The UK’s Housing Market Will Never Be the Same: Reasons and Possibilities

Fintech startups become a notable player in the UK property market. The UK’s real estate market has always been consistent, solid, and trustworthy. But right now, the country is going through some rough times. The nebulosity around Brexit has opened the door to speculation about Britain’s long-term economic stability. You don’t need a PEST analysis to see that it affects the housing market.

There are a few scenarios for any industry that’s under pressure, and they all boil down to “stagnate” or “mutate”. In this article, we will look at the domestic influences acting on the UK’s property market as well as the global mindset shift that is underway. In conclusion, we will highlight the opportunities that these changes are bringing to real estate technology.

The Real Estate Market in the UK is Changing

The housing economy is all about building, purchasing, refurbishing and letting of property. Buying or selling a house is one of the costliest transactions most people will ever undertake. It is also highly regulated by the government. Mortgages allow people to buy houses and repay the loan over the long term.

There are mortgages for a variety of purposes. Among others, lenders can offer fixed or variable rates, buy-to-lets, and remortgages. It’s often harder to jump on this train if you’re a first-time buyer, but you can usually get support from government programs.

For a real estate software development company, working in this sphere can be a challenge. Besides the coding, you need to handle user identification, credit scores, and consider the working hours of state agencies.

The demand for homes is relatively stable. This means all market reaction to external circumstances is delayed in time. With the steady digitalization of banking and finance, the time has come for the housing industry to become more flexible.

In the EU, people already have a hard time imagining life without mobile payments. Electronic IDs allow citizens to access public services in the UK online, and AI gives people credit scores in China. Germany recently reported that, for the first time, non-cash payments prevailed over cash.

The broader picture looks favorable for real estate marketplace development – especially when we consider the economic and global trends that are reshaping the country.

Here are the major domestic trends found in UK property market forecasts from 2019:

1. Brexit. Obviously.

The future deal will change the UK’s single-market agreement with the European Union. It determines the free movement of capital, goods, services, and people.

Rampant speculation about the economic consequences of Brexit makes it hard to predict prices of many goods and services, including housing. It causes people to delay decisions on big purchases. The UK’s economic slowdown is also fueled by the US-China trade war, which is affecting the major economies of the EU (as stated in The Guardian Brexit watch).

