11 Mortgage Startups That Transforms the EU Fintech

This article explores the rapidly evolving mortgage sector landscape from a startup perspective. Covering the hurdles, trends, and directions for innovative solutions, it introduces the reader to examples of the top 11 online mortgage startups reshaping the industry.

For Django Stars as a software development company, fintech is one of the top priorities. In particular, the portfolio of our engineering team includes projects developed for companies like the Swiss mortgage broker MoneyPark and the UK’s first digital mortgage lender Molo Finance. Years of experience contribute to a deeper understanding of the pitfalls that startups in this industry can face.

Despite being the most common type of collateral used for housing loans, mortgages are still subject to strict regulation and bureaucracy, even in the age of total digitization and process simplification. However, the development of fintech gave a kick to the digital transformation of mortgages. It led to the popularization of online mortgage platforms among millennials, who wanted processes even as complicated as mortgage applications to be fully automated and online. As a result, around 1 in 4 European households now has a mortgage loan. That’s why we wanted to make a list of top mortgage lenders in the UK.

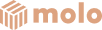

Mortgages constitute a substantial part of the financial services market. For the last decade, the percentage of mortgage loans, among other types of loans, increased by a 4%. But in 2022, they constituted a massive 79% of the total number of loans issued to European households. Moreover, in the U.S., where almost $1.5 trillion is directed to new mortgages annually, the mortgage industry is considered to be a great area of opportunity for mortgage startups.

Read more: Digital transformation in banking and finance

Challenges that Online Mortgage Startups Face

Getting a mortgage is likely one of the most critical decisions in person’s lifetime. That imposes particular requirements on lending platforms, especially regarding security, fraud prevention, and calculations. In the meantime, one of the main goals of a digital mortgage is to enhance the customer experience, making the overall process easier and more accessible. On this basis, there are several challenges that modern mortgage tech startups have to deal with:

- Speeding up the whole process and improving customer experience.

- Making the process fully online.

- Meeting regulatory requirements.

Let’s look at these topics to understand better what every digital mortgage startup should consider when launching a new product.

Read Also: Cybersecurity for Mortgage Software

Speeding up the process

In recent years, with millennials forming another type of customer persona, digitization – and accelerating the mortgage issue process, in particular – has become another focal point in improving customer experience. 2023 demonstrated that mortgage lending platforms can move beyond scanned and emailed documents and paper forms. New technologies like RPA (robotic process automation), ML (machine learning), and AI (artificial intelligence) help digitize and simplify the mortgage process.

In 2023, it took 45 days to close a mortgage. However, companies that moved toward online mortgage platforms managed to reduce the process to 30 days, offering a more convenient experience to customers and reducing production costs in the meantime.

But this scenario works well mainly for non-problematic loans – to customers who provide all the necessary information in detail, tick every single box in the online form, and have been working at the same company for the last three years. When it comes to more complex situations (when the provided info is not complete or straightforward), a manual intervention may be needed. This will delay the issue of the mortgage. In this case, speeding up the process remains a challenge.

Making the process fully online

This challenge arises due to the demand of modern customers for the digital transformation of all the industries they interact with in daily life. Online shopping, financial services, investments, insurance, and much more are subject to digitization, and mortgages are no exception. Millennials want them to be fully online, as there’s no point in using an online platform if they still have to send photocopied documents via e-mail or visit a bank branch in person to get their account receipt stamped.

The problem is that some scenarios, complex ones, require manual processing, as some questions can only be assessed or resolved with human intervention. These issues are usually closely related to fraud prevention and loan security. However, while fintech widely uses ML and blockchain technologies to enhance fraud protection, the burden of complex compliance still may require companies to use hard-copy documentation.

Meeting regulatory requirements

Mortgages remain one of the most complex, regulated, and bureaucratic industries, as fintech mortgage lenders must ensure that every loan corresponds to strict compliance requirements to avoid possible risks. Given that digital transformation poses both actual and potential risks to compliance, the big challenge is to strike a balance between the two.

In addition, it’s important for a company to have a strong compliance back-up or sector that knows the regulations in full and how to apply them in processes. It’s critical to check how much compliance risk the company presents and to implement the necessary compliance controls. This was put in sharp focus last year when regulators put pressure on all aspects of mortgages.

