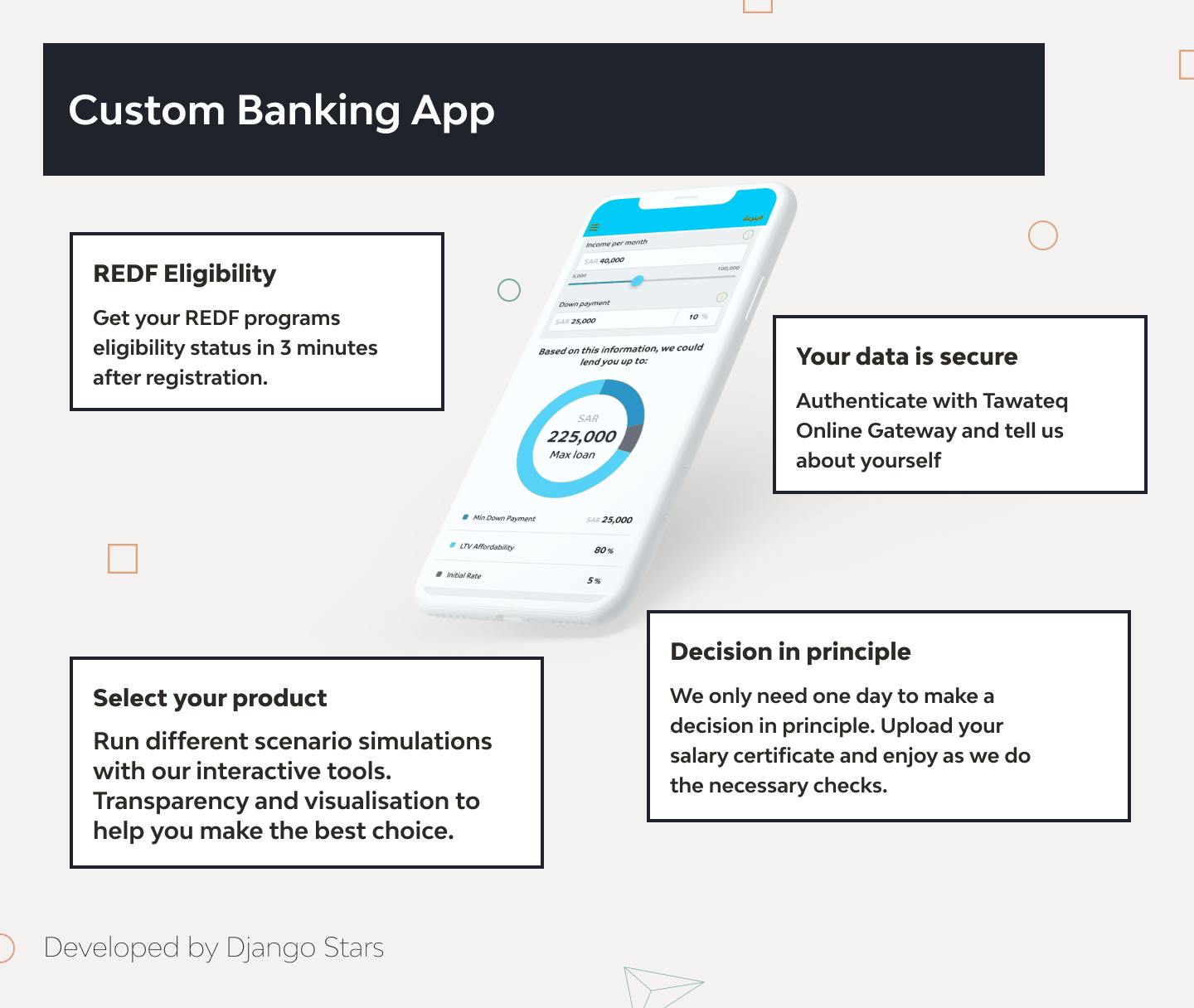

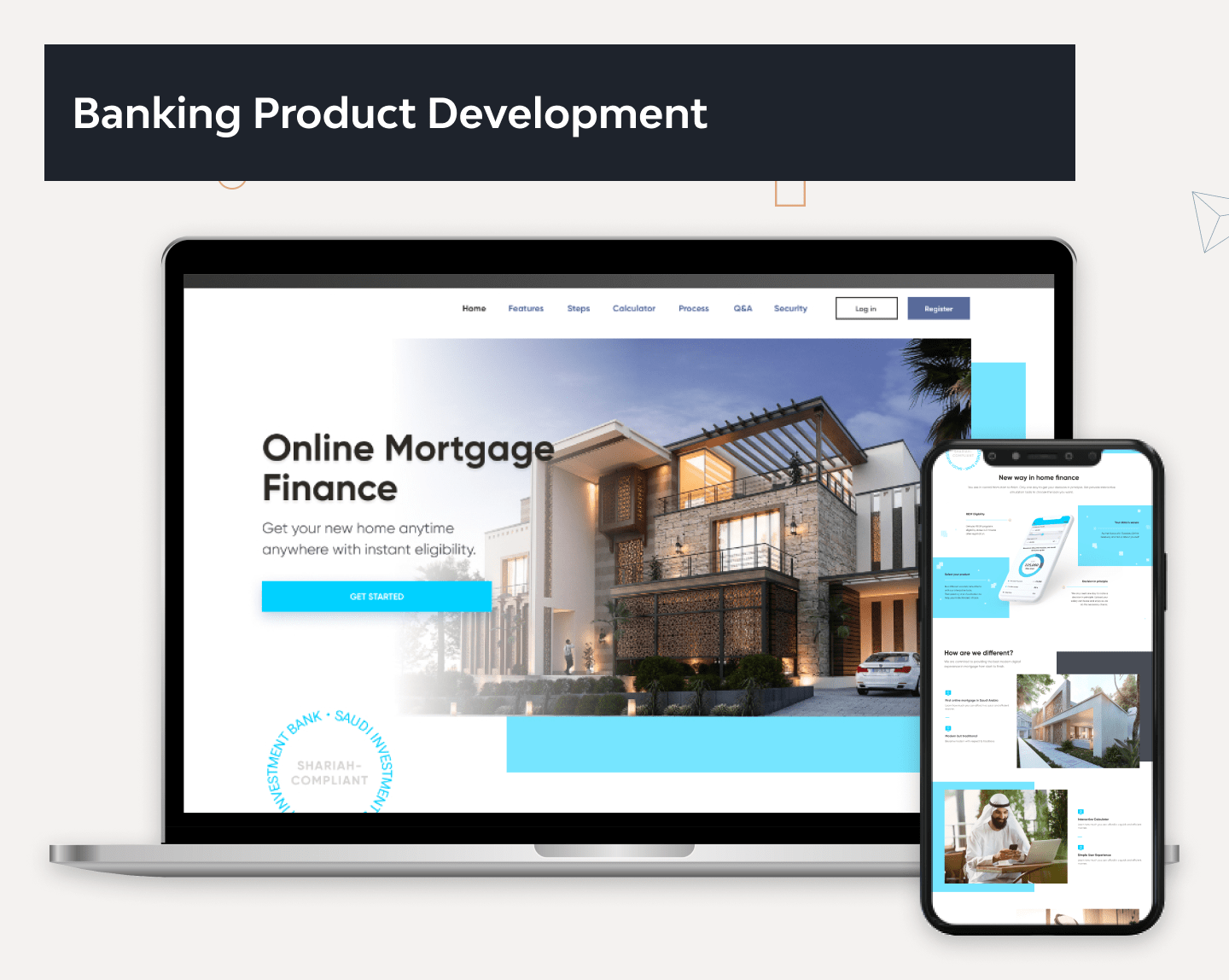

In particular, we’ve worked on a fintech software solution for The Saudi Investment Bank, allowing it to simplify and speed up the provision of banking services. Previously, most transactions were carried out in branches or over the phone, so the client needed a complete digitalization of all processes.

Stay tuned to learn key mobile banking app technologies to consider before starting app development, its essential (like KYC) and additional features, tech stack, MVP cost, and other things you want to ask about.

All information is based on Django Stars’s real-life experience with Molo Finance and SAIB.