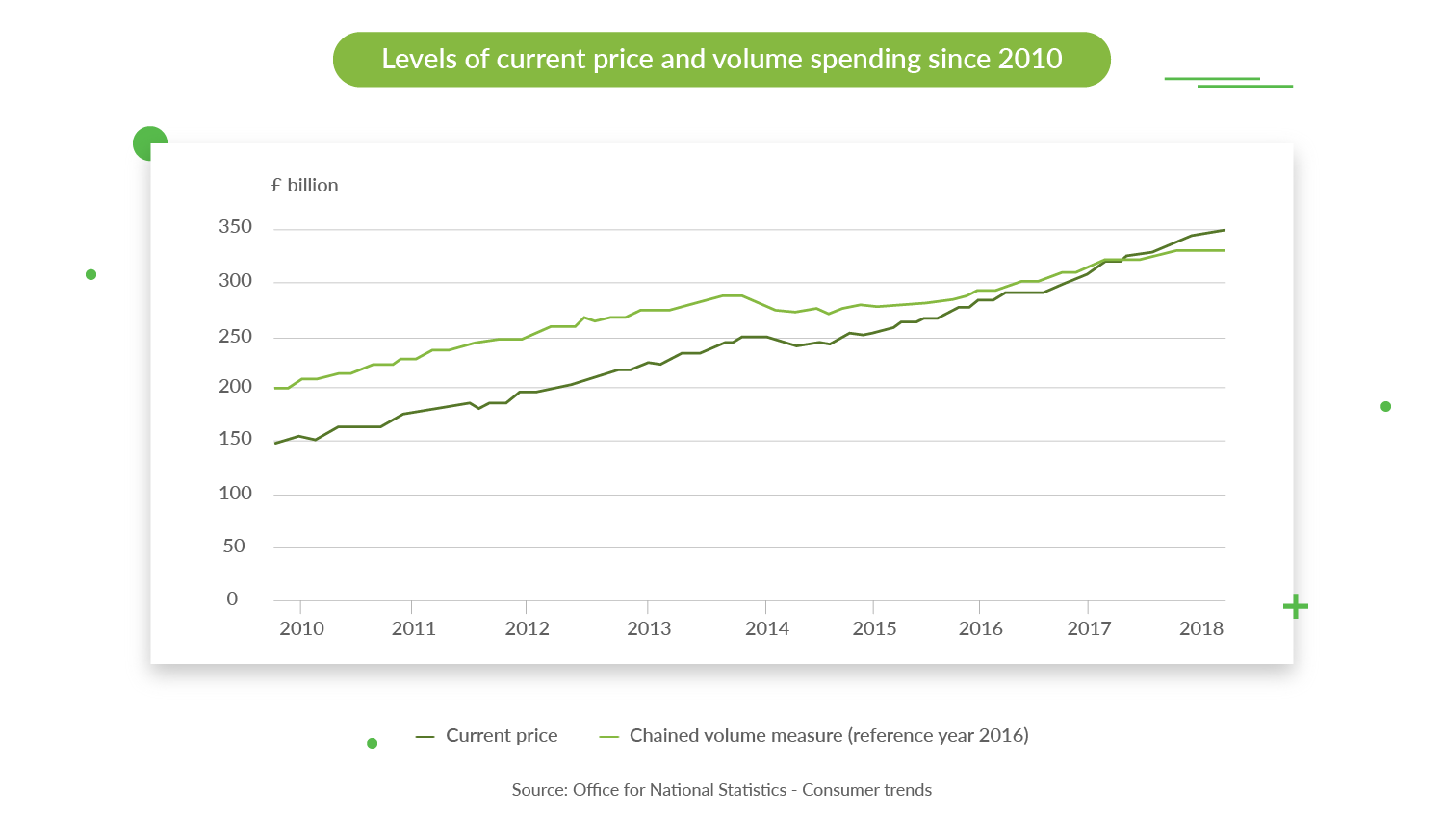

2. Consumer spending

Office for National Statistics and public reports from companies like Visa or EY show that consumer spending is shrinking, even though average salaries have risen slightly.

Some people are saving more, while some households are running down their savings to sustain spending.

