Non-banks and P2P: SME Lending Goes Digital

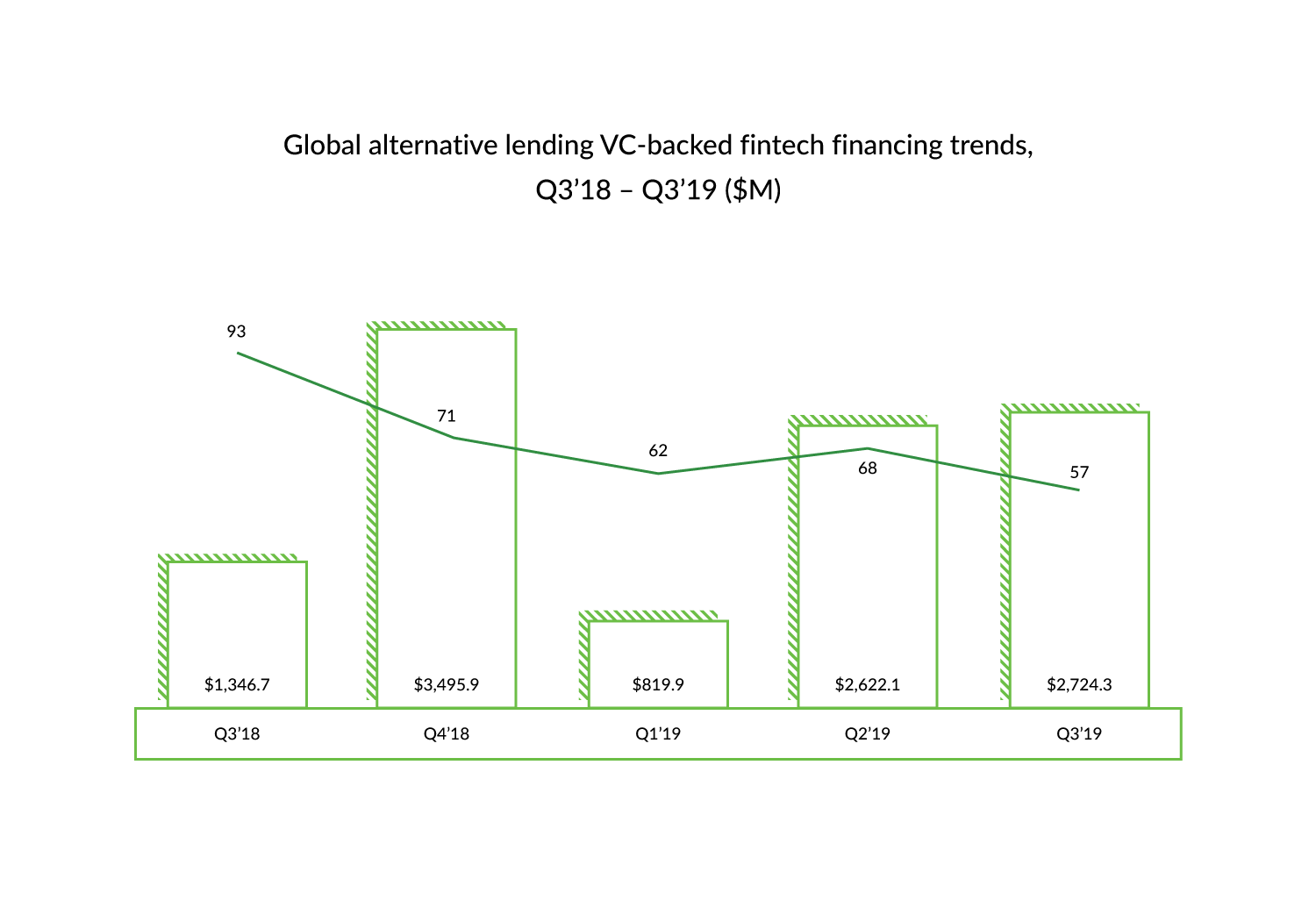

Recently, there’s been much talk about small- and medium-sized enterprise (SME) finance, peer-to-peer lending, and alternative lending in general. At least, this was our impression when our fintech software development company was sponsored at LendIt, an event that gathers all the companies that shape fintech in Europe. And these people know all about the burning points of the industry. Which is why we kept our eyes and ears open and tried to get more detail on the newest finance technology trends.