Advantages of Mobile Banking App to Customers

The evolution of banking app development has completely reshaped how we handle our finances—more convenience, more control, and stronger security than ever before. But what makes it so powerful? Let’s break it down.

24/7 Access to Banking Services

One of the greatest mobile banking app benefits is instant, 24/7 access to account information, transactions, and payments. No more waiting for bank hours or visiting physical branches—users can manage their finances anytime, even on weekends and holidays, maintaining full control over their money.

Real-Time Alerts and Notifications

Instant notifications for transactions, low balances, or suspicious activity help users stay informed and react quickly. This proactive alert system enhances security and improves financial awareness, allowing users to address issues before they escalate.

Simplified Transactions

Banking apps streamline tasks like money transfers, bill payments, and loan applications—no paperwork, no queues, just quick and secure transactions. With just a few taps, users can complete operations that once required physical visits to a branch.

Enhanced Security Features

When considering how to create a mobile banking app, security should be the top priority. Implementing features like biometric authentication, multi-factor verification, and robust encryption ensures that sensitive information is protected from unauthorized access.

Reduced Banking Costs

Switching to mobile banking significantly cuts down on fees linked with traditional banking. Digital transactions, paperless statements, and automated bill payments help minimize costs, making banking more affordable and efficient.

Personalized Financial Management

Modern banking apps empower users to track spending, set budgets, and receive personalized insights. Advanced analytics provide a clearer understanding of financial habits, enabling smarter money management and better planning.

Types of Mobile Banking Apps

The rise of mobile technology has led to the development of various types of mobile banking apps, each tailored to meet specific financial needs. Whether for personal use, business transactions, or digital-only banking, understanding these categories is key for effective banking application development. Here are the main types that are transforming the financial landscape:

Retail Banking Apps

The apps are designed for everyday users to manage their personal finances. They allow customers to check balances, transfer money, pay bills, and even apply for loans directly from their mobile devices. Features like biometric login and real-time alerts make these apps secure and convenient, eliminating the need for branch visits and offering 24/7 access to banking services.

Business Banking Apps

Focused on business needs, these apps enable companies to manage payroll, monitor cash flow, and authorize transactions on the go. Multi-user access, customizable permissions, and integration with accounting software make business banking apps essential tools for efficient financial management.

Neobank Apps

Neobanks are fully digital financial institutions with no physical branches. Their apps offer opening accounts, transferring funds, and accessing credit—through a mobile-first experience. The apps are known for their seamless onboarding, real-time transaction updates, and user-friendly interfaces, making them a popular choice for tech-savvy customers.

Peer-to-Peer (P2P) Payment Apps

P2P payment apps allow users to send and receive money instantly, making everyday transactions like splitting bills or paying back friends quick and hassle-free. With just a few taps, users can securely transfer funds without the need for cash or checks.

Investment & Wealth Management Apps

These apps let users manage investments, track portfolios, and execute trades from their smartphones. Real-time market analysis, automated savings, and portfolio monitoring help users grow their wealth and optimize investment strategies effectively. Enhanced with educational tools and insights, these apps empower users to make informed financial decisions.

Whether you want to create a banking app for personal, business, or investment purposes, understanding the key features of each type is crucial for success in the market.

Core Mobile Banking App Features

The selection of banking app features is one of the most critical decisions in developing a banking application. Besides focusing on customer needs, it’s important to consider your product’s current stage. For instance, if you’re launching an MVP, you don’t need the full range of banking app features—just the essentials to validate your idea and gather user feedback.

As a software development company, Django Stars recommends starting with the core features, which include these best banking app features:

