MoneyPark’s Benjamin Tacquet on Doing Less, But Better | Django Stars

Technology changes our lives, even in countries where centuries-old industry traditions dominate culture, society and emblematic banking systems. But even such a traditionally conservative part of banking like mortgages can be affected by technology. A mortgage is based on an ancient idea of a loan against collateral, and it still uses mostly the same ancient mechanics of different players collecting data, offline most of the time, while multiple third parties profit from different parts of the process. This is where startups come in to make this process faster, smoother, and more transparent.

Switzerland’s mortgage market, for instance, is worth $1.01 trillion and keeps growing. Almost ten years ago, a startup called MoneyPark wasn’t afraid of the competition and started working on its very own online mortgage brokerage for the Swiss market.

MoneyPark started working with Django Stars in 2012, almost from day one. Since then they’ve gone a long way to become the market’s leading mortgage broker. Company CTO Benjamin Tacquet has shared the story of MoneyPark and its future plans. Read on below.

How MoneyPark Works

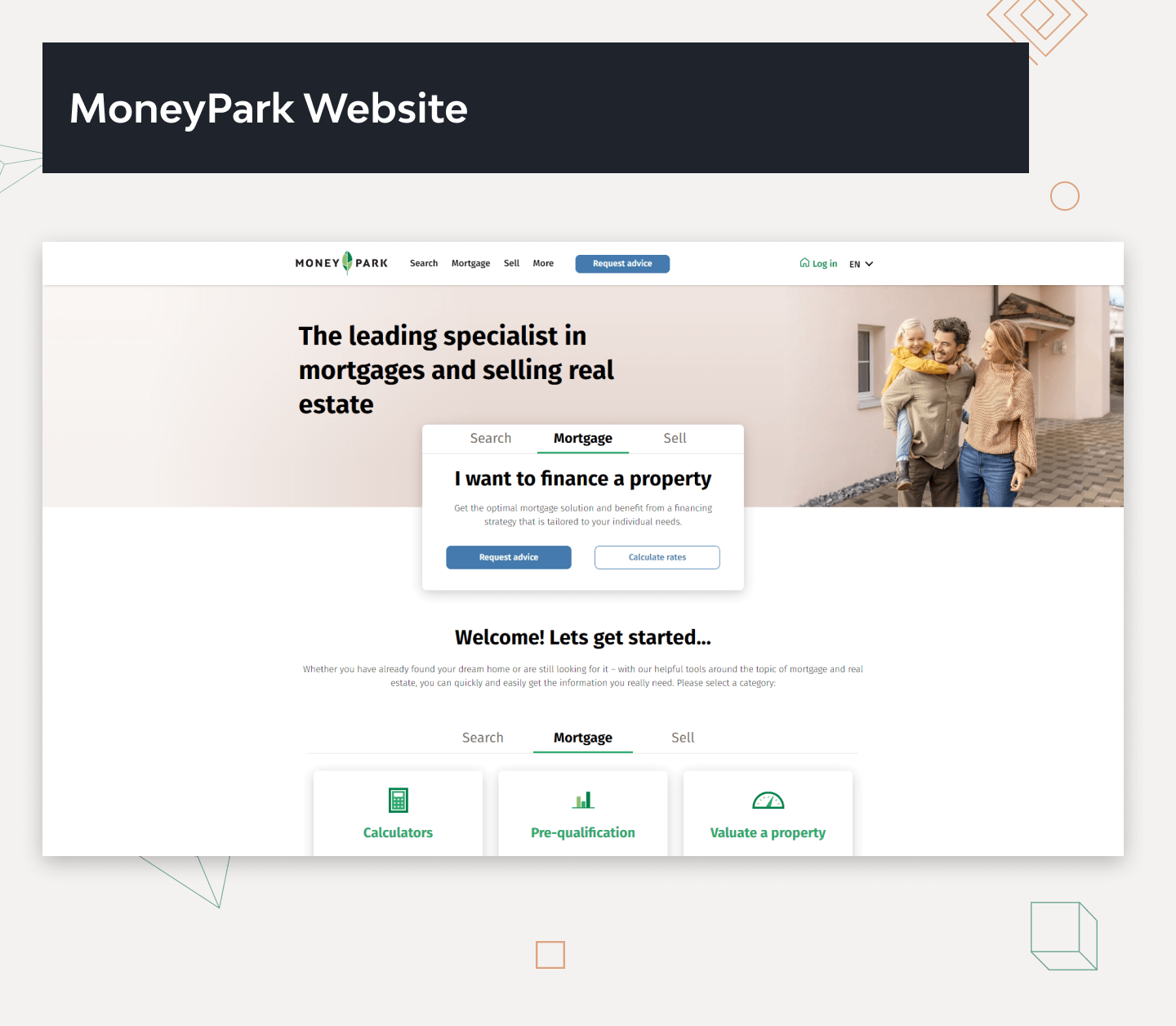

How exactly does MoneyPark work?

