Digital Transformation in The Mortgage Industry

Some things just appear and change our lives. They are barely noticeable to us, but after they arrive, we can’t imagine how we lived before the change occurred. This is basically what happened with fintech. The industry started just a couple of years ago, yet it has caused a digital boom in the finance world.

Fintech is one of the priority industries where the Django Stars developers have gained extensive experience participating in a number of outstanding projects since 2008. In this article, we spoke with Amitabh Ghatak, CPO at Molo Finance, about digital transformation in the sector and mortgage software development services that change the market.

Fintech: Redesigning the Mortgage Industry

Generally, digitizing finance will eventually increase transparency and reduce human error and manual work in all of its various subfields. The fintech trends of 2018 show that more and more financial operations are being conducted online because doing so is more convenient and meets the needs of the modern world.

We’re seeing more automated financial decisions and actions being taken and new apps that help people automate their financial habits. Big banks are acquiring fintech companies to keep up with the new world they find themselves in. New bank products focused on the highest-profit segments are appearing, and mortgage services are going fully online via mortgage management platforms and other lending startups.

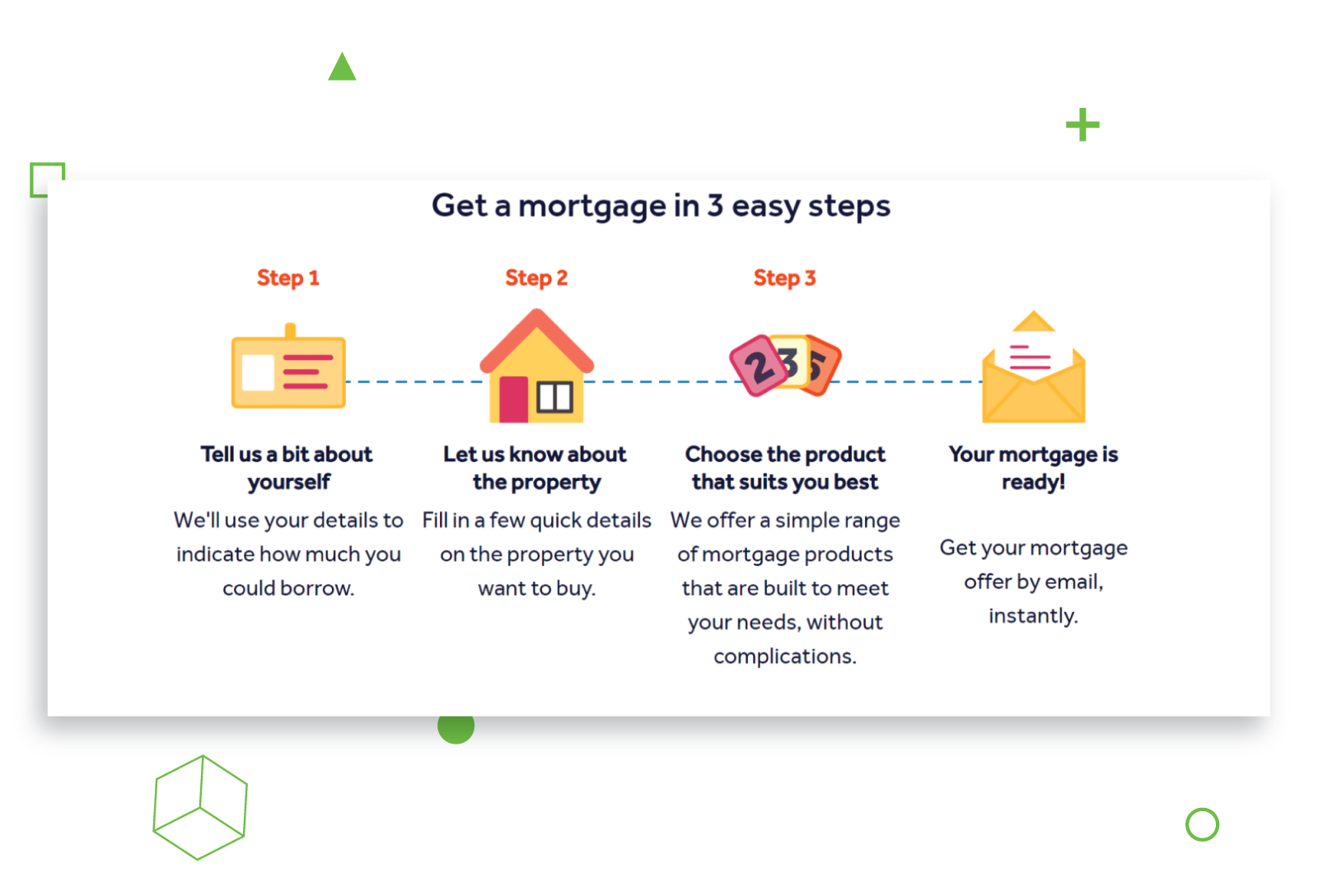

Mortgage services, by the way, have been in dire need of a revamp for ages. And fintech has finally managed to facilitate this change due to mortgage industry digitization. Previously, to get a mortgage, you had to save enough money to make a deposit, make sure you could afford the mortgage, find a property, decide what type of mortgage was best for you, and then actually find one. You had to have your credit rating checked and go through all kinds of bureaucratic procedures that could take up to eight weeks. In a fast-paced world like ours, no one has time for that. Custom fintech software solutions allow for the creation of mortgage websites that let you get a mortgage almost instantly.

Amitabh notes that “the way the traditional industries work is that it takes four to eight weeks to actually get a mortgage. Not a single person I know who has a mortgage in the UK is thrilled about how they went about getting their mortgage.”

But the truth is, everyone wants this procedure to be quick, less cumbersome, and more accessible. No one wants to waste half of their lives to get ahold of all the papers they need and the other half to apply for a mortgage. This was exactly why the online mortgage tech company Molo Finance was created.