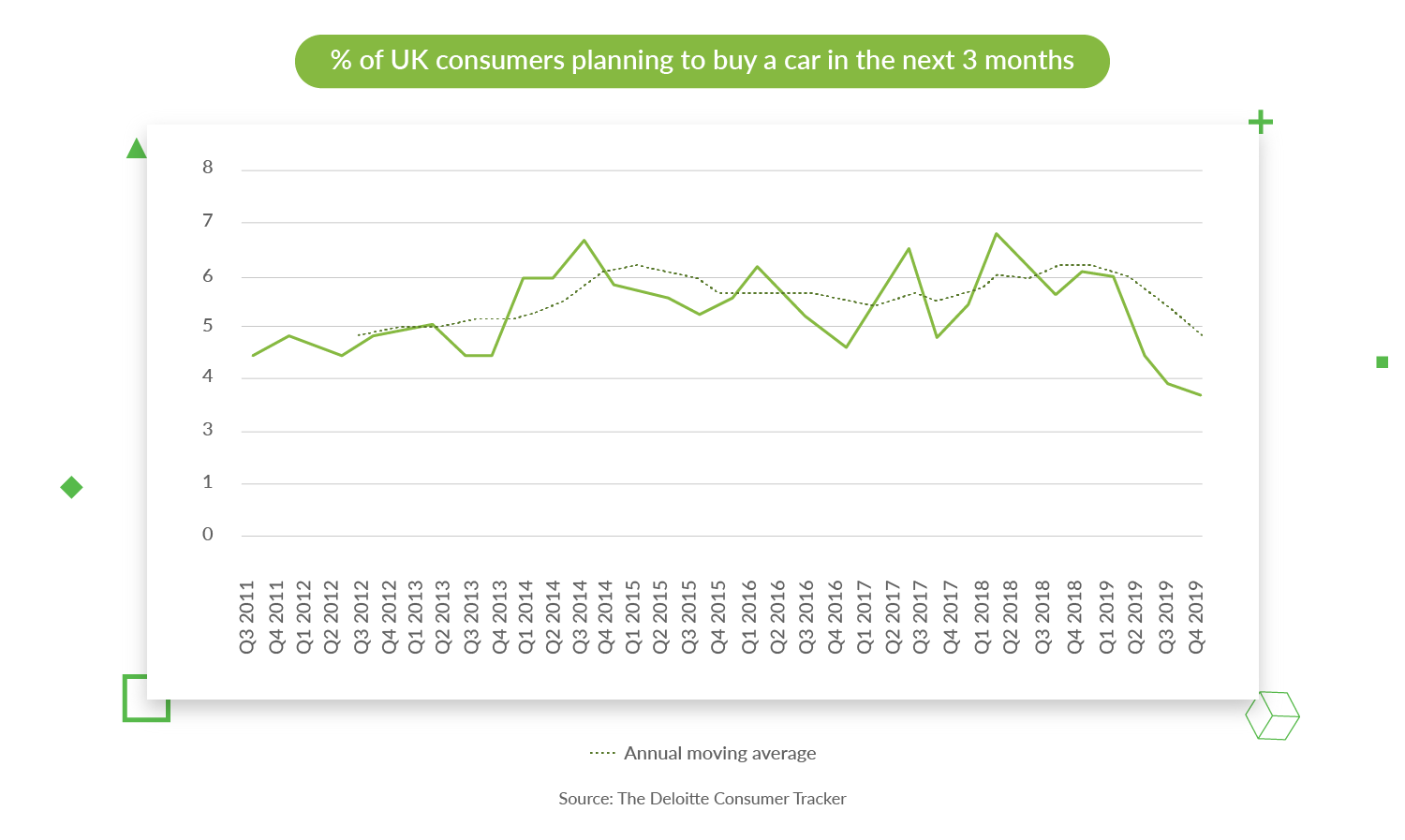

3. Consumer confidence

“Signs of a Consumer Slowdown” is a descriptive name for the latest Deloitte Consumer Tracker paper. People are more confident about their personal finances than the state of the economy.

UK consumers appear to be increasingly wary of making major purchases,

concludes Mike Woodward of Deloitte.

4. Interest and mortgage rates

The battle for consumer attention has been unleashed. Lenders are offering record low prices for fixed mortgages to lure borrowers from competitors. Prices are falling for buy-to-lets as well.

Today’s competitive mortgage market means people looking for a new deal can pick from some of the lowest rates on record,

commented Graham Sellar of Santander for the FT.

General Reasons: Mindset and Digitalization

Is it only media coverage that is distracting people from traditionally buying houses? Probably not. Human behavior emerges from a whole set of experiences. A generation is, broadly speaking, just a big bunch of people who share similar life conditions.

The name of the most active consumer generation refers to young adults in their thirties. Insight into their lives and values gives provides a better understanding of a country’s future than digging into statistical graphs.

This is why we need to talk about them – the Millennials. They’re the ones who are starting businesses and families, and buying cars and houses.

