How to Build Digital Mortgage Software Successfully: Tips & Insights

The custom mortgage software market enjoys an extended period of growth when the mortgage industry faces a recession. Why so? Several factors are fueling the surging demand for digital mortgage transformation.

Adopting artificial intelligence for automation improves fraud detection and enhances employee efficiency for tasks like underwriting. Meanwhile, the built-in search functionality and loan calculators help lenders and borrowers find suitable deals. This allows companies to process more applications and serve their customers better.

Django Stars has stood at the forefront of this transformation for years, helping businesses create loan origination software and mortgage solutions. One notable success story is Molo Finance, The UK’s first digital mortgage lender we worked on. It took us only eight months to develop a minimum viable product for their online mortgage platform — after another outsourcing company failed to deliver.

We are ready to share our expertise. This article will explore how to develop mortgage apps, focusing on essential features, software architecture, integrations, and design. We’ll also share valuable insights on navigating the complexities of building digital mortgage solutions — so companies can improve their chances of creating a successful platform.

The Mortgage Software Market in 2023

We once wrote that building fintech products became a mass phenomenon because of the customer demand for accessible financial services. The digital software market phenomenon supports this statement.

Most industries were in recession due to the COVID-19 pandemic. Meanwhile, all fintech categories — including mortgage and custom loan origination software — have grown 25% in usage (according to MarketWatch’s 2023 Digital Mortgage Software Market report).

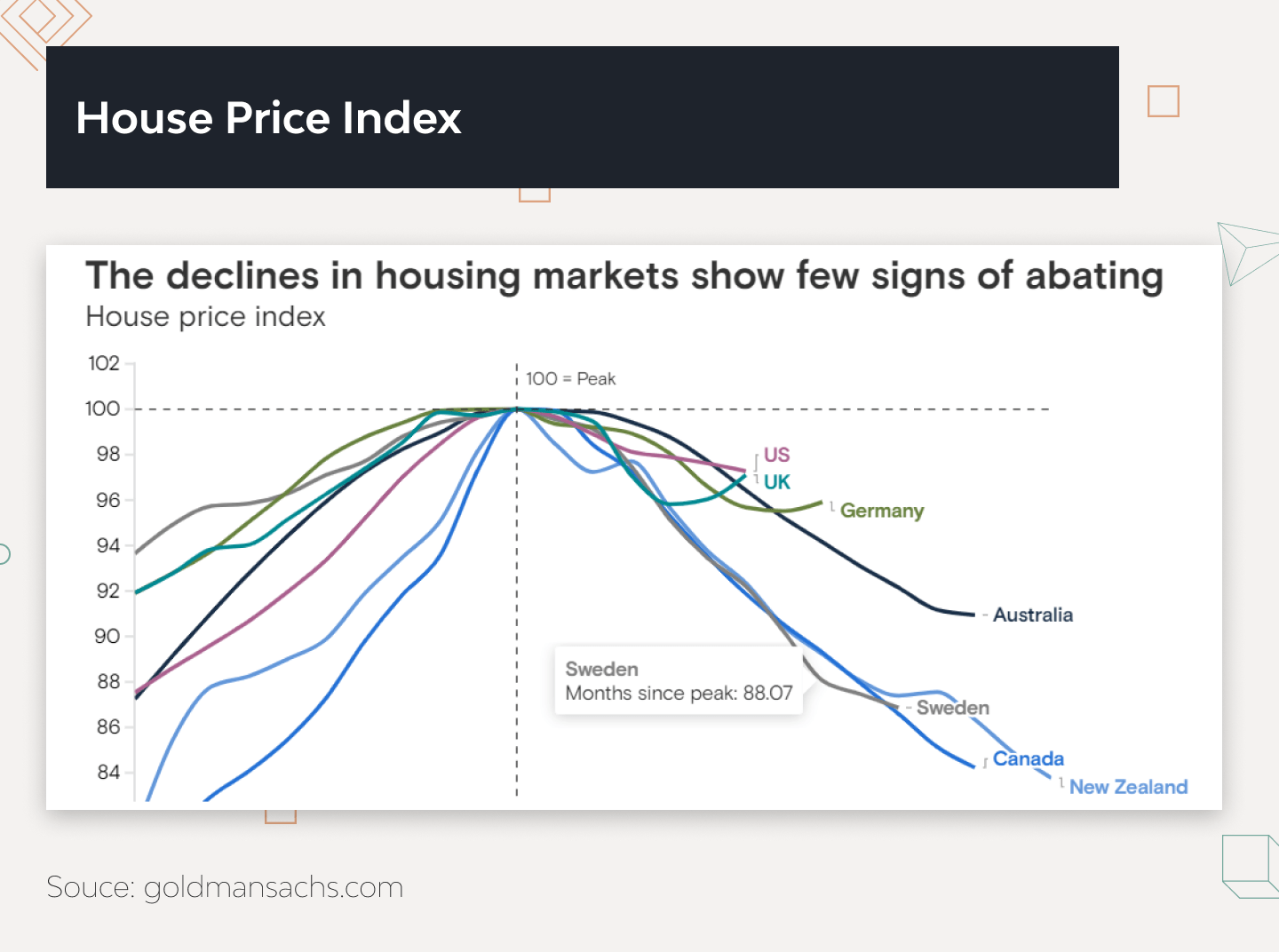

Or, consider the fact that the mortgage market declined after the global pandemic. According to Goldman Sachs’s insights, mortgage rates surged in the second half of 2022 due to rate hikes enacted by central banks.

Despite the recession, online mortgage platforms feel more than well. The MarketWatch’s 2023 Digital Mortgage Software Market report estimates the digital mortgage market to grow from $3.38 billion in 2022 to $10.29 billion by 2028.

Other agencies have an even more positive sentiment. According to Adroit Market Research’s 2022 Digital Mortgage Software Market report, the market can reach $44.50 billion by 2023, with the North American region grabbing the largest share. Similarly, Django Starts predicts a surge in UK’s mortgage app development initiatives.

In the meantime, the mortgage market is expected to level out. The Goldman Sachs team anticipates relatively tame home pricing in the US market in the following years. Additionally, the researchers at Fannie Mae hint at market recovery after 2024.

Despite the growing popularity of mortgage software, businesses still face risks. MarketWatch refers to tightening eligibility standards, mortgage financing scams, and rising cyberattacks as the main challenges. It’s crucial to recognize these threats and invest in cybersecurity measures for mortgage products.