For us, the most important part was to understand to what extent non-banking financial institutions are necessary competitors with banks in lending, how can they prove they’re trustworthy, and how they might create an SME product that people will actually want to use.

Alternative SME lending platforms are a fairly new idea. Numerous small businesses apply for loans at traditional banks and leave empty-handed, so fintech companies and lending startups offer them an alternative. They can get funding online – verified within minutes, with access to previously unavailable resources, with less to no paperwork and an automatic verification process.

Of course, the first and main attraction of alternative lending platforms is that, from the very beginning, they’re built digitally – even if communication with customers tends to be driven by relationship managers and interpersonal communication. This makes the platforms easier to use, more accessible for SMEs, and quicker to respond, while they retain the personal touch that is necessary for gaining trust – especially when it comes to large amounts of money. No wonder this approach created many fans among SMEs.

“A pent-up demand within a community which is meaningfully underserved has driven that growth,” says OakNorth CEO and co-founder Rishi Khosla, explaining the growing popularity of non-bank lenders, including his own company. But let’s see what small- and medium-sized businesses can really count on.

Online Lending Software Development

Transforming ideas into digital lending solutions people want to use. Build yours now.

Friends or Foes: How Banks Work (or not) with SME

These days, the number of businesses worldwide – especially small- and medium-sized businesses – is probably the highest ever.. They are the core of, and the key to economic development. They create jobs, pay taxes, and increase people’s purchasing power. Of course, banks don’t want to miss their chance to earn money by working with them. They want is to earn interest on loans, not hand out charitable donations.

After the 2008 financial crisis, the banking situation only got worse. To protect themselves, banks changed rules and regulations that made it even harder for small- and medium-sized businesses to get loans for their needs. More and more, we hear stories about how big banks refused to give loans to small businesses. You may have been a devoted bank client for years, but when it comes to a loan, all this history will mean nothing.