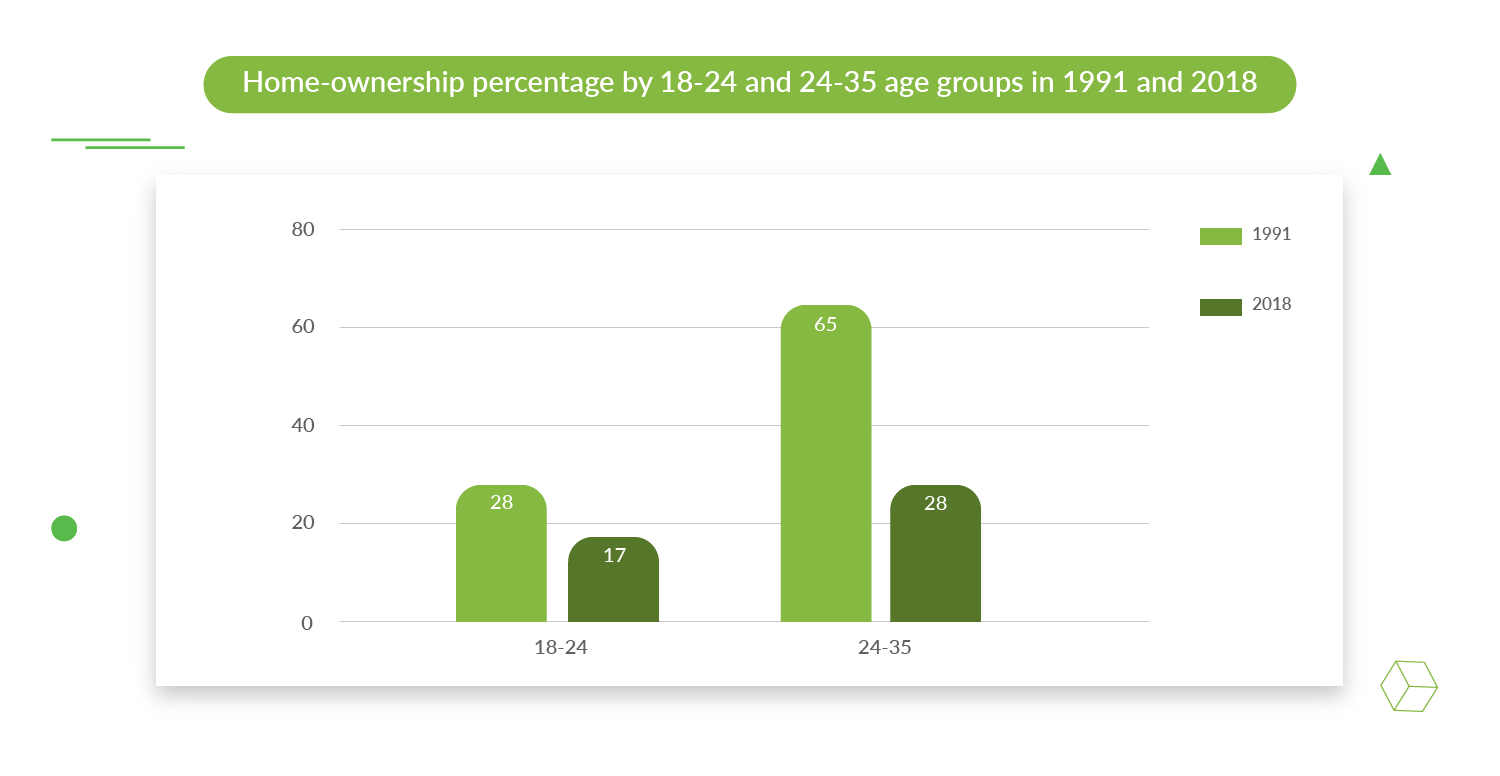

The most economically active generation is out of it

It’s clear that 25-35-year-olds are the ones who are most ready to build a new family, buy an electric car, and get a small black dog to be good friends with their toddler. But when we look at the stats, we see this is not happening to the extent that it should be.

Well, they definitely can get a dog and a toddler. But compared to a few decades earlier, the Millennials are missing out on one big important piece of the picture – a house. Less than 30% of this age bracket were homeowners in 2018 compared to 65% in 1991, as we can see in the government charts below.

Mindset and values are changing

What is the reason for such an astonishing breakdown? Well, being forever free and wild is indeed a swing promoted in current culture. Just look at these 21 thousand Brits who applied to convert their van into a home (according to DVLA, the Driver and Vehicle Licensing Agency).

But let’s be honest: we can’t frame this phenomenon as the result of memes and influencers. The IFS reports show that over the last twenty years, the wages of young adults have risen by 22%, while house prices have grown by 152%.

This means the average price of a property is four times larger than a millennial’s annual after-tax income. Say hello to a new generation living with their parents way after their 40s. It makes sense now to furnish a van.

