10 Latest Mortgage Technology Trends For 2024

Today’s mortgage businesses should rely on technology heavily to do more with less. With the US Federal Reserve increasing interest rates and borrowing costs, banks stepping back from mortgage servicing, and 49% of homebuyers preferring self-service portals, according to ICE Mortgage Technology, mortgage market players must rapidly adopt technology to remain competitive.

90% of the Borrower and Lender Insights survey participants stated that digital mortgage technology is a must for a positive customer experience, and 70% claimed that using mortgage lending technologies helps drastically reduce the time to close a loan. With most consumers preferring to complete loan applications online, lending companies need mortgage technologies that allow catering to this customer preference and getting ahead of their competitors.

We know this first-hand since Django Stars has ample experience with delivering custom software for digital mortgages. From mortgage calculators and KYC verification features to building B2B interfaces and property evaluation tools, we serve various software needs for fintech companies. Molo, Sindeo, MoneyPark, and Lendage are just some case studies in our fintech portfolio.

Read more: Top 11 lending startups that are disrupting the real estate industry

That is why we want to share our vision of the prominent mortgage industry trends for 2024. Understanding the impact and value of each of them can help mortgage companies make an informed decision on their fintech product updates.

Digital Mortgage Software Market Size and Forecasts

The UK’s Financial Conduct Authority reports that by the end of 2023, the value of all residential mortgages amounted to £1,654.3 billion, with new mortgage commitments of £51.5 billion, the industry in the UK is growing at the fastest pace since 2007. Despite the war-induced energy crisis and other factors (like the Bank of England increasing the interest rates), people still need places to live, and property ownership can become one of the drivers of post-COVID recovery.