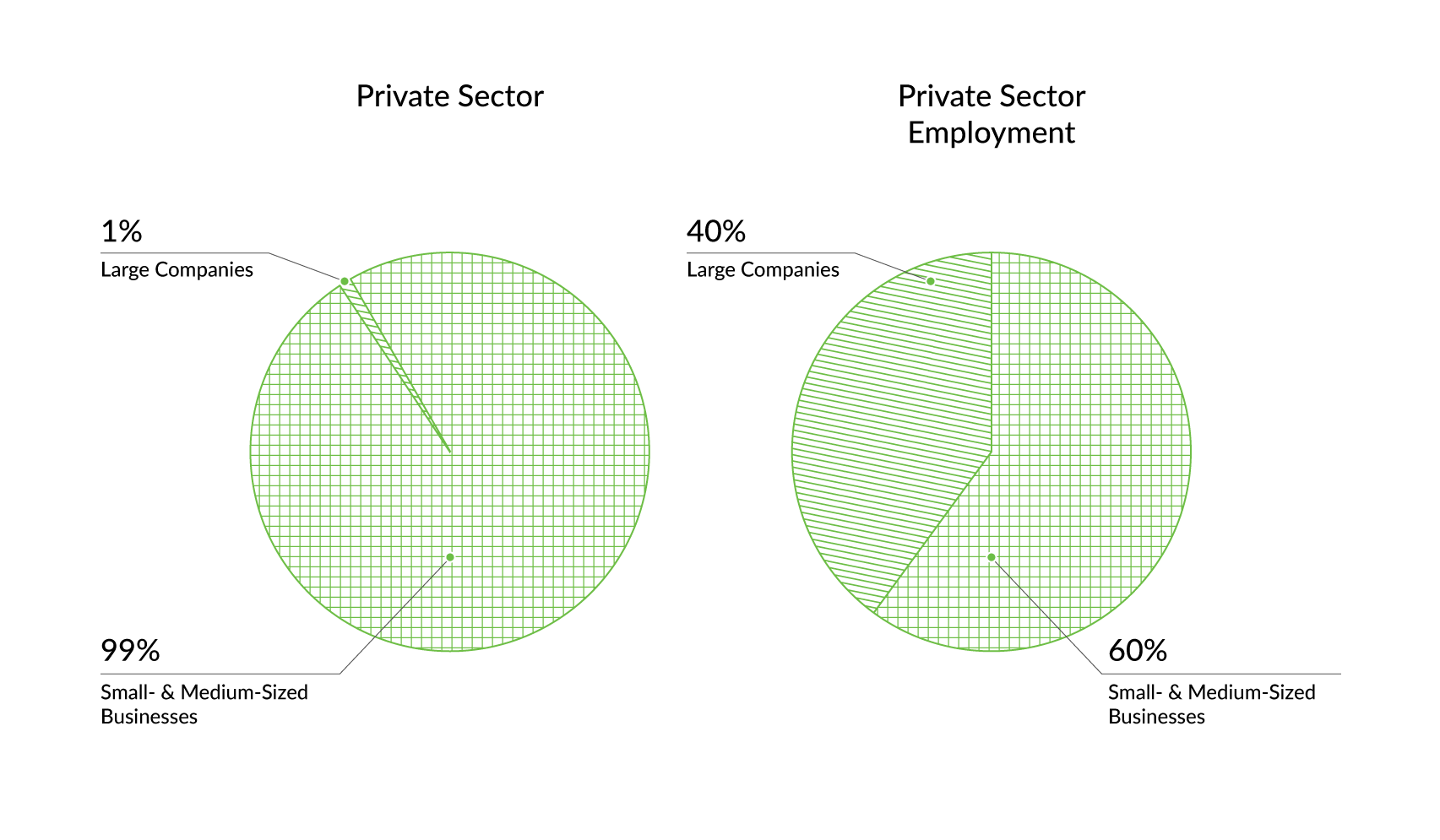

For instance, let’s take the UK. There, SMEs account for dazzling 99.9% of the private sector. Moreover, they account for about 60% of all private sector employment. But if you take a look at the value of annual total lending approved for micro- and small business, you’ll see that between 2013 and 2017 it dropped by 38.7%, or £7,2 billion.

Globally, SMEs make up nine out of ten businesses, yet still they depend almost solely on alternative (non-bank) sources of credit such as friends, family, and supporters. Surprisingly, 70% of small businesses in emerging markets have no access to credit at all. But unless banks build a trustful relationship with SMEs, the credit gap will only grow bigger. The truth is, the current global credit gap between SME needs and the availability of financing is in the trillions.

In trying to find a custom fintech software solution to this problem, we’ve asked ourselves: Why is it so hard for a small business to get a loan? Here’s what caught our eye:

- For a bank, the costs associated with giving out a $5,000 loan and a $500.000 loan are the same. So why give out a small loan?

- Smaller loans generate less profit.

- New businesses most likely don’t have a perfect credit history, which means bad credit scores. Banks find it hard to verify the borrower and evaluate risks.

- Small businesses most likely don’t have collateral to offer.

So what are SMEs supposed to do?

Alternative Digital SME Lending

While the world of banking is still deeply rooted in tradition and generally doesn’t have much competition, alternative lending challenges the ossified banking landscape more and more every year. Alternative SME finance is becoming the best way for small businesses to get funding outside of traditional banks. It uses technology for faster and more efficient credit profiling and to provide faster loan approvals.

Even though non-banking financial institutions, or non-banks, don’t have a full banking license, they offer more flexible and accessible lending options to business loan seekers. This poses an increasing threat to the dominance of incumbent banks that is pressuring them to go digital.

