How to Get Funding for Your Startup Project

Django Stars isn’t in the business of investing. Our expertise lies in web development, bringing ideas to life through code. While we’re not an investment firm, we place importance on helping clients make their initial development costs pay off and secure ROI for their capital providers. In this article, we’ll explore the key criteria a project should satisfy from the outset to boost its chances of attracting potential investors and fulfilling the startup funding requirements.

Capital is the fuel for business. If you too are looking to get investors for a business idea, find out what investors look for in a startup from this article. Discover investor types, where to find them, and how to strengthen your pitch.

While global markets are going through turbulences, investor preferences shift. Yet, effective strategies to attract investors to your startup change not that much. If you want to get funding faster, showcase unique technology, market understanding, and a credible team. Also, consider the vital role of a tech team in project funding. The best way to find investors would be to hire experienced developers to build an initial version of your product (a working prototype or MVP) and demonstrate how it solves customer problems. In such cases, a picture is worth a thousand words.

At Django Stars, we’ve helped startups create products that attracted substantial investments. Check our portfolio, featuring success stories like Molo Finance, Money Park, and PADI Travel. With minimal startup capital, they managed to enter the market on time, attracted investments that met their project funding requirements, and gained industry prominence.

While we don’t assist in the search for investments, we offer expertise in developing software or prototypes for startups, aiming to make them the most appealing to potential investors. Feel free to reach out as your initial step.

By the way, we have a lot of fintech experience and are ready to discuss building investment platforms as well.

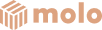

What Does an Investor Look for in a Startup?

- Team — The well-coordinated team plays a crucial role to investors, who will be more ready to invest if the founders have a solid educational background and some business and/or technical experience. Investors need to be convinced that the people who will eventually be in charge of their investment can be trusted to run the business and have the skills required to do so. From the experience of our clients, this can be supported via the involvement of a reliable software vendor such as Django Stars. Talking about startups, investors would like to see a coachable team with a curious mindset, openness, and willingness to learn.Extensive experience in creating lightly efficient and profitable products is also a must-have, and we have it. Check some of our recent projects we are proud of:

- PADI Travel, the US-based world’s #1 booking platform for scuba divers and diving businesses.

- Molo Finance, the UK’s first digital mortgage lender aims to bring lending 100% online and introduce rapid application and decision-making with advanced automation.

- Illumidesk, a US-based edtech platform to empower instructors and large educational institutions to deliver content and teach data-driven subjects more efficiently.

- Product — Investors want to invest in products that resonate with customers and provide solutions to their problems. If the product has a novel approach that adds value to customers’ lives, it will sell like hotcakes. Thus, research your market and segment it so that you can understand the existing pain points of the customer, instead of replicating existing solutions. Many of our clients have discovered that our emphasis on product quality and alignment with the market has significantly expedited their path to securing investor backing.

- Value proposition — Founders should have brand thinking. Namely, what investors want to see in a product is that founders think not only about their unique tech solutions but about the value they will bring to customers, meaning the reason why customers will buy the product. As Paavo Räisänen from Maki.vc confirmed in the interview for Superangel, a customer value proposition is required; founders may not have it at the start, but they should be curious about that and have this in mind.

- Big market potential — Investors are interested in the size of your market, the existing players, and a clear plan about what percentage of the market you plan to capture in what time. The market size will determine the returns the investor expects. The investor might turn down an offer if the market is small or includes too many players, which would leave little scope for a new entrant, affecting funding requirements for projects.

- Valuation — The value of the startup, its financial viability, and cash flow are the main pillars the investors will scrutinize before investing. Thus, the startup founders should present a detailed business plan that reflects the entire process of implementing the project on the market from scratch, ways to develop and upscale it, production and marketing methods, and different potential financial outcomes from the worst to the best. It’s crucial because the more fluid the market is, the more unstable prognoses are.