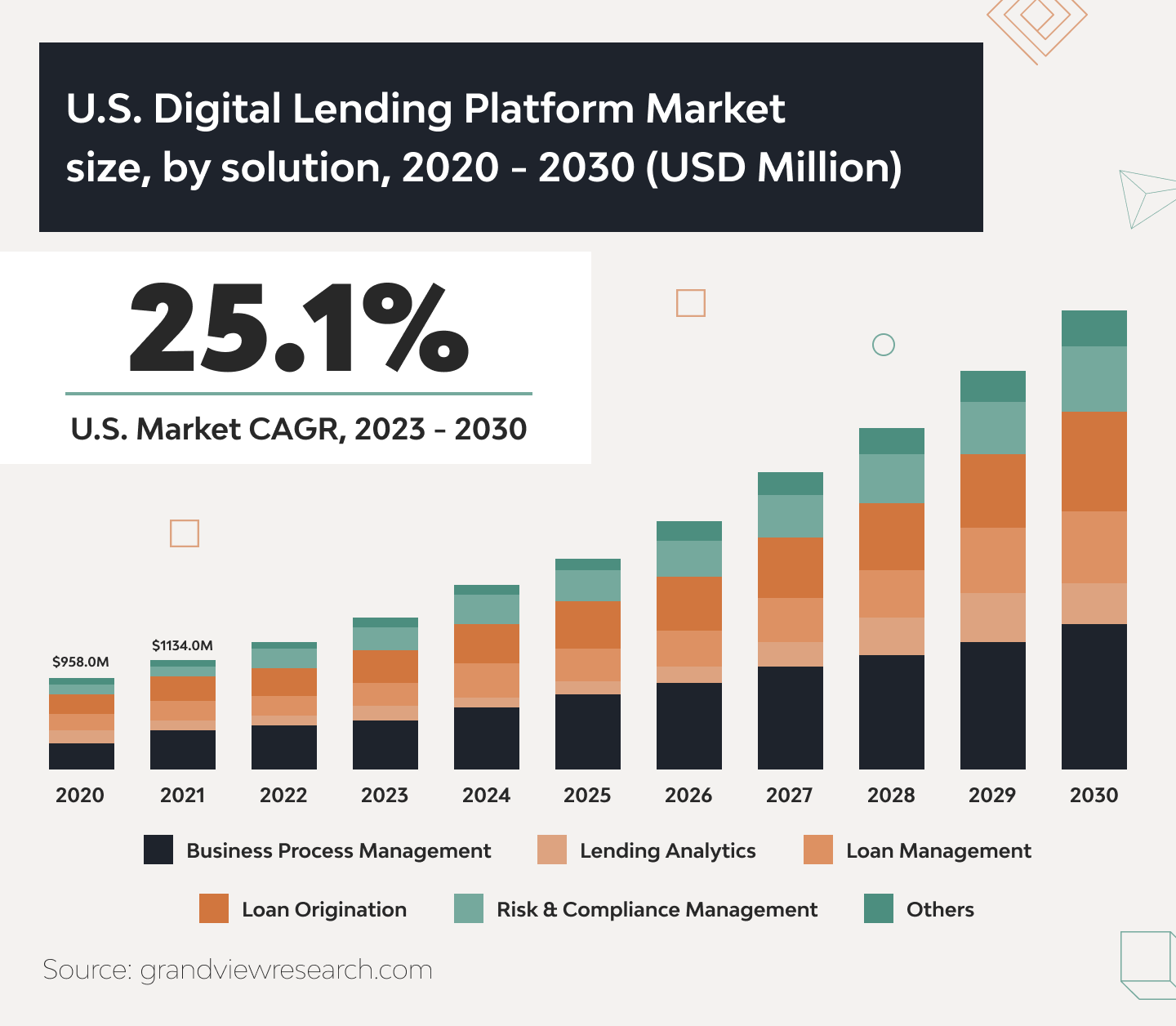

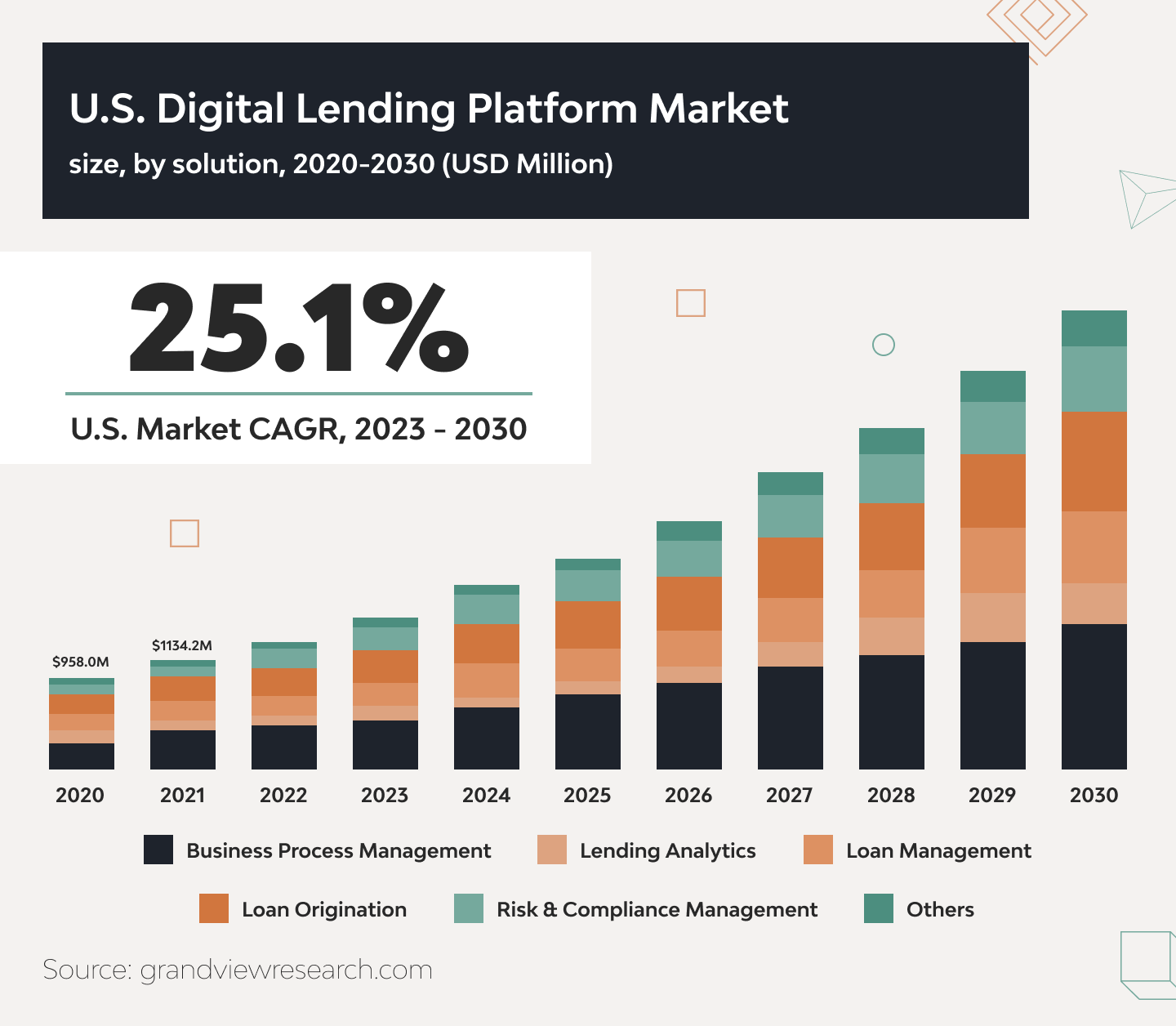

The global market for digital lending platforms reached a value of $5.84 billion in 2021. And it’s expected to grow by 25.9% annually until 2030. This growth is underpinned by various mortgage tech trends as digital technology provides multiple benefits: from streamlined loan origination and informed decision-making to greater compliance and enhanced operational efficiency. Specifically, mortgage industry trends like open banking and blockchain are creating new opportunities that further expand the market for digital lending.

Some trends in mortgage technologies have been around for quite some time — like blockchain, cloud computing, and big data analytics. Other trends, like open APIs or NFTs, are just picking up the pace. However, being informed about them is essential to forecast the future of the mortgage industry and know the right time to integrate technological advancements into mortgage workflows.

Read Also: 3rd Party API Integration for Fintech Applications

10 Mortgage Tech Trends To Pay Attention To

Digital mortgage technology is bringing new life to an industry that used to rely heavily on legacy systems. Mortgage lending operators used to build siloed infrastructure islands with internal processes, making data exchange complicated. But modern solutions demand seamless data transfer to provide an uninterrupted and positive customer experience.

Here are the top mortgage industry trends shaking up the tech scene.