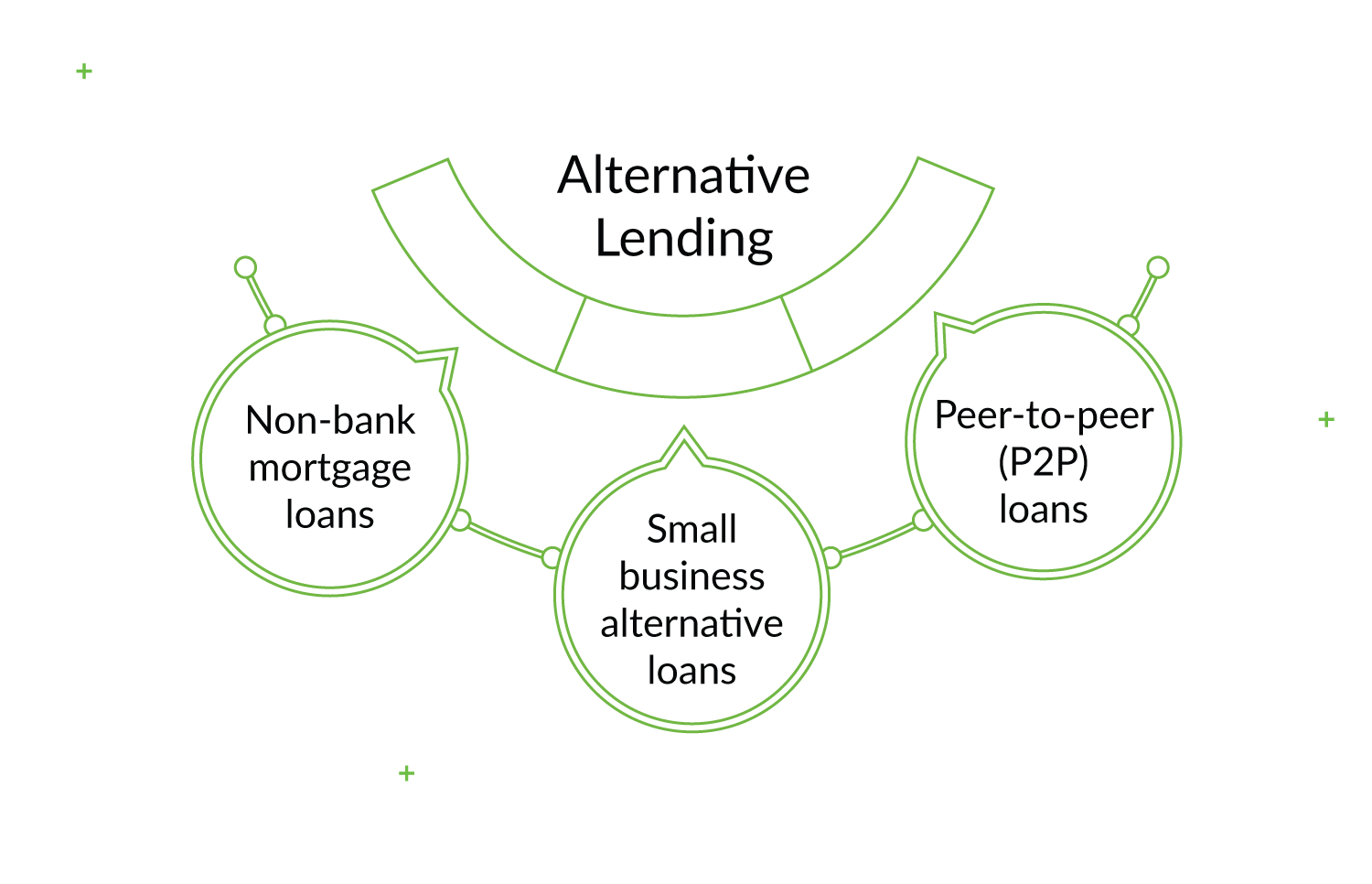

Non-banks engage in typical banking activities like credit card operations, but their most important services include lending options like mortgage loans, small business alternative loans, and peer-to-peer loans.

Non-bank mortgage loans

While traditional bank restrictions prevent them from fully digitizing lending, alternative lenders can successfully supply customers with mortgage loans. Due to a simplified process, customers can get digital loans at a lower cost and with more attractive eligibility criteria.

Alternative small business loans

We’ve already talked about how SME loan applications are often declined by large traditional banks. Alternative lenders can capitalize not on the smaller size of the businesses that apply to them, but also on their high demand. In 2016, 71% of SME loan requests were approved by alternative lenders, while only 58% were approved by traditional financial institutions, according to a 2016 survey by the Federal Reserve Bank of Richmond.

Peer-to-peer (P2P) loans

SME P2P lending is online and brings together borrowers and lenders offering suitable rates, using metrics like credit scores or social media activity. Since the platforms don’t actually own the loans, they can provide services at very low costs. This is probably the most popular form of alternative lending.

As fintech grows as an industry, it provides the much-needed automation. “It is simply not possible to offer the customers the speed they need in today’s economy with manual processes,” says Igor Pejic, author of Blockchain Babel. The secret is that within the lending software development fintech merges financial know-how with the newest technology to change SME lending, speeds up decision-making, and offers the funds that enterprises need to grow and develop.

