How to Create an Investment Platform: Essential Steps & Features

Since it starts at 200 person-days to build an investment platform (or $50,000 for a basic version or MVP), clearly understanding how this time and the corresponding budget will be allocated is crucial. This article will guide you through the details of the process, from project requirements, logic, and scalable architecture to individual features, testing, and cybersecurity. This knowledge will be valuable when communicating with technical partners.

With digitalization lowering the cost of financial services, even the most prominent and sternest industry players are considering digital fintech products. For investment companies, this usually means using an out-of-the-box solution to fix some issues in the existing system, as they hesitate to create an investment website custom-built for their needs.

Unfortunately, this approach to investment digitalization often backfires for two reasons. First, building an investment website by digitalizing particular system parts while leaving the rest unchanged is inefficient. Second, due to the differences in state regulation, no universal ready-made platform would fit every investment company’s needs and processes.

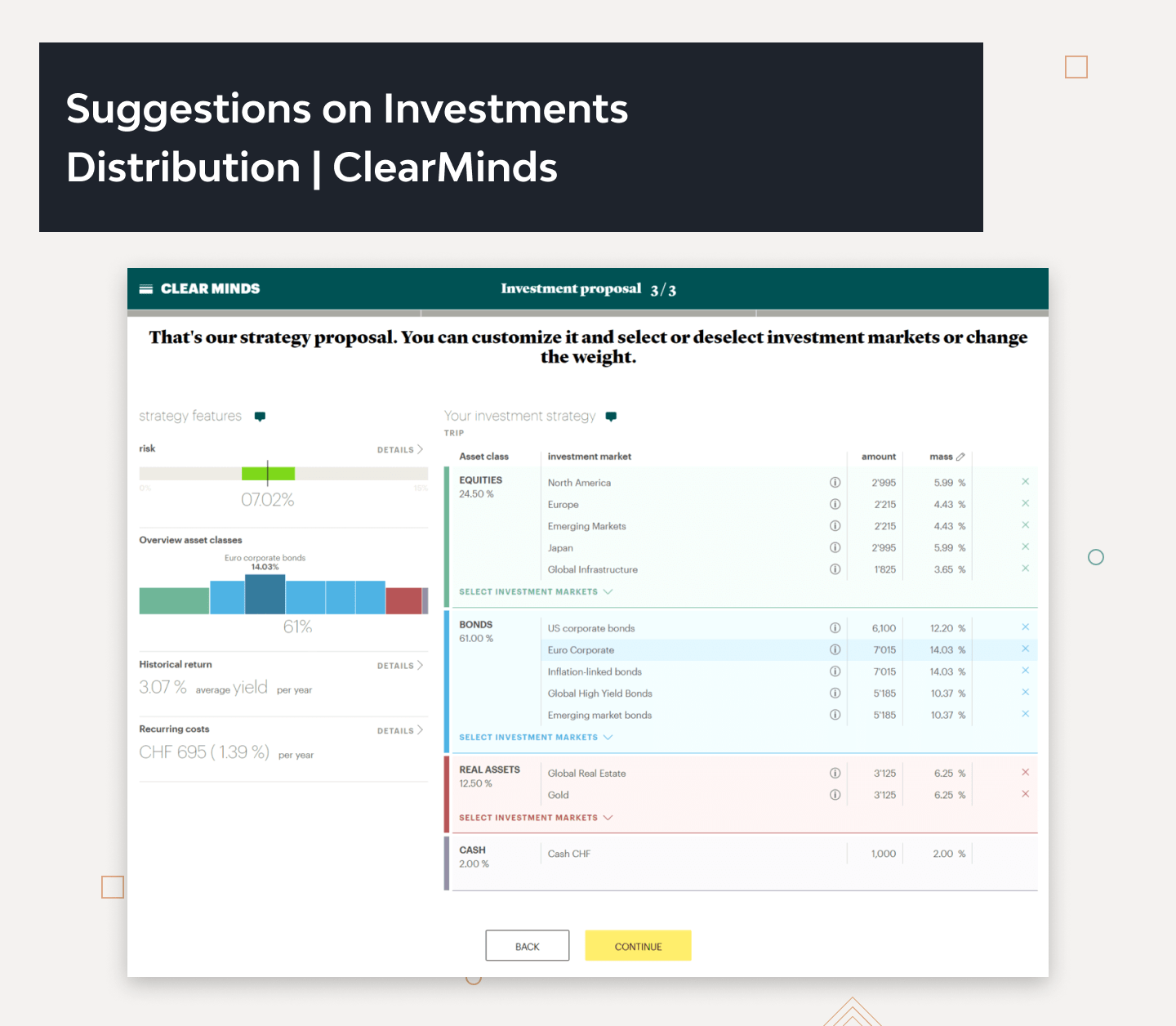

On the other hand, as, for example, our case study with the innovative Swiss investment platform Clear Minds shows, developing from scratch provides the benefit of greater flexibility, allowing a company to build its platform scalable and optimize its processes.

But what does it take to create an investing app that includes a website, a web app, or a mobile application? Continue reading to discover what to consider before creating an investment platform, what features it should have (based on the fintech projects we’ve developed), how to create an investment app, and how to calculate the investment platform development cost.

What Is an Investment Platform

An investment platform is a digital tool that allows users to buy, manage, and track financial assets in one place. It often includes features like real-time data, portfolio management, automated strategies, and access to financial insights. If you’ve been searching for what is an online investment platform, it’s essentially a streamlined way to invest without relying on traditional intermediaries. With investment platforms explained in clear terms, navigating the world of finance becomes more accessible and user-friendly.

Key Types of Investment Platforms

As demand for digital finance tools grows, investment platform development continues to evolve. Whether you’re comparing tools or building an investment platform, it’s important to understand the key types—each designed with different levels of automation, user control, and risk tolerance.