Conversational Chatbots and IDAs

Conversational chatbots are among the most impactful mortgage industry trends for 2024. This technology uses natural language processing (NLP) to comprehend and answer questions like humans. In 2023, chatbots significantly contributed to cost savings in customer service for businesses. Chatbots across industries helped businesses save up to 30% on their customer support costs. The financial gain on human resources optimization from the chatbot sector in 2023 was substantial, with an estimated income of roughly $137.6 million.

The use of chatbots in the banking industry is projected to increase further by 2030.

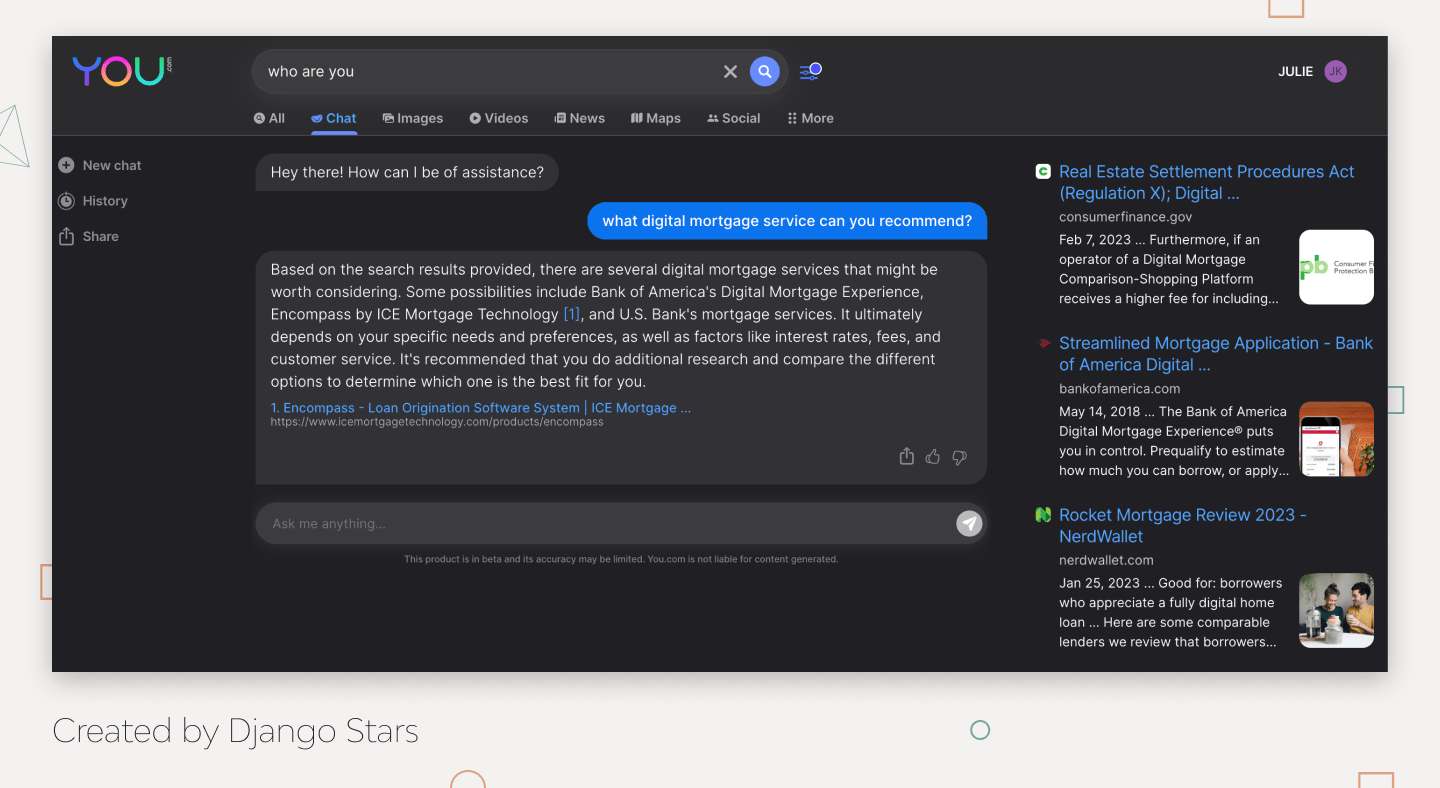

These bots simulate human conversations to engage potential borrowers, intelligently answer questions, and escalate queries to the right agents. However, not every chatbot is up to modern challenges. People can always sense when a machine simply selects preconfigured options because it was designed based on a simple rule-based system. Instead, they expect a meaningful dialog with an intelligent digital assistant (IDA).

That is when advanced AI models like ChatGPT come into play. Because their conversational nature advises users instead of merely resolving specific issues, AI-based IDAs can actually form and grow relationships with clients. Keeping up with conversational AI trends is essential for leveraging AI’s full potential in enhancing customer engagement and experience.

The Chicago-based real estate firm Berkshire Hathaway HomeServices recently released Elle, a website chatbot ready to cater to customers 24/7. It’s programmed to find out what customers want and store records of conversations so they can always go back to resume the discussion.

This innovation reiterates BHHS Chicago’s commitment to using technology for the mortgage industry to enhance the customer experience. We support this trend and offer AI-based chatbot and virtual assistant development as part of our customers’ fintech products.

Read also about alternative SME lending platforms.