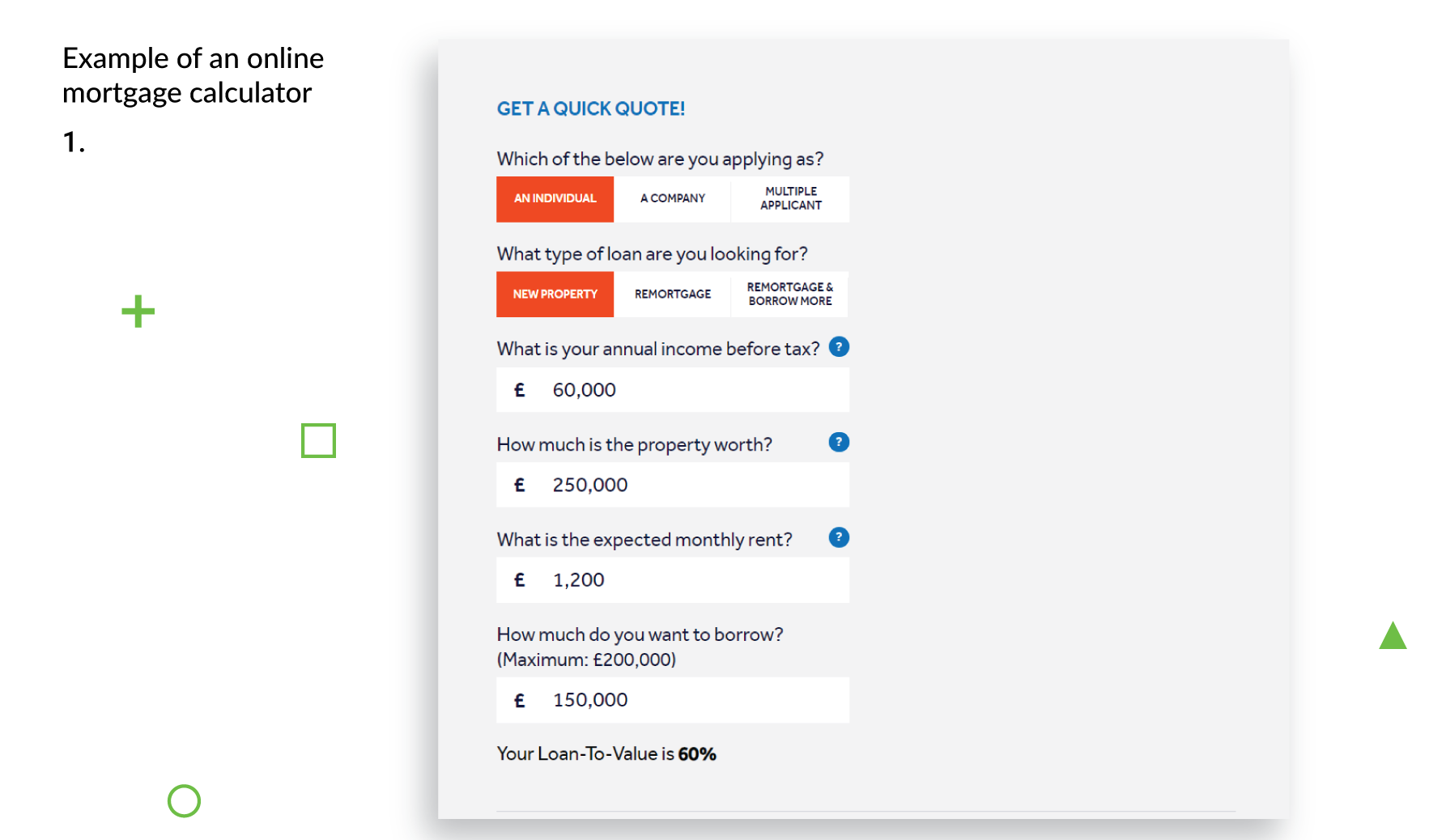

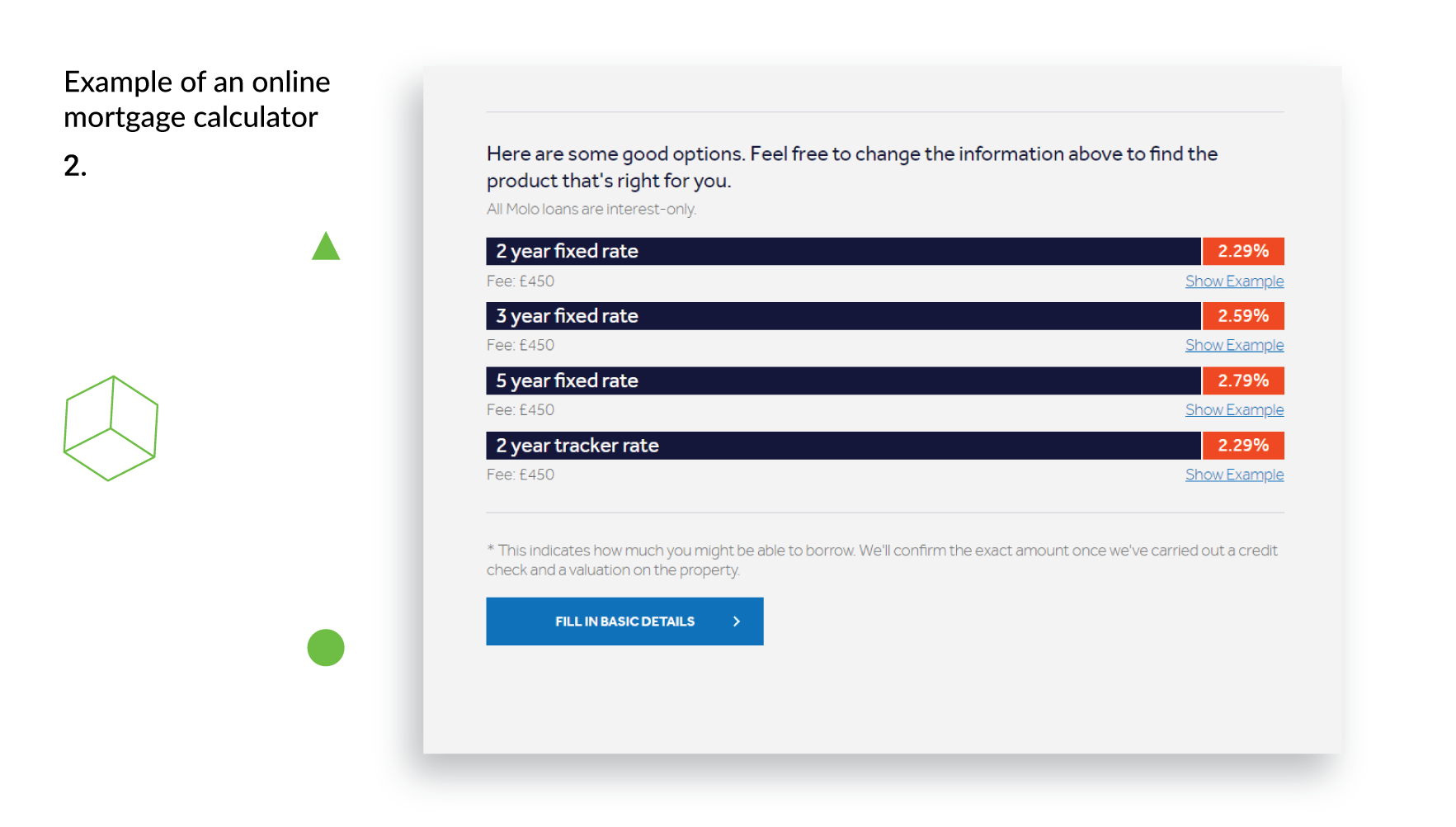

“Molo is actually an interesting concept,” says Amitabh. “It is effectively a fully digital platform for getting a mortgage. We try to give a mortgage in about 15 minutes.” How about that? Using a platform that helps you weigh your options, calculate your mortgage, and pick what’s best for you, there’s no longer any need to wait for eight weeks for your mortgage approval.

How Digital Transformation is Changing The Mortgage Industry

There are many significant changes brought by digital transformation in the mortgage industry, revolutionizing how lenders operate and customers receive services. It stimulates mortgage providers to discover new opportunities by leveraging digital technologies to streamline processes, enhance customer experience, and stay competitive.

For example, many changes have been made possible by the shift towards a paperless mortgage process. This allows customers to apply, upload documents, and sign contracts electronically, reducing processing times and increasing efficiency. Moreover, customers can now access their mortgage accounts and get real-time updates on the status of their loans through mobile apps.