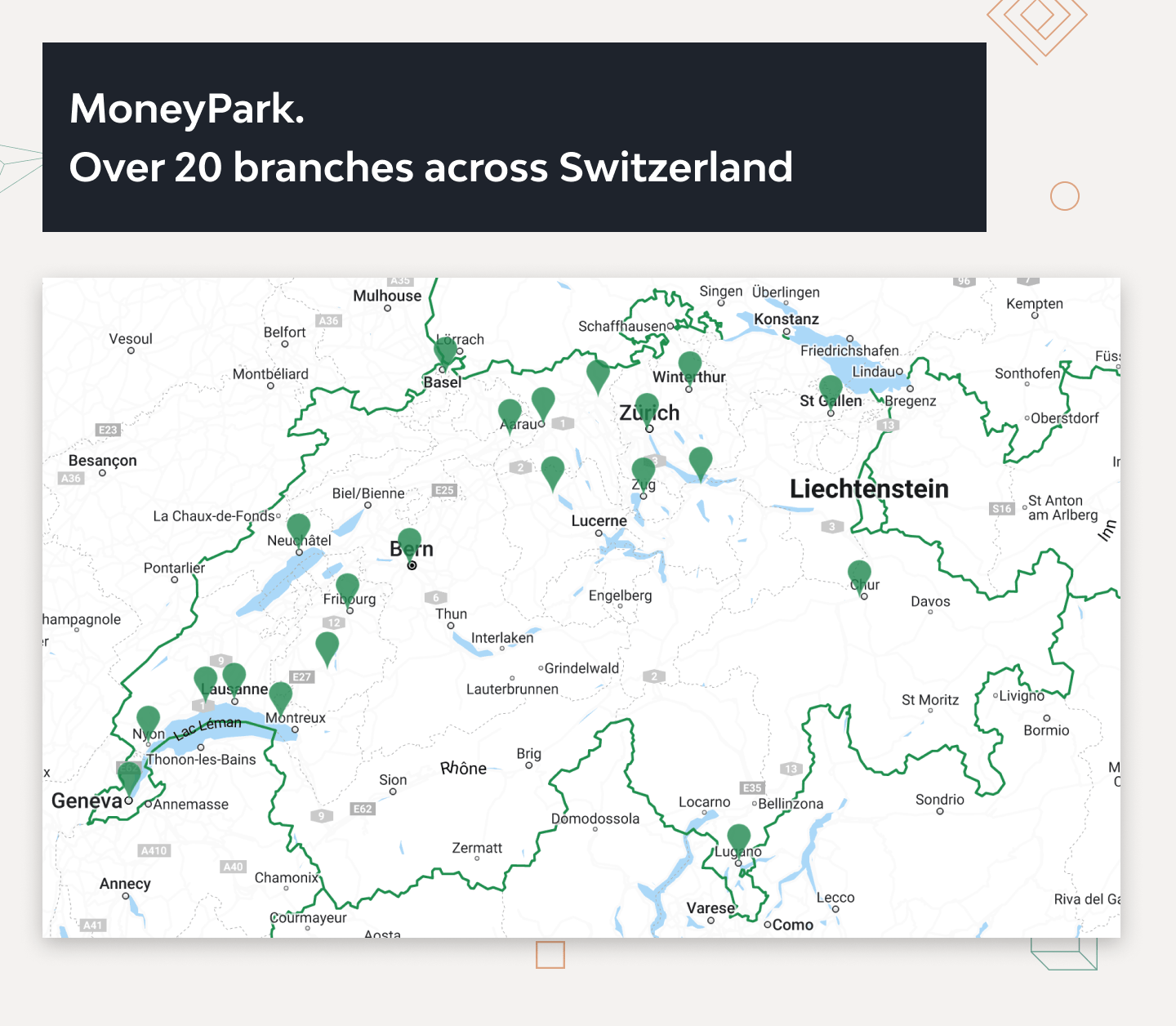

Customers start their journey online, and then come to one more than 15 locations all over Switzerland for counselling. We help them acquire their dream property.

