Financial Data Providers: Types and Features for Business

For many industries, data is the key to delivering better services and solutions. This is especially true in the fintech products and services, where data is used in every field of application.

With the rise of open banking, many different options became available. For customers, it meant they could now manage their money without leaving home. For companies, it opened up a universe of new possibilities and technology solutions.

If you’ve been thinking about using financial data service providers for your fintech project, stick around. Take advantage of the opportunity to learn from the experience of the fintech projects that the Django Stars team has added to its portfolio over the past 15 years. In this article, we’ll dive deeper into the topic of data-providing services for fintechs and the role these services play in the fintech industry.

Why Do We Use Third-Party Fintech Data Providers?

Many companies use data collected by another organization because it saves them a lot of time, money and effort, especially when they need a way to easily integrate data into a product architecture.

As a fintech software development company, we also use third-party data providers and have discovered that they also offer other benefits. And here they are.

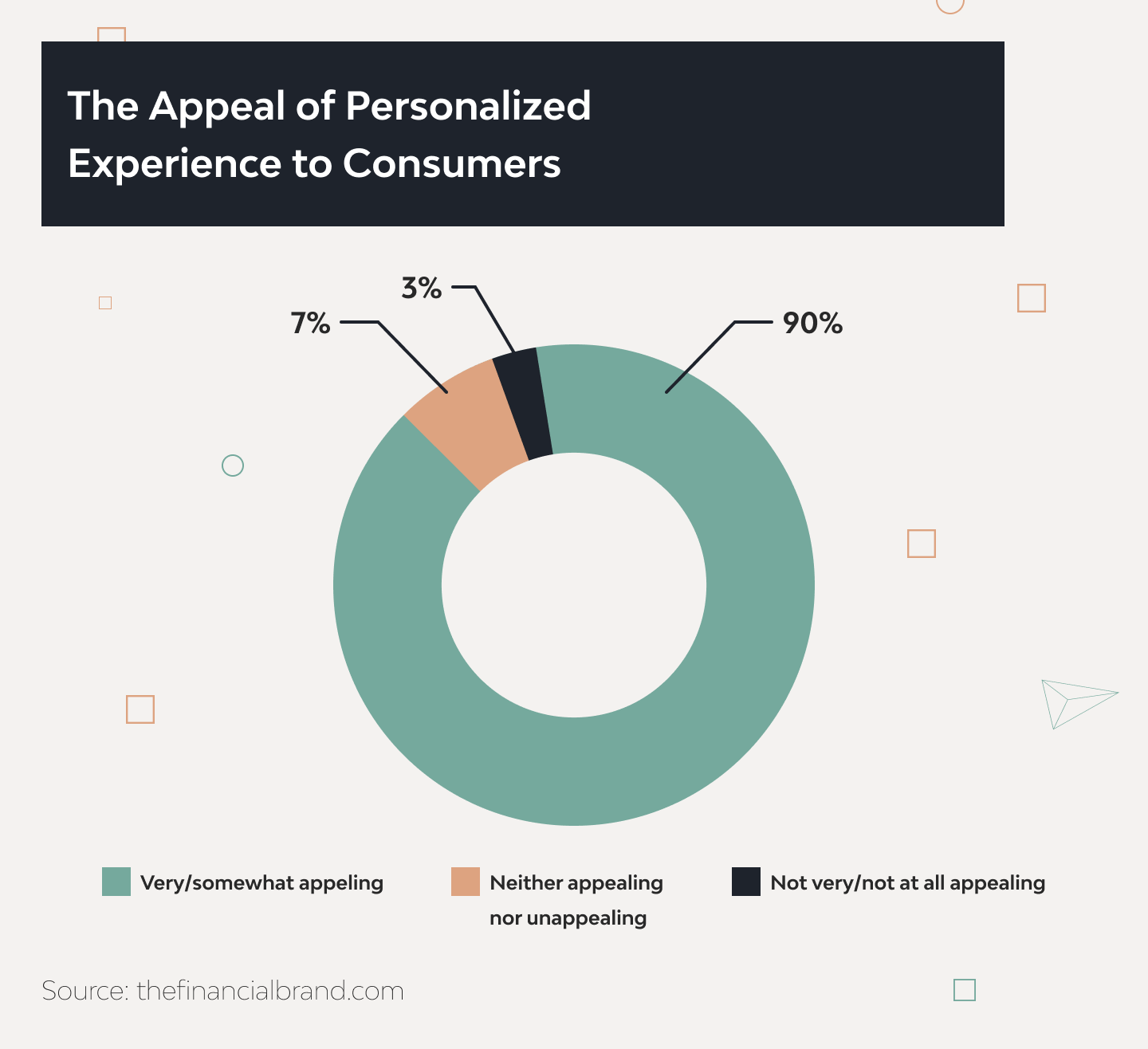

The Benefits of Using Data-Providing Services for Fintech Products

Third-party Data Providers in Fintech revolutionize financial service delivery by offering essential, high-quality data. This partnership enables fintech firms to develop accurate and personalized products efficiently. These providers’ specialized data aids in risk assessment, customer profiling, and regulatory compliance, fostering innovation and agility in the fintech sector. This collaboration underscores a transformative era in utilizing financial intelligence effectively.

Simplifying financial service

Financial data providers greatly simplify the operations of finance companies and customers by offering seamless access to accurate and comprehensive financial data. This integration enables organizations to process transactions more efficiently, reduce errors, and offer better customer service. For customers, it means a more intuitive and hassle-free payment experience, with quicker transaction processing and easier access to financial information. This simplification leads to enhanced user satisfaction and trust in financial services.

Personalization

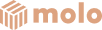

Fintech products and services are gradually replacing traditional banking services and approaches. According to an Epsilon report, most consumers expect personalized services and are ready and willing to provide their personal information so that a company can serve them in the right way.

For a long time, the only way to deliver a personalized experience to customers was to divide them into groups based on geography, genre, age, etc. Now we have access to much more information, such as buying habits or even app-using behavior. It allows businesses to become intimately familiar with their customers and better able to hit the target with their offers and services.

Such personalization requires huge amounts of data that can be acquired more conveniently from third parties, as opposed to gathering the data on your own and developing the required software from scratch.

Customer Segmentation