- Equities: Represent ownership in a company. Investors earn through price growth and dividends, but values can fluctuate with the market.

- Bonds: Debt instruments where you lend money to a government or corporation in exchange for regular interest payments and return of principal at maturity.

- Mutual Funds: Professionally managed pools of money from multiple investors, offering diversification across various assets like stocks and bonds.

- Exchange-Traded Funds (ETFs): Traded like stocks on exchanges, offering flexibility, transparency, and typically lower fees.

- Segregated Funds: Insurance-backed investments offering market exposure with added protection, such as maturity and death benefit guarantees.

Before Creating an Investment Platform

When embarking on creating an investment platform, it’s essential to provide a clear roadmap and the necessary resources to ensure a successful project. However, the Django Stars team’s practical experience in developing investment platforms can help. Here’s a breakdown of what we would like our client to be equipped with in this journey.

- A Clear Vision and Strategy. Before you create an investment app or platform, defining your strategy is crucial. What is the core purpose of your platform? Who is your target audience? How do you plan to differentiate your offering in a competitive market? Contact our specialists to turn your vision into a successful investment platform that stands out in the market.

- A Well-Defined Budget. Developing an online investment platform requires a realistic budget. This budget encompasses various aspects, including development costs, regulatory compliance expenses, marketing, and ongoing maintenance. Factors influencing the cost of development are discussed in more detail below.

- Regulatory Compliance. Investment platforms, especially in the financial sector, must adhere to strict regulatory requirements. Understanding and complying with these regulations is non-negotiable. Moreover, it’s crucial to consider regional specifics, for example, how US investment platform regulations differ from European ones. The Django Stars team has experience navigating the intricacies of regulatory compliance and can assist you in ensuring your platform meets all necessary legal standards.

- Clear Requirements. You must have a clear list of requirements to build an investment app that meets your users’ needs. What features and functionalities do you want to include? What is the user experience you aim to deliver? A comprehensive requirements set will streamline the development process and minimize potential setbacks.

- Technical Expertise. Developing a robust investment platform demands specialized expertise. Our team has a proven track record in building secure, scalable, and user-friendly investment apps. We understand the technology stack required for such projects and can guide you in making informed technical decisions.

- Risk Management Strategy. The world of investments involves inherent risks. Developing a comprehensive risk management strategy is vital to protect your platform and users.

- Marketing and User Acquisition Plan. Once your investment app is ready, you’ll need a well-thought-out marketing and user acquisition plan to attract your target audience.

Typically, we recommend conducting the Discovery phase to test your ideas and implementation strategies and optimize development costs and the product launch speed. It’s a reliable starting point for the next stages of the project.

What to Consider When Developing an Investment Platform

Patrik Hansson, our client and founder of Swiss fintech startup Clear Minds, believes that building an investment platform primarily requires agility:

“For those who are just starting out the journey to build their own fintech, the best advice I can give is be agile; be fast; listen to the market; have your idea but do not be too attached to it: try it out and adapt. That is the key point if you really want to create a good solution for the market.”

And we agree. Additionally, you have to be clear about who your target audience is and whether the platform will be B2B or B2C.

Analyzing the audience is important because the architecture of the service depends on it. For instance, with B2B, it’s going to be more branched out and complicated.

However, the audience doesn’t influence every aspect of the development. Allow us to walk you through them all.

1. Architecture

A thorough audience and market research allows developing your value proposition, which, in turn, can help you choose the right architecture for an investment platform. On top of that, fintech products usually require scalability, security, and compliance more than, say, ecommerce solutions, so their architecture needs to account for that.

Generally speaking, there are several architecture types we use most often, each with its pros and cons:

- Layered architecture (aka, n-tier architecture) — easy to start with but hard to scale

- Event-driven architecture — good scalability and performance but issues with eventual consistency

- Microkernel architecture (aka, plugin architecture) — easy-to-add functionality thanks to plugins but challenging to design

- Microservice architecture — great scalability but issues with designing and testing

Selecting an architecture type for a fintech project — or any software project, for that matter — is an essential but complicated step that requires specific skills. That is why it’s best to leave it to a software architect who carefully considers reliability, scalability, team composition, and other technical and business goals before deciding.