Switzerland is the land of banks. How do you stay afloat with just one website and 21 branches?

MoneyPark’s unique selling proposition is that we’re absolutely independent. When a customer goes to a bank, they will get the product the bank earns money from. Instead, MoneyPark advisors remain independent – there is no need to select one partner or the other. They select what’s best for the customer. They help customers see how this purchase will reflect on their tax situation, whether they need insurance or not, etc.. We give our customers advice. We look at the big picture. That’s what we do at MoneyPark. That’s why we’re the best at it.

We work with more than 150 partners. We’ve built a great customer interface that enables customers to compare all the products on the market. Customers start their journey online using website tools. But when it comes to making a decision, they need to talk to someone. We tried to do everything online, but it didn’t work well. In most cases, a home is the biggest purchase of your lifetime, and you need to see someone and talk to a live person. So, that’s what we do. We advise customers, and we do it very well.

Back in the day, like every startup, you had your struggles. What was the hardest part of your way from startup to #1 market player?

Finding the right people is always the biggest challenge. But the truth is, you can overcome any problem if you find the right team. The second hardest thing after finding like-minded people was keeping them, of course.

Looking Back

What is your background and how did you end up with MoneyPark?

I have a background in computer science and management. I was always passionate about interface, and that’s why I shifted into the web industry. A few friends of mine were working on a startup, and we always exchanged ideas. So I built my first project and we sold it. Eager to start a new startup, I followed Stefan’s invitation to Switzerland. He showed me his idea for MoneyPark. I liked it, and we started working. That was ten years ago.

You pivoted several times. What caused you to pivot?

We’ve pivoted, because we tried. You shouldn’t be afraid to try. You know this American concept: try and fail fast? We started a few times, and if we saw that something didn’t work, we simply stopped. But we knew we had tried.

But in the end, what was it that helped you succeed as a startup?

You need the right people. You have to try, try again, fail, and try something different. But it only works with a group of people you can rely on. That’s critical. So, at the end of the day, you still have the energy to try again and not be afraid to fail.

How to Succeed in the Realities of Today’s Swiss Market

It seems that the Swiss housing market is a bit more complex than a buy-and-sell proposition. Income, taxes, insurance and many other criteria are involved when a customer chooses a property. How did you manage to simplify the process? How did the market and the customers react?

The most important work here was the advisors’. They give our project a friendly face. They gain people’s trust. When you gain people’s trust, it makes everything easier. Of course, people will challenge their advisor a bit. But once they gain people’s trust, they can actually make the decision for the customer, and the customer will appreciate it.

At first, acquiring customers was difficult. In Switzerland, mortgage brokers represent about 3% of the market. In the US, it’s just over 80% percent. We had to educate the customers, and explain the business and how it works. If you’re a pioneer in the market, you have to invest in people’s education.

How do you choose your business partners – banks to potentially lend money to your customers? Some banks may not be happy about their offers being listed with those of their competitors. How did you deal with that?

We started with around 30 partners, which was already a lot. Today, we are bigger, and we’ve grown to become an important player in the market – #3 in the Swiss mortgage market. Now we can push our partners more to get better offers for our customers and better deals.

GDPR was a big deal for the European fintech industry. What about Swiss regulations? How do you deal with those?

We’re a small company of about 300 people. The IT department has about 30 people, so it’s quite easy to synchronize. GDPR is big for big companies, but for smaller ones it’s easier to deal with. If a customer asks for his data to be deleted, I will personally take 15 minutes to take care of it. Also, our location in Switzerland makes our life easier – due to its status in Europe, they haven’t signed the GDPR yet, so we have extra time to adapt our processes.

Meeting Customers’ Needs

What about your customers? How do you identify their needs, collect insights and use them with MoneyPark?

We work both online and offline, we’re in direct contact with our customers. Every day, our advisors meet customers, talk to them on the phone, receive feedback from them. Online, we use tracking, mouse flow, A/B test tools.

To collect insights, sometimes we simply talk to the customers. When they come to the branch, we ask them to answer a few questions after the meeting. Usually, customers are very positive and mostly say yes. We send in a project team that collects all the information. Which is then used again by a project team who iterate on the input of the business and of the customer and come up with a project.

At some point, you created MoneyHome to retain customers. Can you elaborate?

The purchase process takes a few weeks. During this time, 30% of customers will lose their object (or desired home) to the highest bidder. It’s a lot of business for us to lose. To solve this, we created a project called MoneyHome. When a customer loses an object, we automatically send him new property that matches his needs and criteria – location, price, etc..