In addition to creating personalized user experiences, third-party data can be used to segment a customer base for different purposes, such as marketing campaigns or product development. And one size can never fit all.

Especially today, when users have so much choice, the ability to tailor your app’s features to meet personalized meets is a powerful benefit that can lead to significant sales growth. For example, a company can segment consumers by parameters such as their monthly spending and feature requests, and offer services relevant to those customers’ needs.

Fraud Detection

According to Onfido’s Identity Fraud Report 2023, fraud attempts in financial services increased by 23%. This comes as no surprise: more and more transactions are taking place online, so it’s logical that the fraudulent activity will also increase.

By using big data from fintech data providing companies, you can better understand and analyze your customers’ spending habits and detect unusual activity that should trigger additional security checks.

Risk Management

Fintech data providers enhance risk management by offering advanced tools and analytics that help in identifying, assessing, and mitigating various financial risks. They provide real-time data and insights, allowing businesses to make more informed decisions. This includes analyzing fintech market trends, customer creditworthiness, and potential fraud.

By leveraging big data and machine learning algorithms, fintech services can predict and alert organizations to potential risks before they become problematic. This proactive approach in managing financial risks leads to a more stable and secure financial environment for businesses, reducing the likelihood of significant losses and enhancing overall financial health.

Automated Customer Service

Again, people always have options, so high-quality customer care has become another powerful advantage that retains users. And this is another sphere where fintech data is king.

You can create a chatbot to handle some of your customer service workload, or buy software that helps your managers offer the most beneficial investment strategies. These are only two of many cases where using third-party data can offer benefits in terms of customer service, increased customer satisfaction and income.

Read also: How to Create Python Telegram Bot

Better Compliance

The financial industry is highly volatile. Laws and regulations, politics, medicine, new fintech technologies — anything can cause fluctuations or even a worldwide crisis. And this is another case when it’s a good idea to use third-party financial data providing services. It allows you to have at your fingertips all the info you need, as well as the ability to analyze it.

The person or company that has more data has a great competitive advantage in the market, because they can always be prepared for events that are about to happen.

By the way, you can also learn more about what gamification ideas for banking services exist and how they help retain users.

Read More: RegTech Development Guide: Staying Ahead of the Latest Fintech Trend

Top 7 Financial Data Providers

In our practice, we often use financial APIs to develop efficient solutions for our clients. Some of them help to know your customers, and some DaaS for fintech products help to verify their credit data without excessive upload of their documents. Others let to transfer property ownership without bureaucracy but still secure. Below, the top financial data providers are listed.

