A Complete Guide on Loan Lending App Development

The across-the-board digital drive penetrates all spheres of our lives, and the financial domain is no exception. Robust products of fintech app development help people pay for goods and services, transfer money (both domestically and internationally), make investments, manage financial portfolios, control their budgets, handle insurance, perform cryptocurrency operations, you name it.

One of the most wanted banking operations conducted through mobile channels is lending. Four years ago, 40% of borrowers ditched brick-and-mortar facilities in favor of digital resources when it came to getting money here and now. Evidently, the percentage is much higher now. Why? Because in our hectic world, it is very convenient for people to make a couple of taps on their smartphone screen and obtain the necessary funds to be used at their discretion, whenever and wherever they need them.

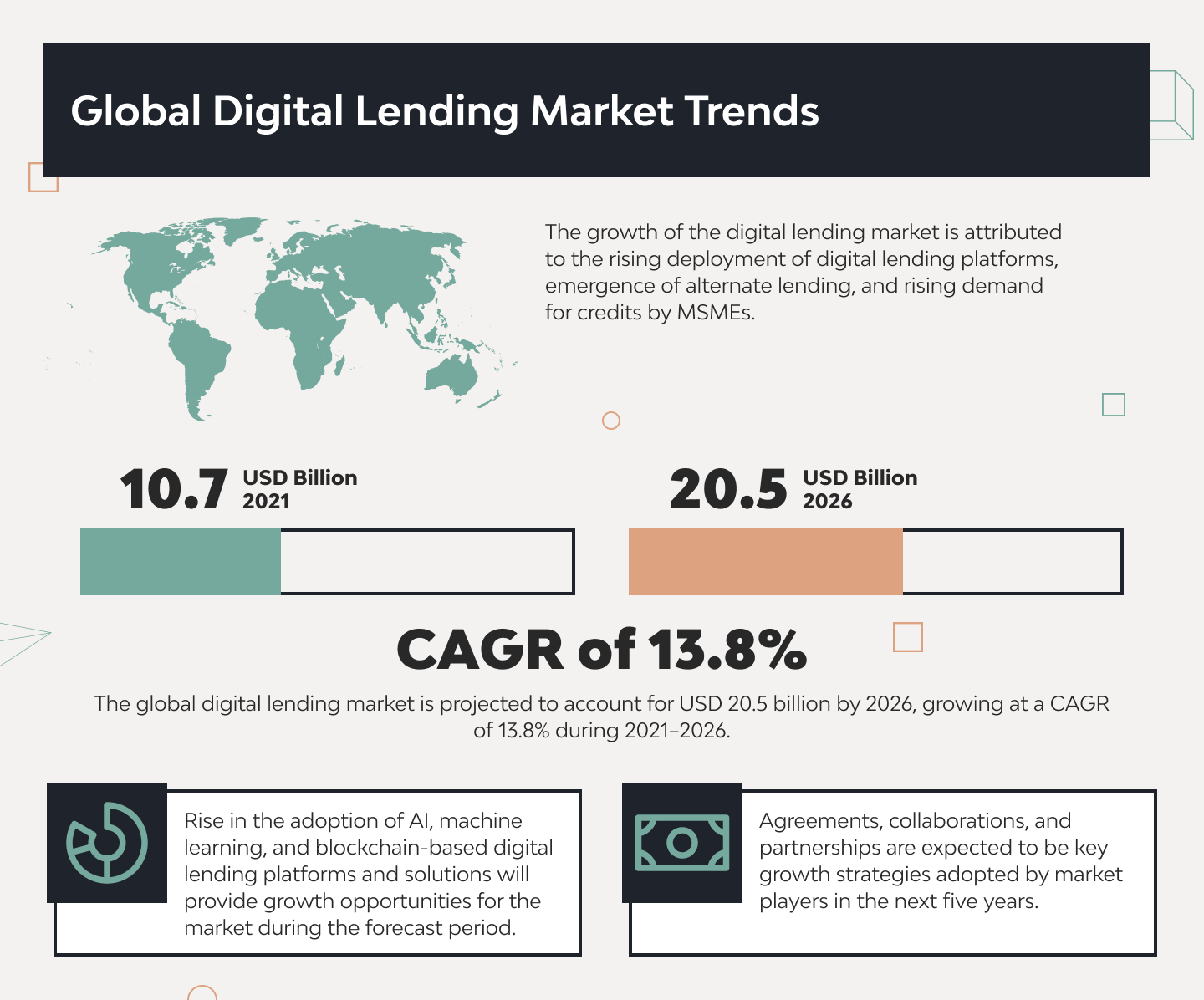

No wonder such accessibility caused a meteoric rise in the popularity of online loan platforms, with the market size predicted to expand almost twice between 2021 and 2026, manifesting a solid CAGR of almost 14%.

Financial organizations poised for big-time success can’t ignore such a mouth-watering revenue opportunity, so investing in loan lending mobile app development should become one of the top priorities among their strategic growth initiatives. This article can be used as a comprehensive manual by financial and banking institutions planning to launch their money lending software.

We will explain what a digital lending app is, describe its benefits, types, and features, list challenges companies face when building a solution, and outline an algorithm for dealing with them.

A Mobile Loan Application In a Nutshell