Brexit anxiety may seem to be a source of constant distraction, but uncertain times are not always a bad thing. As our beloved science of Economics teaches us, when someone loses, someone else gains. And this is what on a stake with the housing market during the current crisis.

While the supply declines, we can see housing prices pause as well. This has led, surprisingly, to the number of first-time home buyers in the UK to rise to as high as the 2006 peak. For them, it’s an interesting time to step in the mortgage hustle. House prices have flattened and are not expected to grow for at least the next 12 months after the elections. The idea is supported by the Deloitte Consumer Tracker, which shows that the consumer confidence of non-homeowners is improving.

Recognizing the importance of digital transformation in business is crucial for staying agile and competitive, allowing companies to adapt to market changes, optimize processes, and meet evolving customer expectations effectively.

What’s so special about going digital?

The retail estate market historically was overly bureaucratised. It left first-time buyers with the headache of a months-long – and frustrating – purchasing process.

But there is a ray of hope here. A long-awaited disruption is coming to the financial and banking battlefield with fintech. While banks struggle to meet the expectations of youngsters, a new wave of startups is steadily penetrating the market. They know this is the high time for them to bite off a big chunk of the next paying audience.

Only those banks that are able to reinvent themselves will thrive in the future, but this is so difficult to do as an incumbent institution: incentives are not aligned, legacy systems get in the way, layered organizational structures paralyse decision making. Hence, the need to start from a clean slate, to look at things with a fresh perspective and build for the future rather than trying to fix the past.

Franchesca Carlesi, CEO at Molo, to Financial Reporter

Think about it. Even 70-year-olds are enjoying online banking. They accurately do their digitalization homework. At the same time, our friends-millennials are too bored to deal with the old system. Why would they bother if everything else in their life has already been digitized for them?

If one wants to take advantage of favorable market conditions, they need to take the fastest route to a deal. Today, this route is not through the common retail brokers we had just a few years ago.

Get a Hold of Business Opportunities Behind Digitalization

Digital solutions are designed to tackle customer pains. They bring positive change with automatic processes unseen by the user. In the property market, almost any part of the process is worth optimizing, and people are eagerly anticipating the results.

The millennials stepping in power are not the consumers everyone used to deal with. They are less interested in owning a house, and often have fewer opportunities to do so. Companies should propose new business models in housing, credit approvals and payment schemes to grab the attention of the new generation.

To develop custom real estate software, you should bring balance to searching for, consulting, and securing the deal. Don’t forget to consider some of the emotions that can interfere with the process – among them, lack of trust in digital solutions, privacy concerns, and the anxiety around making big and long-term decisions. The UK is leading the number of proptech startups in Europe, and its investment in new technology in the sphere has reached 9 billion pounds.

Let’s look at the list of possibilities for transformation:

1. Unlimited options to choose from

Traditionally, agents and banks artificially restricted borrowers’ options, offering only the deals they had in their portfolio. Simple online listings of properties and mortgages available allow customers to catch the ultimate deal. Lenders can now manage their portfolios online. Real estate marketplaces can aggregate data from multiple propositions on the market.

2. Lower prices and cost optimization

In the UK, property brokers get commissions from both the lender and borrower, as a percentage of the final deal amount. Startups working for a fixed price or for commissions from the lender disrupt prices a lot. If users can find property without a bank or mortgage broker, they can save significant costs.

3. Save time. Lots of it.

From automatic background checks to speaking with a broker online, proptech makes the process of buying or letting a house a lot faster.

Usually, people have to wait to meet with a consultant or make unnerving trips to the property. By sidestepping such tasks, proptech brings customers’ interests to the fore.

4. Accessible mortgages

When human labor is optimised, startups can get creative with rates. They can offer lower transaction costs and innovative deal schemes. This opens up the potential for people with much lower incomes to buy a home – much more so than the current high-street system allows.

5. Human-centered design and user experience

There is a huge scope for improvement here. The more pleasant it is to use a service, the more competitive the company is on the market. The ability to adjust to changes and facilitate automatic delivery to all users is a crucial advantage. You don’t need to retrain your employees every time a change is introduced. All you have to do is change code – and make life easier for all your clients, instantly.