At MoneyPark, we try to create a standard procedure for mortgages. In the US, for example, there are websites and applications that allow you to get a mortgage on your phone. In under one hour, you have purchased your house. You answer questions like whether this is the house you’re going to live in, whether you’re employed, and whether you’re of a certain age before retirement. This gives an 80% success rate, which they focus on. Our goal is to give mortgages to 100% of our customers by standardizing the procedure, even for special cases – we focus on that 80% to optimize this part and support the remaining 20% manually. We want all of our customers have a signed contract at the end of the first meeting.

To support the project, you’ve built 6 web platforms and a mobile app. Can you describe the mortgage platform development process, and how you combine features for different platforms?

We’ve built one platform to serve different customers. We have a platform for our biggest partners. But behind it, there’s the same application as for everyone else. The interface for every group is different, though. For our advisors, we have the CRM. And when customers come to a MoneyPark branch, we use a different interface.

Previously, we’d built a mobile application. It didn’t work as planned, so we stopped using it, but I’m glad we tried. I think it failed because there are too many applications on your phone that you use only at a certain time. If you need a certain occasion to use a certain app, it doesn’t work this way. We will come back with a new application, but later.

Originally, Moneypark was built for end customers. Now, you have a b2b platform as well. Is there any difference in building b2c and b2b platforms?

Well, it’s similar in a way, it’s just a different customer. We have our CRM for our advisors, it’s for the end customers. And there’s our new customers – banks, insurance – that are interested in using our solutions. Turns out our software solutions are good. So good that other companies are interested in using them. But that’s again a different customer. They will have different requirements, needs, that’s why we’ve built another interface to isolate each customer group.

MoneyPark Today

What does your company structure look like now?

We have the classical departments: first of all, HR, as we value the human factor and rely heavily on our advisors. Then we have the marketing department, quite a big one, and the financial department.

In IT, we have five teams. We have the product team and the system administrator. They’re like a protection layer for the developers. All requests first go to the product team or the system administrator. So the developers can focus on what they do best – development, and not answering questions like “I’ve lost my passport again, what do I do?” That’s how we structure it.

We have developers in Zurich, in Kyiv, and in Lausanne for historical and practical reasons.

The team in Lausanne, for instance, is important for regionalization. Which is a big deal in Switzerland. Each region is different, and we need to maintain this difference. For example, in Romandy, the French-speaking part of Switzerland, when people renegotiate their mortgage, you can increase or decrease the amount. If you increase the amount, you can use the extra money for anything. In Zurich, you can’t. If you increase your mortgage amount, you have to use it to invest into your property.

With all these regional differences, we need to have a local team in place to deal with it. Then comes Zurich – it’s our main HQ. And we’ve had our partner Django Stars in Ukraine since the very beginning.

You manage several teams around the world. What are your secrets to effective team management?

We’re all human. This means we respect people no matter where they’re from. You have to give the same amount of love and respect to anyone, regardless if they’re in Kyiv or in Zurich. You can’t say “Ah, just give it to Kyiv,” It doesn’t work. It’s people, and the secret is to respect them.

Founder’s Tips

Outsourcing vs. staying in-house. How do you choose?

We don’t have a specific guide for that. It has to be mixed. Some things are more interesting, some are less. Which is why you should diversify. You can’t always outsource uninteresting jobs, it doesn’t work this way.

What are your personal pros & cons of working with remote teams?

There are a lot more pros than cons, actually. It’s a bit cheaper, but it’s not the main reason. MoneyPark relies on sales and technology, fintech. Don’t get me wrong, we do a lot internally and we love technology, but our main workforce is not technology. That’s why we work with Django Stars. Technology, Python, Django – it’s in their DNA. This way, we have solid support whenever we need it.

Remote teams give you security. In case you have someone leaving your team, you have a bigger pool of talent that can support you. The bigger the pool, the more they can exchange knowledge and experiences. If another project uses similar technology, you can learn something from it.

Outsourcing is good, but you must have some capacity in-house. You have to balance things. Because if you have no understanding of what you’re doing, it’s not good. But outsourcing on top of our internal team is something we appreciate and will continue doing.

What tips can you give to people who want to start building complex fintech products?

Sometimes you want to do too much. My best advice is to do less, but better. When MoneyPark started, we wanted to cover a lot of things: online, comparisons, etc.. In the end, we dismissed a lot of directions and focused on mortgages only, until we mastered it. And we still have to work on it, until we do it perfectly, before growing further.