At the same time, digital transformation solutions for the mortgage industry provide lenders with advanced analytics tools. This allows them to get better insights into consumer behavior and make informed decisions on loan origination, underwriting, and servicing. Adding new features to their digital products, mortgage providers can offer personalized services to their customers, such as tailored loan products, targeted marketing, and improved customer service through chatbots and virtual assistants.

Thus, mortgage services are becoming more customer-centric, providing a more satisfying experience for borrowers.

It should also be mentioned that despite all its achieved progress, digital transformation in the mortgage industry is still in its early stages. The innovation here is fast-paced and can have a great impact on further mortgage software development.

How to Build an Online Mortgage Platform

The mortgage industry is a strictly controlled branch—the money it involves is not a taxi fare; it’s the people’s dreams and a lot of their hard-earned money. Especially in highly regulated industries, every country has its own regulatory framework. But the truth is, despite all the difficulties, it was time to bring the mortgage industry out of the 1970s and into the 21st century and to introduce the application software that would keep up with modern times and mortgage industry trends.

If your business plans to launch a lending platform and offer high-quality services, look at how mortgage technology companies approach it—and ask yourself, “What do customers nowadays truly need?”

“Having that customer-centered focus is central to all the conversations about every feature we build and how we build it,” explains Amitabh, describing how his company develops mortgage loan software.

But money-related industries are complicated and vulnerable to disruption. All heavily regulated industries are, as well as those that require a lot of intermediaries you need to deal with to get the end product. New online financial services have used this knowledge to change the financial industry forever.

