Personal Financial App App Development Services

Combining a decade-long experience in building personal financial applications with expertise across the US, EU, and MENA markets, we equip our clients with software that sets their businesses up for long-term success.

-

Fintech products

in our portfolio

-

Our clients raised

in investments

-

Trusted by

Fortune 500

Access our expertise to design precisely the solution your business requires

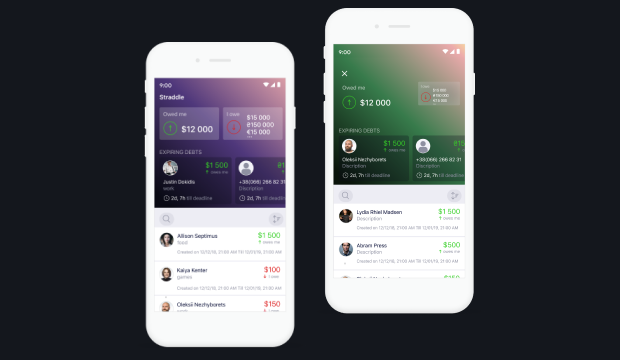

From lightweight mobile apps to advanced budget planning solutions, we help our clients enable better accountability, categorization, and a smooth user experience. Providing personal finance app development, we focus on a combo of easy perception and comprehensive representation of data to create budget planning apps that attract and retain customers.