Before the advent of lending software solutions, customers had to visit a physical bank, undergo a lengthy application process, get approval, and only then receive money. Mobile technologies have streamlined and facilitated multiple finance-related processes, and lending is one of them. Using a specialized app for borrowing money, people can go through all red-tape routines in a matter of minutes and get funds to their bank account without the need to go anywhere, fill out numerous forms, and submit various documents in paper format. How does it work?

A user registers on the app by providing personal information and contact details. Then, they integrate their bank account or upload an ID, bank statement, and income proof to verify their profile. With all documents uploaded, they can apply for a loan by entering the amount they need, specifying the repayment time, and choosing the loan type. As soon as a person’s creditworthiness is assessed by evaluating their employment status, income level, credit score, and other financial parameters, they receive several loan offers for them to select. After the choice is made, a digital loan agreement is signed, and the client gets the money in their account.

The loan repayment is performed in installments according to the schedule specified in the agreement, very often automatically when a certain sum is charged off the customer’s account. To ensure the borrower stays in the know, the loan disbursement app sends reminders and notifications for the next payment. Besides, the app for digital lending enables borrowers to monitor their credit scores and conduct loan repayment tracking to understand how much they have to pay to redeem the loan.

As inalienable elements of the contemporary fintech landscape, lending apps promise numerous benefits to stakeholders.

Analyzing the Benefits of Mobile Loan Apps

Financial services consumers are the most evident beneficiaries of leveraging lending apps. We have gathered the most expected features users look for.