So, what is an online mortgage platform? To answer depends on the functionality it may include.

Must-Have Features for Custom Mortgage Software

To build digital mortgage software, companies should prioritize user experience. The apps should streamline the application process and be easily accessible via mobile. Other than that, the platform must follow risk management and compliance regulations.

In addition to these characteristics, an online mortgage service should comprise the following essential features to deliver an outstanding customer experience:

Registration

A seamless registration process is critical to boost user engagement and reduce dropout rates. This feature allows users to sign up easily, confirm their email, and set up a secure account.

Implementing Single Sign-On (SSO) can enhance this process by enabling users to log in using credentials from platforms like Google, Facebook, or LinkedIn. This simplifies the registration process and reduces the need for users to remember multiple login details.

User profiles

A well-structured user profile system helps deal with client information. It stores contact information, preferences, and financial history to provide a more organized user experience.

For the client’s convenience, the profile management hub should showcase the most critical information first. It can include the current loan application status, outstanding loan balance, next payment due date, and available credit.

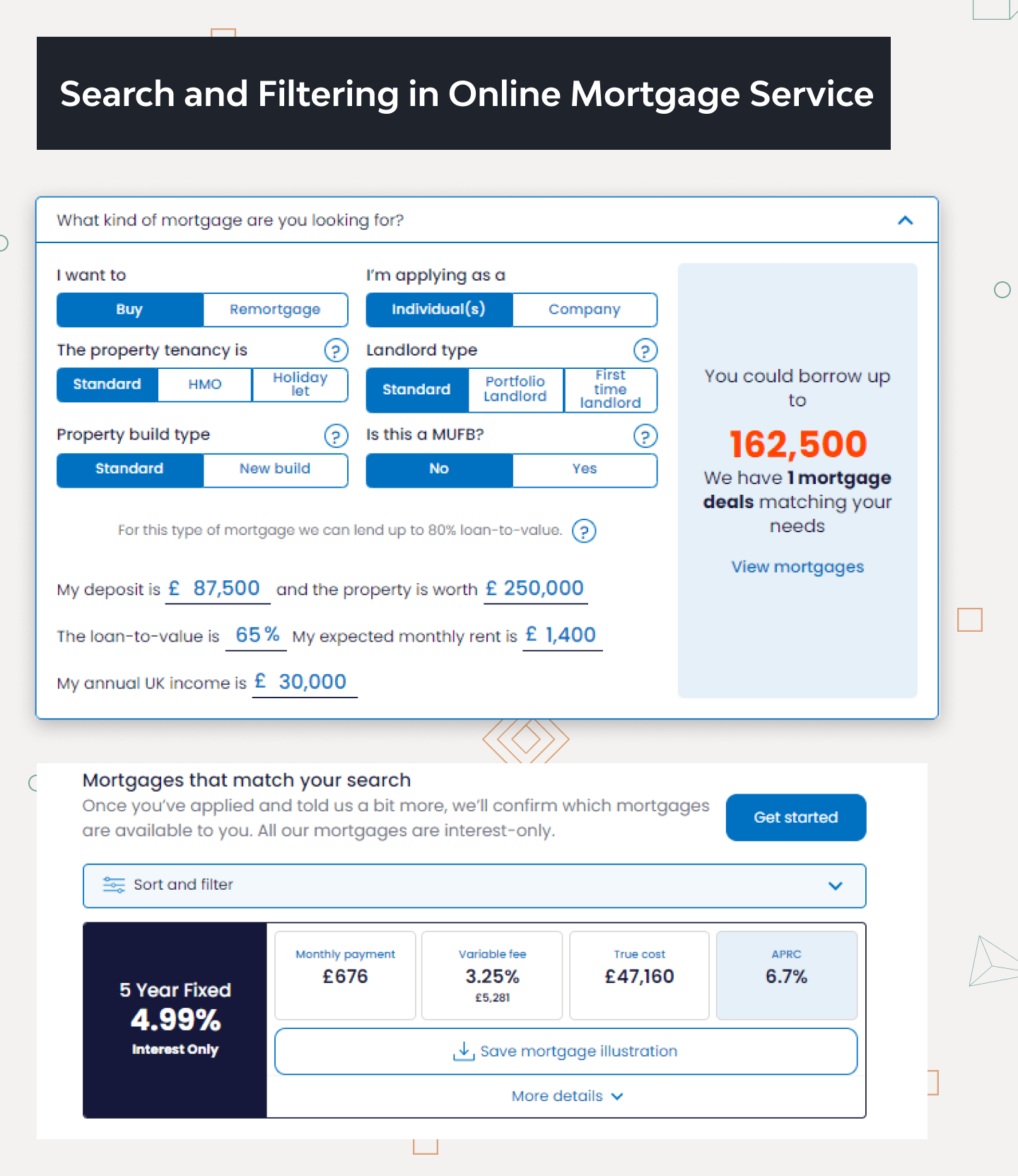

Search and filtering

Search functionality is critical during mortgage app development. Ideally, it should be intuitive enough to let customers find available deals from their smartphones. The platform should also allow fine-tuning the search results with filters.

The essential search variables should include the price range, desired loan term, property type, location, and down payment percentage. Extra filters may consist of property features, like the square footage, the number of bedrooms and bathrooms, and amenities.

Loan application form

An easy-to-navigate loan application form allows clients to apply for a mortgage without requiring assistance from the support team. It’s important to provide brief explanations for certain sections that may confuse the user. A good example would be adding smaller notes or pop-up windows that clarify terms like gross income and variable interest rates.

Review status tracker

A mortgage tracker allows users to follow the status of an application. The main goal is to alleviate anxiety for clients, which reduces the number of customer support requests. It may also show customers what actions they need to take next to get their mortgage approved.

Push notifications

Push notifications are a valuable tool for informing clients about important updates, deadlines, and documents they should provide for the application review. Other uses may include transaction updates (like overdraft fees or declined payments) and marketing messages (like new mortgage options).

Property evaluation

The online mortgage platform can help homeowners and investors estimate the property’s value based on its condition, location, size, and other factors. An evaluation tool gathers accurate information from public records, real estate databases, and other platforms. Additionally, the platform can calculate the value impact of the potential renovations.