These challenges gave rise to particular trends that formed the development of the modern mortgage industry. We’ll look at some of them in the following sections.

How Mortgage Startups Compare to Traditional Lenders

Mortgage startups and traditional lenders can have distinct characteristics and approaches that set them apart. Here are some key points to consider when comparing:

- Technology-driven approach. Mortgage startups often leverage tech and digital platforms to streamline the application process and improve efficiency. To deliver a seamless and personalized customer experience, they may invest in user-friendly interfaces, digital tools, and responsive customer support. Traditional lenders, on the other hand, may have established customer service departments and processes that rely more on manual operations.

- Speed and convenience. While traditional lenders may have longer processing times and require more paperwork, mortgage startups prioritize speed and convenience and strive for greater ease of interaction. They may offer online applications, automated underwriting, and quicker loan approvals.

- Product offerings. Traditional lenders typically offer a wide range of mortgage products, including conventional loans, government-backed loans, and specialty programs. Mortgage startups may focus on specific niches or innovative loan products tailored to specific customer segments.

- Regulatory compliance. Both mortgage startups and traditional lenders must adhere to regulatory requirements and compliance standards. However, traditional lenders often have more experience navigating complex regulatory landscapes, while startups may need to establish their compliance frameworks.

Modern users consider these factors and evaluate their individual needs, preferences, circumstances, and priorities when choosing between a mortgage startup and a traditional lender. Offering unique benefits to the market is crucial for the company to stay competitive.

Mortgage Industry Trends

The mortgage industry has always been one of those dinosaurs who are uneasy about anything related to tech innovation. However, times change, digital transformation in mortgage has become inevitable, and delaying it may adversely affect the development of the business. Over 50% of mortgage companies in the US have already adopted AI and ML technologies in their work. In the light of the recent wave of digitizations, the following mortgage tech trends will shape the industry in the near future:

- AI and ML as the new-gen predictive technologies

- Robotic process automation

- Simplified user experience

AI and ML are enhancing the customer experience

AI and ML are mostly used for task and process automation in order to save time and resources. These technologies help the software development team enhance the customer experience through a faster, more customer-oriented, and more secure process flow. For instance, ML algorithms can be used to validate the documentation necessary for a lending deal, identify problematic issues, and raise notifications for a quick settlement.

Robotic process automation

The benefits of automating routine and repetitive tasks are easy to define. Process optimization doesn’t just increase efficiency; it also allows employees to spend their working time on strategic and higher-value activities that will boost business growth and enhance the customer experience. For instance, combining OCR (optical character recognition), object recognition, and direct application integration might completely replace manual documents and complaints reviews. This will not only significantly shorten processing times, but also result in more consistency, higher accuracy and better compliance.

Simplified user experience

In the digital age, when people rarely take their eyes off their phones, borrowers, especially millennials, want a fully digitized approach to mortgages. They want everything completely online, without the need to make appointments or even upload scanned documents or send emails. And the whole deal must be completed in no more than 20 minutes. Mortgage brokers must take this trend into account and be prepared for customers who want to make purchases quickly, with no red tape. Thus, they are already becoming digital mortgage brokers, expanding the range of their capabilities.

The trends listed above will transform the industry sooner rather than later, but there are already a number of players on the market who have implemented innovations and created new-age mortgage solutions. Below, we’ll take a closer look at a few industry pioneers.

Read more: The Latest UK Real Estate Software Trends

Types of Mortgage Fintech Startups

The mortgage industry is complex, and the recent rise of digital transformation has made it even more multi-faceted. It has spread far beyond the classic notion of a mortgage. Nowadays, when a company wants to create a mortgage website, it has to realize that the modern industry offers a vast number of services and solutions that straddle the border of different business areas, such as mortgage, insurance, data analysis, and finance.

Depending on the solutions the company offers, there are several types of mortgage fintech startups:

- Mortgage processing and workflow software providers. These include servicing platforms, providers of loan origination systems, and other solutions aimed at mortgage servicers, issuers, and originators. In short, they are targeted at accelerating and simplifying the mortgage application and closing process.

- Tech-based mortgage lenders. Or, as they are also called, digital mortgage lenders. These ones provide mortgages directly to borrowers, acting as direct lenders.

