Digital Transformation in Banking and Financial Services: A Complete Guide

Advances in technology and business are creating new needs and providing resources for the invention of novel solutions in finance and banking. Increasingly, economic operations are going cashless and streamlining bureaucracy—at least for FinTech end users—pushing the boundaries of digital transformation in banking and financial services. As the industry evolves, a well-structured digital transformation strategy for banks is no longer optional; it’s essential for staying competitive and meeting modern customer expectations.

Django Stars has been providing fintech software development services since 2008, including for mortgage, investment, and banking platforms. Several of these projects are detailed in our case studies, including development for Molo Finance, the UK’s first digital mortgage lender, and Money Park, Switzerland’s largest mortgage online broker. Thus, for a banking company considering the possibility of digital transformation, turning to the expertise of our specialists is an advantageous option.

Digital transformation in finance and accounting is proving to have immense potential for startups and innovations that can change the traditional view of both global banking and the management of people’s personal finances. If you want to navigate this fast-growing and ever-changing realm, reading Digital Transformation in Banking and Finance: The How and Why is a great first step!

What Is Digital Transformation in Financial Services

Digital transformation in the financial services reshapes how banks and financial institutions operate, leveraging technology to streamline processes, enhance customer interactions, and drive growth. It’s not just about replacing outdated systems—it’s about reimagining services through automation, data-driven decision-making, and seamless digital experiences. Real-time payments, AI-powered risk assessments, and blockchain-based transactions are just a few examples of how digital transformation accelerates efficiency and reduces costs. For financial institutions, it’s a path to greater agility, stronger compliance, and enhanced customer trust.

Key Areas of Digital Transformation in Banking

Digital transformation in banking and financial services is reshaping how institutions operate, engage with customers, and manage risks. As technology advances, several key areas have emerged where transformation drives the most impact. Here’s how digital solutions are evolving the core pillars of modern banking:

Customer Experience

Digital platforms have transformed how customers interact with banks. Mobile apps, AI-driven chatbots, and online portals now provide real-time transactions, personalized advice, and 24/7 access. In the digital transformation in banking industry, seamless customer experiences are critical for building trust and loyalty. Banks that prioritize intuitive interfaces and instant service are setting new standards in client engagement.

Operational Efficiency

Traditional banking processes are often slowed by manual tasks and outdated systems. Digital transformation addresses these gaps with automation and advanced analytics. Technologies like robotic process automation (RPA) and cloud computing optimize back-office functions, reduce human error, and cut costs. Streamlined operations mean faster service delivery and quicker adaptation to market changes.

Risk Management and Security

With the rise of digital banking comes increased risks of cyber threats and data breaches. Modern technologies enhance fraud detection, real-time transaction monitoring, and secure authentication. AI models now identify suspicious patterns instantly, while multi-factor authentication and biometric verification strengthen data protection. In today’s connected world, robust risk management is vital for maintaining consumer trust.

New Business Models

Digital transformation is not just optimizing current services—it’s enabling entirely new business models. Open banking allows third-party developers to create financial products on top of existing platforms, driving innovation and customer choice. Blockchain technology is enabling instant cross-border transactions and decentralized finance (DeFi). For traditional banks, embracing these new models means staying competitive in a rapidly changing market.

Technologies Powering Digital Transformation in Banks

The rapid pace of digital transformation for banking is fueled by innovative technologies that optimize operations, enhance security, and elevate customer experiences. Here’s how they are reshaping the industry:

Artificial Intelligence & Machine Learning

AI and Machine Learning automate processes, improve fraud detection, and personalize customer interactions. Chatbots deliver instant support, while predictive analytics help banks anticipate risks and optimize decision-making.

Blockchain

Blockchain introduces transparency and security to financial transactions through decentralized ledgers. It reduces fraud risks, accelerates cross-border payments, and enables smart contracts, offering tamper-proof records and secure digital identities.

Cloud Computing

Cloud solutions drive digital transformation in the financial services by providing scalable infrastructure and real-time data access. Banks leverage cloud platforms to streamline operations, reduce costs, and enhance data processing for faster service delivery.