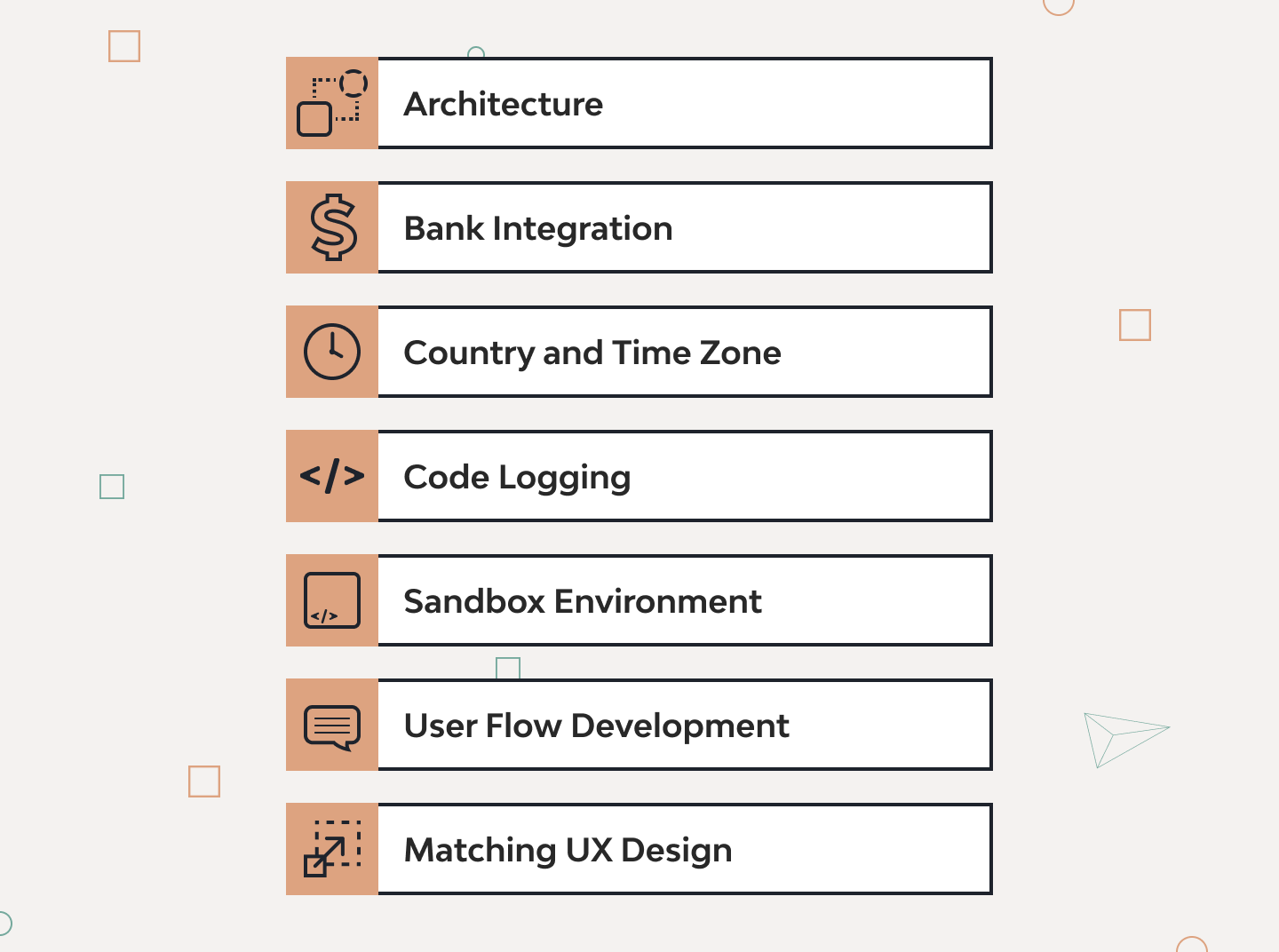

2. Bank Integration

Naturally, developing fintech apps or investment websites requires integrations with financial institutions. Without this, the product won’t be able to obtain financial information about customers, their balances, transactions, credit scores, and more.

In the case of an investment app we developed, integration allows users to receive their credit scores from banks after a short survey. Based on the data, every user gets a score as a ground for investment suggestions.

3. Country and Time Zone

The geography of an application is also an essential factor to consider due to the banks’ varying regulations and operating hours integrated with the investment app. For instance, in England, banks only provide information Monday to Friday from 9 AM to 6 PM.

However, these restrictions don’t mean the application should not work on weekends. If, like us, you happened to encounter this inconvenience, you can make it seem invisible to the users by extracting data from the most recent updates. In that case, if a customer makes an investment inquiry on a Saturday, they will get the investment rates from Friday, even though they may have changed.

4. Code Logging

We’ve seen that third-party integrations are vital for proper code error logging, seeing what caused errors, and how to prevent them.

Here’s an example from our experience. The format of a third-party API changed, and the transactions weren’t going through anymore. However, it wasn’t clear what the actual problem was because errors weren’t displayed correctly. This inspired us to create a tool for error logging that would log our every inquiry to the third party as well as its response to us. Now, when an error occurs, we see it in the log list.

5. Sandbox Environment

When choosing a third party or bank, make sure they have a sandbox option for safe code development. It will help to avoid accidental user information corruption or unwanted charges for using bank information.

What we mean by a sandbox environment is an exact copy of the third-party function set that connects to the source code without risking customer data. When you’re done coding, simply replace the sandbox URL with a real one.