Experian

Experian, based in Ireland, is one of the world’s most popular financial data providers, and we often use its products in our work. It gathers financial information and credit reports about more than a billion people and companies from all over the world.

In addition to the general third-party benefits we listed above, Experian offers its own Developer Portal, which provides easy access to its fintech APIs, relevant API documentation and credentials, as well as test APIs. This makes it very easy for us to use their data for building fintech products.

Experian has three main products: CreditWorks, IdentityWorks, and The 3-Bureau Credit Report. Each product includes different types of credit reports, alerts, and identity theft protection for companies and users.

In our practice, we use Experian for different purposes and find it to be the best solution for customer’s verification. In the case of any fintech product, be it a mortgage or investment platform, it’s important for the application to ensure that it’s dealing with a real person. Also, data provided by the API allows to find out whether the information provided by the customer is valid, ensuring fraud detection. This integration of verification services exemplifies the innovative approach to fintech product development, where leveraging advanced technologies is paramount to enhancing security and trust in financial transactions.

Thus, Experian helps to create a fully digital fintech product. For example, we used Experian to build solutions for Molo, a digital mortgage platform that enables UK consumers to gain easy and instant access to mortgages online without having to spend an inordinate amount of time or money doing so. Using our Experian integration, we created a life-cycle mortgage management module to schedule regular payments and track arrears.

Onfido

Onfido is another fintech solutions provider we used to develop solutions for fintech products. Specifically, we use Onfido to develop a tool used to verify and confirm photo identities.

This software company helps businesses verify people’s identities through selfies, photo IDs, and AI algorithms. The company has three main products: Document Verification, Biometric Verification, and Authentication.

We use Onfido for three reasons. The first one is the overall customer experience it provides: it’s user-friendly, and helps us reduce the time required for integration. The second reason is that it allows us to build identity profiles that are as robust or as shallow as we want via services such as database checking, document verification, and biometric verification. Lastly, we use Onfido’s extensive security features to help detect fraud.

Yodlee

Yodlee is an American software company whose product aggregates and consolidates the financial data of users — from credit card information to their travel rewards account balance — on one screen. It offers a number of products for data aggregation, budget planning, classification, a virtual financial assistant, and more.

Yodlee has over 1000 partners, both in the traditional financial arena and fintech, and an extensive data network. Its product also has API features such as rapid authentication, which reduce fraud and risk. Finally, since it’s an open-source platform, developers can easily use the latest APIs in their own fintech products.

Read more: Working with Ukrainian IT Companies

We’ve used this software in two of our fintech development projects: Sindeo and Lendage. Here’s how:

Case 1. Sindeo is innovative digital mortgage software that uses technology to improve the property-buying experience. It consists of two portals: a Mortgage Consumer portal and an Internal Mortgage Advisor portal. We used Yodlee to develop Sindeo’s employment,asset-verification, and income-verification features.

Case 2. Lendage is a platform that offers data-based advice to people who are looking for the best mortgage options. One of Lendage’s most notable features is its ability to verify the incomes, assets, and employment information of users by means of several third-party integrations, including Yodlee.

Other Possible Integrations for Your Financial Product

We’ve just introduced you to our favorite data as a service for fintech. But of course, there are more data providing companies on the market that may be useful for fintech development (especially banking app development). Here are some of them:

Dwolla

Founded by two friends back in 2008,Dwolla is an ACH processor that provides a web-based platform for requesting, sending, and receiving funds in the United States. Today it serves thousands of users and includes various functionalities such as identity verification, account history retrieval.

Dwolla specializes in providing solutions to fintech companies, enterprise businesses, and online marketplaces. It also has integrations with such applications as Slack — you can set it up to get notifications about different types of events; QuickBooks — you can download reports to your QuickBooks account and present them to other people; and Sift — a Digital Trust & Safety Suite, which connects data from websites that belong to Sift’s network to prevent fraud.

Trulioo

Trulioo is a Canadian company that’s been operating since 2011. It provides users with access to data on more than 250 million companies and 4.5 billion people spread across upwards of 80 countries to help businesses authenticate financial data & verify identities. Its core focus is to differentiate between human and bot web traffic.

Trulioo has 3 main solutions: identity verification, business verification, and document verification. It has GlobalGateway, Trulioo’s own identity verification platform, which was created to help meet KYC (Know Your Customer) and AML (Anti-Money Laundering) requirements and reduce the risk of fraud. Thus, Trulioo is a fintech data company that helps many financial startups.