Robotic Process Automation (RPA)

RPA is a technology that assigns robots to perform rule-based workflows. It’s ideal for automating repeated and time-consuming tasks, such as auditing loan documents, inputting applicant data into the system, and uploading files, which is why this technology maintains its place in the enterprise-wide repetitive workflows.

With RPA covering tedious tasks, underwriters have more time and bandwidth to provide value-adding services. Deloitte’s survey shows RPA adoption reaches the breakeven point in under one year. Other benefits include:

- 92% improved compliance

- 90% improved quality/accuracy

- 86% improved productivity

- 59% cost reduction

According to Grand View Research, the global RPA market in finance and banking reached around $860.75 million in 2023. Major banks like Deutsche Bank and Axis Bank have adopted the technology, and the biggest banks in Japan are turning to RPA solutions to cut down their labor and operational costs.

Cloud Computing

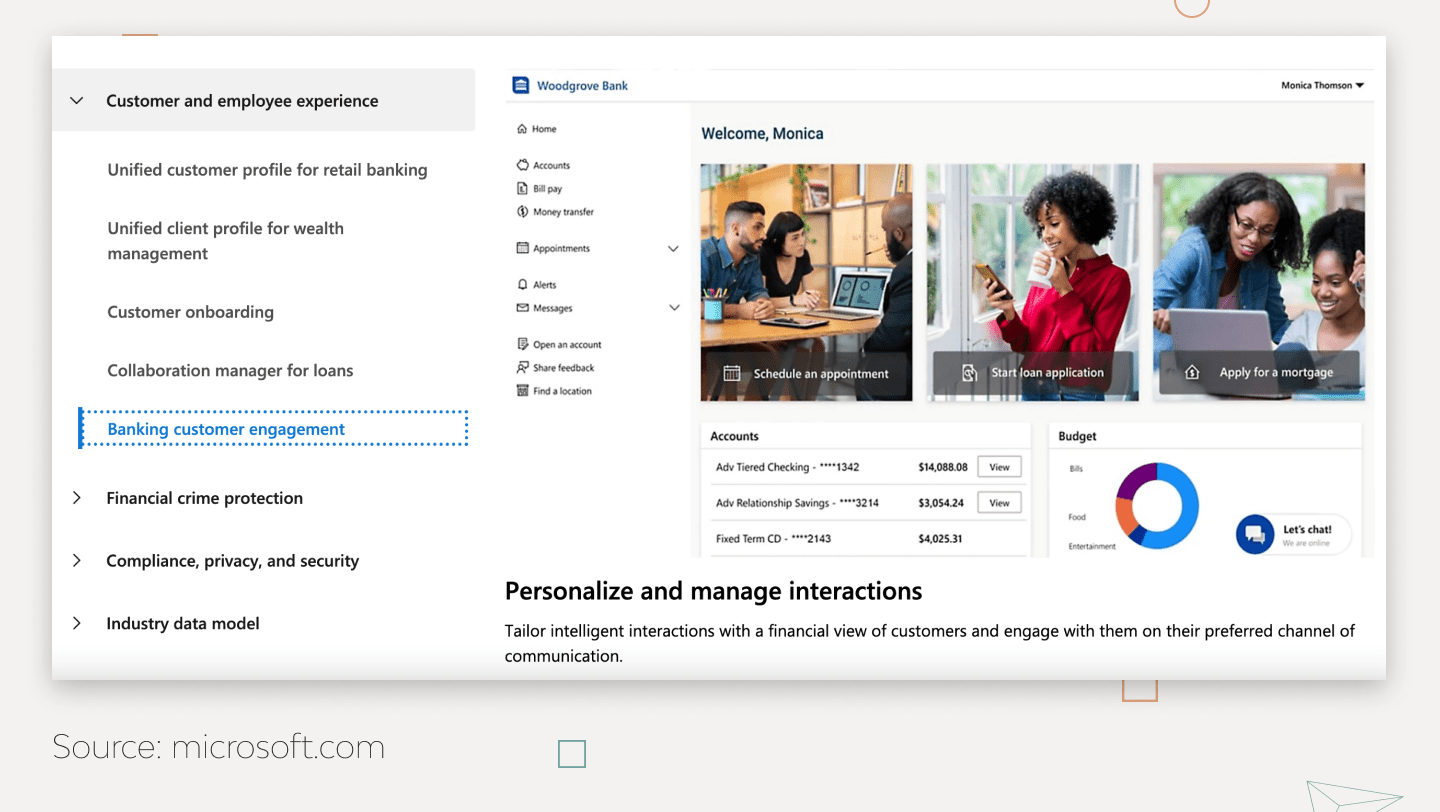

Cloud computing follows the Pay As You Go model, ensuring optimal resource allocation in addition to scalability and security. Moreover, major cloud platforms tailor their offers specifically to meet fintech needs. Microsoft Cloud for Financial Services promises to help accelerate profitability, empower employees, and manage risks.

Major lending companies like the Virgin Money UK and Navy Federal Credit Union have been quick to give Microsoft’s newly released industry-focused cloud platform a try, and the fintech industry is sure to follow suit. The fintech cloud market is expected to reach over $196 billion globally by 2031, according to PR Newswire research. This data is supported by Django Stars’ experience, as cloud and DevOps are among our most popular services.

Read also: What is DevOps?