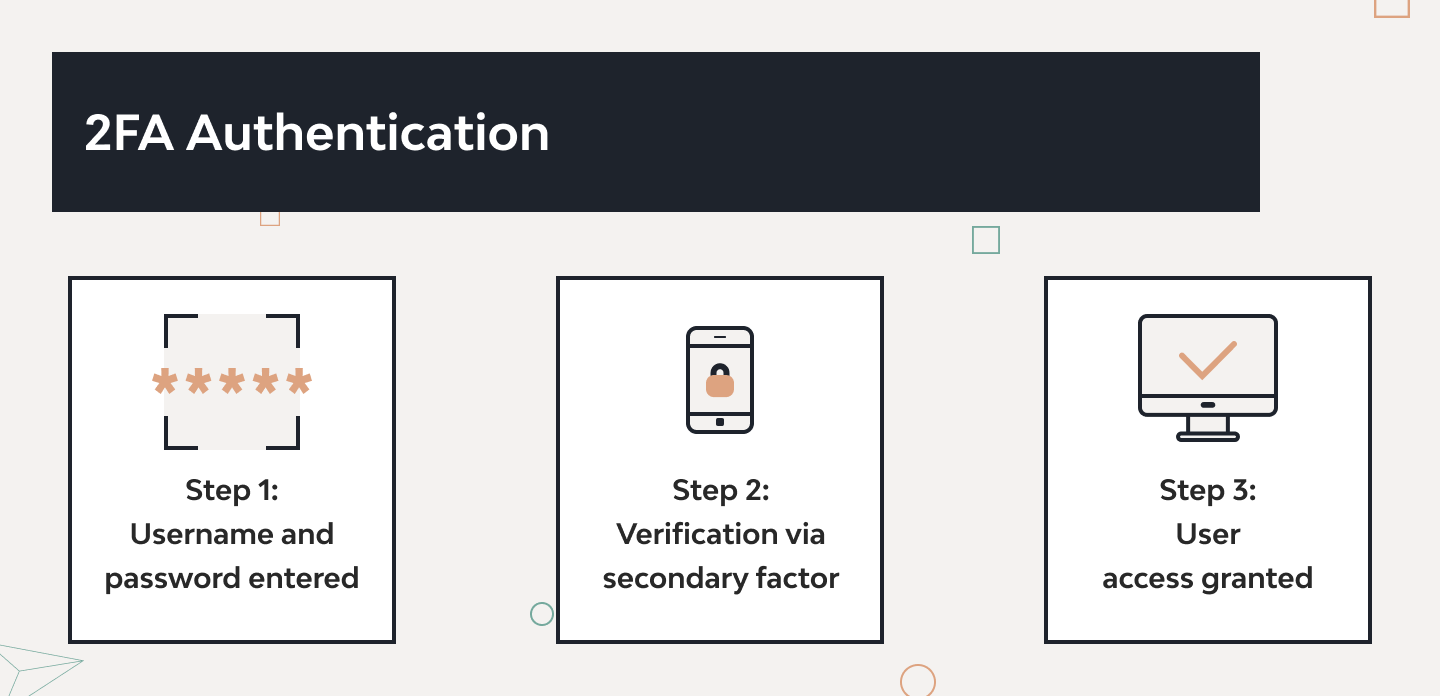

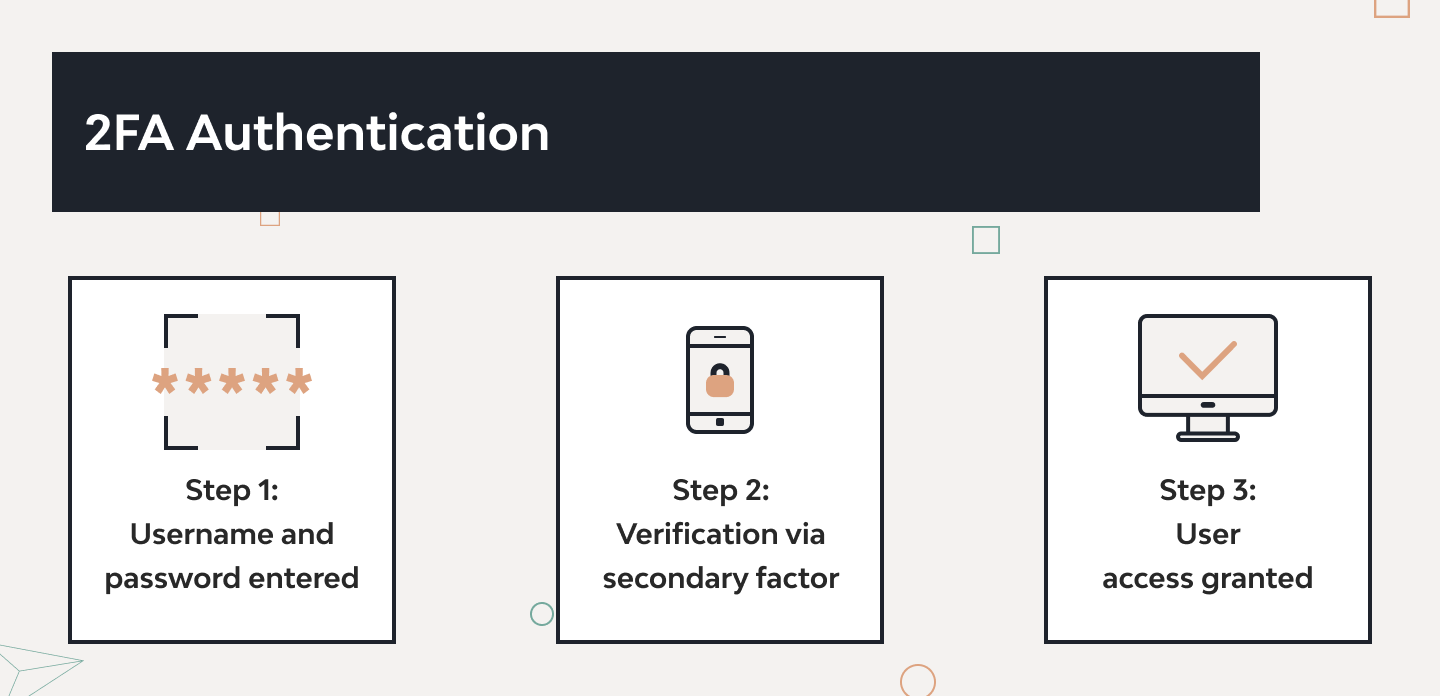

Authentication

Multi-factor authentication (T-FA or 2FA) ensures the security of logging into an account.

It may include:

- Password

- Pin

- Smart token

- Mobile signature

- Biometric data — fingerprint, Face ID, voice, or gestures

When developing a banking app, you should provide users with several authentication options, allowing them to choose the most suitable ones.