By embracing digital transformation for the mortgage industry, lenders can meet customer demands for simplicity and transparency while also improving their operational efficiency and overall customer experience.

When it comes to money, customers want simplicity and transparency. They want to know what happens to their money, and they want to be in control. Besides, as it turns out, not only the digital generation—the 25-40-year-olds—are interested. “What was surprising to us was how interested the older generation is in our proposition as well,” notes Amitabh.

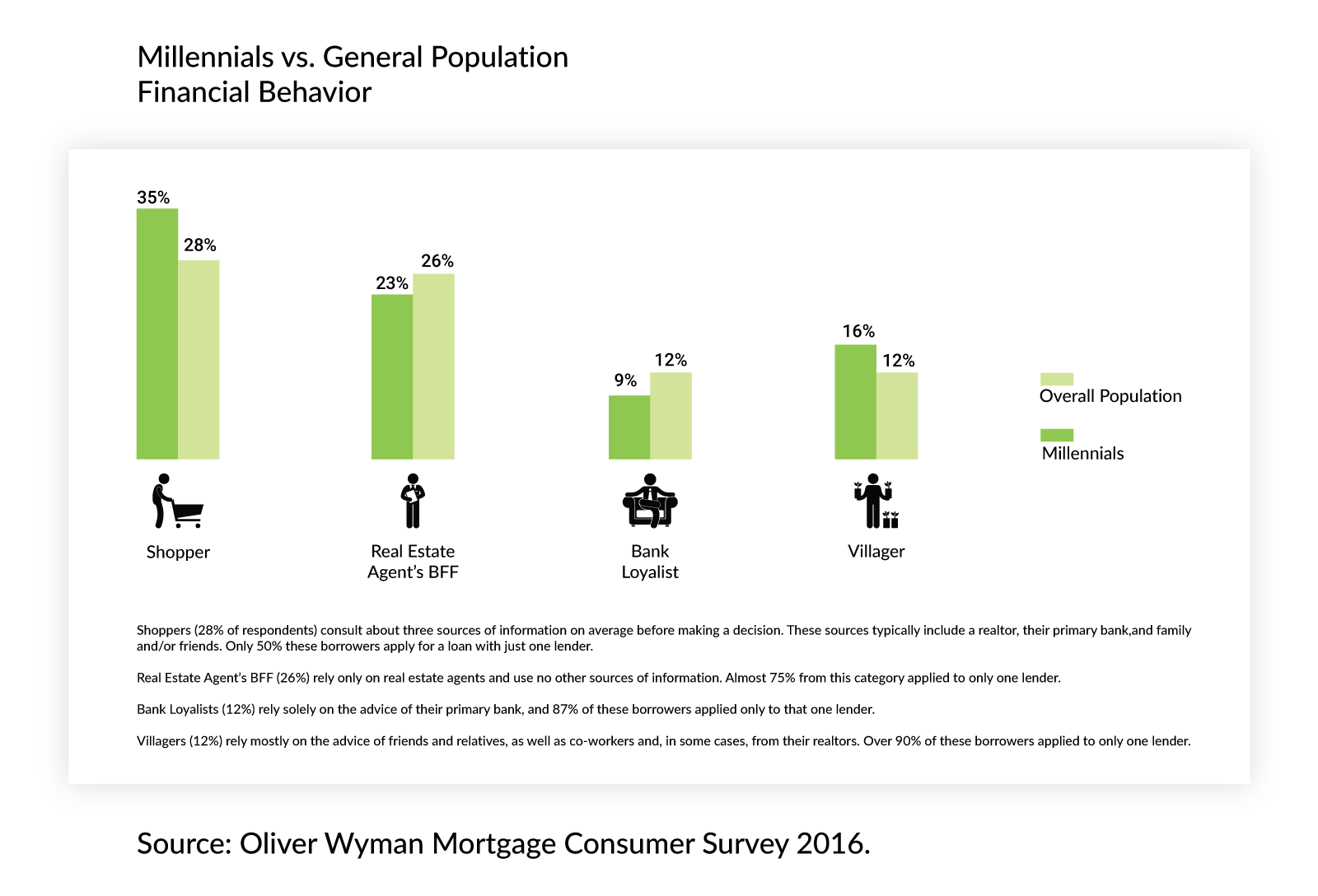

But while the older generations are breaking the stereotype, there’s one growing around the millennials, and it’s not a good one. For some reason, they are considered to be irresponsible and unhappy. But the truth is, countless studies show that millennials are probably the most responsible generation in about a hundred years. They are the ones who will build the new future, free of old-school bureaucracy and paperwork. This is the generation that spends more time with their families is more inclined to have reasonable romantic relationships. And most importantly, they’re very cost-conscious and generally financially savvy. They’re the ones born with technology in their blood, mastering contactless payments and using online banking as if it always existed. On top of this, research shows that millennials who use mobile banking apps have higher levels of education and higher incomes than those who don’t. They’re also more likely to use many different financial products.

Clearly, they’re independent, and they are building a new life for themselves. Which means that they require convenient, reliable, and secure online services so they can be, as the saying goes, the masters of their fates. And fintech is the industry that will give them all the tools they need to access their money, i.e., get a hold of their lives.

Which, by the way, was proven by the Oliver Wyman Mortgage Consumer Survey 2016. As shown below, millennials tend to consult at least three sources before making a mortgage decision. They rely a lot on advice from family and friends—which proves they are sensible and responsible.

So, what mortgage companies like Molo have taught us is that it’s all about simplicity and going your own way.