Big Data and Analytics

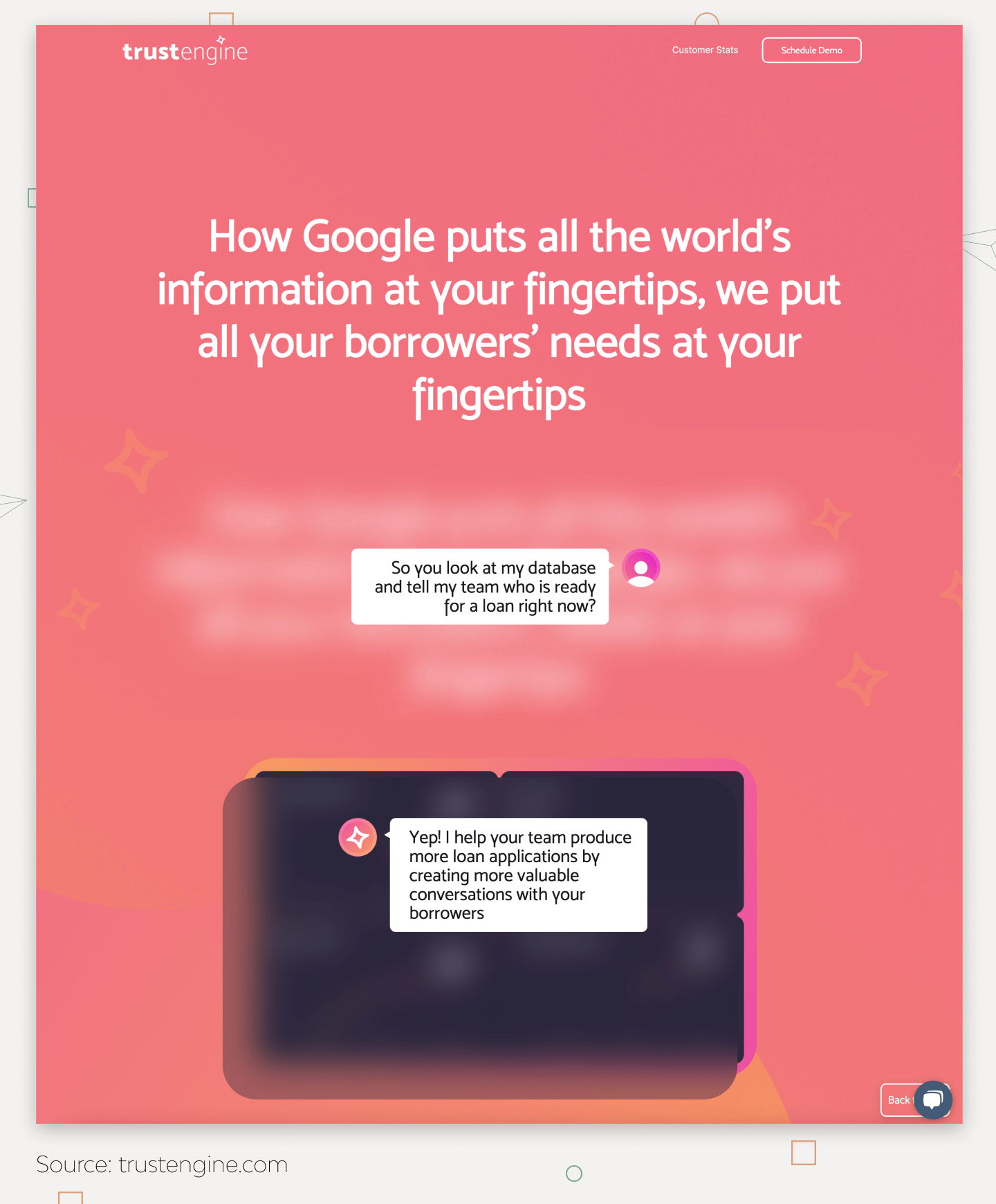

Lenders use data analytics to create holistic profiles that include the customers’ backgrounds, behaviors, and payment habits. These profiles enable financial institutions to provide personalized services and make customer-focused decisions. For example, TrustEngine combines AI and big data to perform automated mortgage customer profile checks whenever there is a mortgage inquiry, credit score update, equity, etc.

ICICI Bank, a leading Indian private lender, relies on its digital infrastructure to future-proof the business. Real-time data analytics is an important ingredient of their IT architecture, which is shifting its focus from products to customers.

Blockchain and NFTs

NFT-based digital mortgages allow lenders and borrowers to store lien information and borrower data on the blockchain. And because NFTs are non-fungible, buyers can own digital assets that can’t be replicated. This means they get more protection from fraudulent transactions than they would if they still took the traditional route.

Brightvine is one example of a company using blockchain to revolutionize how mortgage loans are processed. By tokenizing the mortgage loan, they’re increasing the asset’s liquidity and reducing the costs for borrowers.

Document Management Software

Verification checks and loan approval involve document-intensive processes. Document management software provides mortgage companies with a secure platform for file storage, document editing, organizing tools, and imaging solutions. Companies can use imaging conversion to digitize documents, indexing to file them in organized folders, and metadata to instantly pull up specific data.

The recent data breach at KeyBank, an Ohio-based regional bank, magnified the need to use trusty document management software with access control, audit trail, and data encryption. And as a digital mortgage technology development provider, we fully support this focus on the security of document management features.