- Marketplace lending platforms. These offer a marketplace for lending and investing platforms for commercial and residential mortgages and mortgage and student-focused loans.

- Mortgage data and analytics. These startups collect and supply data to mortgage providers or investors. They include analytics software that gauges loan quality and credit-scoring software. In alternative credit scoring, these startups leverage innovative methodologies and data sources to provide more comprehensive and accurate assessments of borrowers’ creditworthiness.

- Digital mortgage brokers. Such mortgage tech companies find the best mortgage offers on the market based on the customer’s requirements and characteristics and connect the customer with the service provider.

And depending on how the startup is well-planned and fit into the market, there are successful and failed startups. Check our startup handbook to learn how to become the former one.

The 11 Best Mortgage Startups

Now that we’ve given you a general overview of the current state of the mortgage industry, let’s look at our list of the 11 best broker startups. As a web development company, we chose the best online mortgage brokers because of their high-quality service, innovative approach, rapid deal processing times, and fare rates. Here is the list of online mortgage lenders:

1. MoneyPark

MoneyPark is an independent fintech mortgage broker and advisor for mortgage and insurance products. It acts as an intermediary between banks and private customers, helping clients to find the best deals on the market. For more than a decade of partnership, Django Stars’ developers help Money Park provide customers with comprehensive and customized mortgage and real estate solutions and bolster its leadership in the Swiss market.

Country: Switzerland

Services: Mortgage, real estate, health and property insurance

Founded date: 2011

Capital raised: Acquired by Tamedia for an undisclosed amount

Technologies used: Python, Django, Redis, Nginx, PostgreSQL, Celery, AngularJS

Case study: https://djangostars.com/case-studies/moneypark/

2. Molo Finance

Molo is a fully digital mortgage lender with a direct-to-consumer approach. Using its tech-enabled platform, the company allows users to get a mortgage in the shortest period of time without having to submit paper forms and make appointments and avoid manual reviews, traditional banks, and old-fashioned mortgage lenders.

Country: United Kingdom

Services: Buy-to-let mortgage

Founded date: 2016

Capital raised: £3.7M seed funding in 1 round by Ubon Partners

Technologies used: Python, Django, Redis, Nginx, PostgreSQL, React

Case study: https://djangostars.com/case-studies/molo/

3. Hypomo

Hypomo is a global online mortgage broker that aims to simplify mortgage deals by processing them completely online, for free. Certified by the National Bank of Slovakia, the online mortgage company aims to transform the traditional broker system by paying their staff a monthly wage instead of interest for each closed deal.

Country: Slovakia and Hungary

Services: Online mortgage brokering and home loans

Founded date: 2017

Capital raised: Pre-seed funding round with an undisclosed amount from MKB Fintechlab

4. Habito

Habito is a free online mortgage broker that offers both loans and remortgage services. The platform scans through existing deals on the market and offers the customer the most suitable ones.

Country: United Kingdom

Services: Mortgage advice

Founded date: 2015

Capital raised: £19M over 5 rounds

5. Trussle

Trussle also offers free online mortgage advice, whether consumers need to buy a house or remortgage. But what makes the company different is that they compare available deals daily and notify clients if they can save money by switching to a more favorable deal.

Country: United Kingdom

Services: Online mortgage broker

Founded date: 2015

Capital raised: £19.3M over 5 rounds

6. LoanLink

LoanLink specializes in providing mortgage advice in Germany, where getting a home loan may be quite challenging. Their key audiences are foreigners, freelancers, and international investors. The company offers not only the best deals on the market, but supports clients with expert advice and secures the mortgage deal.

Country: Germany

Services: Online mortgage broker for foreign buyers

Founded date: 2017

Capital raised: Undisclosed amount over 3 rounds

7. Homegate

Homegate is an online platform for real estate services that offers customers lower interest rates, a more transparent approach, and a quick and easy application process.

Country: Switzerland

Services: Digital real estate marketplace

Founded date: 2001

Read more: Real estate app development guide.

8. Landbay

Landbay is a lending platform that works on a peer-to-peer basis. It enables lenders to give money to property investors, facilitating local government, institutional and retail investments in UK real estate. All loans are secured by top-ranked residential properties across Wales and England.