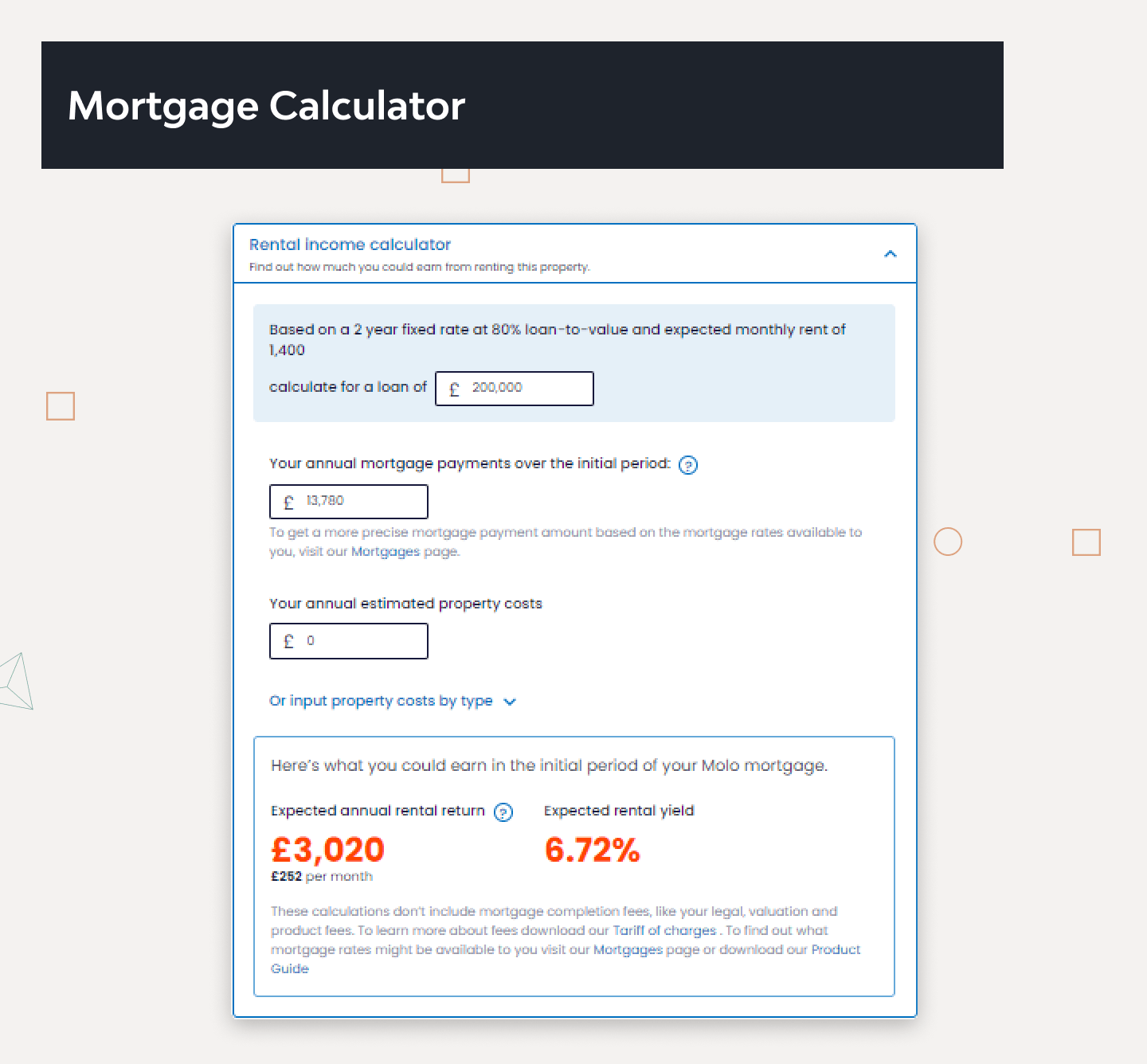

Mortgage calculator

A mortgage platform should allow calculating monthly mortgage payments based on factors like interest rate, property taxes, insurance premiums, and down payment. This feature helps clients plan their budgets and compare different loan options to select an optimal one.

KYC identification

The Know Your Customer (KYC) identification system allows the platform to verify the customer’s identity. Mortgage platforms usually verify people via ID documents, proof of income, or selfie photos.

This primarily facilitates identity verification, mitigates fraud, and avoids regulatory fines. KYC systems ensure adherence to relevant regulations, like the Anti-Money Laundering (AML) and the Bank Secrecy Act (BSA). In addition, it prevents using the platform by high-risk users, politically exposed persons, and sanctioned individuals.

Credit rating service

A credit rating service helps assess clients’ creditworthiness based on previous loans, debt level, payment behavior, and other factors. The customer-facing functionality can include a dashboard that lets clients monitor their credit health and eligibility for mortgages.

Document management

A well-designed eDocument module allows customers and managers to sign documents for a mortgage electronically. The platform should also let users quickly and securely upload, store, and handle different types of files. It also should be organized to maintain a clear document trail, which helps to reduce the risk of errors when tracking loans.

Customer support module

A customer support module is critical for addressing client inquiries, concerns, and complaints. This feature offers multiple channels for communication, such as chat, email, and phone support. Timely, personalized, and relevant assistance helps clients with their mortgages, improving the overall user experience.

Customizable offerings

Data analytics, business intelligence, and rule-based algorithms allow online mortgage platforms to tailor offerings. It can factor in different variables (like interest rate, preferred property type and location, and payment capacity) to segment customers. Then, the service can present customers with mortgage deals they’re likely to accept.

Some companies don’t need all this functionality to build digital mortgage software, while other custom mortgage software may need even more. To understand the requirements, organizations should start identifying the target audience with their outsourcing partners before the development.

By the way, in our new article we discuss the impact of digital transformation in the mortgage industry and how technologies are transforming the way people buy and sell homes.

Streamlining Collaboration with Technical Partners

Companies should align their goals and establish the work processes with the external team before development begins. Here are the key aspects to focus on.

Identify the users

Mortgage platforms address the needs of a diverse range of users. These can include homebuyers, real estate investors, brokers, and financial institutions (banks or credit unions). By understanding the needs of these different user types, companies can build a custom loan origination software or mortgage platform for their requirements.

For a deeper understanding of the target audience, organizations should answer the following questions:

- Who is this platform intended for?

- How do users interact with one another?

- What are the primary objectives of each user type?

- Which pain points are typical for these users during the mortgage process?

