Top 11 US Lending Startups Disrupting Real Estate

The common pain of all millennials is having multiple debts — starting with student loans and ending (or not) with loans for their car, a house, and so on. This is the main reason why the lending market is on the rise:

- Direct student loans equal $1.24 trillion, with over 35.1 million borrowers

- Consumer credit reached a peak of $4.15 trillion in Q3 2019

- Finally, mortgages comprise the largest part of the US lending market, with a total debt of $9.2 trillion.

As a result, numerous lending fintech startups have emerged to get a piece of the pie. Let’s look at why fintech lending startups are growing in number, examine other causes of their growth, the trends and challenges that small online lenders can face, and study the most successful examples of US digital lending startups.

Online Lenders: An Accessible Alternative to Legacy Banks

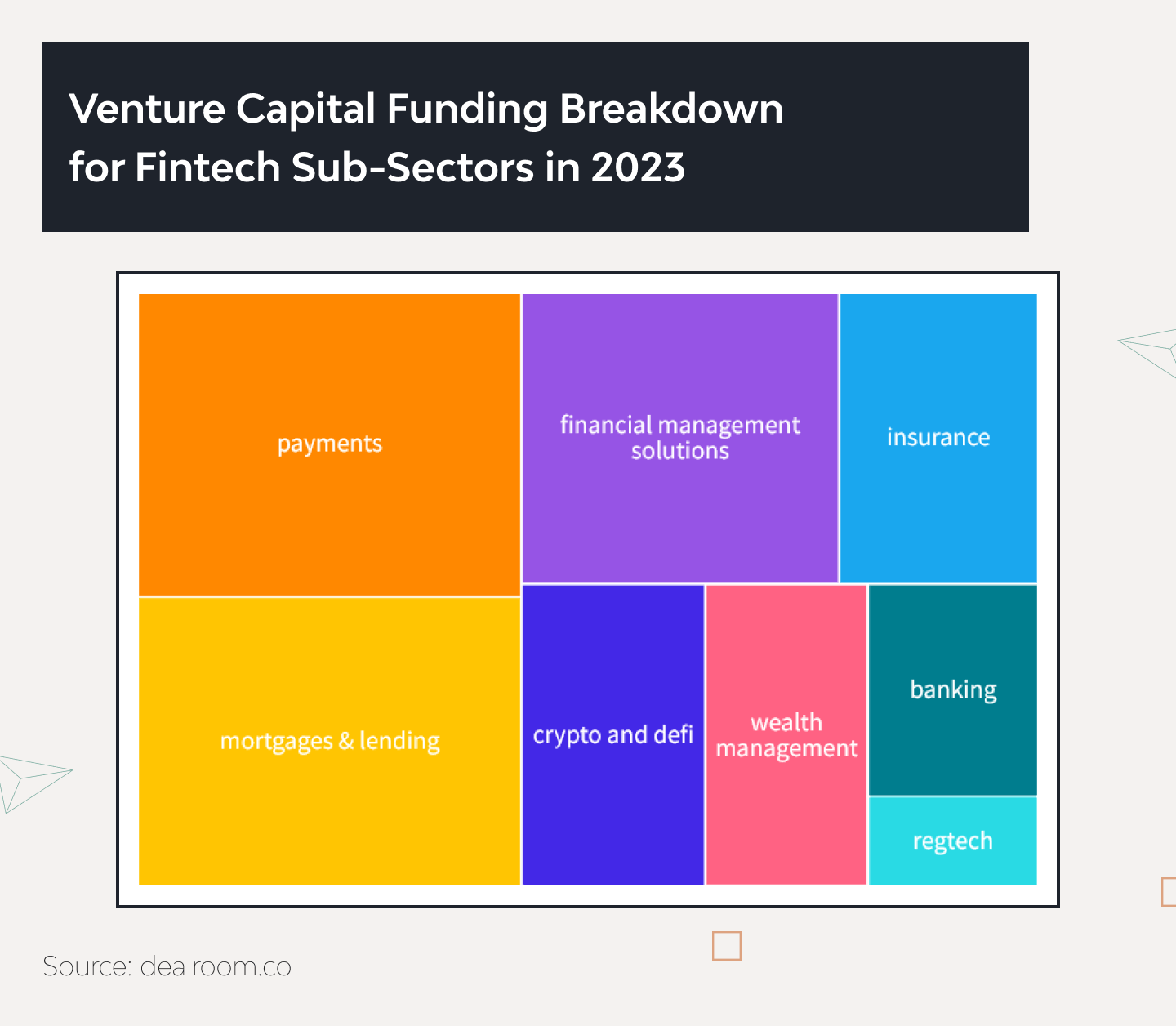

Only 23% of American homeowners possess their homes free of mortgages. Meanwhile, the global neobanking market was valued at USD 66.82 billion in 2022 and is anticipated to grow at a CAGR of 54.8% from 2023 to 2030. And even despite the significant decline in investment in fintech as a whole in 2023, the share of mortgages and lending remains high with a value of $2.04B.

To understand the reasons for the high demand in fintech lending, it’s beneficial to look at the digital transformation in mortgages. But look no further. Here are the top reasons why consumers prefer online mortgages and other loans to those offered by legacy financial institutions:

- Accessibility. Online lenders (or nonbanks) are always on hand. You don’t need to adjust his your schedule to the bank’s business hours — to apply for a loan, you can simply browse a mortgage website or open an app.

- Convenience. Again, compared to traditional banks, online mortgages offer customers a simple form to fill out instead of asking them to bring all their documents, including their pet’s ID.

- No human factor. Lending fintech companies analyze the data a user submits without seeing the person behind it. This helps them make an unbiased decision based on a user’s credit score and other important information, not on someone’s judgmental attitude.

- Speed. A consumer that requests a loan online can see the status of their application faster, since nonbanks can verify the information they receive in minutes, not days. Of course, the final decision can take more time. Still, the online loan application process is 20% faster than what a legacy bank can manage.

- Lower interest rates. Since alternative lenders don’t need to comply with as many regulations as a traditional bank, they can offer their clients more flexible rates.

The numbers prove that online mortgages are winning big at the lending game:

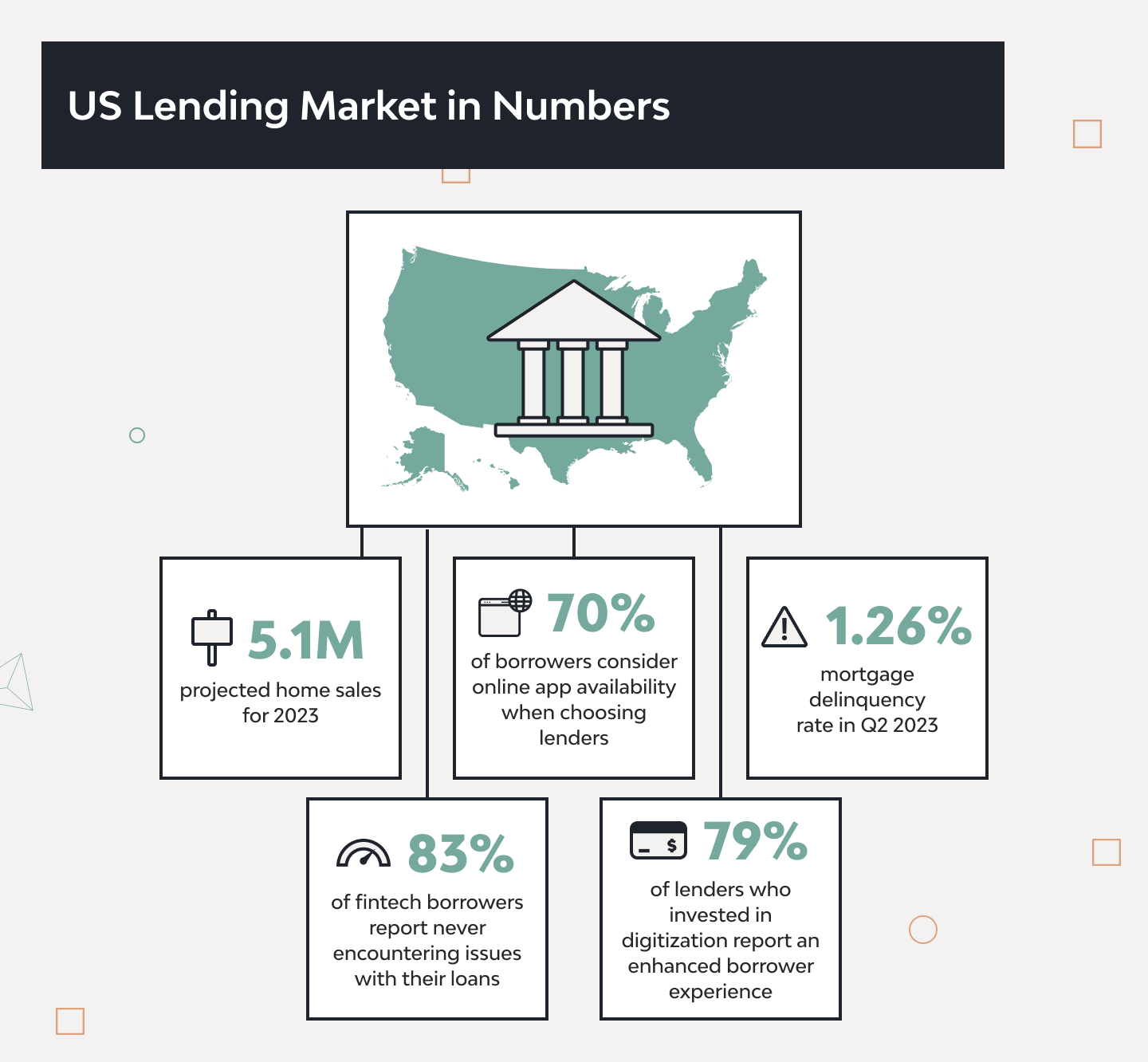

- Home sales transaction volumes are projected to reach 5.1 million in 2023.

- 83% of customers report never encountering issues with their loans, compared to 74% of non-fintech borrowers.

- Lenders who invested in digitization found it effective in enhancing the consumer experience (79%) and increasing productivity by reducing cycle times (70%).

- In Q2 2023, the mortgage delinquency rate stood at just 1.26%.

- 7 in 10 borrowers stated that the availability of an online application influenced their choice of lender.

Challenges and Trends in the US Lending Market

Though the demand for loans is growing, a number of things can hold you back if you decide to launch one of the lending tech startups. There are challenges you might come across and trends you’ll need to keep up with. Still, there’s nothing extraordinary, so let’s put the negative thinking aside and get down to business.

Lending Trends to Watch for in 2023

The lingering effects of COVID-19, geopolitical instability, and potential recession are contributing to a foreseen economic tightening in 2023. Thus, cost containment looks inevitable in 2023. At the same time, banks and lending institutions must prioritize long-term strategies to adapt to changing consumer needs, increased regulation, and rising competition.

With a predicted $308 billion rise in banking IT spending in the next five years and 78% of CFOs planning to maintain or increase digital investments through 2023, the emphasis is clearly on digital transformation. It’s not just about keeping up with trends in consumer lending but setting them.

So you won’t think of these trends as simple buzzwords, we’ll discuss only the most essential ones for 2023.

1. More digitalization and automation. In addition to round-the-clock availability for customers, going online offers benefits for alternative lenders as well:

- Operating costs reduction. One of the most obvious advantages of having a tech-based mortgages company is the potential to optimize your budget. Owners of online lending startups don’t need to waste money on office rent or facilities or on hiring an army of in-house employees.

- Faster decision-making and requests processing. The main reason why digital mortgages succeed is the speed with which application can be processed. The powerful mortgage technology behind that user-friendly interface analyzes the data a borrower submits, determines their eligibility for a loan, and provides you with a decision based on that potential client’s risk factors.