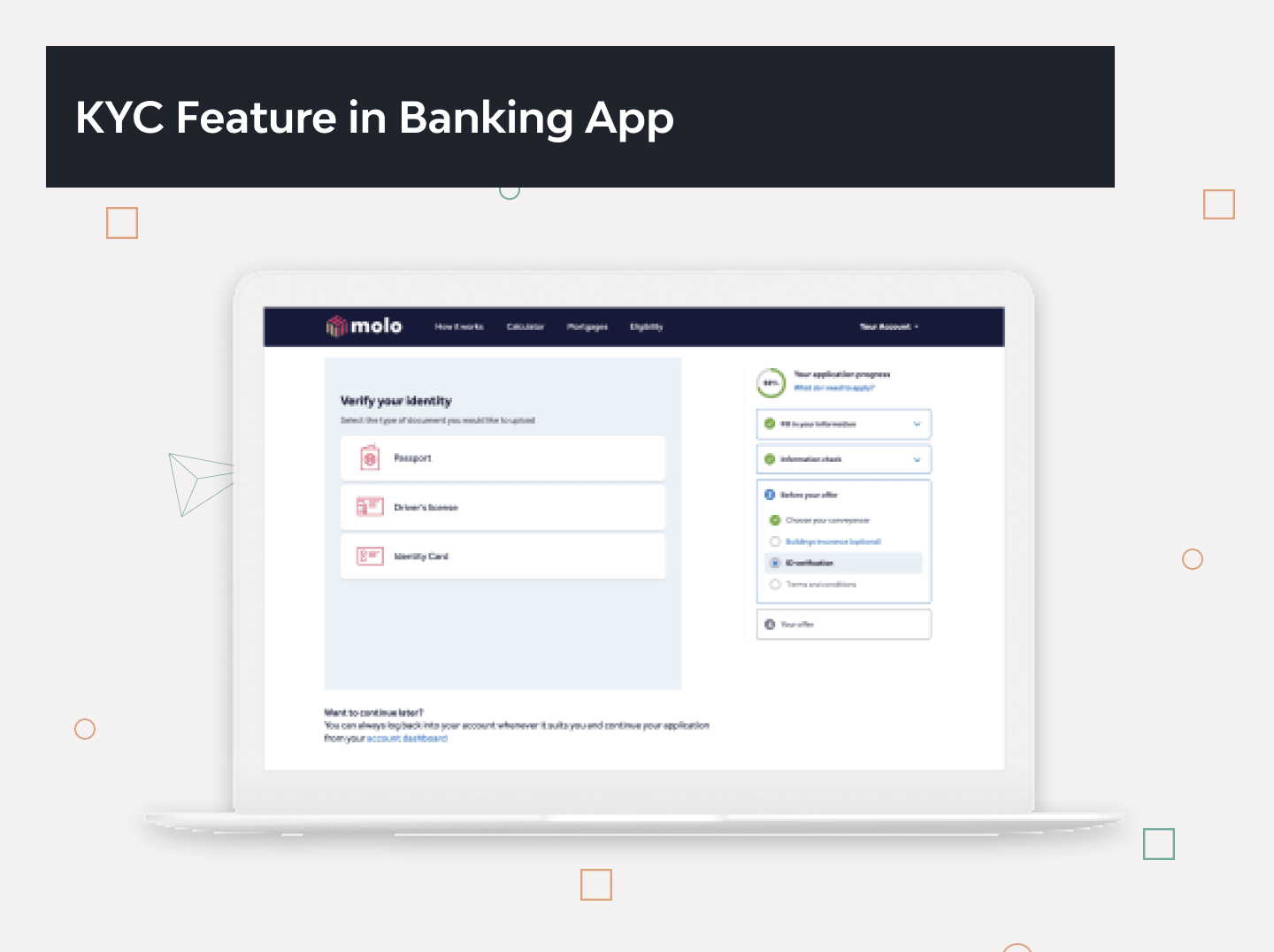

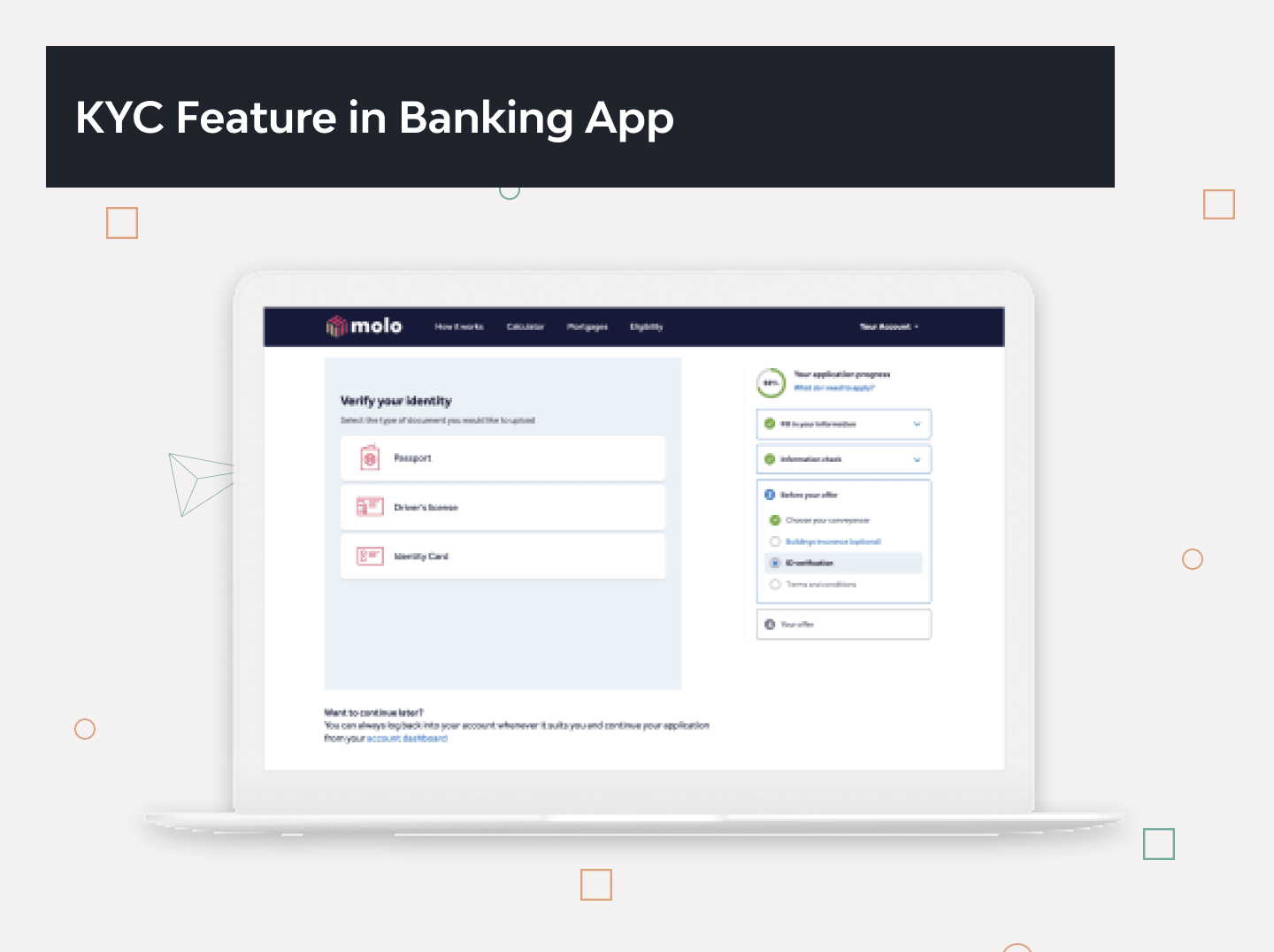

KYC

Know Your Customer (KYC) is an identity verification process. With it, banks protect themselves from fraud, money laundering, terrorist financing, and other unclean schemes, which regulators closely monitor.

KYC uses verification, such as:

- Proof of Identity (POI) — passport, national ID, driver’s license, student ID, military ID, arms license

- Proofs of Address (POA) — notarized proof of residence, lease agreement, house purchase deed, utility bills, or employment verification letter