6. User Flow Development

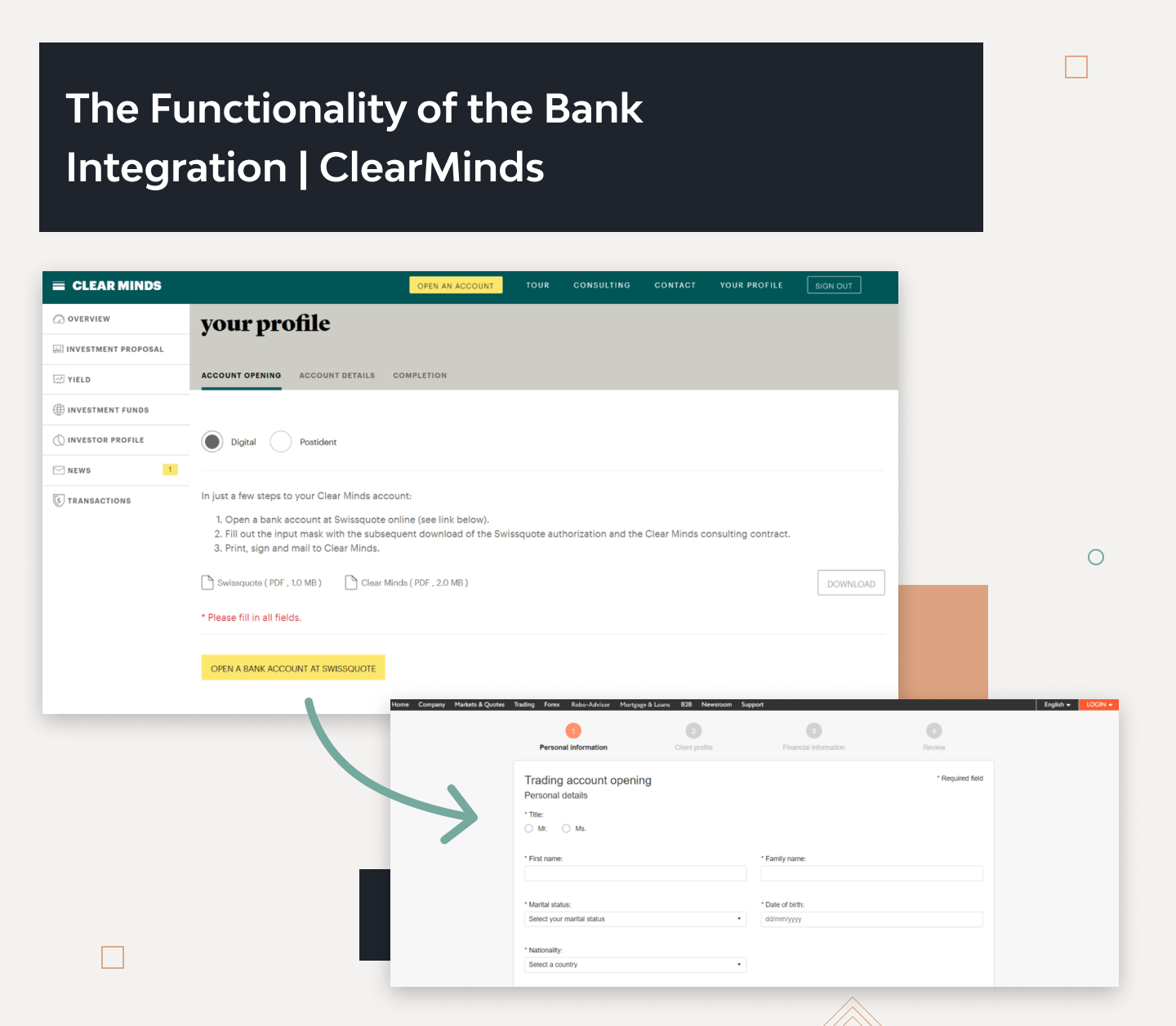

How do customers see your service from their perspective? It’s important to carefully plan the way your platform will interact with users. What steps do they have to take to get results? What should the registration, background check, and investment flow be? Discuss every user action and its detailed flow with an experienced development team.

It’s an example of the registration form for an investment platform we built. We had to leave some wiggle room in case the money didn’t go through or the investment didn’t take place on the same day for some reason. However, the next day’s exchange rates differ, resulting in a different investment outcome.

Still, we found a straightforward solution — restricted usage of the investment portfolio. This means that a certain amount of the client’s assets remains available at all times in case of exchange rate changes or transfer fees.

We also took our time during user flow discussions to determine the best ways to notify users. Currently, there’s no need to check the website or app all the time to see the stock market status. Instead, the investment platform will send notifications if there’s an excellent opportunity to sell or buy.

7. Matching UX Design

User experience design for investment platforms is tricky for several reasons.

- Fintech solutions are notorious for gigantic tables and confusing graphs with all kinds of statistics and summaries. So it’s important to place this information in a digestible and easy-to-navigate form (especially for web and mobile apps).

- The registration forms of investment platforms can easily overwhelm first-time users. With 15 to 20 fields to fill in, it’s no wonder clients do this in haste or don’t even make it to the final questions. It shouldn’t be like this, considering these answers are critical, and the system has to know as much as possible about its users for effective investment management.

However, a thoroughly designed UX can help mitigate this issue. Partially, it can be solved with third-party integrations, like with open banking, but this doesn’t make the form itself less intimidating. So UX designers have to get in the user’s shoes to create a flow that will be understandable, user-friendly, and easy to digest. Some ideas include breaking it up into several steps, putting the critical questions at the top, or gamifying the process.

We also shouldn’t forget about guides and hints for the users. They may not have the necessary experience or knowledge of certain fields or forms. So, balancing between giving enough advice and overloading the interface with pop-ups and notifications is essential. Build an online investment platform you would enjoy using.

If it’s not an investment website for the US market only, a multi-language website or app may also cause trouble. In our case, it was in English and German. We haven’t accounted for the length of German words, which are usually far more lengthy than in English, leading to some layout hiccups.

After considering the architecture, integrations, user flow, and other facets of investment platform development, it’s time to think about its features.

6 Key Steps to Create an Investment Platform

Launching an investment platform demands a clear strategy, regulatory insight, scalable architecture, and a deep understanding of investor needs. These six steps outline how to move from concept to launch while ensuring long-term growth.

Define Your Vision and Target Users

Start by identifying who your platform serves—retail investors, financial advisors, or niche segments—and what problems it solves for them. Product focus early on helps prioritize features and avoids unnecessary complexity. We support clients from the concept phase, helping translate strategic ideas into a technical foundation.

Ensure Regulatory Compliance

Compliance isn’t just a box to check—it shapes the entire platform. From licensing and KYC/AML to GDPR and data encryption, early planning with legal advisors is essential. At Django Stars, we’re ISO-certified and fully GDPR-compliant, so we embed regulatory workflows into the product architecture—helping you stay secure, scalable, and audit-ready from day one.

Design a Clear, User-Centric Interface

An investment platform must balance complexity with usability to serve both novice and experienced users. We map out real user flows, reduce friction, and simplify complex data through intuitive layouts and smart visuals. This approach helps to increase user engagement, reduce drop-offs, and create a product experience that stands out in a competitive market.