- Which features and capabilities are the most significant for each user group?

A clear audience portrait helps convey the project goals to the technical partner. The outsourcing partner can use it to define roles and create specific user types. For example, the lender, borrower, and mortgage intermediary may possess different permissions, capabilities, and interfaces (while being able to switch between them).

Create a high-level user flow

Understanding the target audience helps create a flow map that outlines how users interact with the mortgage platform. This serves to identify essential features and predict necessary third-service integrations to smooth out the customer journey.

A flow also helps identify paint points users may experience during the mortgage process. By addressing these pains, the platform can transform negative experiences into positive ones.

The identified bottlenecks can be perplexing application forms or intricate terminology. Companies then may instruct their technical partner to implement an intuitive authorization mechanism and present the wording in an understandable format. This changes the perception from “Why don’t I just hire a lawyer?” to “Applying for a mortgage is pretty easy!”

Optimizing the flow enhances the user experience and contributes to the platform’s success. However, when estimating the time for specific operations, remember that some processes have to involve foot-dragging bureaucracy.

Manage international teams

Outsourcing solutions for mortgage software from international companies can provide many benefits. For example, Eastern Europe is full of skilled Python developers that don’t overcharge like many experts in the US.

However, collaborating with an international team presents organizational challenges. These tips can ensure a more effective collaboration:

- Third-party services typically operate during local business hours. Plan meetings accordingly to avoid delays.

- Consider the time zone differences. Schedule at least three overlapping work hours for effective collaboration.

- National holidays may fall on working days. Inquire about such dates with the technical team to prevent disruptions.

- Utilize real-time collaboration tools. Task management, document sharing, and communication platforms keep the client’s team informed about the progress.

- Establish shared key performance indicators (KPIs). Doing so helps measure project success at different stages of the Software Development Life Cycle (SDLC).

Additionally, the right software development methodology goes a long way to ensure smooth collaboration. The Agile SDLC model, in particular Scrum and Kanban, is the optimal choice for startups due to its flexibility, adaptability to change, and focus on continuous improvement.

Architecture for Digital Mortgage Solutions

Software architecture defines the components and interactions of a digital mortgage platform. The monolith and microservices are the most common types of architecture.

A monolith is a tightly coupled system with a single code repository for business logic and data. Meanwhile, microservices distribute a system into independent components — each with isolated computing resources and databases. The microservice approach emphasizes loose coupling and high cohesion, letting developers manage each component separately.

We prefer to build digital mortgage software on a modular monolith architecture. This model splits the system into layers while keeping all modules within the same code base. One component could impact the entire system, as in a monolith. Yet, strong boundaries and minimal dependencies reduce potential issues.

Our experience shows it’s best to separate the business and data layers for fintech app development. Clearly defined boundaries between these layers help update and improve the platform. For example, developers can easily add or replace integrations without disrupting core features.

Successful mortgage platforms accommodate the entire client lifecycle and support growth. As such, architecture choices should consider product goals, target audience, and technical requirements.

Flows, Integrations, and Cloud Strategy for Mortgage Platforms

Companies refine their customer journey by optimizing the user flow, third-party integrations, and database management tools. Here are the practices that can improve these aspects during the mortgage app development.

Streamline information gathering

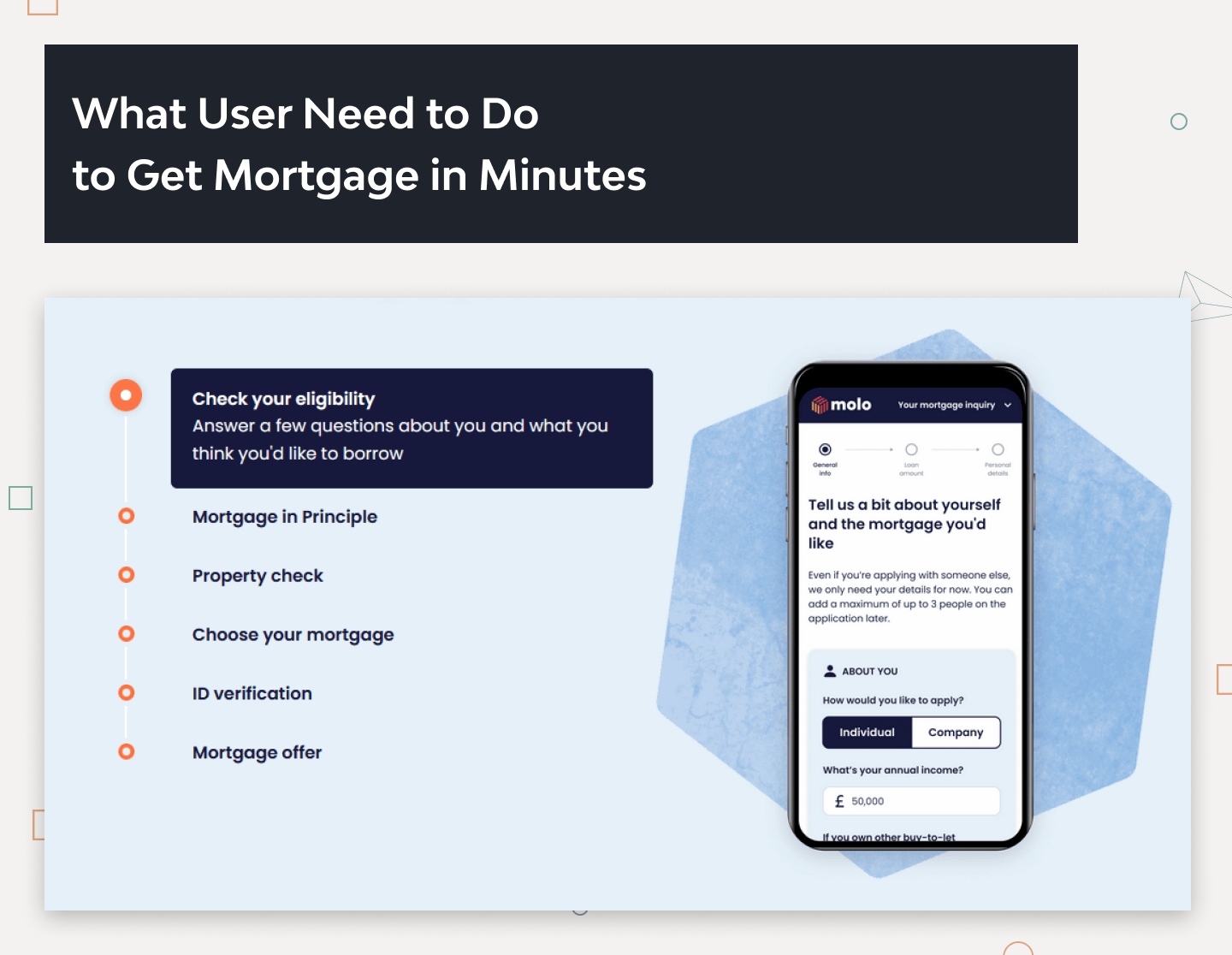

A well-thought-out user flow keeps users engaged during an unarguably tedious mortgage application process. It basically defines whether a potential user will turn into a customer. So, simplifying information gathering is crucial as users often abandon websites when faced with cumbersome forms.