Big Data & Analytics

Big Data enables banks to extract insights from vast datasets, optimizing decision-making and risk management. Advanced analytics allow for personalized client interactions and smarter lending strategies, making banking services more efficient.

Internet of Things (IoT)

IoT connects physical devices with digital platforms, enhancing real-time monitoring and secure transactions. Smart ATMs, connected payment systems, and interactive banking interfaces are transforming customer experiences.

Benefits of Digital Transformation in Banking and Financial Services

The impact of digital transformation in banking extends across all key areas, enhancing efficiency, security, and customer experience. Here are the major benefits driving change:

Reduce Operational Costs

Automation of routine processes and cloud-based solutions help banks cut costs and streamline operations. By minimizing manual tasks and optimizing workflows, financial institutions can achieve greater efficiency without inflating expenses.

Improve Customer Experience

Digital platforms, mobile apps, and real-time services are redefining how customers interact with banks. Instant transactions, personalized support, and seamless online experiences enhance satisfaction and build loyalty. Banking and financial digital transformation is making banking more accessible and user-friendly.

Compliance

Navigating regulatory demands is simplified through digital solutions that automate reporting and monitor transactions. Advanced analytics help banks meet compliance standards like GDPR and PSD2 while reducing risks of fines and data breaches.

Enhanced Security

The rise of cyber threats has made security a top priority. Digital technologies such as blockchain, multi-factor authentication, and real-time monitoring strengthen data protection, safeguarding both institutions and their clients.

Business Innovation and Adaptability

Digital transformation in banking and financial services opens up new opportunities for innovation. Through technologies like open banking and blockchain, financial institutions can explore new business models, enhance service offerings, and quickly adapt to market changes. This agility allows banks to remain competitive and resilient in a rapidly evolving industry.

Key Trends in Digital Transformation for Banking and Finance

To truly benefit from any industry, it’s essential to understand the forces that drive it—and one of the most influential is demographics. Banks’ digital transformation is heavily shaped by the expectations of younger generations who demand quick, seamless, and paperless transactions. Digital financial management aligns with this shift, enabling faster, more efficient banking experiences. This trend is not limited to traditional banking; even if you’re considering banking and financial digital transformation for insurance or investment platforms, these demographic-driven needs are critical for product success. New FinTech solutions are increasingly tailored to accommodate diverse revenue models, including contracting and freelancing, reflecting the evolving nature of work and income streams.

Read More: Best Colors and UI Tips for Fintech Products

The transformation of the financial sector is inevitable – so the sooner companies embrace it, the better the chance they will profit.

Even for those who don’t have a startup idea, FinTech opens a broad field of investment opportunity. As well as technical advancement, investment accelerates the digital transformation of the financial industry, and the relevance of the funded products leads to their success. Although the sphere is new, there are already 48 unicorns out there.

Another important area of digital finance is online banking, which is the most understandable to regular users. That’s why it never loses its relevance and only increases its potential.