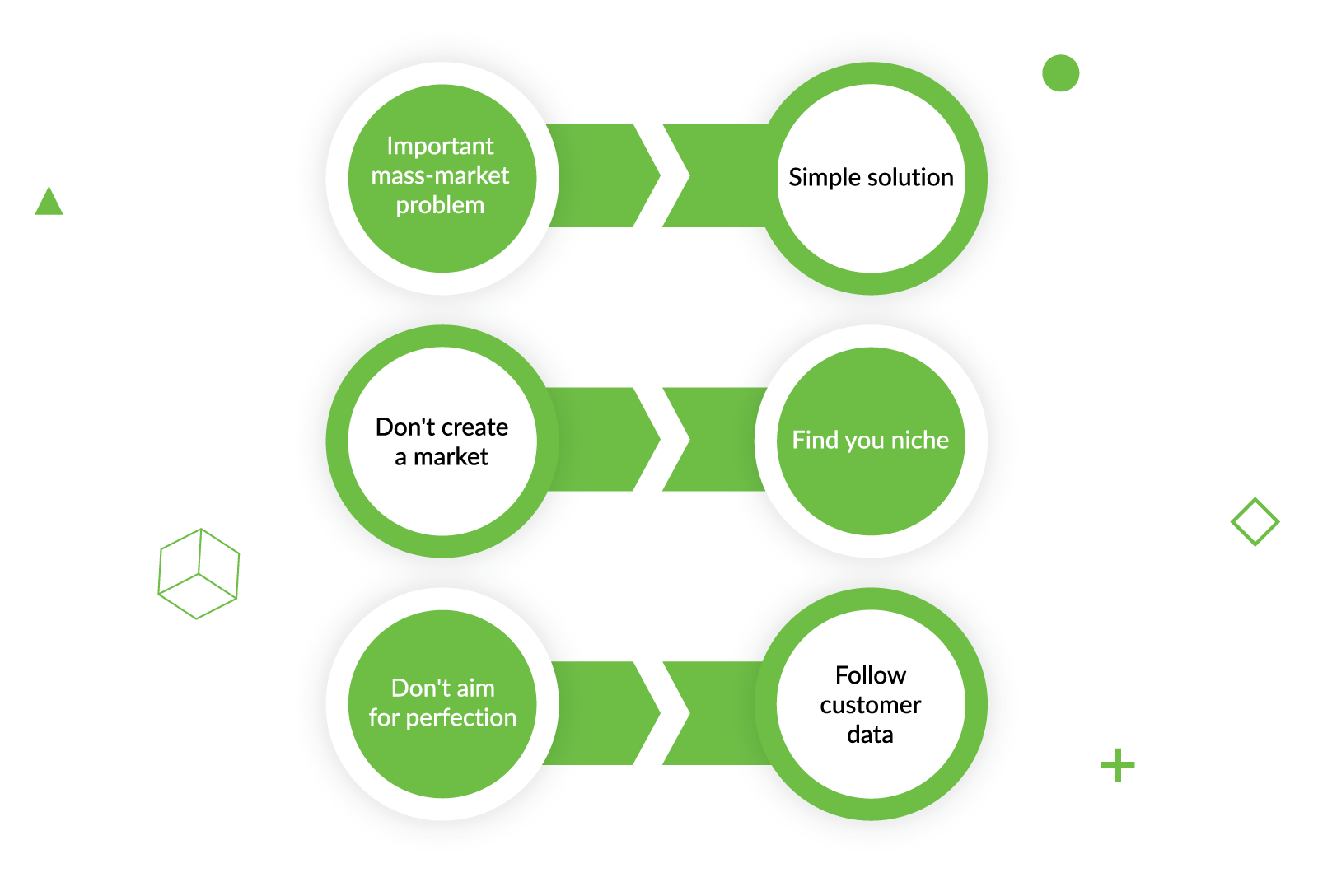

Basically, all you need for a successful business is a really important mass-market customer problem, points out Ghatak. Then you figure out a simple solution for it, based on existing frameworks. Don’t try to reinvent the wheel, and don’t try to create a market. Your main aim should be to find your niche. Simply solve one customer problem, not all of them at once. Work on your MVP, but don’t aim for perfection. Your main objective should be to find the quickest and simplest solution.

Also, don’t go crazy over making the perfect product. Leave room for changes, because the moment you launch your product, your decisions will depend on customer data and needs. And these may differ from what you think is right.

As you see, fintech was a revolution waiting to happen, and digital mortgage industry transformation is something that’s long overdue. From the time when somebody else controlled an important part of people’s lives—their personal and business finances—we’re stepping into an era where everyone can easily manage their own money. Whenever and wherever they want and take full control over their financial lives with just one click. What once took up to two months now takes about 15 minutes. Talk about a fast-paced world!

As a business owner, you can become a part of this change. A part of the digital financial future. You can offer your customers transparency, simplicity, automation, following mortgage data security standards, and everything they ever wanted—right now.

- What are some tech trends in the mortgage industry?

- The most promising trends - including conversational chatbots and IDAs, Robotic Process Automation (RPA), Blockchain and NFTs, Cloud Computing, and others - are discussed in detail in our article 10 latest mortgage technology trends for 2024.

- Why is digital transformation important for the mortgage industry?