Choose the Right Technology Stack

The technology stack behind an investment platform affects security, integration capabilities, and the ability to evolve over time. Support for real-time data processing, modular architecture, and flexible APIs is critical from the start. It also plays a major role in meeting compliance standards, ensuring scalability, and avoiding the need for costly overhauls as the platform grows.

Develop and Integrate Core Features

In investment platform development, key modules like onboarding, dashboards, trading engines, and analytics must function as a cohesive system. Integration goes beyond connectivity—it ensures data consistency, compliance, and smooth user experience. Third-party services can accelerate delivery when aligned with architecture and security standards.

Test, Launch, and Scale

We run usability tests, load simulations, and security audits to ensure the platform performs under pressure. After launch, we support iteration cycles based on user feedback and analytics—so you can create an investment platform that grows with your business.

Key Features of Investment Platforms

We can roughly divide investment platform features into general and industry-specific.

The general features are what you would expect in all kinds of applications, not particularly fintech ones. They include:

- Personal accounts to store all information about the user and their financial operations

- Real-time alerts to never miss an important notification

- Multi-platform support to have access to the platform regardless of the device

- Analytics dashboards to see results and compare them to make investment decisions

- 24/7 assistance to report any issues and get professional help instantly, etc.

However, it’s more important to focus on the features that are inherent to investment platforms if you want to develop a really useful one. Here are the ones we recommend adding when creating an investment platform:

Multi-currency accounts

Multi-currency accounts make it easy to receive funds and withdraw cash whenever, wherever. With platforms striving to make investment markets more available to users, multi-currency accounts give them access to investment opportunities in various countries and currencies.

Unlike banks with a limited number of the most popular currency exchange options, the multi-currency functionality in investment platforms allows exchanging all kinds of currencies. More than that, it does so much more quickly than a bank, with fewer fees and at a lower exchange rate, since users can monitor exchange rates in real-time and choose the most appropriate time to convert.

Automated investment advice

Software’s ability to quickly and accurately analyze gigantic amounts of data makes it a worthy advisor when it comes to making investment decisions. Consequently, an automated investment advice feature will allow platform users to invest effectively.

This kind of advisor can assess the user’s investment portfolio in real-time, compare it to the market situation, and show the optimal time for selling assets. Alternatively, if users consider investing assets, an automated advisor can predict how much they will earn from it in a year (and if it’s even possible).

Investment calculators

A handy feature, investment calculators show users how their investment will grow over a set period of time. They need this information to make better, data-based decisions.

For instance, a user may want to invest in quickly growing, trending assets, believing they are “hot.” But the calculator doesn’t rely on emotions. Instead, it uses machine analysis and historical data to forecast earnings and objectively assess the profitability of an investment.

Cryptocurrency trading

If people are interested in investing, they are almost sure to be interested in cryptocurrencies. A fully functional investment platform should account for that and integrate with various cryptocurrency exchanges to allow buying and selling different kinds of coins.

However, cryptocurrency trading is illegal in some countries (China, Bangladesh, Egypt, and more). So we advise implementing this feature only if your audience lives in countries that allow it (Canada, Germany, Slovenia, Estonia, the Netherlands, Singapore, etc.)