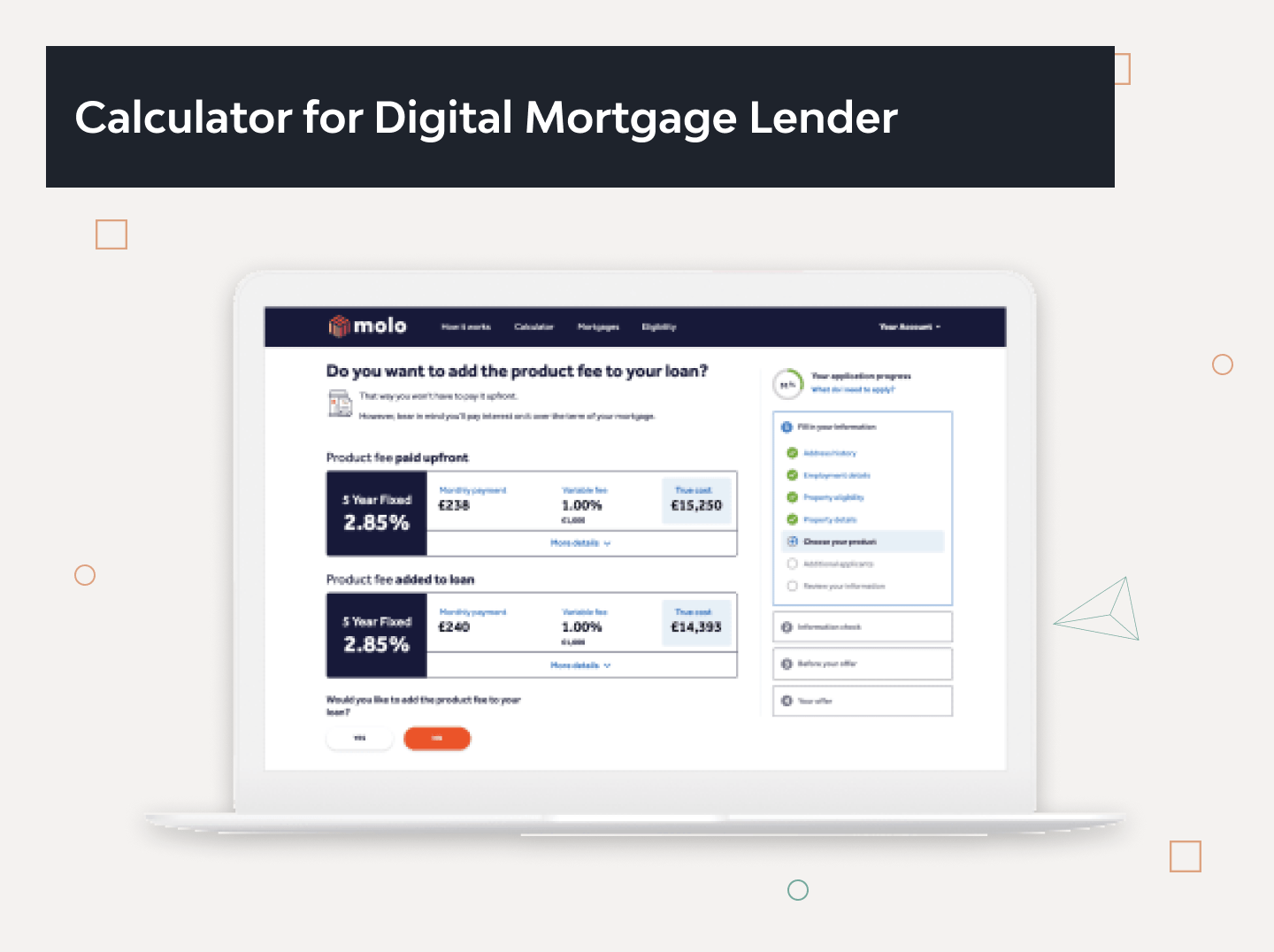

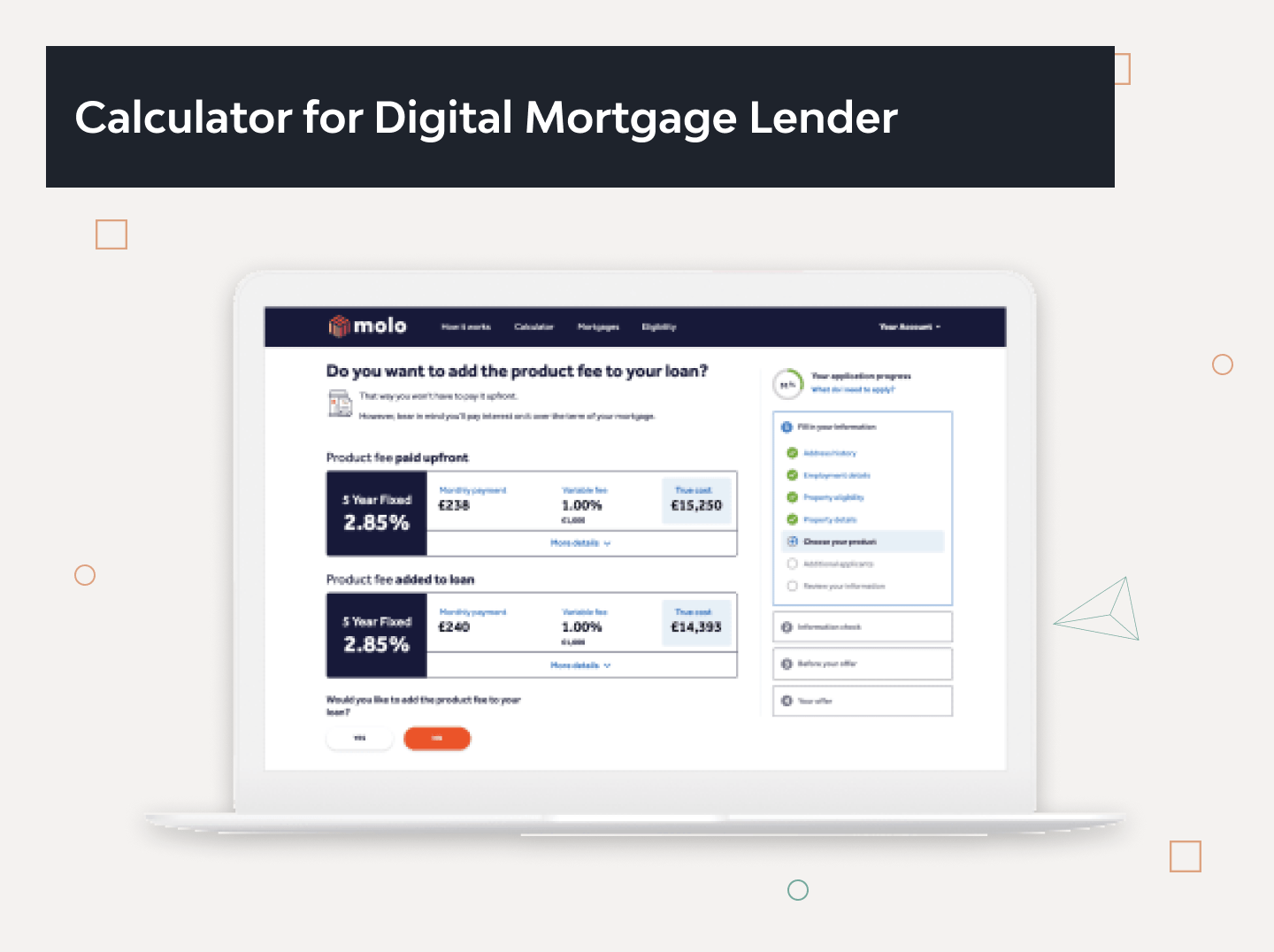

Django Stars has already developed KYC for Molo, the UK’s first digital mortgage lender. With our solution, customers only need to take a photo of their passport and a selfie to prove their identity. It allows Molo to verify clients and save their time.

Card Issuing

The card issuer allows cardholders several options:

- Debit cards

- Credit cards

- Prepaid cards

- Commercial cards

Card issuing includes application review, account and card (plastic or digital) provision, payment processing, and customer service.

P2P

Peer-to-Peer (P2P) transactions happen between two people with separate bank accounts. They can be internal (within the bank) or domestic (between different banks or institutions).

Transaction Processing

Fast transactions are a must-have feature for any financial app. Think about achieving more excellent reliability and performance and connect alternative methods, such as payment by QR code.

Account Management

The primary account management function includes the following features:

- Real-time balance check

- Bank account and card management, including their opening, closing, etc.

- Recent transactions

- Deposit check — balance and interest

You can also offer users additional features for tracking habits, setting savings goals, automating recurring payments, etc.

Customer Support

To provide good service, you should not leave customers with questions and problems. For quick help, you can create a live chat with operators or a chatbot. But be sure to offer communication with the operator if the issue has not been resolved.

Nice-to-Have Features for a Mobile Banking App

To enrich the customer experience, you can complete core features with nice-to-have functions, adding them after the MVP launch.

Secure Payments

Your banking application must ensure the security of transactions and user data.

In addition to mentioned 2FA, KYC, and push notifications, you can use:

- End-to-end encryption that prevents third parties from accessing data without a unique cryptographic key

- Anti-fraud behavior tracking, including motion and touch analysis, activity log, and user actions

Push Notifications

These notifications are essential as they allow you to inform users about:

- Transactions — crediting money, confirming payment, etc.

- Actions in the application — password change or update request

- Advertising notifications — promotional offers, discounts, etc.

ATM

Banking software must meet real client needs. Users often leave their bank cards at home, so let them withdraw cash via SMS or in-app confirmation.

Also, connect a map with ATMs, adding:

- Search by specified parameters

- Working hours

- Data about queues in specific time ranges

Expense Trackers

A spending tracker is a nice bonus, allowing users to analyze the categories, save more, and plan their budgets competently.

Your application may include the following features:

- Expense filter by day, week, month, and year

- Transaction filter by category — groceries, clothing, entertainment, etc.

- Savings goals

- Automatic storage of commercial receipts

Some advanced apps also include loan and investment tracking and tips for increasing net worth. For example, we have developed a calculator for the digital mortgage lender Molo to show loan conditions depending on its amount and individual parameters.

Repetitive Payments

The recurring payment feature saves customers time and shows your care.

Allow your application to:

- Set the duration of payments — within a specific period or an end date

- Remind about payments

- View a list of all recurring payments

- Suspend, cancel, or edit each payment

Cashback

Cashback is an excellent opportunity to reward customers for their choice and encourage further use.

Partner with various goods and services suppliers and let users choose the desired categories. Choose the cashback model:

- Rates depend on the amount spent

- Fixed rates for different categories of expenses

Personalized Offers

Provide valuable services to customers based on their data and previous experience. Remember that personalized service is not essential for only 30% of Generation X and 20% of Generation Y and Gen Z; this is an expected option for others.

In banking, it can take the following forms:

- Personalized avatar, app theme, and other visual elements

- Discounts, coupons, and other special offers

- Personalized UI/UX depending on the phase of the customer’s life cycle

Unique Services

A modern banking application provides services that go beyond payments. They may include:

- Budget planning and investment advice

- Replenishment of mobile account

- Buying tickets online

- Renting a car and paying for parking

- Table reservation in a restaurant

- Lounge access at the airport

- Concierge service

- Delivery order

- Charity

Gamification

Gamification in banking allows you to increase user engagement and retention, attract new customers, and stand out to investors. For example, it allowed Mexican Extraco Bank to raise its customer acquisitions by 700%.

For gamification, you can use:

- Avatars

- Internal scores

- Daily, weekly, or monthly goals

- Progress tracking

- Challenges

- Leaderboards

- Polls

- Lotteries

Wearables

Wearable devices like smartwatches are actively used in financial transactions. Consider moving some functionality to IoT devices to let users:

- Make transactions using NFC

- Check bank account balance

- View transaction history

Chatbot

Chatbots improve customer service quality, resolving issues without lunch and weekends.

Chatbots using AI and ML help users:

- Check balances, pay bills, and track transactions

- Solve urgent problems at any time

- Receive timely notifications and reminders

- Use personal banking services

- Get financial advice

- Prevent potential fraud

Bill-Splitting

A study by Forbes Advisor and OnePoll showed that with rising inflation, Americans have become more willing to use bill-splitting apps. In particular, this applies to 53% of people aged 18-25 and 50% of people aged 26-41.

This feature allows users to split the restaurant and travel bills and fix petty payment requests. It consists of

- Receipt image upload

- Ability to create different groups

- Simple (equal) and complex payment scenarios

- Real-time exchange rates

- Tracking loans over time

Voice Assistance

Voice payments are a real salvation for users with disabilities and a nice bonus for all other consumers.

Voice assistance allows customers:

- Make transactions

- Request balance information

- Perform administrative tasks

Fraud Alerts

Warn customers of potential account fraud using AI and ML technologies that:

- Monitor real-time data

- Track current behavior

- Track geo

- Compare activity with that specific to a given user

- Assess the likelihood of fraud

- Send instant notifications

- Generate reports

By selecting the desired features, you can already form a technology stack. And here is what we talk about in the next section.

Services

Tech consultancy: Get advantage.

Technology Stack for Banking App Development

When it comes to banking app development, the right technology stack is crucial for ensuring scalability, security, and performance. Here are the main technologies we recommend for developing a mobile banking application:

Backend:

- Python & Django

- AWS or Azure

Frontend:

Databases:

- Microsoft SQL Server / MySQL

- Redis

Operating System:

- Red Hat Enterprise Linux (RHEL)

DevOps & Deployment:

This stack is designed to build secure, scalable, and high-performing banking applications that meet modern industry standards.

How to Build a Banking App Step by Step

Developing a mobile banking application is complicated because the design and development process requires accurate planning and strong technical expertise. So, here are five steps to build a mobile banking app.