Project Funding Requirements Checklist

Startup funding requirements encompass the specific financial needs to successfully initiate, develop, and sustain a project. These span from initial costs to future growth funds, representing a comprehensive financial roadmap that outlines how much capital is needed, where it will be allocated, and how it will be utilized to achieve the project’s objectives. Creating this roadmap is pivotal for achieving financial clarity and preparedness, enabling you to confidently approach an investor with a precise funding target in mind.

Check the following set of questions designed to help you assess your project’s funding essentials. Additionally, we encourage you to explore our case studies for valuable insights and inspiration.

Business Plan

- Have you developed a comprehensive business plan that paints a vivid picture of your project’s vision, market analysis, and competitive edge?

- Does your business plan clearly define your revenue model and the strategy for sustainable startup growth?

Initial Costs

- Have you calculated the initial capital required to initiate your project, encompassing expenses such as research, prototypes, and early development phases?

- Are you aware of potential sources of initial funding, be it personal savings, grants, or angel investors?

Operating Expenses

- Have you meticulously determined the ongoing operational expenses vital for sustaining your project, including salaries, rent, utilities, and administrative costs?

- Are these expenses projected both monthly and yearly to align with your financial roadmap?

Product Development

- Does your project have a clearly defined product development roadmap, complete with crucial milestones and realistic timelines?

- Have you included the cost of attracting a skilled tech team in project funding, indicating the value they bring to the table?

Technology and Infrastructure

- Have you described the chosen technology stack and articulated why it’s the right fit for your project?

- Is your technology infrastructure scalable to accommodate growth, and have you allocated funds accordingly?

Legal and Compliance

- Have you addressed legal considerations, including intellectual property rights, patents, copyrights, and regulatory compliance?

- Is your project aligned with industry standards and data protection regulations?

Marketing and Sales

- Is your marketing strategy well-defined, covering both customer acquisition and retention efforts?

- Have you presented a sales forecast that resonates with your revenue projections and customer acquisition plans?

- Are your hypotheses supported by the research that you can present to investors so they can see which customer problem the product addresses and how many customers can be onboarded?

Working Capital

- Have you calculated the working capital required to bridge the gap between expenses and revenue until your project reaches self-sustainability?

- Does your working capital allocation include a cushion for unexpected challenges?

Contingency

- Have you created a contingency fund to anticipate and address unforeseen obstacles and setbacks?

- Are you conveying your prudence and preparedness to potential investors?

Scaling Costs

- Have you factored in the costs associated with scaling your project, encompassing both technology infrastructure and personnel?

- Is it clear how additional funding will support this crucial phase of expansion?

Funding for Growth

- Have you articulated precisely how the investment will fuel the growth of your project, whether through market expansion, product diversification, or increased market share?

- Are you providing a compelling return on investment (ROI) strategy for potential investors?

These checklist items help pave the way for a robust funding plan, aligned with the specific project requirements. Solving all the problems at once isn’t required – you can start with funding for the development of a working prototype and keep iterating it until your customers love it. This strategic approach enhances your prospects of securing the financial support needed to breathe life into your vision and cultivate its sustainable success.

An excellent example is Molo Finance, the UK’s first digital mortgage lender. They contacted us during the pre-MVP phase when they had a product concept, basic design assets, and minor progress from their previous vendor. Together, we swiftly converted it into a fully operational MVP, showcasing Molo’s key strengths to both investors and users. Following Molo’s successful initial funding round and its recognition as one of the top fintech startups in the UK, we shifted our attention to refining the MVP into a fully-fledged digital mortgage platform.