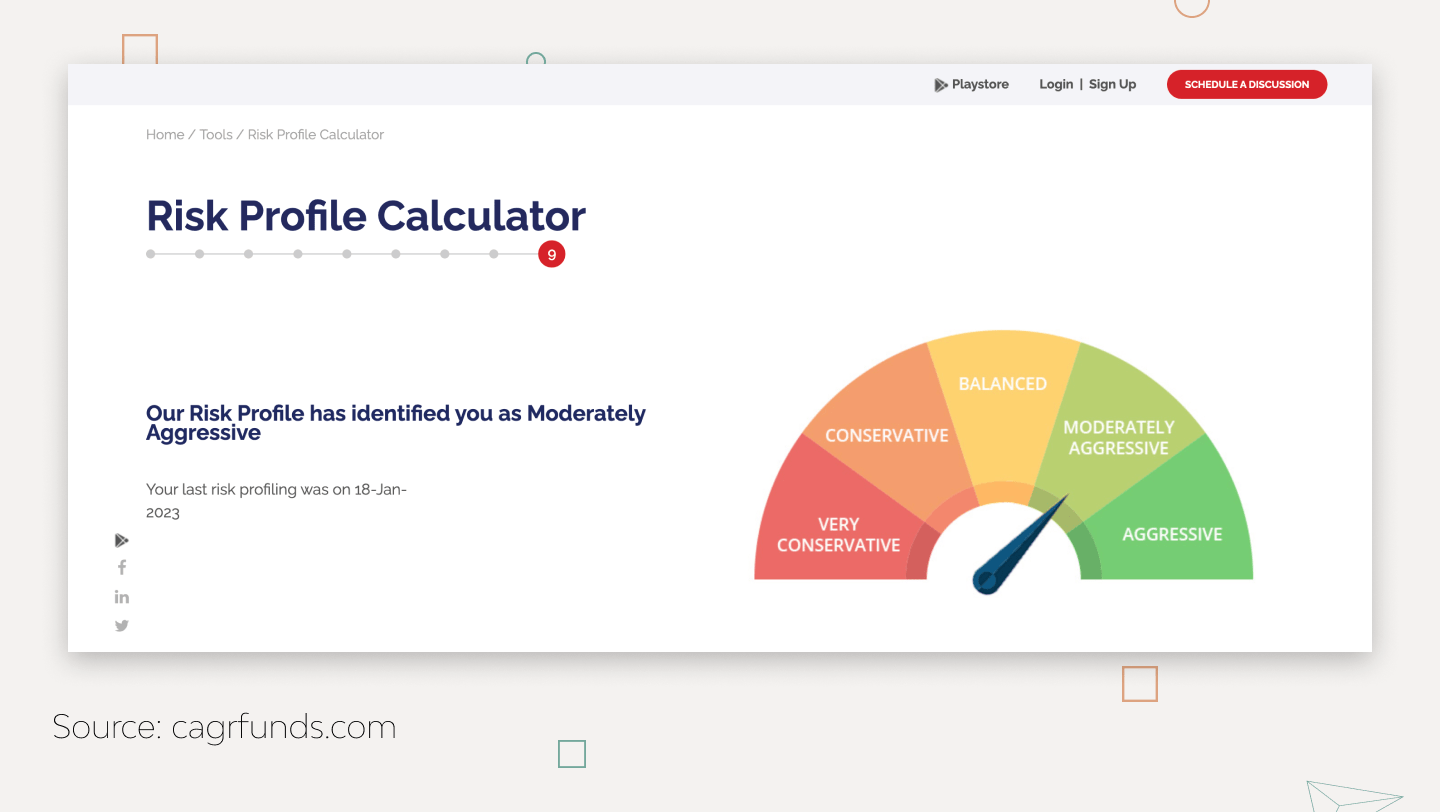

Risk profile calculator

Risk profile calculators help determine optimal approaches to investing. Including questions the user can answer to see their risk tolerance will help them better understand what to invest in. However, it’s important not to overwhelm the user: five to ten questions will do.

Savings goal analyzer

When users set their savings goals, they must accurately calculate the probability of achieving them. This will also help them estimate the amount they would need to invest each month or so.

Investment portfolio health check

Introducing metrics like Standard Deviation or Sharpe Ratio to run the user’s investment portfolio health check will allow them to compare the actual user portfolio and the investment goal.

These are some of the features integrated into the investment platforms, apps, and websites developed by Django Stars. It doesn’t mean every feature on this list should be included, nor does it mean others can’t be added. In any case, it’s crucial to implement the features the audience expects and consider platform model specifics.

Investment Platform Models

The most general distinction includes B2B and B2C investment platforms. But they can also differ inside each group. The following two examples of investment platforms we developed in Django Stars are B2C, yet for different audiences.

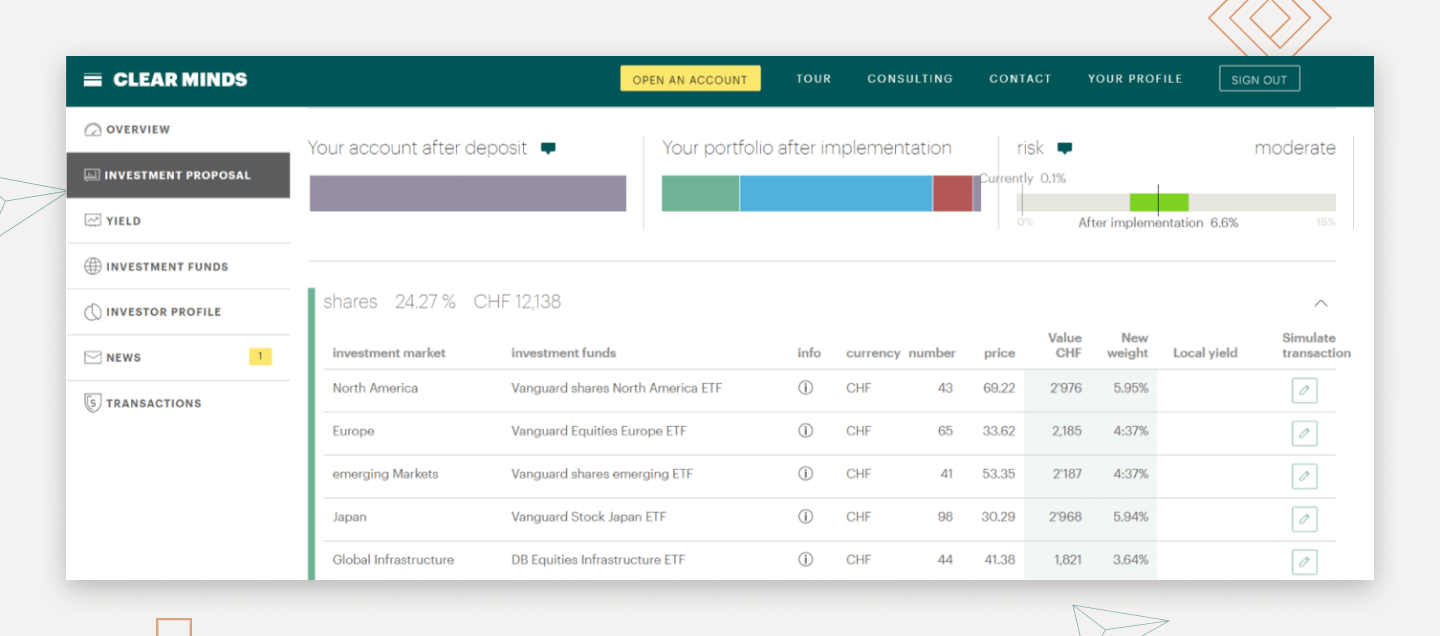

The first is Clear Minds, an intuitive app for private investment with a very straightforward workflow: users download the application, invest their money, and wait for the return.