SensiBill

SensiBill is one of the 3rd-party data aggregators for fintech companies. Think of SensiBill as a virtual wallet, one that is overflowing with old receipts and loose change. What SensiBill does is simple, yet remarkably innovative: it provides banks and other financial institutions with the ability to give their customers access to receipts from their bank account. It has 2 integration models: API integration with a completely customized user interface, and a native, white-labeled SDK (for Android and iOS).

First Access

First Access is another example of data-providing services done right. The company provides custom credit scores to everyday folk who want an alternative to the credit scores given — and monitored — by traditional credit bureaus. First Access provides companies with business information pertaining to everything from credit scores to the size of loans.

The company has many different use-cases, from routine online loan applications and optional site visits to digital appraisals for microcredit, rural business credit via mobile, and home improvement credit via API.

To ensure a seamless user experience across these diverse use-cases, fintech product design plays a crucial role in creating intuitive interfaces and user-friendly interactions.

What Factors Should You Consider While Selecting a Third-Party Finance Data Provider?

In view of the above, selecting the right 3rd-party provider is a decision that can either propel your business forward or impede its growth. Below are some aspects that might be taken into consideration, tailored to address the unique needs and challenges of the fintech industry.

- Compliance with Regulations. In the strictly regulated world of fintech, GDPR, CCPA, and industry-specific laws are non-negotiable. Evaluate the provider’s alignment with these legal frameworks, as non-compliance could have severe repercussions on your operations, including fines and reputational damage.

- Quality Assurance. Data accuracy is paramount in apps such as risk management and trading algorithms. Look for independent validations and evidence of how the data can enhance precision in areas vital to your industry.

- Scope of Data. Assess the range and relevance of data segments, focusing on how they align with your unique financial products and market targeting. Does the provider have data that’s pertinent to your niche, such as investment behaviors or credit risk assessment?

- Pricing Structure. Analyze the provider’s prices, weighing their potential ROI. Specialized services may command higher prices but offer unique insights for fintech.

- Segmentation. Consider providers that offer customization to suit specific financial products or services. This flexibility can be a game-changer for targeting unique client needs.

- Data Management Platform (DMP) Access with Fintech Focus. A provider with a DMP can enhance data segmentation and insights into audience behavior, specifically geared towards financial service trends and customer behaviors.

- Responsive Support Team. Look for a support team that understands the fintech industry and can offer tailored solutions and guidance. Quick access to expert assistance can lead to optimized targeting and strategy implementation.

Consider a fintech-focused software consulting partner when evaluating 3rd providers. It’s not just about the numbers; it’s about finding the insights that fuel your business’s goals and industry challenges.

Conclusion

Fintech technology and data play an enormous role in the financial services sector. Literally, the more data you own, the more influence, product development possibilities, and security you have. Of course, there are many ways to gather and classify data, but using quality third-party solutions and APIs makes it much easier to access the data you need.

Adopting Python for fintech applications can significantly enhance data processing and analysis capabilities.

If you want to know more about the solutions we offer, contact us using the form below. You might save time, money and effort, and also enrich your product with new and beneficial features.

- What are the types of data in financial services?

- In financial services, data types range from personal and transactional data to market and regulatory data. Personal data includes customer details like name, age, and address. Transactional data covers records of financial transactions. Market data comprises information on stock prices, exchange rates, and economic indicators, while regulatory data pertains to compliance with financial laws and regulations.

- What is financial data in business?

- Financial data in business refers to the quantitative information used for making business decisions, tracking financial performance, and planning strategies. This includes balance sheets, income statements, cash flow statements, and other metrics like sales revenue, expenses, profits, and losses. It's essential for understanding a company's financial health and making informed economic choices.

- What is an example of fintech as a service?

- An example of Fintech as a Service (FaaS) is digital payment processing platforms like PayPal or Stripe. These services allow businesses to process customer payments online, integrating seamlessly with their existing systems. They handle the complexities of financial transactions, including security, compliance, and currency conversion, providing an efficient solution for digital financial operations.

- Why is financial data important in business?

- Financial data is crucial in business for several reasons. It aids in tracking income and expenses, ensuring compliance with financial regulations, making informed investment decisions, and evaluating business performance. Accurate financial data helps in forecasting future revenue and expenses, leading to more effective strategic planning and risk management.