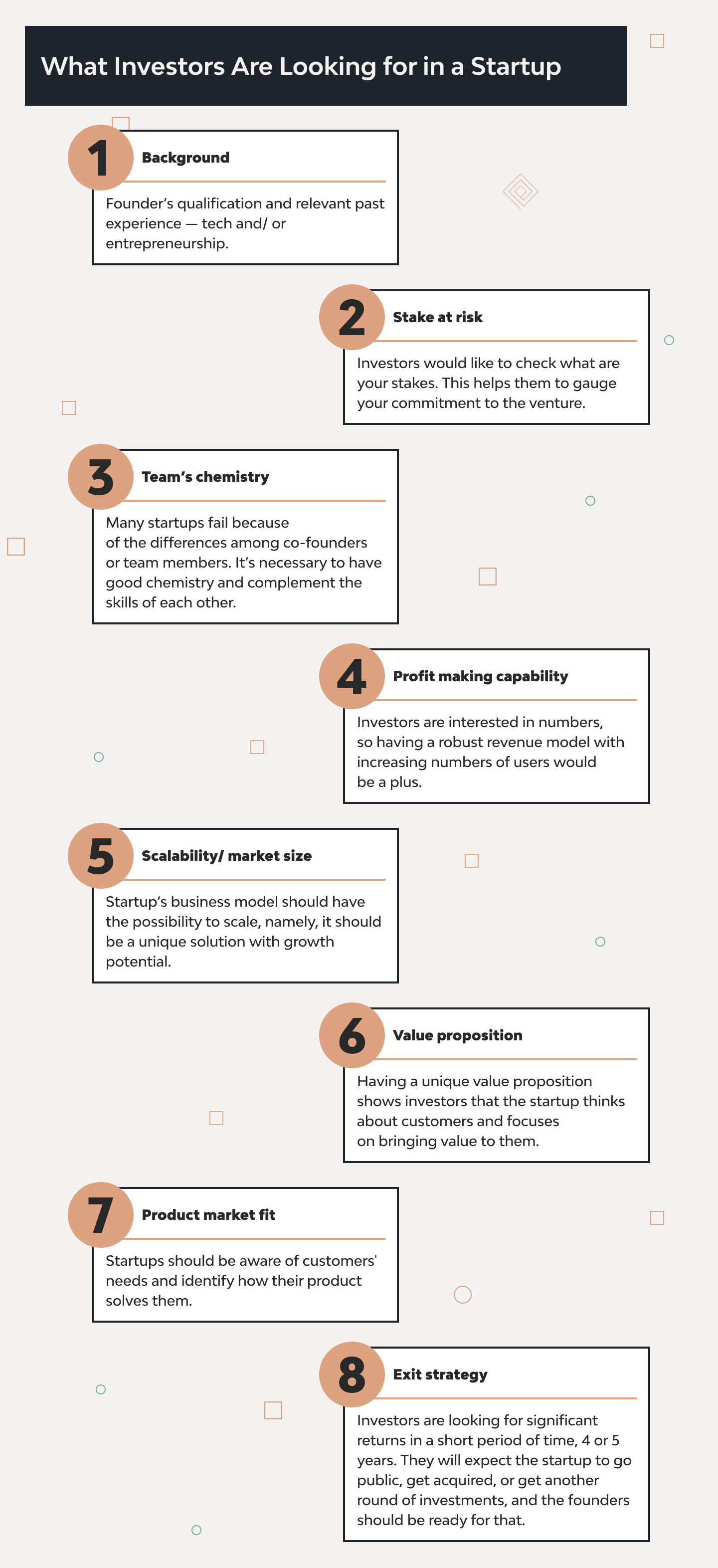

Types of Investors for Your Business Idea

By meeting project funding requirements, it will be easier for a startup to quickly attract investors. The key is to look for the correct type of investor. In fact, it is a prerequisite that budding entrepreneurs acquaint themselves with the types of investors available. Once you know who to pitch to, it’s all about perfecting your pitch to seal the deal.

Banks

Banks are the age-old source for capital lending and loans. Early-stage startups are unlikely to receive bank funding. However, banks run numerous industry-specific loan programs to promote innovation and support early-stage ventures.

Advantages

- Owners retain control of their business — Many entrepreneurs prefer debt financing compared to losing equity. Taking a loan enables them to keep their control over the company. A bank loan provides much-needed working capital. While it does increase the company’s debt, the owners can run the firm the way they want to, as the ownership is not diluted.