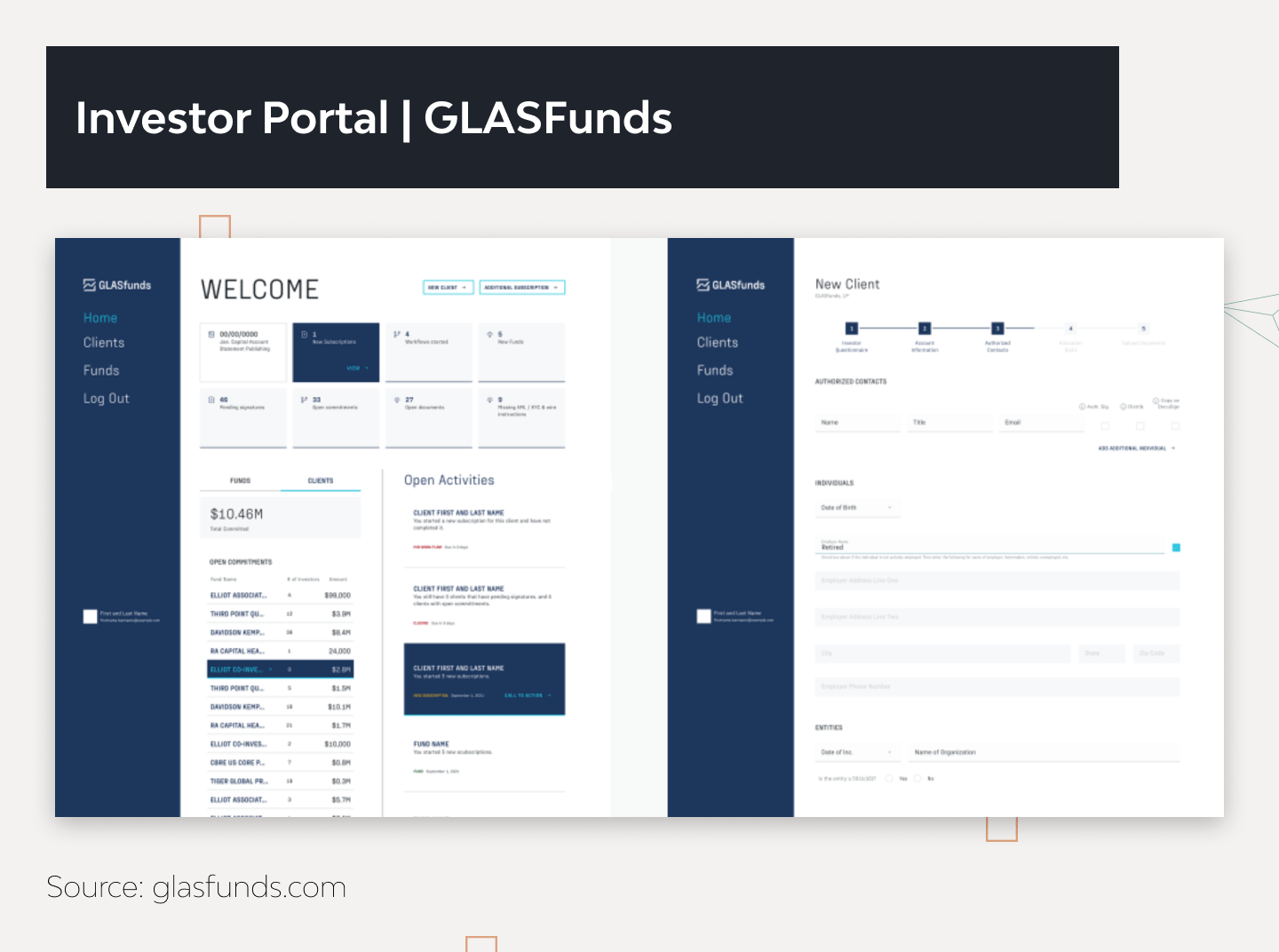

But we also worked for GLASfunds — a complex alternative investment and operational platform that allows building custom private market portfolios. The platform collects capital calls from private companies and distributes them among registered investors for a single management fee.

To manage these and other operations, a system like this needs to have two portals:

- For users to see capital calls from different companies and the statuses of their investments

- For administrators to manage the process, send reports to investors, see how many investors committed and for what, who has transferred their money or not, and generally manage the entire process

This is what the administrator dashboard might look like:

As for examples within the B2C category, you can also check out our case study with Sanostro, a Swiss-German investment platform. Sanostro enables small and medium-sized investment funds, pension funds, and banks to make smarter investments by analyzing large amounts of historical data.

Investment Platform Data Security

The security of a complex system depends on the weakest link in each subsystem. Data should be protected on all levels of an investment platform, website, web or mobile app.

For instance, it’s important to always use the latest TLS protocol (currently, it’s 1.3) to secure a website. It will ensure the secure encryption of data passed through the public network to the client’s browser. By the way, TLS 1.3 uses AES encryption with a 128- or 256-bit-long key, which is the gold standard in the industry.

But none of this matters if the authorization and authentication processes are vulnerable. Simply put, protecting investment platform users from their own actions is critical. There are a number of ways to improve security on top of the standard login/password flow. The first thing necessary to add is two-step authentication. Depending on the user’s device, it could be a phone call, a text message, an authorization app, or biometrics (fingerprint, Face ID, etc.).

To go even further, allowing users to manage active sessions opened from different devices is a good idea. Adding an access or session log could help the tech support team or the user pinpoint fraudulent activity. In more innovative investment platforms, intellectual systems based on AI can do this instead.

If an investment app allows sharing data or giving limited access to third parties like consultants or accountants, it will benefit significantly from granular access control and a detailed audit trail.

During the development process, the security of the source code, infrastructure configurations, and cloud resources is crucial as well. All code repositories must be protected using the RSA cryptosystem, two-factor authentication for developers, secure password policies, and robust access control.

Trusting the development team is also vital.

For instance, Django Stars is ISO/IEC 27001 certified, which means clients can rest assured that we know how to protect data from cybercrime, breaches, vandalism, damage, theft, and more.