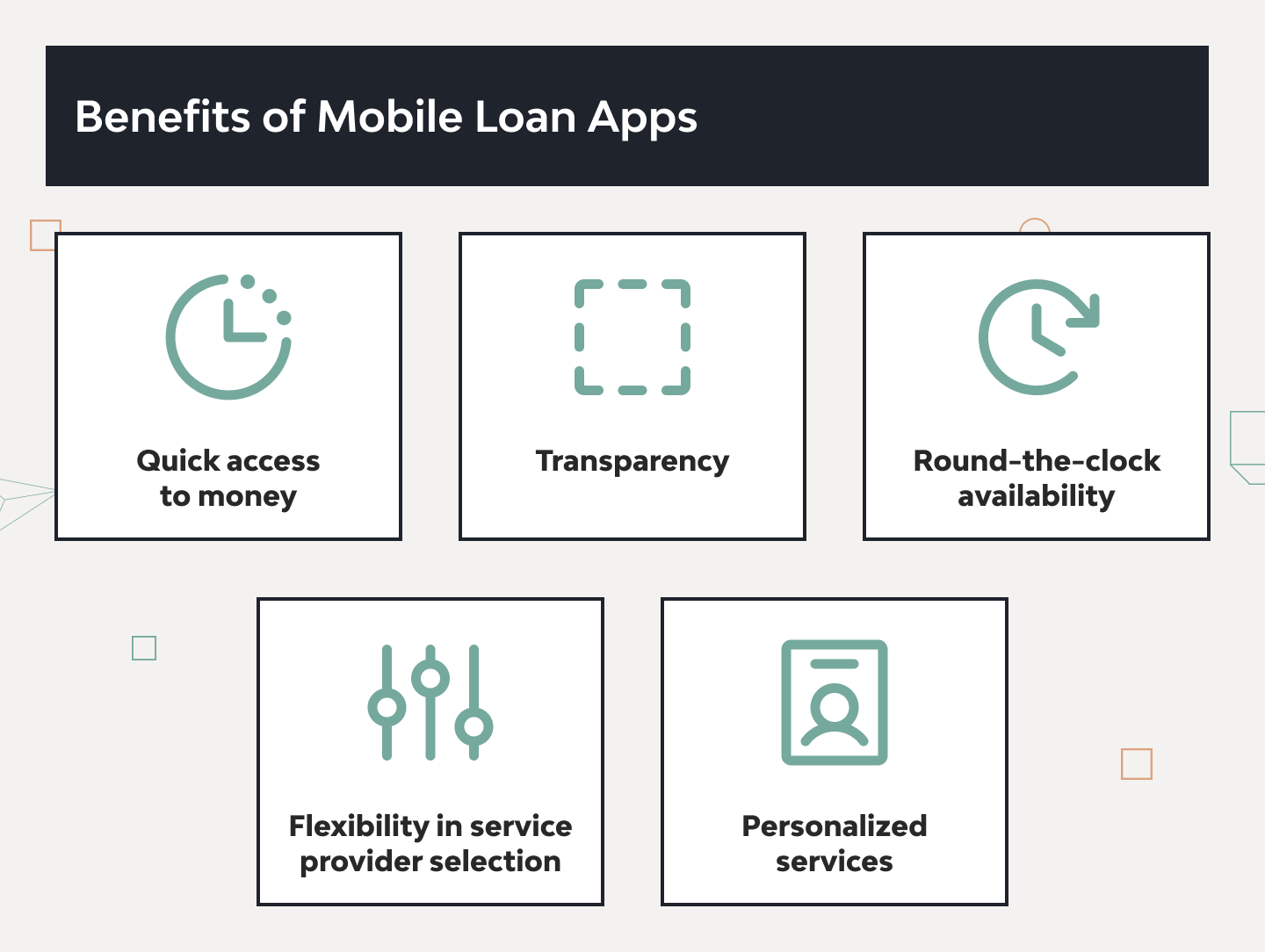

Quick access to money

This is what loan apps are primarily for. In the fast-paced world of the 21st century, decision speed is a game changer. Loan apps enable people to quickly cover their immediate need for money and acquire a product they covet in a New York minute.

Transparency

All loan terms and conditions are laid out fairly and squarely in the agreement the app offers without hidden fees or exorbitant interest rates.

Round-the-clock availability

Forget about a bank’s working hours or days off. If you need money urgently at 2 a.m., the online lending platform is at your service.

Flexibility in service provider selection

There are dozens, if not hundreds, of lending apps out there, so a person can compare their loan approval criteria, rates, and even UI/UX design nuances to opt for the most suitable partner.

Personalized services

In modern loan lending app development, utmost customization and personalization of services are the name of the game. Their creators make sure users enjoy custom-tailored offers, terms, features, and UI design details to guarantee maximum satisfaction and customer loyalty.