- A bank loan is temporary — A bank loan is a temporary source of funding. It needs to be repaid as per the terms and conditions of the loan. This keeps your capital commitments intact, and the capital requirements can be fulfilled without sacrificing ownership in the company.

- Interest is tax-deductible — The interest on the bank loan forms part of the financing costs of the company, and thus is a deductible expense. This reduces your tax bill. Even though you’re not getting any extra money, a penny saved is a penny earned!

Disadvantages

- Tough to qualify — Banks require collateral or security worth more than the value of the loan before approving a loan. This is a tough ask for startup founders, who often struggle to fulfil this condition. Thus, taking out a bank loan is more suitable for established businesses than startups.

- High Interest Rates — In the unlikely event that a bank approves an unsecured loan, it will charge a risk premium. This pushes up the interest rate, and servicing the loan becomes more difficult. This will remain an expense on the company accounts until the loan is completely paid off. Regardless of whether you have profits or not, you will always have to pay the interest on the loan to your bank.

How to Find a Bank for a Loan Application

About one-third of small and medium businesses in the USA turn to the bank for a loan. International and local institutions offer different loan terms and conditions, depending on the loan amount, the loaner’s credit score, the state of the market, and other conditions unique to each financial organization.

Here are the three main factors you need to consider when choosing a lender for a startup:

- Annual percentage rates. Business loans have annual percentage rates of about 9% or higher. Large international banks usually have better APRs, but getting a loan approved may be difficult, especially for a startup. Local banks’ credits are more expensive to service, but small organizations have much better approval rates for small businesses and startups.

- Fees and additional payments. Banks often levy additional fees to cover paperwork and verify application information. Being aware of these fees is crucial, as they can amount to as much as 5% of the loan. This knowledge will help you prepare your budget and make an informed decision.

- Lender reputation. A lender’s reputation is a crucial factor to consider. It’s essential to delve into the experiences of current and past borrowers with the bank. Some banks offer flexible terms and the option to restructure the loan if needed, while others impose hefty late fees even for minor delays. If you encounter any red flags, such as negative customer support experiences, during your research, exploring other financial institutions for your borrowing needs is advisable.

Angel Investors

True to the name, an angel investor is a private investor who supports entrepreneurs by backing their ideas with capital. It is typically a high net-worth individual who invests their money in exchange for a share of equity in the company.

Advantages

- Less risky than debt financing — The angels become a part owner of the company, so you don’t need to repay their debt in a structured manner. If your product takes a while to take off, you’ll have one less thing to worry about. On the other hand, you must repay your debtors, no matter what your P&L statement looks like.

- Offers valuable knowledge — These product investors have acquired their wealth through astute business decisions – and they can pass it on to you. Since their own money is at stake, you can count on them for expert guidance.

- Suitable source to get business going — Investors want to see your product succeed, as their own capital and reputation are on the line. They are part of your management committee and can offer valuable input and constructive criticism.

Disadvantages

- The loss of complete control — The investors have a fair amount of control over the company. If you fail to grow your business, or the investor feels that growth is stagnant, the investor may demand an additional stake in the company without an infusion of extra capital.

- Higher Expectations — Investors fund a lot of companies, and they know that some of them will eventually sink. Therefore, they expect heightened profit margins from the ones that get off the ground. The owners are always under pressure to deliver higher margins and bump up valuations so that early-stage investors can get a decent return.

Best Way to Find an Angel Investor

More than 90% of European early-stage investments in small and medium startups come from angel investors’ capital. However, the main deal is finding an angel investor interested in the product a startup is creating.

Here are five steps to increase the chances of being seen by an angel investor:

- Look for investors in specialized networks. Some online communities and groups have been created for this purpose, such as AngelList, Angel Capital Association, Angel Investment Network, Gust, Angel Forum, Investor Hunt, etc. Each country has its own communities and websites for searching for investments. These are usually open to startups and easy to use.