1. Research

Creating a reliable and secure banking application requires a structured approach and attention to detail. Here’s a step-by-step guide to effective banking app development, ensuring scalability, security, and user satisfaction:

2. Define Purpose & Features

The first step to build a banking app is to clearly outline its purpose and core features. Decide if it’s for retail banking, business transactions, or digital-only services. Key features often include account management, transactions, bill payments, and notifications. Understanding user needs helps shape a robust and focused application.

3. Ensure Regulatory Compliance

In banking application development, compliance is crucial. Your app must adhere to financial regulations like GDPR, PSD2, AML, and KYC standards. Building in compliance from the beginning helps avoid costly adjustments later and ensures user trust. Collaborate with legal experts to integrate local and international regulations.

4. Choose the Tech Stack

Selecting the right tech stack is critical for security and scalability. For the backend, technologies like Python and Django are ideal. For the frontend, React provides a modular structure for easy updates. AWS or Azure can handle cloud storage, while SQL databases ensure smooth data processing.

5. UI/UX Design

A user-friendly interface is key to keeping customers engaged. Focus on simplicity, intuitive navigation, and responsive design. A clean, well-structured UI enhances user experience, reduces friction, and makes transactions smoother. Investing in quality UI/UX design increases user retention and satisfaction.

6. Development

The development phase involves coding the frontend, backend, and integrating third-party services. Use agile methodologies to manage workflows and iterations. During this stage, features like account management, transactions, and payment gateways are built and tested for reliability.

Ready to Build Your Banking App?

Our expert team at Django Stars can help you design, develop, and maintain a secure and scalable banking application

7. Build Core Banking Features

Core features like real-time transactions, account statements, fund transfers, and bill payments should be integrated seamlessly. Advanced features like budgeting tools and spending analytics can further enhance user experience, offering more value and control over finances.

8. Implement Security Measures

Security is non-negotiable in banking application development. Implement biometric authentication, multi-factor verification, and data encryption to protect sensitive information. Regular security audits and compliance with industry standards like PCI-DSS ensure user trust and data safety.

9. Test and Maintenance

Before launching, rigorous testing is crucial. Conduct functional, usability, and security tests to identify vulnerabilities and performance issues. Post-launch, regular updates and bug fixes maintain the app’s performance and security, preventing downtime and enhancing user trust.

10. Update and Support

Continuous improvement is key to keeping your app competitive. Regular updates introduce new features, improve security, and adapt to regulatory changes. A dedicated support team ensures smooth user experience and resolves issues promptly.

Things to Consider in Banking Application Development

A successful banking app development process should result in a solution that is convenient for developers, businesses, and end users. To achieve this, it’s important to consider key parameters such as:

- Convenient and intuitive interface. Users and employees should efficiently perform tasks, understanding how to do them and what the result will be.

- Safety. Your software should protect clients’ personal and financial data from unauthorized access and defend the business from regulatory issues.

- Thoughtful architecture. A flexible and scalable solution allows you to update the application with minimal cost. High-quality code ensures easy verification during technical due diligence provided by potential investors.

- Reliability and responsiveness of the system. In the financial industry, time is money, so the application must work with minimal downtime and errors.

- Customizability. The application should be flexible, allowing users to configure and disable features, change the display of notifications and edit their data.

- Product relevance. The banking application must remain relevant to market demands and offer progressive solutions for users and businesses.

The best thing you can do to ensure the quality of your software is to find a reliable partner. Django Stars digital solutions fully meet these criteria. Our clients continue cooperating with us after the MVP release, bringing new technologies to life and offering customers a richer service. Contact us to discuss the development of your banking product.

Mobile Banking Development: US and EU Regulations

Online banking offers convenience but also introduces security risks. Global and regional regulators enforce strict standards to protect users and institutions. Non-compliance can lead to fines, reputation loss, or even license revocation.

Worldwide Regulations

- PCI DSS: Security standards for card transactions, focusing on data protection, access control, and network security.

- MTL (Money Transmitter License): Required for currency exchanges, money transfers, and check cashing to prevent fraud and money laundering.

EU Regulations

- GDPR: Allows EU citizens to control, correct, delete, and limit the use of their personal data.

- PSD2: Enhances payment security with strong authentication and mandates banks to share data with third-party providers.

US Regulations

- CCPA: Gives California residents rights to access and restrict the sale of their personal data.

- MSB: Registration required for digital wallets, P2P systems, and mobile payments to comply with AML and CTF regulations.

- TILA: Ensures transparent disclosure of loan costs, including APR, fees, and payment terms.

- FCRA: Regulates the collection and access of consumer credit information, allowing disputes over inaccuracies.

- BitLicense: New York’s regulation for cryptocurrency companies, enforcing strict compliance and security.

Services

Django: The Best Quality-Value Ratio.

How Much Does It Cost to Develop a Mobile Banking App

The banking app development cost varies widely depending on the app’s complexity, features, and team location. On average, creating a mobile banking MVP starts at $100,000 and can go up to $500,000 or more. The final price is influenced by development hours and the hourly rates of specialists.

Key Cost Factors:

- Product Requirements: Purpose, features, and functionality significantly affect costs. More complex mobile banking application development demands more time and expertise.

- Scope of Work: Project goals, timeline, deliverables, and conditions all influence the budget.

- Team Location: Hourly rates vary; for example, developers in Eastern Europe typically charge less than those in the US or Western Europe.

If you’re unsure about the app’s functionality, it’s wise to start with a Discovery Phase. This helps outline project details, minimizing costly changes later.

Banking App Development Case by Django Stars

Django Stars focuses on customer needs and existing market offerings, proposing cutting-edge solutions.