Financial organizations that launch loan apps also end up in the black since they enjoy:

- Embracing innovation. We live in a digitally-powered world that moves at a breakneck speed. And also the ruthless and oversaturated financial services market. Failing to harness state-of-the-art technologies can have catastrophic consequences.

- Loan lifecycle automation. Thanks to the loan management system ushered in by the lending app, banks, and institutions can essentially automate the lion’s share of processing and approval operations, thus radically reducing the proportion of manual effort involved in the workflows.

- OPEX minimization. Since a significant part of pipeline processes is delegated to machines, enterprises don’t need physical infrastructure and a large workforce on their regular payroll. That is why their expenditures plummet, whereas the efficiency of services soars.

- Greater consumer reach. With a lending app as a crucial element of their digital ecosystem, companies can find clients all over the globe. As a result, they expand their customer base, augment their service roster, and diversify revenue sources.

- Improved customer satisfaction. The ability to apply for a loan and receive it on short notice creates an ever-increasing pool of pleased customers who are likely to come back for more and recommend your services to their family, friends, and colleagues. In such a way, the app fosters brand visibility and loyalty coupled with strong customer trust and a positive image of the company.

- Additional source of customer data. Financial organizations don’t have to resort to acquiring data from data providers because lending apps collect a slew of information related to the users’ demographics, preferences, lending behavior, and pain points. Data analysts can turn such records into valuable insights that are highly instrumental in tailoring their marketing strategies, cross-selling and upselling offers, and product recommendations that will dovetail with each client’s tastes, interests, and revenue level.

- Competitive edge. A user-friendly and seamlessly operating loan app is a surefire recipe for standing out among your rivals in the niche and winning over a larger share of consumers to engage with your brand.

Sounds appealing, doesn’t it? Well, it does. Once you realize that such a custom fintech application is worth launching, you ask yourself how to start a loan app. The first step toward its creation is determining the app type.

Zooming in on Loan Lending App Types

As a vetted IT vendor specializing in fintech software development services, Django Stars knows what lending apps rank high in popularity among both financial organizations and their clients.

Want to learn more about the fintech projects we have delivered? Read this case study.

Personal loan apps

These solutions are honed for providing unsecured loans that individuals need for their personal use, such as defraying healthcare expenses, covering home refurbishments, consolidating debt, and more. An ideal personal loan app is one with an easy application process, flexible repayment options, credit scoring integration, and personalized offers.