- Attract interest in social media. Tell about the concept of your project and its potential impact on the market as much as you can. Create accounts on popular social media: X (former Twitter), Facebook, Instagram, and LinkedIn. The more people will come across your idea, the more chances you’ll be noticed by investors.

- Attend networking events. Business forums are specially created platforms to find like-minded entrepreneurs and investors. The best way to take part in such events is to design a project’s booth and develop a comprehensive and involving presentation that attracts attention. And, of course, it’s crucial to communicate a lot with people.

- Compete in startup pitch competitions. Create a solid startup pitch deck and sign up for such events. Here are some of the most interesting: Startup World Cup, Collision, TechCrunch Disrupt, Slush, Next Founders, Jacob Startup Competition, SXSW EDU Launch Competition, and WMF Startup Competition. Winning at any of them gives a huge boost to project development, but even participation may attract investors interested in your vision and concepts.

- Engage with an incubator or accelerator. These are platforms created by investors or investing companies to help new businesses to enter the market and grow. For example, Y Combinator, TechStars, 500 Startups, MassChallenge, SOSV, Innovation Works, Alchemist Accelerator, StartX , and AngelPad.

Venture Capital (VC)

A venture capital fund is a pool of investments managed by professionals. They usually invest in innovation and technology-based startups with high potential, and exit after the business achieves the desired valuation.

Advantages

- Expertise — VCs can provide guidance, as they know the market forces well and keep an eye on changing consumer preferences. They are experts with cross-industry experience. This is an asset for passionate founders who need constant guidance.

- Connections — VCs can connect startups with additional resources. They know how to identify ideas and people with potential. They have built a great network along their journey and can point you to the right people.

- No repayment of capital — Since VCs usually invest in a company by means of a stake in the company, they don’t ask for repayment, as they already own shares in the company. They often offload their shares at an appropriate time to secure returns.

Disadvantages

- Loss of ownership — The investors have a say in the management and day-to-day operational matters of the company. If you fail to grow your business, or the investor feels that its growth is stagnant, the investor may demand an additional stake in the company without infusing additional capital.

- Higher return expectations — VCs invest in many startups and expect high profit margins. If the margins are not met, they may pressure you to generate returns by hook or by crook.

How to Find a VC For Your Startup

Venture investors are usually companies or associations that invest in startups and growing businesses to earn money. This means entrepreneurs must contact their officials. The Small Business Administration is the only cabinet-level federal agency dedicated to small businesses. It helps with many tasks, including finding investments.

Moreover, many venture funds have special programs to stimulate business growth in particular regions or areas. For example, the National Venture Capital Association has a simple form for startuppers who seek investments in underrepresented US regions and communities.

Venture investing communities are unique to each country, but they are open to cooperation and may be easily found through a simple online search.

Personal Investors

A personal investor is a person who invests money in capital markets and is not associated either with an investment firm or financial institution.

Advantages

- Trust relationship — These product investors could be normal people, like your relative, a friend, or anyone who wishes to invest in your business. Since they trust you, attracting investment for your startup becomes much easier.

- Simple investment structure — Since these are personal investors, the complex formal regulatory requirements don’t need to be completed. Often, your deal is based on good faith and a handshake.

Disadvantages

- It can ruin the relationship — There might be a low ebb where the business is not doing well and the lender is losing patience and wants to be repaid. The situation then becomes difficult, as the withdrawal of their support could strain your personal relations.

- No added value to the company — A personal investor is often a well-known person who may lack business expertise. This is not a good situation for a business, as their presence does not help in any way other than by providing capital.

How to Find a Personal Investor

Family members and friends are joint investors in startups and other types of small businesses. Over 38% of startups get their first investments from families. The average amount of invested money is $23,000, so it cannot be a ground for some ambitious projects, but it’s always a fine boost for idea and product development.

Peer-to-Peer Lending

Peer-to-peer lending (P2P) enables an individual to get financial assistance from another individual directly, without the need of a middleman or a financial institution.

Advantages

- More accessible source of funding — Peers are always there to help you. They will have gone through different journeys and gained valuable experience along the way. They can understand your product and invest in it if they see promise.