In 2017, fintech companies were the third-largest source of SME funding in the US, which accounted for only 24% of business lending in general. This may have pushed incumbent banks to review their style. Seeing how financing SME alternatives are taking over the lending sector, old-school banks have become increasingly open to fintech collaboration. This means the new challenge is to successfully merge traditional banking strengths and the innovative solutions offered by lending fintech.

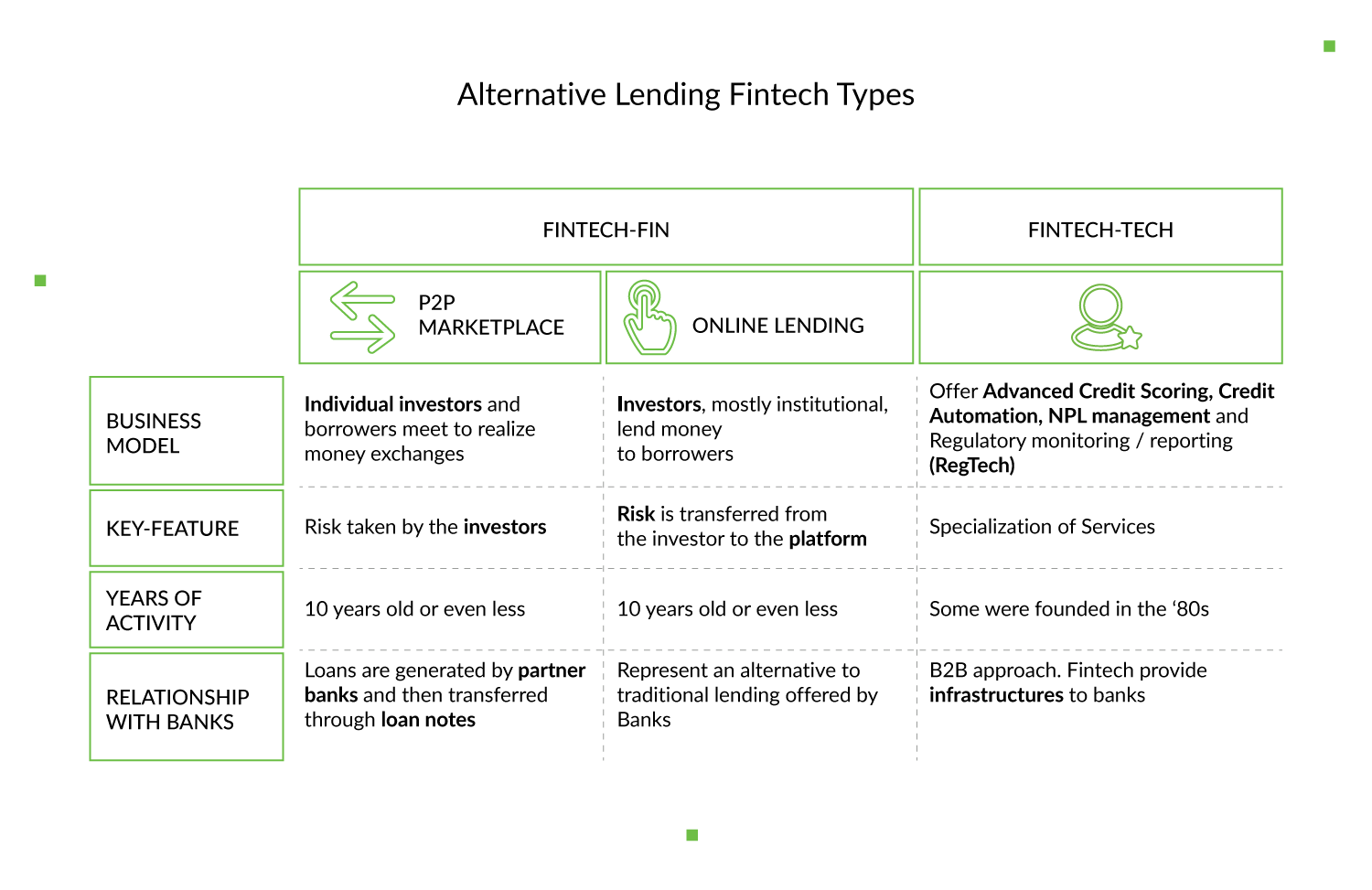

Consequently, fintech has started to grow in two distinct directions – the so-called “fintech fin” that deals directly with consumers, and “fintech techs”, which focus on providing specialized services to banks. For instance, the peer-to-peer loans and alternative online lenders (including SME, mortgage, etc.) we mentioned earlier are two groups in the fintech fin category. According to Accenture, the most profitable players have been the techs (i.e., those who provide fintech services to banks).