- No human error. Even if you have a couple of people on your staff, automating routine tasks will reduce their chances of making a mistake. It will also empower your employees to focus on establishing long-term relationships with clients and/or investors.

2. An omnichannel user experience. Being only on one platform means losing customers in other places where you might have reached them. Covering multiple channels of communication is a better option, yet the optimal choice is to orchestrate every touchpoint you have with your borrowers. This means not just enhancing the customer experience for desktop and mobile users, but also making it smooth whenever your client switches from one platform to another.

- Given the widespread use of smartphones globally, mobile payments have become one of the leading consumer lending trends. Mobile payment platforms facilitate increased borrower responsibility, closer client connections, and mortgage data security through features like encryption and multifactor authentication. These platforms are crucial tools for communication, increasing client trust in the brand and enabling easy access to loan information and repayments.

- Point-of-Sale (PoS) financing, with its immense market value, is a leading trend in consumer lending. It’s easy to integrate and encourages spending by allowing borrowers to finance higher-ticket items and pay back over a period of time. PoS offers flexible payment terms and promotional offers, servicing clients’ needs on a new level and encouraging economic growth while offering clients higher-quality purchases.

- The banking sector is evolving, with neo-banks like Chime offering digital-first services, and Big Tech firms such as Amazon and Meta entering through fintech partnerships. In 2023, the role of traditional branches is shifting towards the so-called “phygital” strategy, which combines physical and digital advancements, while embedded finance is gaining traction, with expected revenues to grow tenfold by 2026.

3. Turning data into actionable insights. As noted above, digital solutions allow you to speed up the verification of the borrower’s info based on the data he or she specifies when completing a form on your website or in your mobile app. The quicker you process loan applications, the more deals you can close. Additionally, faster processing times enhance the user experience and develop customer loyalty.

But having all the data is not enough. If you analyze it properly, you’ll gain a competitive edge over other nonbanks. Of course, it’s hard to do without the proper tools, and this is where artificial intelligence (AI) can come in handy. Because it’s a high-end self-learning system, AI can supply you with more accurate and client-oriented decisions over time.

- Alternative credit scoring, facilitated by intelligent AI models like GiniMachine, allows lenders to assess creditworthiness more comprehensively by going beyond fixed credit histories. This method analyzes factors such as transaction history, bank account balances, utility and rental payment history, and online behavior, thus expanding the pool of potential borrowers and reducing lending risk by predicting lending defaults more accurately. It aims to engage a wider audience safely without immediately excluding younger borrowers or immigrants.

- In the evolving landscape where personalization is key, mortgage software companies are offering solutions that meet client-specific needs, and lending is no exception. Providing tailored client service, from allowing borrowers to choose specific loan amounts to offering custom repayment terms, enhances borrowers’ agency over their loans, potentially leading to higher repayment rates. As consumers observe greater flexibility, they become more comfortable with borrowing and are more likely to do so.

The Most Common Lending Challenges You Can Face

Despite the rise in online mortgages, even the best US digital lending startups still encounter similar difficulties. Let’s look at some of them so you can be prepared:

1. Low mortgage rates. Consumers have enjoyed low APR levels for a long time, although nonbanks didn’t seem particularly pleased about it. However, 2023 brought significant changes. Forbes reports that mortgage rates have nearly doubled compared to 2022, reaching the highest levels in decades due to the Fed’s tightening policies.

2. Fewer homes for sale. The number of houses being built can’t meet the growing demand from young adults who want to buy their first home. Here are a few reasons for the housing shortage:

- Homeowners refuse to sell their houses. They prefer to rent it to somebody and earn passive income from it.

- People stay in the same house longer. According to the National Association of Realtors, in 2022, a typical seller had lived in their house for 10 years, compared to eight years before.

- Homebuilders are under more regulatory pressure. Regulatory spending represents 40.6% of total multifamily development costs, making it too expensive for some developers.