Self-Service Improvements

Based on the data from Django Stars’ customers, knowledge bases and customer help sections are among their most popular website areas. Backing this up, research claims 73% of customers would rather find solutions on their own than wait around for an agent.

PNC Bank (a leading US-based financial institution) proved to be ahead of the curve when it worked with Blend (a cloud banking software provider) to adopt an end-to-end online mortgage application process. Given that 43% of mortgage borrowers don’t mind completing loan applications via self-service portals, Django Stars considers fully digital mortgages to be an essential aspect of the future of the mortgage industry.

API Adoption

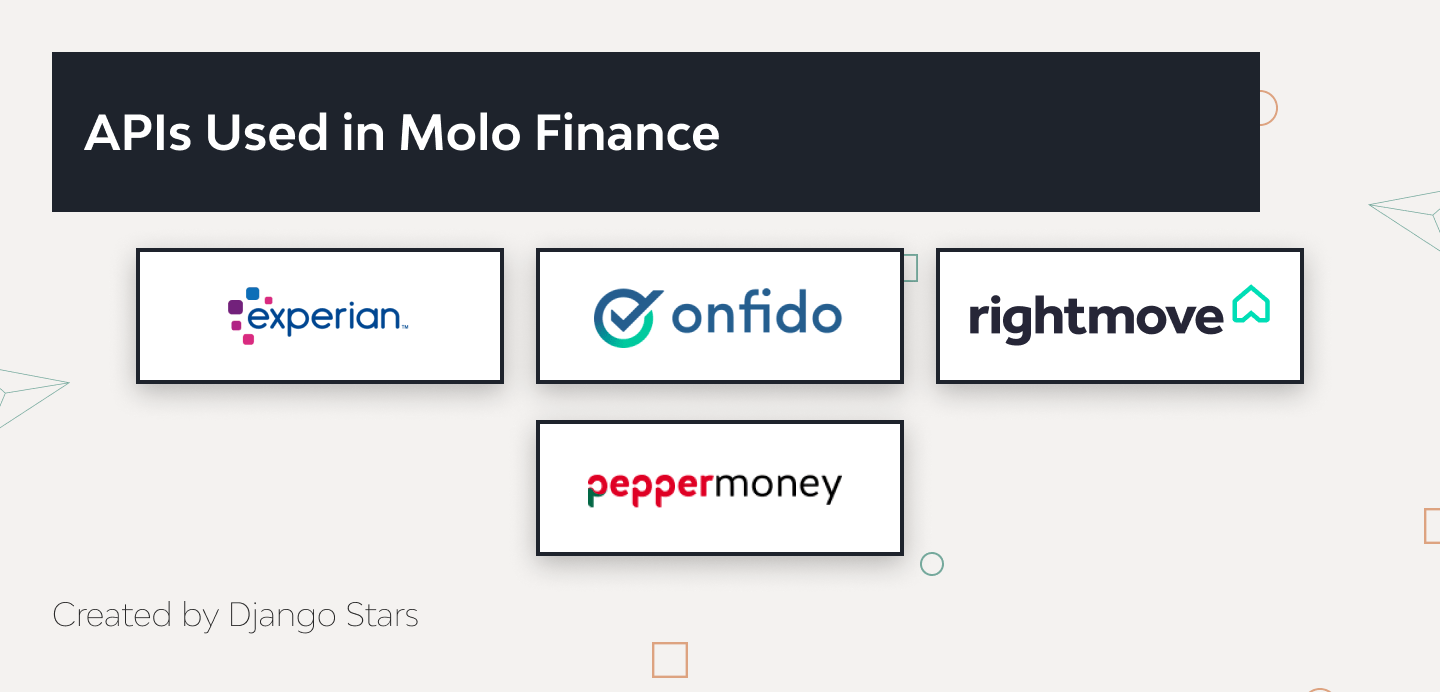

API-enabled software systems allow lending companies to integrate various functionalities into their mortgage portal. Combining previously siloed systems boosts operational efficiency and enhances customer experience. These improvements help increase revenue, free up company resources, and enable expansion into new mortgage markets.

The APIs commonly used in the mortgage industry are open banking (data sharing between banks), application processing, loan pre-qualification, and digital identification.

Open banking is particularly thriving in the UK banking scene, with 246 providers of the API in the UK alone (a huge figure when compared to the 338 total providers in the whole European Economic Area).

Read more: 11 startups that are transforming the EU mortgage industry

Business Intelligence Systems

Business intelligence systems comprise big data tools that allow mortgage companies to leverage data mining, data visualization, and business analytics. They organize all the data involved in your business and offer insights that improve decision-making processes.

Loan Market Group (LMG), the largest loan aggregator, continues to expand its business intelligence offering and has recently announced the hiring of a new inaugural chief data and analytics officer.

Fintech Collaboration

Traditionally, tech startups viewed banks as broken systems that needed fixing, while banks treated them as newcomers who didn’t know what they were doing. This competition, however, is starting to turn into a collaboration that benefits all players.

Fintechs commonly act as product or service providers to banks. In the world of mortgage lending, they typically provide lending automation platforms that streamline loan origination. These tools allow banks to efficiently complete the underwriting processes and delivery of documents and contracts.