Country: United Kingdom

Services: Peer-to-peer funding in property investments

Founded date: 2013

Capital raised: £1.6B over 13 rounds

9. LendInvest

LendInvest is a mortgage marketplace that offers opportunities for investments in the UK mortgages for institutions and individuals “providing stable income secured against UK property.”

Country: United Kingdom

Services: Peer-to-peer lending

Founded date: 2008

Capital raised: £993M over 17 rounds

10. Interhyp

Interhyp is a mortgage broker that works both online and via telephone. It provides services on mortgage advice, finds the best rates for individual property financing, and helps customers complete the loan application process.

Country: Germany

Services: Private mortgage lending

Founded date: 1999

Capital raised: £7.2M over 1 round

11. bijBouwe

As the first digital mortgage lender in the Netherlands, bijBouwe provides top-quality management and direct-to-customer origination of customized mortgage portfolios.

Country: Netherlands

Services: Online mortgage provider

Founded date: 2015

These startups represent the variety of services the mortgage industry offers nowadays. They form its innovative image and make getting a mortgage more accessible and comfortable than ever.

How Django Stars Can Help

Django Stars’s developing team has extensive experience designing and programming mortgage industry applications. And we’re incredibly proud we’ve created two projects from above – MoneyPark and Molo.

We partnered with Molo Finance at the pre-MVP stage, having just an idea of service and basic features. We’ve designed a fully functional MVP project using Python and Django framework in eight weeks. It showed Molo’s core advantages to investors and users. With our help, Molo raised $3.8 million in the first investment round.

During the years of our partnership, Molo transformed from a promising startup into a true market leader. We still work together when Molo is the UK’s digital mortgage market leader.

MoneyPark is another project that went from a small startup to the #1 Swiss mortgage broker platform with our help. We started in 2012 by designing a fully functional MVP for the online mortgage platform. We’re helping it expand its complex mortgage system through advanced calculations, financial analysis, automated property valuations, and other technological features new to the Swiss market.

Starting our cooperation with mortgage tech companies years ago, we obtained vast experience and knowledge of all nuances and peculiarities of the international mortgage market.

Check the Case Studies section to learn more about our work, and dive deeper into our blog to find more expert articles on technologies, management, and lifestyle. Or get in touch with us and describe your idea directly.

Conclusion

It’s not an exaggeration to state that mortgage startups are revolutionizing the homebuying process in the EU by leveraging technology to offer faster, more personalized, and more convenient services to homebuyers.

These startups are streamlining the mortgage application process, making it more accessible to a broader range of people than traditional lenders. While each startup has unique advantages and disadvantages, many offer competitive rates and fees and are subject to strict regulations to ensure reliability and trustworthiness. As the popularity of mortgage startups continues to grow, we can expect to witness even more innovation and disruption in the homebuying industry in the years to come.

The Django Stars team excels in providing high-quality digital mortgage software development services. Feel free to contact us if you require technical assistance developing your startup.

- What are mortgage startups?

- Mortgage startups are innovative companies that use technology to streamline the mortgage application process, making it more accessible to people compared to traditional lenders.

- Are mortgage startups in the EU reliable?

- EU mortgage startups are subject to strict regulations to ensure reliability and trustworthiness. While individual startups may vary in performance, they must operate within the regulatory framework and prioritize maintaining a high level of reliability. It's important for potential customers to conduct due diligence, research the reputation and track record of specific mortgage startups, and consider reviews and feedback from other customers before making a decision.

- How do mortgage startups compare to traditional lenders?

- Mortgage startups offer numerous advantages compared to traditional lenders, such as speed and efficiency (including robotic process automation), personalization, enhancing the customer experience (with AI and ML, digitalization, and getting rid of red tape), accessibility to a broader range of borrowers, and competitive rates and fees. However, traditional lenders have their strengths, such as established reputations, extensive branch networks, and long-standing customer relationships.

- How are mortgage startups changing the homebuying experience in the EU?

- Mortgage startups are revolutionizing the EU homebuying industry by leveraging technology to offer faster, more personalized, and more convenient services to homebuyers. To answer what a successful mortgage startup might look like, refer to the above 11 examples, including Molo Finance, Money Park, Hypomo, Trussle, and Habito.