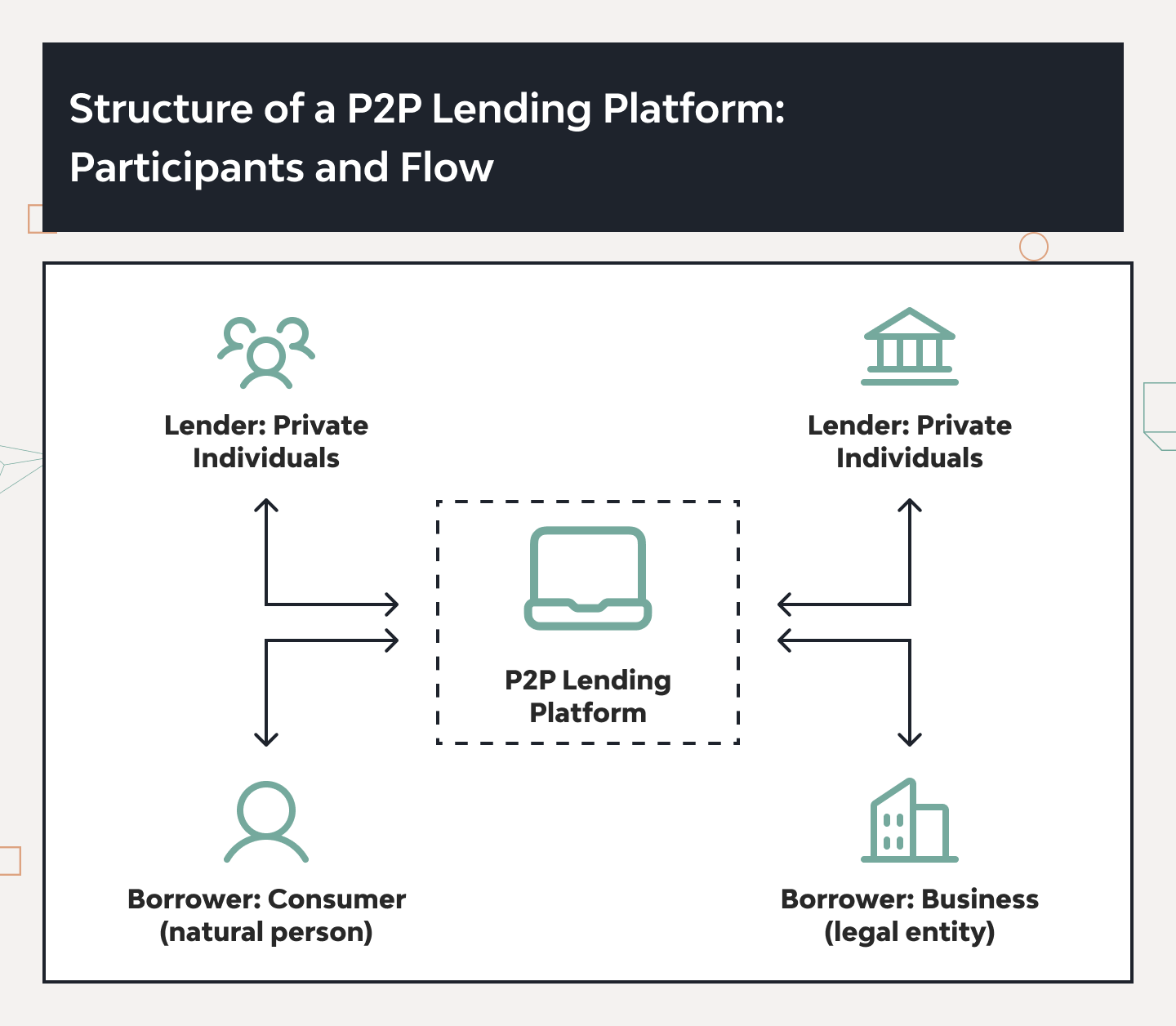

P2P lending apps

The global market size for peer-to-peer loan solutions was estimated at $218.68 billion last year and is expected to increase almost five times as much by 2032 at an astounding CAGR of 21.6%. Leveraging them, people count on financial help not from specialized organizations but from individual lenders who can offer attractive terms and earn interest on their funds that are free at the moment. Such an app serves as a mediator between a borrower and a lender, ensuring their seamless connection, displaying investment options customers can choose from, and providing foolproof loan management tools.

Microloan apps

Sometimes, low-income population strata need short-term loans to cover their urgent moderate expenses (like buying a mobile phone or home appliances). Microfinance apps are tools that can address such problems, promoting financial inclusion and covering underserved consumer audiences.

Such applications are geared for prompt approval without lengthy checks or numerous documents and rely on alternative credit scoring. Usually, they decide on the client’s solvency by examining the applicant’s history of payments for utilities or mobile communication. A specific feature of such apps is the financial education module, which teaches customers the basics of financial management.

Mortgage loan apps

As it is easy to guess, these apps are called to let people receive a home loan. Since the property is a big-ticket item, the application and approval process is more serious here, requiring the capability to upload various documents. Also, it is a more extended routine, so people should be able to track their application’s progress and get real-time updates. Besides, they need a mortgage payment calculator to understand how much they will have to pay.

Discover details of mortgage loan app development in this case study

The type of lending app largely conditions the scope of features it has.