Fintechs are also increasingly collaborating to bolster the ecosystem. Visa recently partnered with Fintech District, an international community that drives the Italian fintech scene forward. Django Stars’ experience also shows that an open ecosystem leads to much more added value as compared to providing standalone services.

What Else Will Help Improve Digital Mortgages?

While mortgage technology trends can give companies general ideas about their future solutions, we wanted to give several final tips on how to make these solutions even better. Based on Django Stars’ experience, our advice is to pay special attention to the following:

Personalization

It is not enough for mortgage companies to offer digitalized loan application processes. Customers seek personalized services that have the right balance between technology and human interactions. They want their lenders to provide customized options that pave the way for favorable financial decisions. Data and analytics make this possible.

End-to-End Digital Processes

The pandemic has pushed the mortgage industry to go digital over the past few years. Although banks and mortgage companies are making tech-driven improvements, they are retaining some of their traditional processes. This results in failing to provide end-to-end digital processes and a mobile-first experience.

Mobile-First Behavior

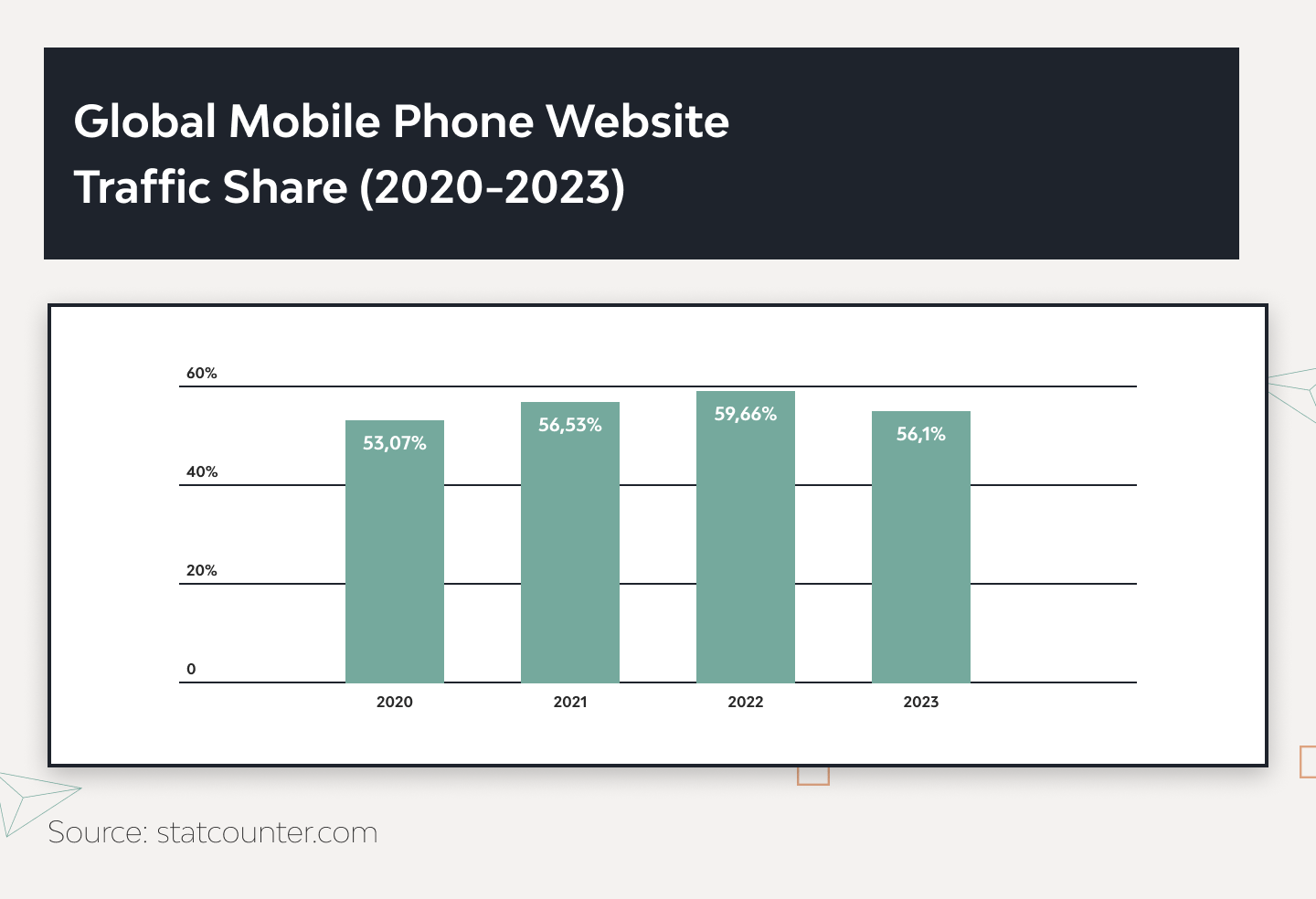

More than just digitalizing processes, lending companies also need to go mobile. Around 56% of web traffic comes from mobile devices, and businesses that do not leverage mobile platforms are missing out on a huge market.

Read more: How to build a successful online mortgage service

How Django Stars Can Help

Django Stars has a track record of delivering custom fintech software solutions that help businesses succeed. We are particularly proud of our solution allowing customers to complete all mortgage processes online, from paperless application to loan approval.