- Assets management across bank accounts

- Expenses tracking by categories

- Flexible categorizing and personalization

- Advanced analytics and recommendations

- Payments automation and template systems

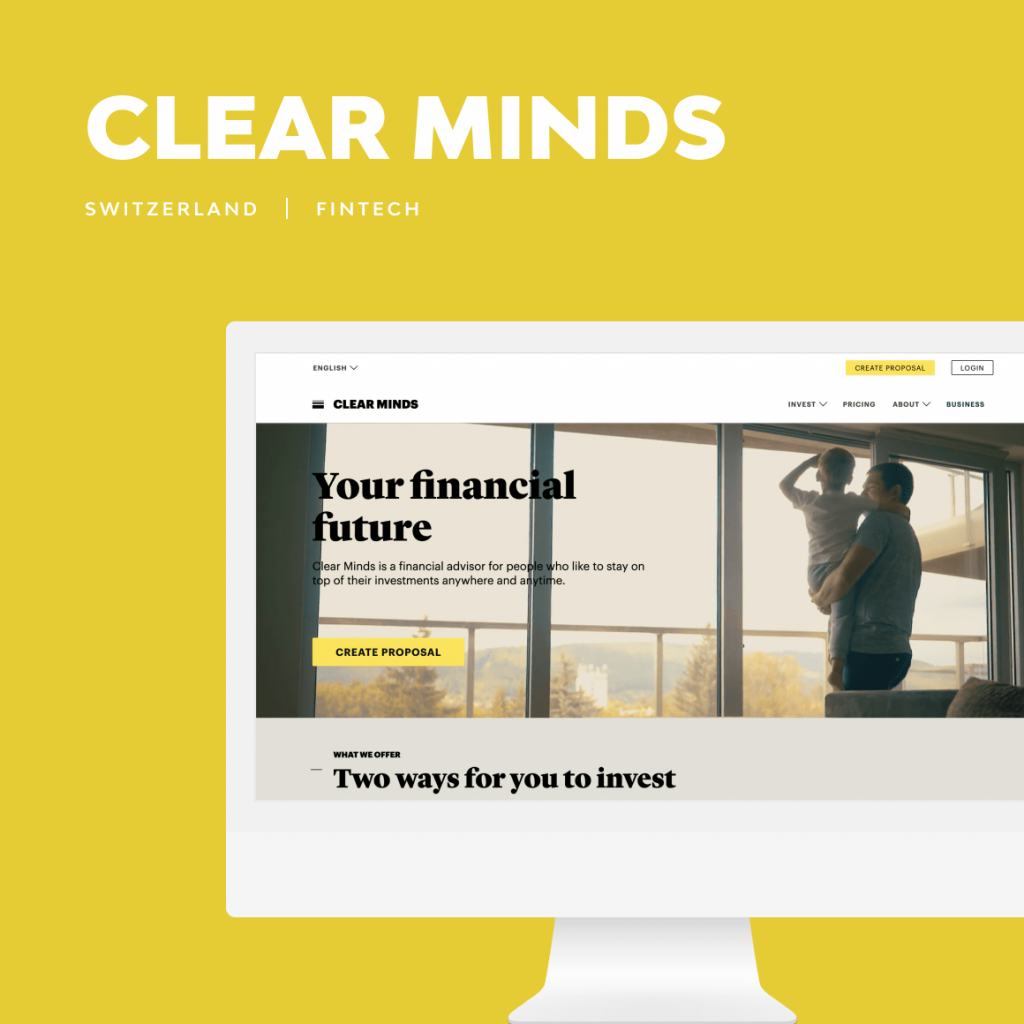

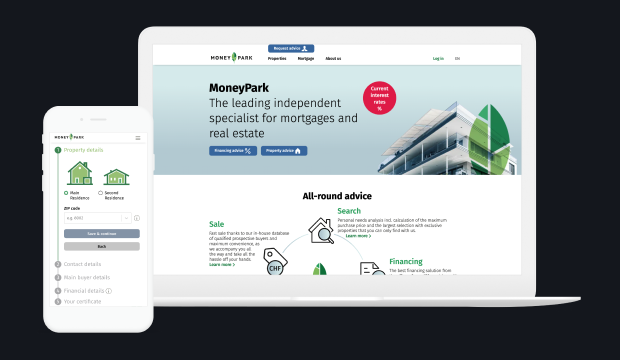

A secure investment process combined with easy flow and rich data representation is a combo we stand for when it comes to personal investment solutions. Time efficiency and ease of use are of the essence when it comes to personal investment, and, developing a personal finance app, we strive to ensure not only rich app capabilities but personalized user experience and flows.

- Investment portfolio dashboards

- Accelerated investment flow

- Smart analytics and management

- Multiple investment goals systems

- Asset diversification recommendations

With our personal finance app development services, we help businesses to design digital solutions that allow end-users to reduce their taxable income effortlessly, define tax exemptions they are eligible for, file the forms and retrieve information from forms with OCR tools, automate reporting, and get personalized tax recommendations.

- Automated tax data import options

- Sync transactions from banks and investment platforms

- Built-in or integrated tax forms filing system

- Seamless expense tracking

- Multiple account access levels

We build solutions that allow for multiple retirement planning options, introduce advanced risk calculation, and have a design that makes it easier to understand large amounts of financial information. With our financial app development, we empower businesses to combine robotic tools and the human touch and enable precise retirement planning.

- Retirement risks analysis tools

- Seamless expenses analysis

- Comprehensive retirement planning

- AI-driven advisory mechanisms

- Retirement planning for couples

We focus on what makes a difference for your customers

- Biometric authentication

- Reduced session time

- Multi-factor authorization

- Advanced data encryption

- Intuitive app interfaces

- Device-optimized charts and tables

- Smart dashboards

- UX/UI best practices

- Save personal settings and data

- Integration with social media

- Smart notifications and alerts

- Geo-based recommendations

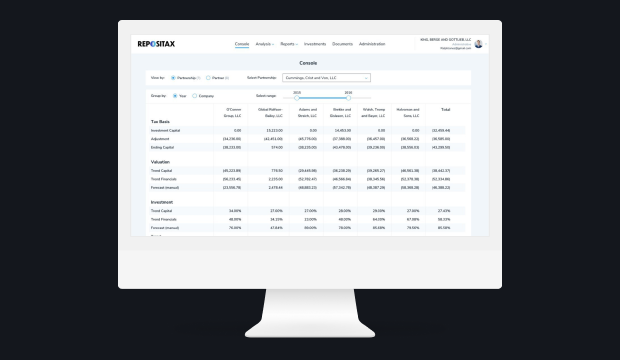

Visualization schemes

Financial apps need to display large amounts of data in an easily perceptible way both on a large screen and mobile device.

With our personal financial app development company, you can introduce flexible design solutions and tailor your app to the audience’s preferences, display charts concisely and minimize the amount of effort required to input and analyze financial data.

AI-driven advisory

We help you build products that enable your customers to align their financial goals with expenses, optimize assets, and identify the most efficient ways to save or invest.

Introducing automation and AI-driven advisory, we bring advanced cost-efficiency and personalization to your business.

Automation

From basic operations like expense management and tracking to investment process peculiarities, our personal investing app development empowers your users with advanced automation.

Flexible automation settings combined with personalization set users up for the exact use cases they experience.

Gamification

Gamification is an essential part of the customer retention strategy which motivates your customers to utilize your product more often and helps them develop a habit of using it.

As a finance app development company, we help our partners build sharp, audience-tailored gamification systems that transform finance management routines into engaging experiences.