Whether or not you’re relying on custom mortgage software development services, one defining trait of such platforms is the requirement for users to submit a substantial amount of personal information. The developer must figure out how to make this process less stressful.

To ease the process, companies can adopt a progressive disclosure approach. It means asking only for the necessary information during the initial steps. Once users receive early feedback, such as rough mortgage estimates, the system can fetch the necessary data from other platforms.

It helps to prioritize forms from the most to least important. Highlight the required fields and mark optional ones.

Optimize bank integrations

Integrating with banks and payment systems is critical. Online mortgage platforms rely on banks to share valuable user information, such as IDs, customer emails, approximate income, and credit records. Platforms get this information via a request using an Application Programming Interface (API) — software that allows apps to communicate.

The problem is: these requests often have a fixed fee per request (typically $1 to $10). To build digital mortgage software that saves money for a company and customer, developers should reduce the number of API calls. It also makes sense to fetch the data only when the customer fills out the application.

Mortgage platforms may benefit from integrating other third-party services, such as credit bureaus, insurance companies, or property valuation services. These integrations can give customers more comprehensive financial insights, faster decision-making, and a smoother application process.

Implement tax optimization services

Mortgage apps often contain third-party services for financial planning. Such tools can include calculators that predict mortgage payments based on the individual needs of the user.

One such service is Logismata — an advisory and tax reduction service that enables users to calculate the mortgage sum. The platform considers numerous factors (like the tax amount, income, and region) to help users see if they can afford the deal.

Similarly, planning services can help customers reduce their tax burden. For example, Swiss citizens often secure a mortgage with their pension funds. Platforms like Logismata help deduct the interest for every deal, helping users to find the less costly deals.

Add a client self-service

A customer portal with self-service capabilities lets customers easily manage their accounts and personal information. It can also contain an FAQ and a searchable knowledge base to guide them through various processes.

The chatbot, powered by advanced language models, can also manage most customer inquiries. Unlike primitive bots, these AI-based tools handle a wide range of questions and problems without involving live agents. This can enhance the user experience and reduce the support team costs.

Thoroughly test APIs

Rigorous testing is crucial when integrating APIs into the mortgage platform. This process is lengthy, but it’s imperative to cover all possible use scenarios, problems, and risks. For example:

- What does the system do if the customer’s card has expired?

- What happens if the card is reported stolen or lost by the customer’s bank?

- How does the platform handle incorrect user input (an invalid card number or incorrect security code)?

- How does the system respond to declined transactions due to insufficient funds in the user’s account?

- What is the platform’s behavior when there are technical issues with the bank’s API or server downtime?

- How does the system manage changes in mortgage rates or terms from the bank’s side?

- How does the platform handle potential security threats, such as fraudulent activity or unauthorized access to user data?

It’s better to avoid using real funds from the company’s bank account. The development team should instead use tools like Postman or REST-assured to simulate requests and analyze responses from the APIs. Many financial services also provide test data for developers to check various outcomes.

Adopt a multi-cloud data management

According to Accenture’s 2021 To the Multi-Cloud and Beyond Report, 92% of enterprises already use separate cloud services for different workloads. With the right planning, this strategy enhances performance, reduces service disruptions, and shaves some of the unnecessary costs.

Multi-cloud is a strategic approach for companies that build digital mortgage software. It’s possible to run an app on AWS EC2 and host the database on the AWS RDS server. RDS request processing through PIOPS will improve the database workload’s latency and simplify data administration with automated and user-initiated backup mechanisms.

Development teams should explore different database management solutions to find the best fit for the mortgage app requirements. Important factors include security, performance, and ability to scale as the platform grows.

Building UI/UX for Digital Mortgage Solutions

As Dieter Rams aptly puts it, good design is as little design as possible. By designing a seamless flow, we may even create an experience where people do not recognize it as a financial service.

So, this section will address specific design challenges of online mortgage platforms and solutions that help improve the user experience.