Read more: How to create an investment platform

Go in Prepared

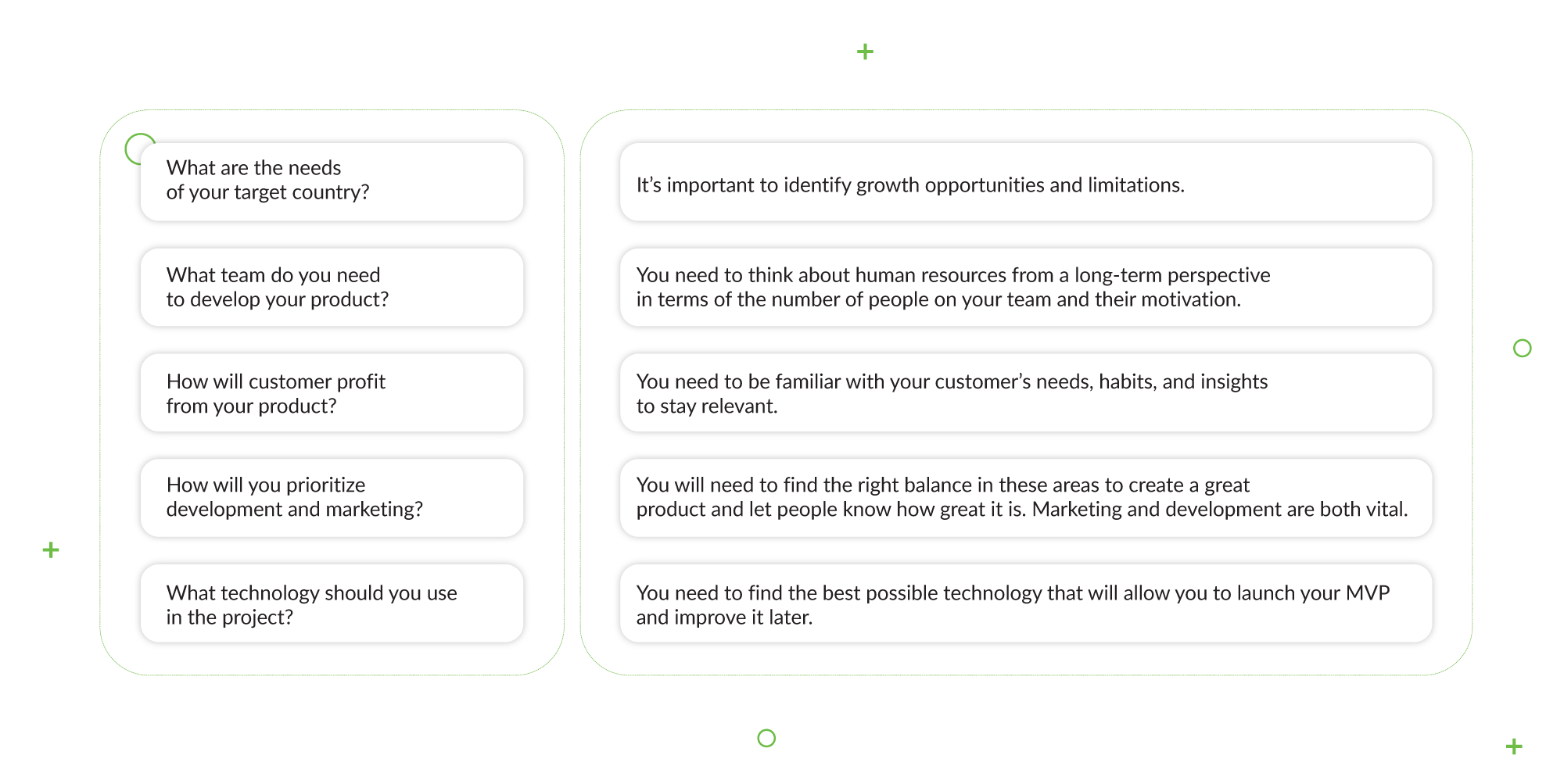

If you recognize FinTech’s potential and want to take advantage of it, just jumping into the game isn’t the way to go. Planning a banking digital transformation for the CEO is crucial. Before introducing a new solution – one that will be genuinely useful and profitable – you need to ask a few questions:

- What are the needs of your target country? It’s important to identify growth opportunities and limitations.

- What team do you need to develop your banking app or financial service? You need to think about human resources from a long-term perspective in terms of the number of people on your team and their motivation.

- How will customer profit from your product? You need to be familiar with your customer’s needs, habits, and insights to stay relevant.

- How will you prioritize development and marketing? You will need to find the right balance in these areas to create a great product and let people know how great it is. Marketing and development are both vital.

- What technology should you use in the project? You need to find the best possible technology that will allow you to launch your MVP and improve it later.

Evidently, the answers will be different in digital transformation in investment banking and digital transformation strategy in healthcare. Nonetheless, all of the questions above are important to answer for anyone hoping to make a solid start in FinTech. Each answer will play a role in the project’s eventual success. The details of each are available in the ebook.