In the words of Oleksandr Ryabtsev, our backend competency lead, Django Stars controls security on various levels during development:

- The code level. Following the SAST testing methodology, we ensure the code doesn’t contain errors that could make it vulnerable.

- The third-party app level. We ensure that all third-party services we integrate are up to date on their fixes.

- The deployment level. Our DevOps engineers make sure the cloud servers on which we deploy software don’t have OS-level issues.

All in all, a tech team with expertise in fintech development will be most suitable for building an investment platform according to industry standards and security requirements.

How Much Does It Cost to Create Your Investment Platform?

The investment app development cost varies greatly depending on the specific requirements and features requested. However, based on our general estimates for product development, designing an investment platform from start to finish can take a minimum of 200 person-days.

It’s impossible to accurately estimate the cost of development without genuinely understanding the scope of work. Factors affecting development cost include the platform’s complexity and the number of integrations required. Will it be MVP development, refactoring, or scaling, or does the client need to expand on the previously developed MVP? Each request differs in the scope of work and, consequently, price.

Functionality is another issue that adds to the cost of the development. Features will also vary depending on the project’s goals at a particular stage of development. An investment app that’s just a concept to be shown to investors will have different features from a POC. Not to mention, various software vendors have different prices. But still, you may evaluate the approximate amount of work at each stage of creating an investment app.

| Feature | Number of Hours | Price* |

|---|---|---|

| Sign-up form | 70 | $3,500 |

| Registration and verification system | 80 | $4,000 |

| Linking of bank accounts | 200 | $10,000 |

| Stock trading features | 350 | $17,500 |

| User profile | 120 | $6,000 |

| UX app design | 200 | $10,000 |

| Total | 1020 | $51,000 |

* Consider that the prices above are exemplary and relevant if the developers’ hourly rates are $50. These values are average for teams from Central and Northern Europe, but they may be a few times bigger for North America and Western Europe. So, the total cost of creating an investing app would be $100,000–150,000 or even higher.

Ultimately, the cost of developing an investment platform will be unique to each project and will depend on the specific needs and goals of the client. Therefore, the best way to determine the cost of building an online investment platform is to ask.

If you contact us, Django Stars’ experts will interview you to determine project details and give you an estimate. After all, we’ve developed over 20 fintech applications and have some tips and tricks up our sleeves.

Our Advice on Investment Platform Development

After delivering an investment platform for the Swiss market, a SaaS investment platform, and numerous other fintech projects, we’ve learned how to make the development process smooth the hard way.

Read Also: SaaS vs. Open-Source in Python

Here are the tips from our hands-on experience you are welcome to use:

-

- Provide the specifications and business logic of the future investment platform in formulas with concrete examples.

- Skip the complicated business talk and describe the requirements in simple terms so the team can quickly and easily understand what should be done.

- Remember: engineers may have experience creating investment apps or websites but aren’t fintech experts. So, providing them with simple and logical formulas and algorithms to calculate investor reliability coefficients depending on their portfolio is a good idea. The same goes for calculating customer risks – time of deposit, primary investments, etc.

- Ensure that every team member is on the same page about the project. To avoid mix-ups in terms and their meanings, compile a dictionary where every term is explained. Consider conducting workshops for the development teams to explain the business logic and functions of the solution.

- Don’t hold back on testing costs because users will lose trust in your platform with every bug or glitch they encounter. In the case of investment solutions, it’s critical to pay special attention and test the formulas that calculate investment risks, distribute the portfolio, etc. Because sometimes formulas that work well on paper or in MS Excel don’t perform as well in code.

We have plenty more tips on the architecture, data analysis, API integrations, and the UI/UX of investment platforms. If you would like to hear them and tell us about your fintech ideas, don’t hesitate to contact us.

Read more: Empowering Fintech with Vue.js: A Comprehensive Guide

Summary

Thanks to investments with no minimum amount, investment apps are a hit, but they need to follow specific guidelines to catch the attention and earn the trust of users.

So, if you are thinking about creating an investment platform, consider its architecture, integrations, geography, user flow, and experience first. Then, with the tech team, discuss the features you want to see in the platform and whether they’re easy to implement. Finally, make sure that the team knows how to secure user data in the investment app according to the latest industry standards.

Building an online investment platform is no easy feat — working with sensitive matters like finances never is. That is why we recommend cooperating with a software development partner specializing in creating fintech solutions. Investing in their experience can become one of your best business decisions.

- How to make your own investment platform?

- Creating your own investment platform involves several key steps: defining your business model and target users, ensuring regulatory compliance, choosing a scalable tech stack, and designing a user-friendly interface. You'll also need to develop or integrate core features like account management, trading tools, data analytics, and secure payment systems. Thorough testing, ongoing iteration, and a clear product roadmap are essential for long-term success. Collaborating with an experienced team can streamline the process and reduce risk at every stage.

- How much time does it take to make an investment website?

- The development period for an investment website can vary significantly depending on the website's complexity and features. Complex platforms usually take several months to develop. By initially focusing on creating a Minimum Viable Product (MVP) with core features, you can expedite your entry into the market and gather user feedback for further enhancements. Thus, starting with about 200 person-days could be a reasonable estimate.

- How does an investment platform work?

- An investment platform acts as a digital interface between investors and financial markets. It allows users to open accounts, deposit funds, and buy or sell assets such as stocks, bonds, or funds. The platform connects to data providers and brokerages through APIs, processes transactions securely, and displays real-time market data and portfolio performance. It may also include tools for risk assessment, goal tracking, and automated investing to support informed decision-making.

- Can I hire investment platform developers from Django Stars?

- Absolutely! We have ten years of experience creating investment platforms for the US, UK, and Swiss markets and will be happy to build one for you. We work with Fortune 500 companies, are a top B2B company on Clutch, and our processes are ISO certified. Contact us to learn the details.