Examples of Real Estate Startups in the UK

Simplicity and a human-oriented user experience make proptech a viable solution for millennials. Here are a few of the companies bringing innovation to one of the last frontiers of the UK housing market in 2019:

REalyse

This is a tool for real estate insights that are helpful to investors. The team leverages hundreds of databases and claims to be able to forecast the UK market for over twenty years in advance. With REalyse, investors can stay ahead of the competition by determining the sweetest spots to build on, based on big data. The most basic use for REalyse is for the validation of new property assumptions in a fast, user-friendly way.

Askporter

This is a tool for agents and landlords that helps them manage meetings and collect rents on time with the help of AI. It’s not just a smart calendar; it’s also a concierge who can chat with clients and qualify leads. The team works to integrate the payment system so that it can manage rentals, contractor payments, and service charges.

Habito

This is a marketplace that aggregates various mortgages in one place. It is an online broker, absolutely free, that offers loans and remortgaging options available on the market. Habito helps users get the most suitable offer by giving them better choices and filtering options. Their website illustrations and copy amount to one sweet invitation to a millennial. They also have distinctive services, like one that lets users buy homes upfront, with cash.

Molo Finance

Molo’s founders moved to fintech from banking and consultancy. They saw a gap between the traditional mortgaging process and the way people use technology for everyday activity. Combining their insights and the expertise of Django Stars, we built a top-notch digital mortgage lender.

To build Molo Finance, they combined their insight and our expertise in software development. First, we transformed paper-based and manual work into databases, API integrations, and a handy management module. Second, we reimagined the user experience. Today, Molo is a system of useful tools including a mortgage calculator, automatic advisories and AI-powered valuations. This is how Molo became the UK’s first fully digital mortgage lender.

The platform allows users to:

- borrow buy-to-lets. Startup plans to offer new mortgage options later.

- Check eligibility with minimal information, with no harm to credit score

- upload details step by step and make estimation for mortgage

- receive consulting online. The whole process can be completed on mobile

- get the answer in 15 minutes to 24 hours, with real-time data validation

- sign papers once, with in-house underwriters

Matterport

The first service of its kind, Matterport, materialized the widespread idea of visiting property distantly. They are known globally and allow users to offer 3D panorama tours that work with all kinds of 3D goggles. The platform enables interactivity: users can select objects, view 3D models, and sound and info windows. Matterport has become an accepted industry standard for showcasing the best properties. It has even leaked into the cultural sphere. New museums, galleries, and exhibitions regularly appear on the platform.

Wayhome

This startup has set a high goal of making home purchases fair. Their platform is for people who usually can’t get a mortgage, but can pay rent. After a background check, the company buys the home with its partner funds. The house is owned by the LLP, in which the buyer and Wayhome have their respective shares. The client pays a 5 to 20 percent deposit for the property and can gradually buy it out. In the meantime, she pays rent, according to the average price in the area. The more property she buys, the lower the rent gets.

Proportunity

This is a machine-learning prodigy that works with wannabe first-time homeowners. It foresees future real estate prices and lets the user borrow against the estimate. The result is that one can borrow a better house, with a deposit as low as 5%. By offering equity mortgages, Proportunity benefits when the price starts to fluctuate. They profit by selling the property or repaying the loan.

Conclusion

To sum up the title – the UK housing market will never be the same – and we’re glad it will. Brexit has put the real estate market on the fringe. Consumer spending and confidence are shrinking, and interest rates are at record lows. There’s at least a year to go before we will recover some certainty about the UK economy.

Consumers should remain strong and be ready to take some risks if they want better home prices and new loan schemes. We believe that the growing number of online mortgage and proptech solutions is poised to become a mainstream option in the real estate industry.

What should business do? Stagnate or mutate!

- Get ahead of the competition. Think of customer pains that have become the norm.

- Analyze what solutions are already on the market, and come up with the next breakthrough idea.

- Make it easy to choose the best proposal, and find new ways to own property.

- Develop a new real estate platform that incorporates your ideas.

- Win your customers!

Read more: How to write an investment proposal for a startup