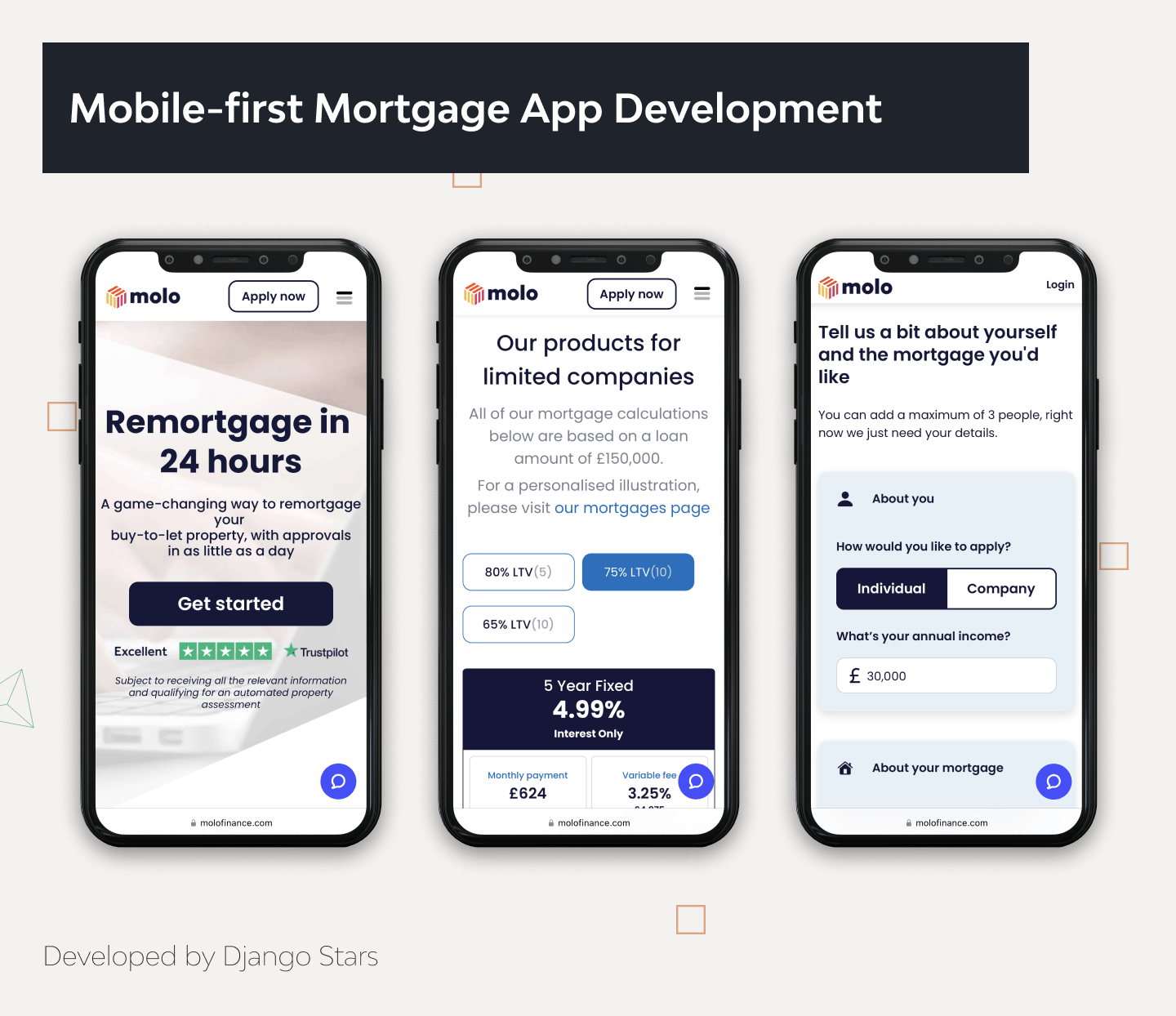

Mobile-first mortgage app development

It’s important to focus on the mobile version during mortgage app development. As much as 43.5% of US customers access banking operations, including paperless landing, through mobile devices (according to Bankrate’s 2023 research). Companies should expect that many customers will use their apps primarily on smartphones.

One of the challenges is displaying data grids on a smaller 5-inch display. Mint App solved this problem by using diagrams instead of grids. This visualization differentiates spreadsheets (a bad UX) from interactive data (a good UX).

Allowing decimals

Mortgage platforms should inherit traditional banking’s attention to detail, particularly regarding money. For example, all fields where users enter monetary amounts should allow decimals — even fractions of a dollar influence the future benefits. Allowing such functionality prevents customers from facing unfavorable mortgage conditions.

Managing personal data

Limiting users’ ability to modify their personal information for security is recommended. The unrestricted modification increases fraud risks if a hacker gets access to an account. Additionally, sudden changes to personal details can introduce inconsistencies in the mortgage application process, leading to errors and subsequent delays.

There may be situations when updates are necessary, such as a surname change after marriage. The best option is to establish guidelines on what information can be altered and inform users during account creation. Implementing a secure method for users to request changes to their information, such as through customer support or a designated form, also helps to maintain security while accommodating necessary updates.

Incorporating customer feedback

Online mortgage providers should have a sophisticated system to handle a large volume of customer requests. These can include helpful suggestions on the platform’s design elements, functionality, and integrations.

It’s preferable to set up an intranet website to test the design changes before deploying it to live servers. Continuous experimentation of hypotheses received from customers will lead to UX improvements that will satisfy more users.

How Much Does It Cost to Build Digital Mortgage Software?

Developing a digital mortgage platform is similar to a couturier crafting a tailor-made jacket. The cost depends on specific requirements, the intended purpose, and the design concept. Last but not least are the craftsman’s skills.

Django Stars is predominantly a custom software developer. It’s therefore impossible to provide a general estimate without more details.

For example, developing an online mortgage platform with basic features may take up to 200 workdays. Each day consists of eight hours of work multiplied by the outsourcing provider’s hourly rate. However, some features might not be relevant to a particular project, while other necessary features may not be part of the basic package.

Instead of speculating, we want to share actionable tips to help companies estimate development costs and trim expenses:

- Establishing clear goals. Begin with a discovery phase to determine a platform’s objectives and requirements.

- Evaluating resources. Examining IT infrastructure, budget, and other factors to accurately assess available resources.

- Creating design mockups. Developing design mockups or AI proof-of-concept (POC) versions can help reduce development costs by identifying potential design flaws, usability issues, or technical limitations early in the process.

- Building an MVP. A minimum viable product (MVP) lets companies validate a barebone version of the product on a real audience. This helps decide whether further development is feasible or the team needs to revisit the discovery phase.

When discussing development costs, it’s vital to share the budget upfront. Custom development isn’t like shopping for a product with a fixed price tag.

For instance, a client with $5 to spend on dinner may opt for a pre-packaged risotto and then hope it’s at least edible. Instead, we would specify the budget, taste preference, and dietary restrictions, so a professional cook can create a meal that meets the client’s taste palette.

The same principle applies to custom software development. Again, knowing the budget enables the development team to deliver tailored solutions that fulfill specific requirements.

Successful Digital Mortgage Software Built by Django Stars

The tips in this article are based on over a decade of experience in the fintech industry. The following successful mortgage startups showcase the best practices outlined in this article and serve as excellent models for those looking to create mortgage service software.