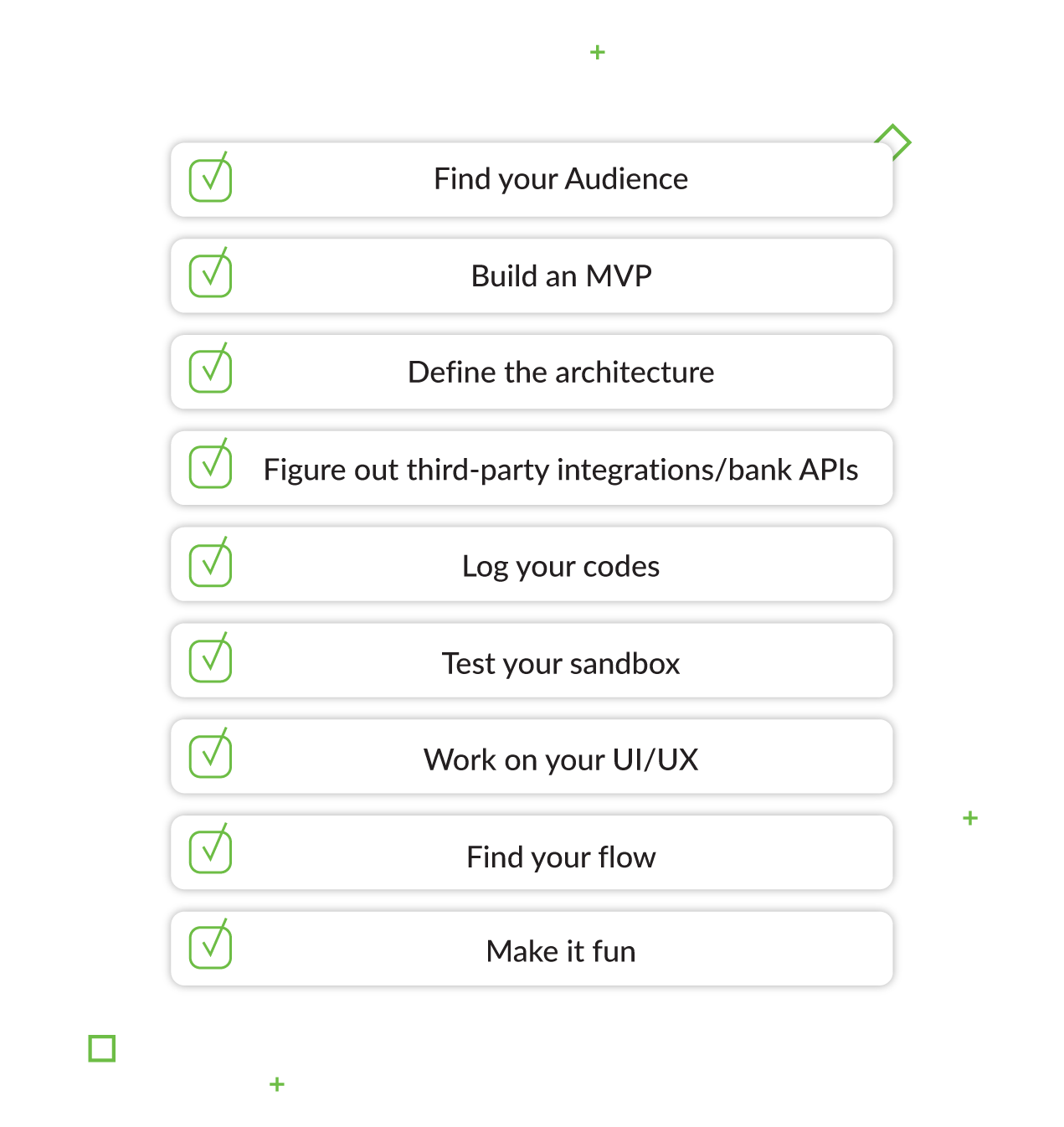

A Financial Solution Development Plan

Even if you have a financial solution that you’re sure will simplify the users’ life, you’ll still have a lot of research, development, iteration, testing, changes, and brainstorming to do.

These checkpoints are closely related to one another. Each has a specific impact on the future of the product.

Perhaps the most valuable part of Digital Transformation in Banking and Finance: The How and Why is its detailed checklist for the development stage of a FinTech solution, which looks much like the list above. Along with this step-by-step checklist, the ebook helps you understand how to tailor it to your unique ideas, goals, and capacities. Each step is reasoned and explained using real-life examples of those who have successfully followed these steps.