3. Higher competition because of FHA loans. Traditional banks held back FHA lending over a couple of years because of tough regulations and penalties for non-compliance. Yet, the Departments of Justice and Housing and Urban Development issued a Memorandum of Understanding (MOU) on October 28, 2019, that aimed to clarify the expectations to financial institutions in terms of the FHA program. Also, the MOU is intended to encourage banks to underwrite FHA loans. Thus, borrowers might have more options to choose from when selecting a lender, which can be troublesome for alternative mortgage providers.

You may consider these challenges critical, but we’re dead sure that there are no obstacles that can’t be overcome. Hopefully, at least mortgage rates might grow a bit after election year.

Top 11 Lending Fintech Startups

Now that we’ve touched on everything you need to know before launching your online mortgage startup in 2023, let’s proceed to our overview of the best mortgage lending companies in the USA.

1. Sindeo

Country: United States

Year founded: 2013

Capital raised: $6.5 million

Services provided: Home loans, mortgage refinancing and advice

Technologies used: Python, Django, Node.js, Django REST framework, NGINX, Gulp, Loggly, PostgreSQL, Redis, AngularJS, Ionic, Ansible, Gunicorn, PhoneGap, Celery, Karma, Fabric, RequireJS.

Sindeo is a handy online mortgage calculator and sophisticated internal advisor portal that provides customers with an end-to-end solution for getting a first loan or refinancing. It offers:

- An easy-to-use rate quote calculator that helps a customer preregister in a program and figure out their monthly payment based on details of their mortgage like home price, downpayment, taxes, insurance, and interest rates.

- An advanced client portal where a consumer can finish their registration, provide all the necessary data to apply for a loan, get it verified, and receive offers from real estate agents.

2. Credible

Country: United States

Year founded: 2012

Capital raised: $25.3 million

Services provided: Mortgages, student loans, personal loans, credit cards

Credible serves as an intermediary between borrowers and lenders. It works with different loans, including personal and student loans, along with mortgages and refinancings. Credible enables customers to:

- Search for optimal offers. Credible selects the best fintech lenders according to the customer’s application details. Unless a client chooses a suitable provider, the latter doesn’t see his or her credit score.

- Compare diverse lenders. A customer can check one provider against another and opt for the most attractive interest rate.

3. SoFi

Country: United States

Year founded: 2013

Capital raised: $2.5 billion

Services provided: Home loans, personal loans, student loans

SoFi stands out for issuing unbiased mortgages, even to borrowers with low credit scores. They also offer flexible downpayments — from 10% to 50%. SoFi provides:

- All kinds of loans. They offer personal loans, student loans and their refinancing, as well as mortgages.

- Fast pre-qualification. This feature analyzes customer’s basic info such as their credit score and minimum personal details to figure out whether he or she has a chance of getting pre-approved by a lender. The pre-approval requires a standard pack of documents that helps determine the final decision about issuing a loan to the client.

4. Reali

Country: United States

Year founded: 2015

Capital raised: $39 million

Services provided: Mortgages and refinancing

Reali provides a full range of services for both sellers and buyers, including:

- Dedicated agents. Reali states they have expert real estate agents who take care of each step of home selling or buying.

- Quick home loan approvals. If a customer finds a home they like but lack money for it, they can get a mortgage nearly instantly. The company approves loans within hours instead of three days or a month, like most banks do.

5. Lending Tree

Country: United States

Year founded: 1998

Capital raised: Not specified, the fintech lending company mostly invests in or acquires other companies

Services provided: Mortgages and refinancings, personal loans, credit cards, business loans, student loans, auto loans

Lending Tree is a kind of marketplace that unifies various lenders and allows customers to choose the most suitable one. It offers clients to:

- Compare different lenders. A user can submit his or her personal details and get quotes from the potential lenders.

- Choose from multiple loan products. As a mortgage fintech startup pioneer, the company offers a wide choice of options for borrowers, including credit cards, mortgages, and so on.