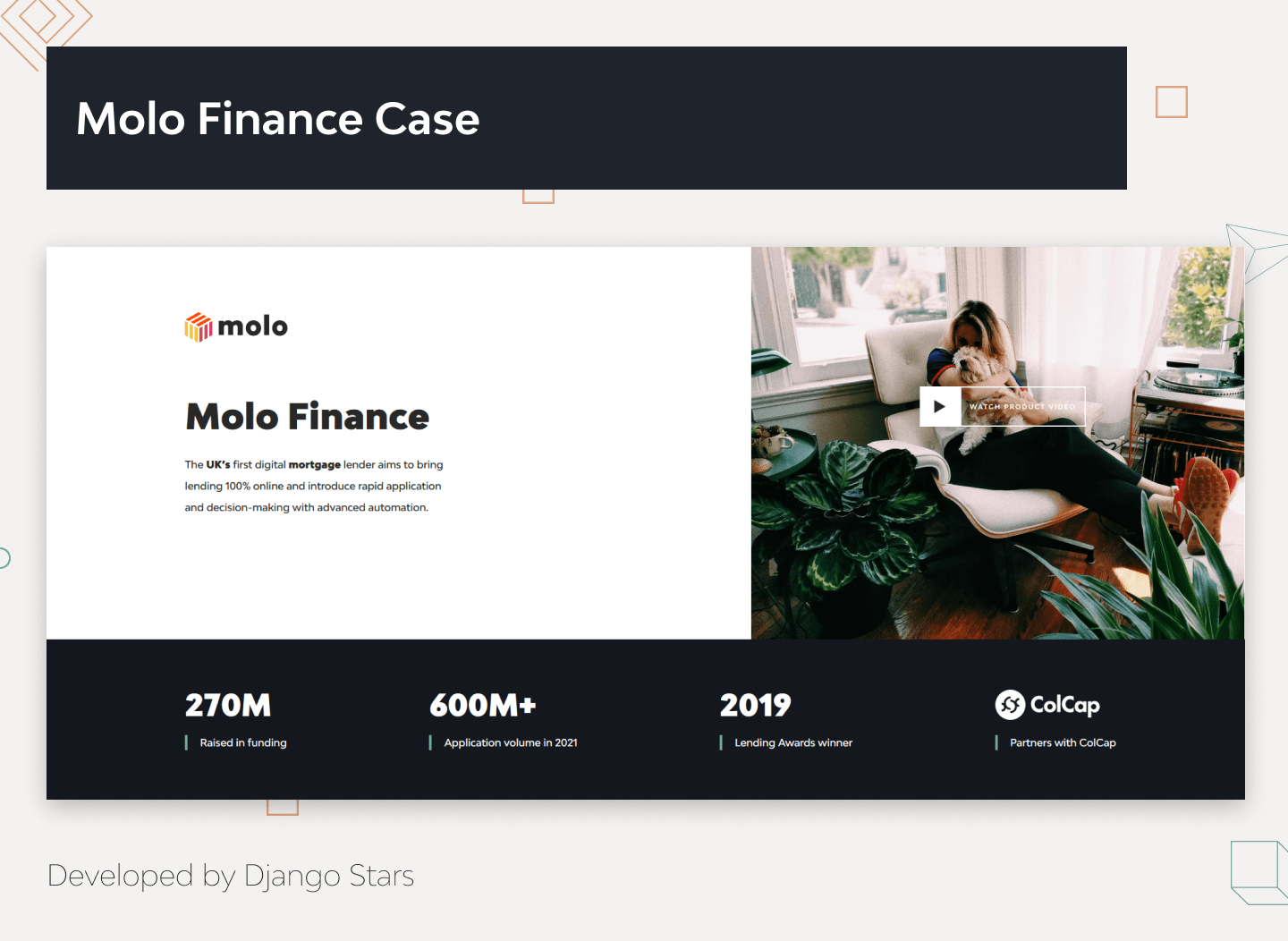

Molo Finance

Launched in: 2016

Funding: £3.7 million raised during the first round of investment (Series A)

Molo streamlines the mortgage loan decision-making process and minimizes the documentation required from customers in the UK. This digitally native mortgage platform partners with banks and features notable AI-based automation tools to help users find the appropriate deal faster.

Distinctive features:

- A proprietary mortgage calculator — the computational system provides approximate estimates based on user inputs, real estate properties, and other factors.

- An automatic advisory system — analyzes user data to craft offers that meet the individual needs of different customer groups.

- AI-driven evaluation functionality — for swift user ID verification (via photos, documents, and other means) and accurate real estate assessment.

- The Primary Offer — this feature matches user credit scores with available mortgages, simplifying the selection process.

- A legal maintenance mechanism — ensures compliance with applicable mortgage laws and data sharing regulations.