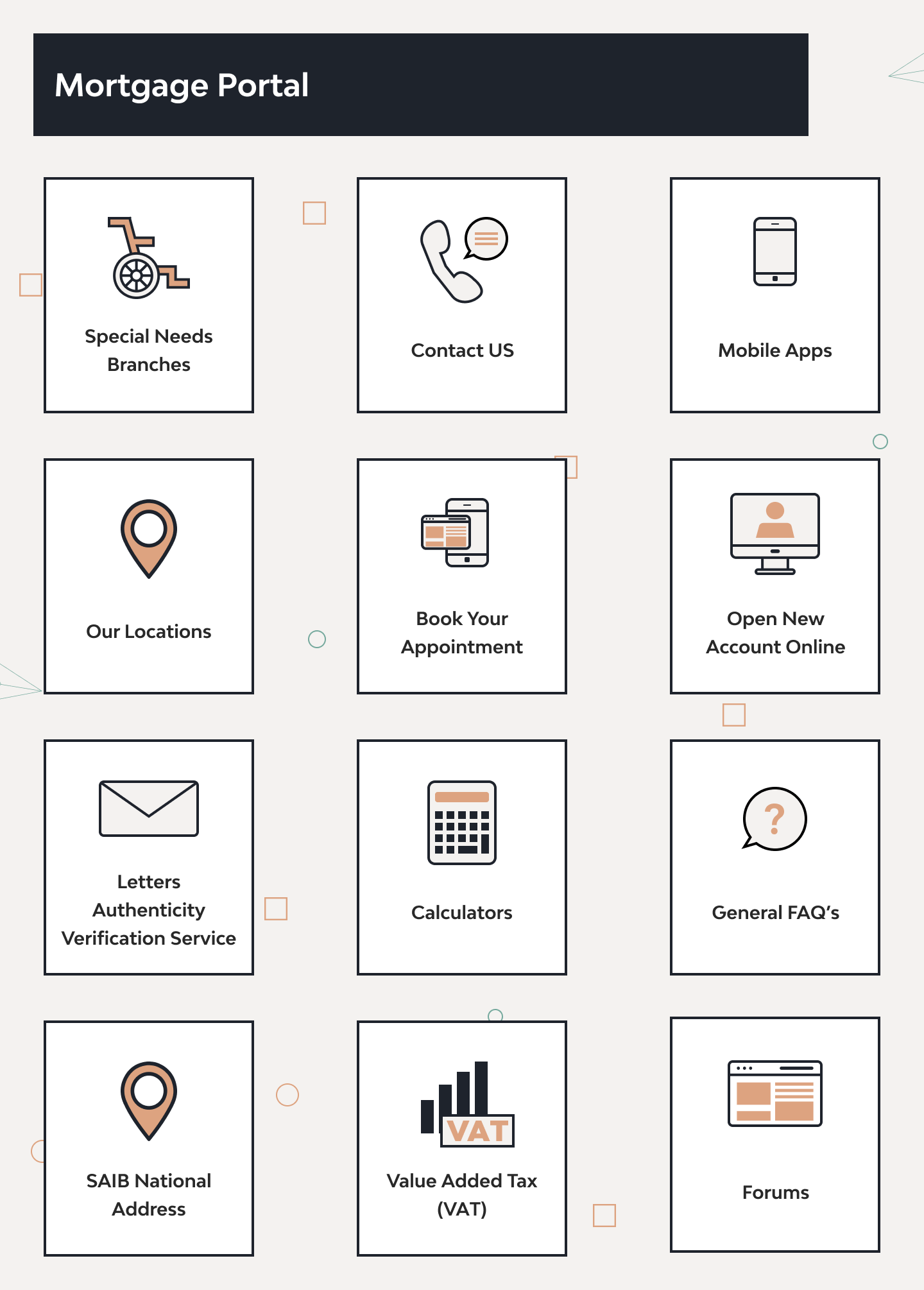

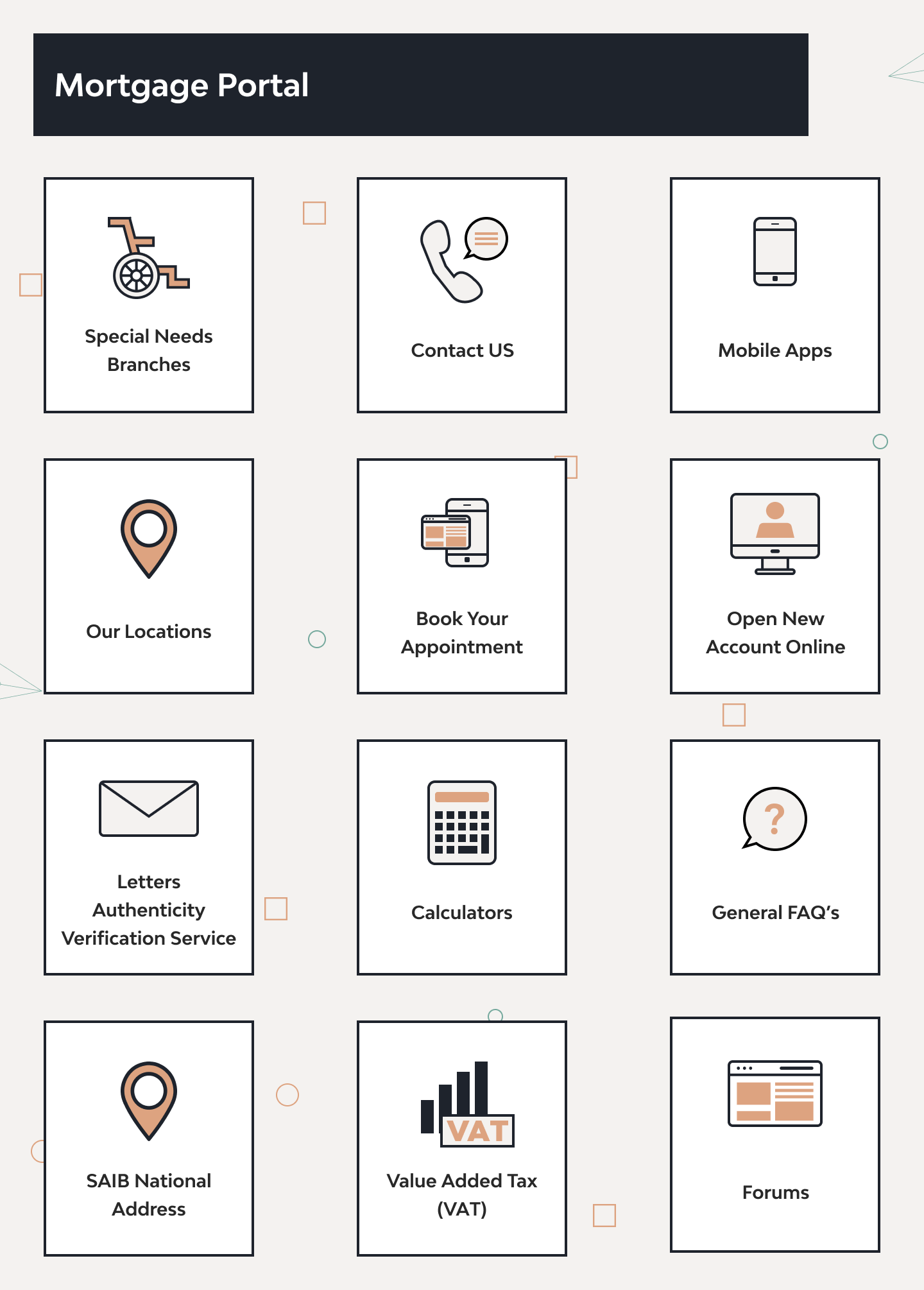

For example, for Saudi Investment Bank, we created a mortgage portal to help users visualize the future mortgage process and speed up the application process. Also, it was crucial to implement the mortgage mechanics, considering Islamic principles (Sharia).

Traditionally, the mortgage application process takes a lot of time and effort for everyone involved. To solve this problem, we have developed software and divided it into three semantic modules:

1. Mortgage portal

To modernize the mortgage process, we have created a portal with the following features:

- Hijri and Gregorian calendars

- Authorization in the Tawtheeq national authentication system

- Rapid (only 15 minutes) initial eligibility assessment mechanism based on national identity card and proof of income

- Possibility to apply, track its status, and communicate with bank managers

2. Customer’s journey

SAIB customer’s journey is now easy and completely transparent:

- Filling out the questionnaire

- Documents’ submission and verification

- Property valuation

- Opening an online account

- Replenishment of the account with bank funds

- Agreement signing

- SAMA credit advisory

- Loan booking

Developing a questionnaire, we considered such cultural characteristics as medical eligibility. We have also developed various identity verification mechanisms, including biometric, simplified the submission of documents, and introduced application status notifications.