- Generally, digitizing finance will eventually increase transparency and reduce human error and manual work in all of its various sub-fields. More and more financial operations are being conducted online because doing so is more convenient and meets the needs of the modern world. By embracing tech solutions such as automation, data analytics, and online platforms, mortgage companies can enhance their efficiency, reduce costs, and provide faster and more convenient services to customers. Digital transformation also enables mortgage companies to better manage risk and compliance, and to stay competitive in an ever-evolving industry.

- How can digital transformation improve the customer experience in a mortgage?

Fintech solutions allow for the creation of mortgage websites that let you get a mortgage almost instantly.

Digital transformation can streamline the application and approval process. With digital tools, customers can easily apply for mortgages, upload documents, and track the progress of their applications in real-time. This improves transparency and reduces the time it takes to get approved.

Additionally, digital solutions can provide personalized recommendations for mortgage products based on a customer's financial history and goals. This makes the process more convenient and efficient, as customers can find the right mortgage for their needs without extensive research or guesswork.

- How can lenders ensure data security and privacy in the digital mortgage industry?

- Lenders can implement strong cybersecurity measures, such as encryption and two-factor authentication, to protect sensitive customer data. They should also comply with data protection regulations — such as GDPR and CCPA — and establish clear policies and procedures for data handling and breach response. Regular security audits and employee training can help prevent data breaches and ensure data protection. Additionally, lenders should partner with trusted technology providers who prioritize data security and have a proven track record in the industry.