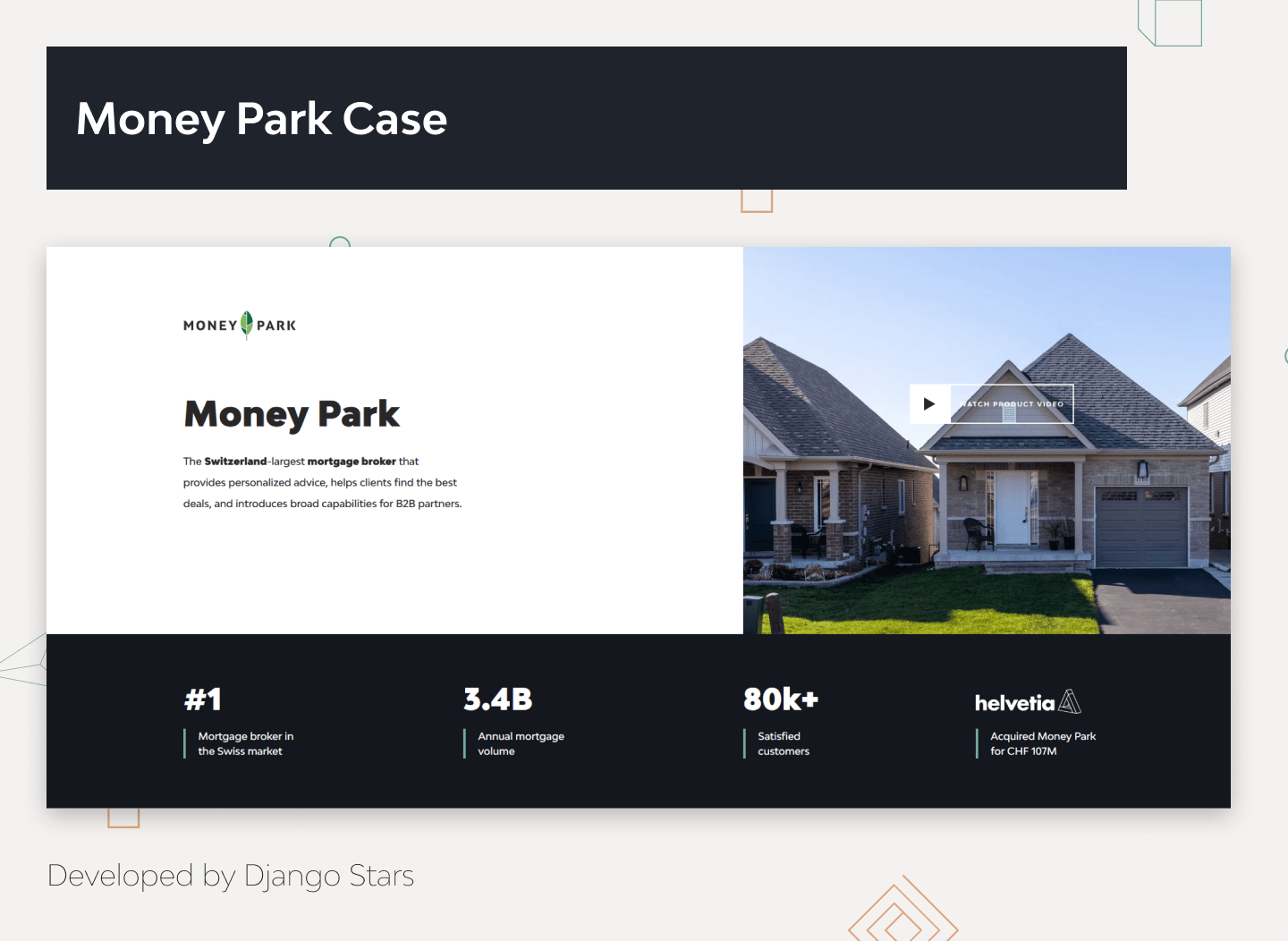

MoneyPark

Launched in: 2011

Funding: Bought by Tamedia (transaction value not disclosed)

MoneyPark serves as a broker between banks and customers, specializing in mortgages and insurance services. The platform also offers personalized advice for finding, investing, and trading real estate.

Distinctive features:

- A user-friendly website — a free calculator and intuitive comparison tool enables preliminary assessments and helps identify the best mortgage deals.

- A sophisticated web platform — facilitates communication with bank representatives and advisors for in-depth valuations, ensuring customers make informed choices.

- CRM system — streamlines internal data processing and handling and a B2B CRM system that connects MoneyPark with over 150 Finance Park partners.

- Finance Park — a cutting-edge web platform for partners who wish to offer similar services using MoneyPark’s proven technologies and expertise.

- iOS and Android apps — provide easy access to information, appointment scheduling with advisors, and direct communication with MoneyPark representatives.

Sindeo

Launched in: 2013

Funding: $25.5 million raised; Acquired by Renren

Sindeo was a US-based mortgage LOS platform with personalized advice services. Access to a network of loan programs and innovative technology helped speed up the pre-qualification, loan application, and mortgage approval.

Distinctive features:

- Mobile-friendly consumer portal — empowered real estate agents to efficiently originate loans for their clients.

- Mortgage advisor — securely handled customer personal data to verify identity and validate credit scores.

Integrations:

- Salesforce.com — for effective lead generation, communication history tracking, and personalized customer service through dedicated representatives.

- Box.com — allowed secure and convenient document uploading to the portal, streamlining the application process.

- Mortech — for accurate rate quote calculations, ensuring clients have access to the most competitive offers.

- Yodlee and Finconnect — verified customers’ personal information (such as employment and income) for a seamless user experience.

- Mismo and other integrations — for reliable online credit reporting and secure data exchange between companies in the mortgage industry.

Final Thoughts

Like all fintech software, online mortgage portals should make the traditional mortgage issuing process more convenient: faster, intuitive, and paperless. Companies should build digital mortgage software with this core idea in mind.

A focus on the user experience should guide the design, flow, and functionality choices. The software architecture, third-party integrations, and cloud strategy should too reflect the platform’s goal.

Sometimes it’s better to get inspired by examples of successful mortgage platforms rather than trying to reinvent the wheel. But if the company is up for experiments, it’s advisable to work with a team of fintech software developers to accompany the project from the discovery phase.

- Can you build a digital mortgage software MVP in six months?

Yes, developing a minimum viable product (MVP) within six months is possible. An MVP focuses only on the core functionality a company can expand after validating the product. However, the exact time depends on the project’s scope, technical complexity, team size and competence.

Clear technical and design specifications can expedite the development process. If the company lacks concrete documentation, it’s recommended to use a gradual approach. Start with a discovery phase and create design mockups or proof of concept (POC) versions to evaluate the platform on the target audience.

- How to find a team for mortgage management software development?

Consider reaching out to companies that provide outsourcing solutions for mortgage software development. There are many excellent companies on outsourcing review platforms like Clutch. However, it’s important to evaluate potential candidates based on their development methodology, reputation, and relevant mortgage LOS platforms.

- What risks are there when creating custom mortgage software?

Organizations often encounter technical issues, integration problems, and cybersecurity challenges. These issues can lead to missed deadlines and cost overruns in the long term. The company should invest in the research phase and establish clear project documentation to mitigate these risks. This should help set realistic timelines and allocate resources more effectively.

Additionally, implementing Agile methodology helps the development process remain flexible and adaptable. Progress tracking, continuous integration, and automated testing also help address issues early on, reducing the likelihood of encountering major roadblocks later in the project.

- How to monetize a custom mortgage platform?

Online mortgage platforms are monetized by partnering with lenders for referral fees. Companies also provide tiered subscriptions and offer premium features for direct revenue. Additional methods include targeted ad space and value-added services (like mortgage insurance or home appraisal). Ultimately, the strategy depends on the business type, target audience, and competitor’s offerings.

- How do you ensure data security and privacy within a custom mortgage platform?

Cybersecurity can be enhanced by implementing advanced authentication measures, stringent access control, and a zero-trust policy. Companies should unify the business architecture, integrate proactive security tools, and regularly update their IT security.

The development team must adopt automated security software (like SASTS, SQL protection, code quality, and IPS). This should help detect malicious traffic, ensure secure code, and minimize risks of unauthorized access.

- What regulations should I follow when building digital mortgage solutions?

Industry-specific regulations and standards include Bank Secrecy Act (BSA), Anti-Money Laundering (AML) regulations, General Data Protection Regulation (GDPR), and the California Consumer Privacy Act (CCPA). Compliance with these laws ensures robust security and prevents potential government fines.