- Flexibility — P2P loans are unsecured and can be more flexible than traditional loans, as the terms of the loan can be amended by mutual agreement.

- Lower interest rates — Some people have excess funds, and to earn something from cash they may offer money to their peers at lower interest rates.

Disadvantages

- Credit risk — Since there is no proper documentation or formal processes, for the creditor there’s always a chance of a default.

- No insurance/ government protection — These loan transactions are executed without much scrutiny. Therefore, the investor is at a higher risk of losing his/her money, since there is no security to liquidate if the business fails.

How Do I Attract a P2P Investor to My Business?

P2P loans are available only in specially designed systems that connect individual borrowers directly with lenders without using traditional banking or financial institutions. An entrepreneur must register his product and apply a request to ask for investment. If someone is interested in the project, they will respond to it.

We recommend considering three of the most popular P2P investment platforms:

- Prosper is an online marketplace that connects individual or institutional lenders with startups seeking funds. It’s also available for individuals.

- Lending Club. It’s one of the pioneers of the P2P lending industry. However, it no longer allows individuals to invest in loans.

- Upstart. It is a popular P2P lending platform for personal loans. It usually has the best rates and fees compared with other systems.

Read Also: Top 11 US Lending Startups That Are Disrupting the Real Estate Industry

The Main Startuppers’ Mistakes and How to Avoid Them

Many startuppers make some typical mistakes when seeking investments. An entrepreneur must consider these before creating the pitch and communicating with potential investors.

1. Not having detailed research on the local investment market

A startup must research all possible ways to attract investors to its project. Moreover, when defining key players, it’s essential to research them thoroughly. Learn as much as possible about their previous investments, preferences, character traits, geographical location, etc. The more you know about an investor, the more chances you have.

2. Not having a business plan

A startup must have a detailed plan for using the money invested. The plan must highlight all stages of product development, marketing, and sales, as well as gathering loyal audiences and upscaling.

Moreover, it is considered good practice to have several different variants of a business plan, depending on the amount of required investments and the predicted rate of product growth.

3. Asking for too much money

Investors don’t like to lose their money, so every required dollar must be explained in a business plan. Asking for more than you need will alert potential investors. Most of them will not deal with it and just decline the request. Be sure to have a clear and comprehensive explanation of how the money will be used and what investors can expect in return.

The Final Word

As we have mentioned, there are multiple avenues to reach investors who can finance promising product ideas and prototypes: send emails to investors following your networking, participate in Startup Basecamp, contact Y Combinator, etc. Your primary – and the hardest – job is to build a product worth funding. Once you focus your efforts on identifying the pain points for customers and do research on your competitors, you’ll be on the right track.

By following the recommendations above, you can align your project more closely with what potential investors seek. Our product development and management experts can assist you in fine-tuning your concept and building an attractive prototype that meets project funding requirements. Contact us for technical support in growing your business.

- What starting capital should I have for my business idea to be attractive?

- The amount of starting capital can vary widely depending on your industry, business model, and location. It's essential to conduct a detailed business plan to determine your specific financial needs. However, generally, having a minimum of 6-12 months of operating expenses as startup capital is often considered attractive to investors and lenders. Also, demonstrating a clear path to profitability and scalability can make your business idea more appealing to potential partners and investors.

- Who should be on the startup team before looking for an investor?

- Before seeking investors, it's essential to have a core team that covers key areas like operations, technology, marketing, finance, and legal, in addition to the founder(s). If your business relies on technology, having a partner with technical expertise is often crucial. This demonstrates your ability to execute the business plan effectively.

- Is it necessary to have an MVP to find investors?

- No, it's not always necessary to have a Minimum Viable Product (MVP) to get funding. Investors may consider other factors, such as your team, market research, and business plan. Yet, having a prototype or MVP can significantly enhance your pitch and make your business idea more compelling to potential investors. It provides tangible evidence of your concept's feasibility and potential for success.