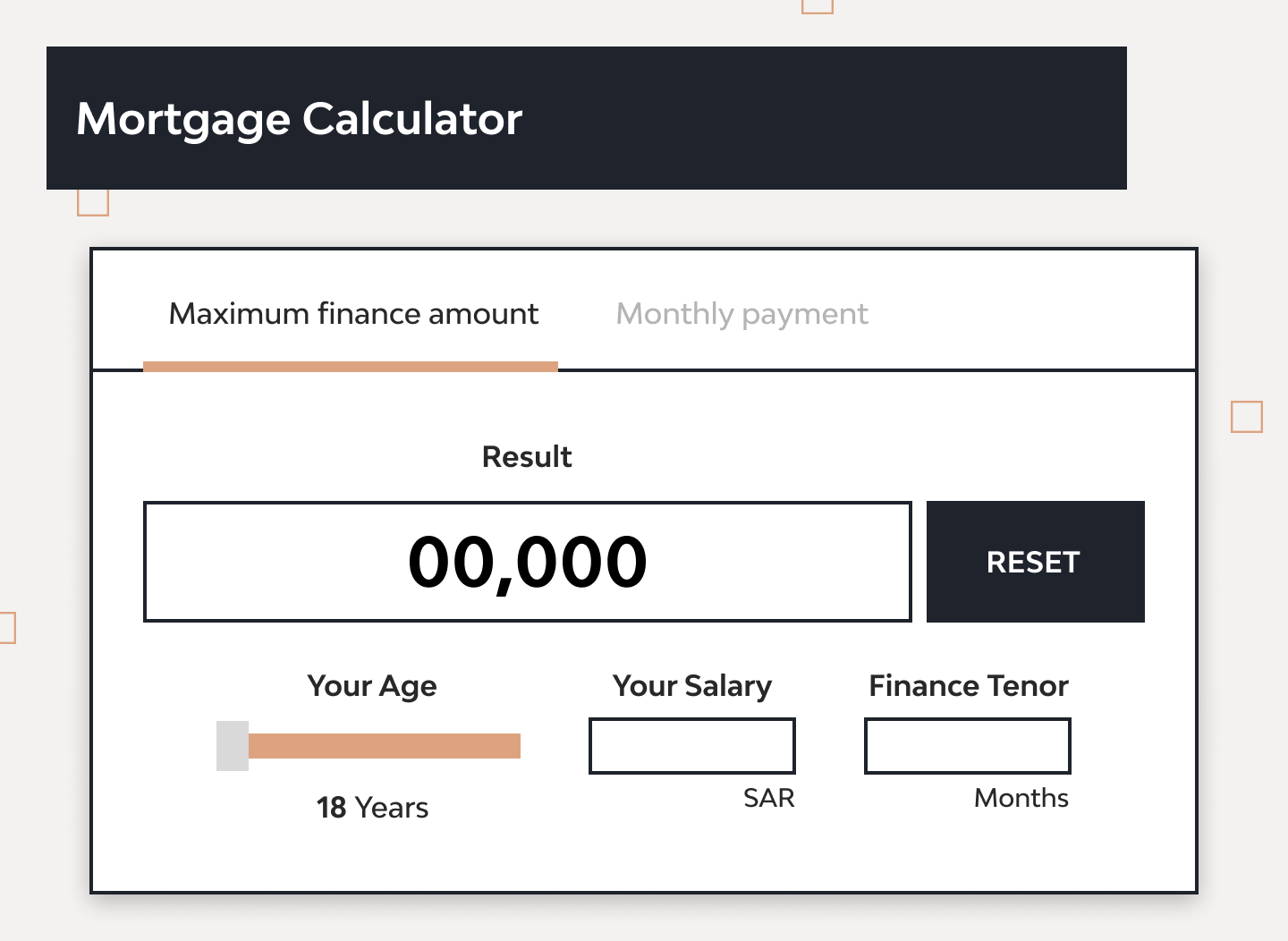

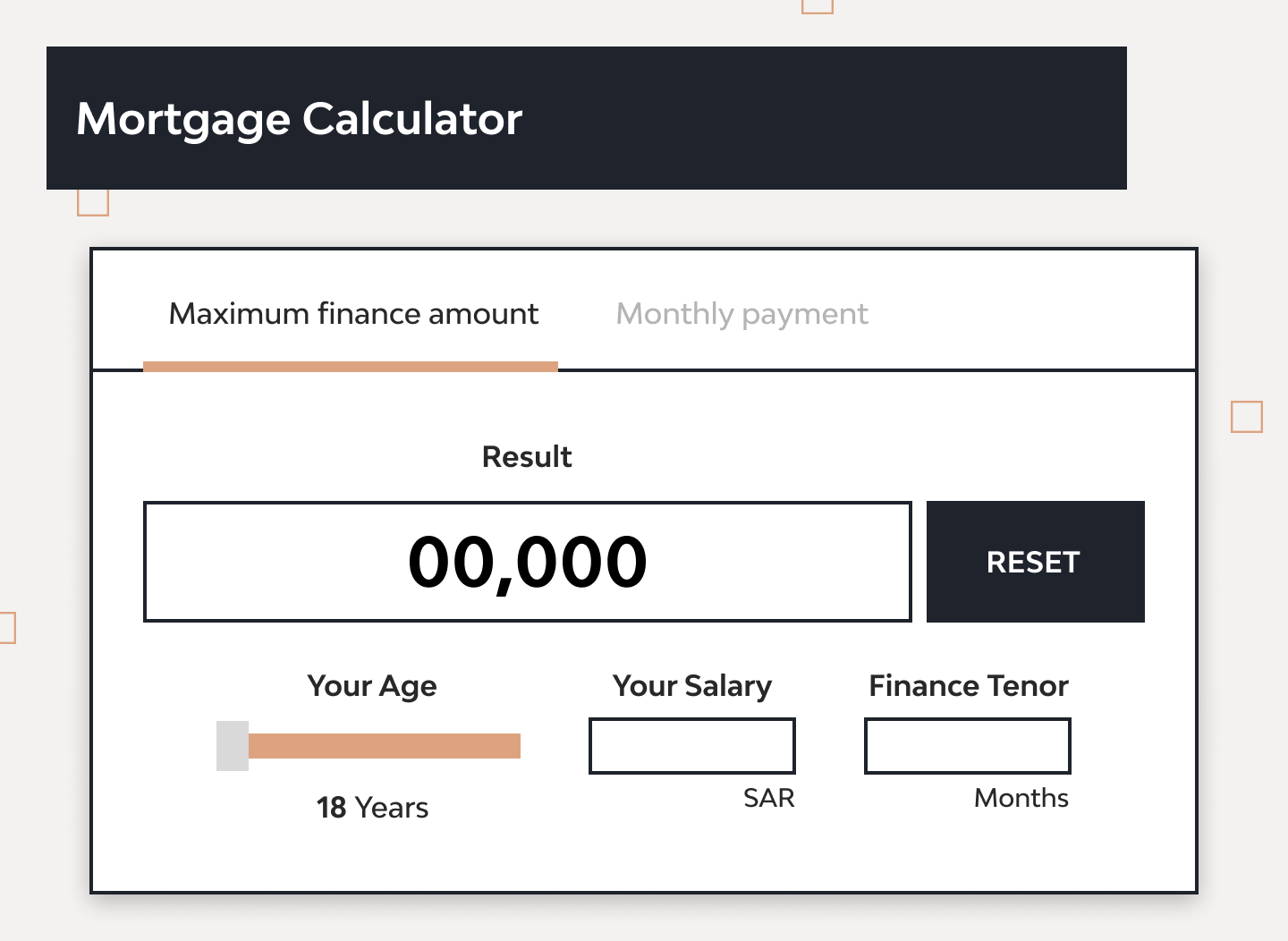

3. Mortgage calculators

Now even unregistered users can navigate the loan terms based on different transaction parameters. The calculator allows them to adjust the mortgage amount, salary, fees, and other criteria accepted in Saudi Arabia.

The mortgage solution for SAIB aimed to help streamline the application process and thus attract more potential customers. At the same time, the software automated many routine tasks, freeing the company’s employees and allowing them to provide better service.

Final Thoughts

Banking apps have evolved beyond simple balance checks and transfers. Modern users expect features like spending tracking, bill splitting, cashback rewards, and chatbot support. Advanced technologies enhance convenience, security, and cost savings.

To meet these needs, partnering with an experienced banking app development company is essential. At Django Stars, we build fintech solutions, including mobile banking, lending platforms, and insurance software.

Contact us to bring your banking app idea to life.

Frequently Asked Questions

- What challenges can you face during banking app development?

- In the fintech industry, it is important to meet the constantly changing client expectations, allow customers to control their spending competently, and also ensure the security of payments and sensitive data.

- Why should you make your banking application?

- Banking apps are becoming more popular because they can offer users 24/7 service, fast transactions and bill payments, and easy access to balance and payment history.

- What is a good banking application?

- Fintech users want the application to be well-designed and convenient, the service accessible, and the functionality filled with the most modern solutions, such as a chatbot or cash withdrawal without a card.

- How to create a mobile banking app and succeed?

- To start, get to know the industry, the consumer, and the competitors well. Determine what user pains you are willing to solve with your product. Find a trusted development team to bring your solution to life. After the release of the MVP, be sure to consider the consumers’ opinion, complementing the functionality and improving the app's usability.

- How long will it take to develop a banking application?

- The duration of banking apps development depends on the complexity of the functionality, team professionalism, its size, as well as the chosen cooperation model — dedicated team, extended team, or outsourcing. On average, it takes a minimum of 200 person-days to develop an MVP.

- How much does it cost to develop a banking application?

- The digital banking app development cost depends on many factors — from the number of features to the team's location. On average, it takes between $40,000 - $80,000 and above to create a mobile banking app MVP. Contact us to get a calculation for your project.

Post Views: 18,560