Digitalization Is Changing Everything

According to the work management platform Workfront, only 8% of CEOs believe that the business model they currently use will survive the digital transformation. However, it seems that business owners still aren’t clear about what this digital disruption actually means. But while flight and travel companies, bookstores and music distributors, and even grocery stores are successfully getting a hold of new technology, banks and other financial institutions have been holding back.

But what happened? How come the newly established fintech has managed to meet SMEs needs, while banks with decades-long histories couldn’t? It’s not like fintech is so kind and generous as to give away money to everyone who asks, and with no collateral. Fintech uses the most precise and effective technology to allow lenders to check their borrower’s history and predict risks online within minutes. This way, AI, automation and open banking allow lenders to avoid bureaucracy and paperwork, and verify identities quickly, as well as drop the deposits and interest rates.

Back in the day, creating stand-alone features for mobile apps and online comparison charts was the top of the technology game. These days, banks are starting to realize that frontline tools, internal processes, data assets, and staff capabilities need to change. Yet not everyone is ready to do so.

Some financial institutions state security and risk concerns as reasons for the slow implementation of new technologies. To some, reforming the entire workflow is too complicated and too expensive. Besides, not all financial institutions have tech-savvy leaders that are willing to embrace such changes.

While fintech lenders are taking over the financial world, most traditional banks are missing out on numerous solutions that could make them better competitors:

- Personal finance software for startups and SMEs

- Open Banking

- Online loan application and management

- Customized financial dashboards

- Financial planning software

- Customer data management solutions

- Data analysis systems for better decision-making

- Investment tracking for more efficient results

- Stock trading or other investments

- Data integration for smooth electronic payments and transactions

However, some banks aren’t as shy about making changes, and are introducing more and more digital products to their list of offerings.

How to Make It: Alternative Lending Products That People Want to Use

Any major shift requires planning: analyze what users value in the industry and reflect it in your product decisions, from UX to fintech api integration. To put it shortly, focus on the customer. What value do they get? What value do you get? What features does a successful product need in general? Using the answers to these questions, we put together a basic list of features:

1. No paperwork. When you can do things digitally, there’s no need to go to the bank to fill out endless forms. Everything is done online, including the lendee’s verification. Different systems have different ways to verify applicants. They either learn from historical data, cash flow, or through psychometric assessments. Using the new technology, SMEs can connect the application process to their accounting software or business bank account.

2. Fast credit decisions. Based on the same tech, the system can use the data to calculate the loan the applicant can get, within minutes. Also, credit decisions can be based on the business’s overall health, or on pre-qualification at the application stage. To spread the risks, peer-to-peer lenders can split the credit among several investors.

3. No interest, no collateral. Instead, you can have businesses pay a flat fee over the life of the loan. Alternatively, bank information can be verified in real time using business bank information and the lendee’s personal information. Historical data can be used to assess potential risks.

Of course, depending on your particular target audience, you can add other functionality, or mix it up with traditional ways of doing business.

The Alternative Lending Hall of Fame

To get into more detail on how alternative lending works, let’s look at a few real-world companies.

By the way, in one of our recent articles we talked about how to choose a payment gateway for a startup, so we recommend that you read it if you are interested.

1. PayPal

The first and probably most famous name that comes to mind is PayPal. The company has made its reputation as a popular digital payment service. However, there’s more to it than that. One product they offer is the P2P payment service Venmo, but what we’re really interested in is their SME lending program.

The program works in two directions. The first one includes PayPal Working Capital, which allows businesses to apply for an interest-free loan of up to $200,000. The funds can be received almost instantly and repaid with an addition of a flat fee. The other is PayPal Business Loans which offer a rather traditional financing of up to $500,000.

2. Kabbage

Kabbage is actually a digital lending veteran for SMEs that started out working with a particular group of borrowers – online merchants who sell on eBay, Etsy, Amazon, and other online platforms. With Kabbage, customers can get an automatic financial review by linking their business information online.