Overcoming Challenges of Digital Transformation in Banking

While digital transformation in banking and financial services brings numerous benefits, it’s crucial to recognize the obstacles that may emerge along the way. Beyond the considerations covered in the book, some specific challenges also deserve attention.

- One of the main hurdles is the resistance to change from employees and stakeholders. Shifting traditional processes and embracing new technologies can be met with reluctance or fear of job displacement. Effective change management strategies and employee engagement initiatives can help address this issue.

- Another challenge lies in ensuring data security and privacy. With the increased reliance on digital platforms and data-driven decision-making, organizations must establish robust cybersecurity measures and comply with stringent data protection regulations.

- Furthermore, the complexity of integrating legacy systems with modern technologies can pose significant difficulties. Legacy systems may lack compatibility, requiring careful planning and execution during the transformation process.

- Additionally, the need for continuous technological advancements and the risk of technological obsolescence pose ongoing challenges. Staying ahead of emerging fintech industry trends and adopting agile approaches are vital to avoid falling behind in the digital race.

Overcoming challenges in digital transformation requires organizations to take proactive measures and embrace a culture of adaptability and innovation.

Our Experience in Digital Transformation for Banking and Finance

The Django Stars team brings years of expertise in developing FinTech projects from the ground up and delivering digital transformation in banking and financial services. Our tailored solutions, supported by expert software development consulting services, are designed to meet the unique needs of growing businesses and established financial institutions.

In addition to Molo Finance and Money Park, our specialists contributed significantly to the successful digital transformation in banking and financial services for Clear Minds, a Swiss investment platform. This project empowered Clear Minds to offer clients comprehensive investment guidance through a seamless blend of in-person and online methods, setting new standards for digital financial advisory.

Another example is related to the development of a fintech software solution for a Saudi Arabia bank aimed to streamline and accelerate the provision of banking services. Read also our banking application development guide to learn more.

Conclusion

In today’s rapidly evolving technological landscape, financial institutions must quickly adapt to emerging tools and technologies to remain competitive. Embracing a culture of innovation and experimentation is crucial for navigating the future of digital transformation in banking. Encouraging employees to explore new ideas and take calculated risks paves the way for meaningful change.

Collaborating with fintech startups offers a unique opportunity for banks to leverage cutting-edge technologies and innovative business models. This partnership not only accelerates their digital transformation journey but also amplifies the impact of digital transformation in banking, enabling institutions to stay ahead in an increasingly digital-first market.

We hope this article has provided valuable insights into digital transformation in banking and finance. Moreover, you are welcome to download the ebook complementing this study. Should you have any further inquiries concerning the digital transformation of your business, don’t hesitate to reach out to us.

- What is the role of digital transformation in banking?

- Digital transformation significantly impacts the banking industry by modernizing processes, enhancing customer experience, and driving innovation. It involves leveraging technology to digitize operations, automate manual tasks, and improve efficiency. Moreover, with the adoption of advanced analytics and AI tools, digital transformation enables better risk assessment, fraud detection, and customer insights. All this empowers banks to stay competitive, meet evolving customer expectations, and adapt to the rapidly changing digital landscape.

- What are the main areas of digital transformation in banking?

- Customer Experience. Enhancing digital channels and personalizing services.

- Process Automation. Automating tasks and streamlining internal processes.

- Data Analytics. Leveraging data for insights, risk assessment, and customer targeting.

- Mobile Banking. Providing convenient banking experiences on mobile devices.

- Cybersecurity. Strengthening security measures to protect customer data.

- AI and Machine Learning. Using advanced technologies for fraud detection and personalized recommendations.

- Open Banking. Collaborating with third-party providers through open APIs.

- What is the future of digital transformation in banking and finance?

- The digital transformation in banking and finance is centered around technology advancements and is characterized by enhanced customer experiences, increased automation, and the integration of AI. This includes personalized services, seamless interactions, and real-time customer engagement. The use of advanced analytics and AI empowers improved risk assessment, more effective fraud detection, and deeper customer insights. Additionally, emerging technologies like blockchain and open banking are reshaping the industry by promoting transparency, security, and collaboration. As digital transformation continues to evolve, banks and financial institutions will need to adapt to stay competitive, leverage data-driven insights, and provide innovative solutions to meet evolving customer expectations.