6. Rocket Mortgage by Quicken Loans

Country: United States

Year founded: 2015

Capital raised: Not specified

Services provided: Mortgages, home loans, jumbo loans

Rocket Mortgage by Quicken Loans aims to make the loan application process easier and faster. It offers:

- Both a web and mobile version. A customer can opt for a more convenient interface and seamlessly enter the required information either from their PC/laptop or from a tablet/smartphone.

- Diverse types of loans. The variety of services includes not only home loans and mortgages, but also jumbo and FHA loans.

7. Better.com

Country: United States

Year founded: 2016

Capital raised: $205 million

Services provided: Home loans and mortgage refinancing

Better.com specializes in mortgages and refinancing, and covers any type of real estate loan for potential borrowers. It features:

- An easy application process. The best thing about it is that a loan pre-approval doesn’t impact the customer’s credit score.

- Optimal rates without extra fees. The company states it has no hidden payments. On the contrary, they show their rates (fixed or adjustable), depending on the loan term.

8. Divvy

Country: United States

Year founded: 2017

Capital raised: $180 million

Services provided: Mortgages, equity loans

Divvy allows its clients to buy a home while renting by building equity credits.

- Savings during renting. This option help customers allocate a fixed sum from their monthly rent payment towards a downpayment. Thus, a customer can start saving to buy the house they live in.

9. Flyhomes

Country: United States

Year founded: 2015

Capital raised: $160 million

Services provided: Real estate brokerage

Flyhomes focuses on providing a full suite of services related to real estate brokerage. It provides:

- Expert assistance with selling a home. The company helps homeowners conveniently trade their house on the platform. If the home doesn’t sell within 90 days, Flyhomes will buy it.

- Cash offers. A great option for those looking for a house. This feature allows prospective buyers to select a home, bid on it, beat other offers, and win the building. After that, the company purchases it and the buyer can get a mortgage using any other lender’s services.

10. Homeward

Country: United States

Year founded: 2018

Capital raised: $25 million

Services provided: Mortgages, equity credits

Homeward enables its clients buy a new house before they sell their existing one, just like Flyhomes. The company offers:

- An easy application form. A customer can get approved within minutes and start looking for a new home nearly instantly.

- The possibility to move in before selling a house. As soon as a client chooses a suitable building, the company buys it and offers a 6-month lease. In most cases, this gives the client enough time to sell their previous home, get a mortgage, and close the lease.

11. Ribbon

Country: United States

Year founded: 2017

Capital raised: $555 million

Services provided: Mortgage, equity loans

Ribbon helps homeowners, home buyers, and their real estate agents to sell or buy houses. They offer:

- A buy-before-sell option and cash guarantee. Similar to the previously mentioned companies, Ribbon empowers homeowners to pick a new house before they sell their existing one. In addition, it provides them with guaranteed cash, regardless of what stage their mortgage is at.

- Faster closing of deals. For agents, Ribbon offers speeded-up signing of agreements (up to 14 days), which results in more clients within the same period of time.

To Conclude

We can assume that the demand for lending fintech startups will only keep growing as more people want to buy or sell a home. Despite the challenges in the current online mortgage market, the opportunities are still numerous — which is proven by a number of loans being processed by existing alternative fintech mortgage lenders and issues the traditional banks have.

To find more relevant information about cutting-edge custom fintech solutions and to keep abreast of the latest industry trends, check out other expert articles on our blog.

To get acquainted with the experience of the Django Stars team, visit the case studies.

And if you are looking for custom mortgage software development, get in touch.

- What makes fintech lending grow in popularity?

- Accessibility

- Convenience

- No human factor

- Speed

- More flexible rates

- Do you provide technical expertise in creating a lending startup?

- The Django Stars team has vast expertise in developing fintech and proptech projects, as evidenced by our case studies. They include the UK's largest digital mortgage lender, a real estate platform that provides information on lenders and mortgages in the US market, an advanced German platform for in-depth property search, valuation, sale, and purchase, and others. Contact Django Stars if you are looking for an experienced software vendor to create a lending startup.