The company works with those who need them the most: SMEs that can’t get funding from big banks because they’re too small or lack a flawless credit history. Automated application processing allows Kabbage to make a lending decision in under 10 minutes.

3. Fundbox

Fundbox managed to pare down its decision-making time to a mere 3 minutes. Using the SME’s accounting software or business bank account, Fundbox can calculate how much the business can borrow. If approved, applicants gets their funding within 24 hours.

Although it sounds too good to be true, this system works perfectly. Fundbox has established a process whereby they lend money against unpaid invoices. However, Fundbox doesn’t control the relationship with the customer. The SMEs repay the loan as soon as the invoiced payment lands in their bank account.

4. Molo Finance

Mortgage loans are one of several services in the digital consumer lending universe. Molo Finance is UK’s first fully digital buy-to-let mortgage lender. Promising no paper, no appointments, quick decisions and no product fees, they offer interest-only mortgages on properties in England and Wales. Borrowers can purchase properties, remortgage them, or remortgage and borrow more. Thanks to real-time decisions and no hidden charges, they quickly climbed to the top of the industry.

5. Funding Circle

Funding Circle is a peer-to-peer lending platform that directly connects investors and small and medium-sized businesses in need of funding. This UK-based company is one of the rare “unicorns” with a market valuation of over $1 billion. SMEs can borrow money, while investors make money from the interest charged. Funding Circle gets an origination fee from its borrowers and an annual servicing fee from investors.

6. Prosper

Prosper gets an honorable mention, as they were the first peer-to-peer lending site in 2005. Through the site, you can check what your interest rate will be without impacting your credit score in any way. Businesses can get fixed-rate loans for a three- or five-year term, while investors can select from seven different risk categories and start with as little as $25.

Of course, these examples are just a tiny fraction of the entire alternative lending market, which just keeps on growing. As banks still lack what the huge SME community is looking for, non-banking financial institutions are increasingly earning trust among small- and medium-sized businesses. Even despite their efforts to digitize some of their products, banks can’t compete with online peer-to-peer lending platforms that are as flexible in their capabilities as the businesses themselves.

Created digitally from the very beginning, alternative funding sources can adapt faster to the changing needs of small businesses, as well as speed up, or completely eliminate processes in which traditional banks still use manual work. This way, they adapt to the pace of modern life and business.

- What is FinTech digital lending?

- Fintech digital lending is a technology-driven approach to providing financial services such as loans, credit, and other financial products through digital channels. It's an emerging trend in the financial services industry, as it provides a convenient, fast, and accessible way for consumers and businesses to access credit. In particular, it can offer digital products for alternative small- and medium-sized enterprise (SME) finance, peer-to-peer lending, and alternative lending in general.

- What are the benefits of digital lending?

- Fintech solutions make it possible to receive funding online – verified within minutes, with access to previously unavailable resources, with less to no paperwork and an automatic verification process. Thus, digital lending platforms are easier to use, more accessible for SMEs, and quicker to respond, while they retain the personal touch that is necessary for gaining trust, especially when it comes to large amounts of money.

- How does alternative SME digital lending work?

- Alternative SME finance uses technology for faster and more efficient credit profiling and to provide faster loan approvals по сравнению с traditional banks. Even though non-banks don’t have a full banking license, they offer more flexible and accessible lending options to business loan seekers. They engage in typical banking activities like credit card operations, but their most important services include lending options like mortgage loans, small business alternative loans, and peer-to-peer (P2P) loans.

- Why digital lending is the future for SMEs?

- Fintech uses the most precise and effective technology to allow lenders to check their borrower’s history and predict risks online within minutes. This way, AI, automation and open banking allow lenders to avoid bureaucracy and paperwork, and verify identities quickly, as well as drop the deposits and interest rates.

- What are the technology trends for SMEs?

For many financial institutions, the challenge is to successfully merge traditional banking strengths and the innovative solutions offered by lending fintech. There are numerous solutions that could make traditional banks better competitors:

- Personal finance software for startups and SMEs

- Open Banking

- Online loan application and management

- Customized financial dashboards

- Financial planning software

- Customer data management solutions

- Data analysis systems for better decision-making

- Investment tracking for more efficient results

- Stock trading or other investments

- Data integration for smooth electronic payments and transactions

For a more detailed overview, we recommend the article on the latest fintech trends to watch in 2023.