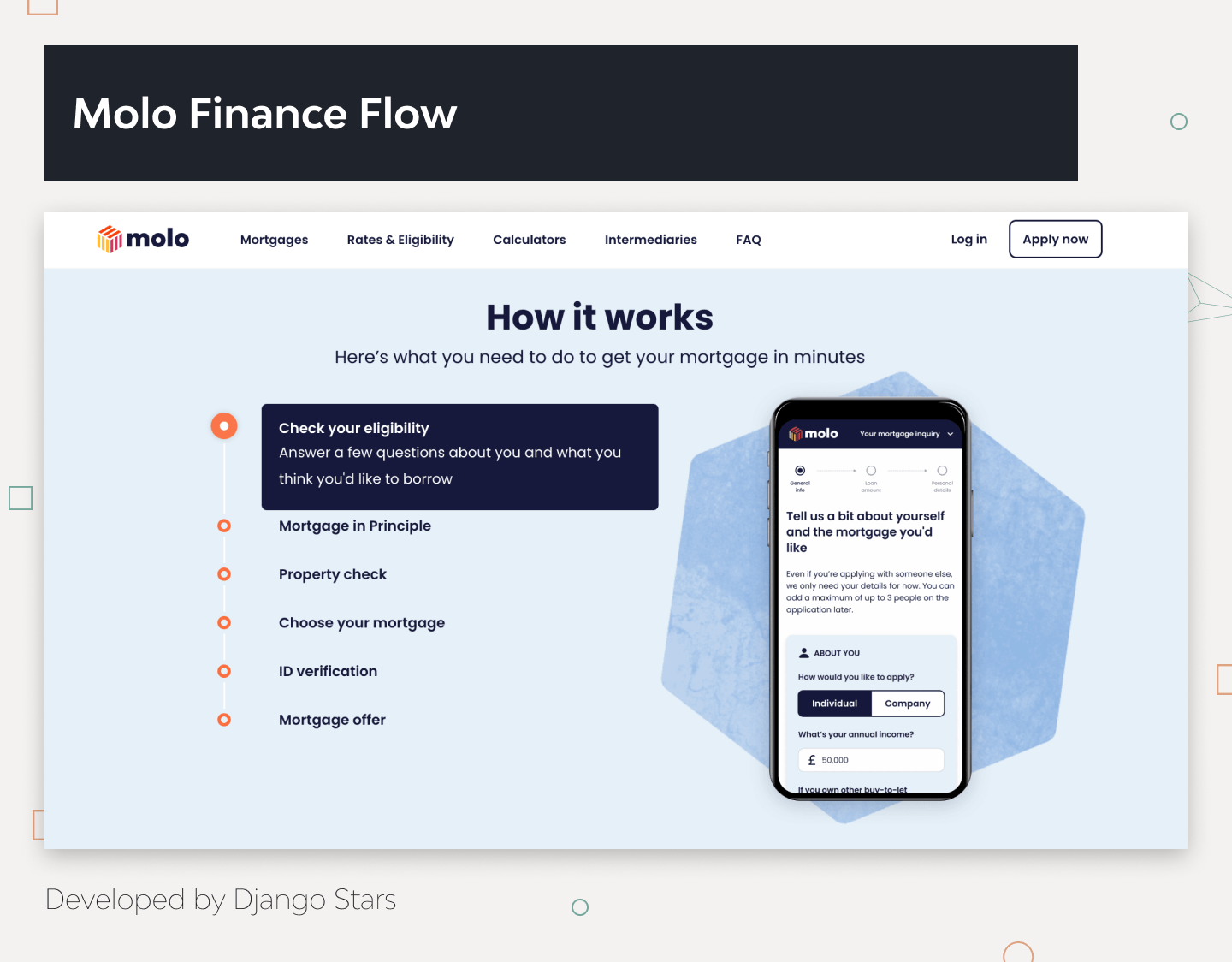

Working with Molo, an award-winning mortgage fintech, Django Stars managed to build a digital platform that’s the first of its kind on the UK mortgage market.

It includes a mortgage calculator, property and credit valuation tools, open banking, ID verification, personalized product recommendations, and a legal maintenance tool that takes into account UK-specific regulations. This particular use case adopts the top mortgage tech trends and those just starting to gain traction.

Final Thoughts

Mortgage companies already benefit from prominent tech trends, such as cloud platforms, blockchain, automation systems, data analytics, and AI-powered bots. These solutions bring a level of efficiency that accelerates the global market expansion for eMortgage platforms.

We firmly believe in the digitalization of mortgage companies and are eager to discuss how we can help you create your own revolutionary fintech solution. Contact us at Django Stars.

- What is the role of technology in mortgage lending?

- Mortgage lending technologies allow providers to speed up loan origination with digital portals that enable online applications and automated data processing.

- What cybersecurity threats are there in the mortgage industry?

- Ransomware, privacy breaches, social engineering, supply chain attacks, rising cloud-based cyber attacks, and the vulnerability of remote work set-ups.

- Which of the mortgage technology trends is the most effective in terms of investment?

- The profitability of specific trends in mortgage technologies will depend on your company’s unique needs and business trajectory. Talking to industry experts allows businesses to get custom tips and determine their best course of action.

- Can you create a digital mortgage solution using artificial intelligence?

- Yes. Many of the top mortgage industry trends for 2024 involve artificial intelligence, including conversational chatbots, robotic process automation, and document management systems.