Obligatory and Optional Loan App Features

Some lending app capabilities are mandatory for products of this kind, while others can be added on demand. Among the must-have features are the following.

Obligatory features

User registration and authentication

This is the starting point of a person’s interaction with the app. The borrower’s onboarding process includes various registration options, such as phone number, email address, social media profile, etc. The registration process should be aligned with providing the financial app’s security via one-time passwords and two-factor user authentication reinforced with disruptive biometric methods for identity verification (face, retina, voice, or fingerprint ID).

Applying for a loan

Using this capability, people can apply for various loan types, choosing the sum to be borrowed, loan purpose, and repayment period. The application routine should be foolproof, allowing the person to quickly complete all necessary steps, from filling out the forms to submitting required documents.

Credit scoring and risk assessment

The app’s integrated mechanisms use this feature to establish the potential client’s creditworthiness by automatically analyzing their employment status, income level, credit history, and other relevant data. The outcome of this analysis is the consumer’s credit score, which conditions their eligibility for a loan and the interest rates applied.

Payment gateway integration

The main two requirements for this capability are diversity and security. Clients should be able to opt for the payment option they are comfortable with and must be sure their financial and personal data are kept safe from leakage or penetration attempts.

Notifications and alerts

Users should keep abreast of all that happens with their application, receive reminders concerning due payments, and be informed about offers and updates promoting the app owner’s financial products and services.

This basic roster can be augmented by adding the following advanced lending app features.

Optional features

AI-driven credit scoring

Today, AI and ML-driven algorithms power many digital products. You can employ them to facilitate various workflows, the most prominent of which is credit scoring, where cutting-edge technologies dramatically improve the accuracy of creditworthiness analysis and conclusions.

In-app chat and support

Conventionally, loan apps are very easy to use. However, if customers have problems with any lending pipeline steps, you can provide them with assistance from fellow users or customer service representatives who will offer timely advice or valuable recommendations.

Loan calculator and EMI estimator

These self-service capabilities allow people to determine what total interest they will have to cover and the number of equated monthly installments (EMIs) into which the repayment sum will be split.

Multi-language and multi-currency support

By including these features, you broaden your app’s user audience, enabling people from all corners of the world to enjoy immediate access to money through the app and adapting it to different currencies with their exchange rates.

Admin dashboard with analytics and loan lifecycle tracking

This feature is geared toward customers with analytical propensities. Leveraging insights provided by such a dashboard, they can control their financial health, track loan performance, and monitor repayment status, improving management efficiency.

As soon as you select the features for your lending app, you can tackle its development hammer and tongs.

How to Build a Loan App: A Roadmap to Follow

When consulting customers on software development routines, we recommend they stick to the straightforward 11-step algorithm we employ in our projects.

Step 1. Discovery phase

Our team meets customer representatives to learn about their vision of the future product’s purpose (providing personal, business, mortgage, or microloans, P2P lending, etc.), the app’s target audience, the functionality list it will contain, and design details vital for customers to see in the solution.

Step 2. Research

We conduct an out-and-out analysis of the niche, reveal major trends in it, identify gaps the new app can fill, investigate the target audience’s preferences and pain points, and look at competitor solutions, paying attention to their fortes and – more importantly – their shortcomings. The key deliverable of this stage is the app’s user persona with their demographics, cultural peculiarities, income level, expectations, and user habits.

Step 3. Getting to grips with the monetization strategy

The choice of an appropriate business model for the app is mission-critical. Typical app monetization methods include fee-based, interest-based, or subscription models. You can combine any of these with additional monetization mechanisms, such as in-app advertising or sponsorship programs.

Step 4. Taking thought for compliance

Legislative regulations concerning data safety in the finance industry are probably the most stringent ones in comparison with other verticals. That is why we approach lending app creation with a compliance-first approach, ensuring data handling processes utilized in the future product are in line with GDPR, CCPA, SEC, PCI DSS, FINRA, and other legal norms.

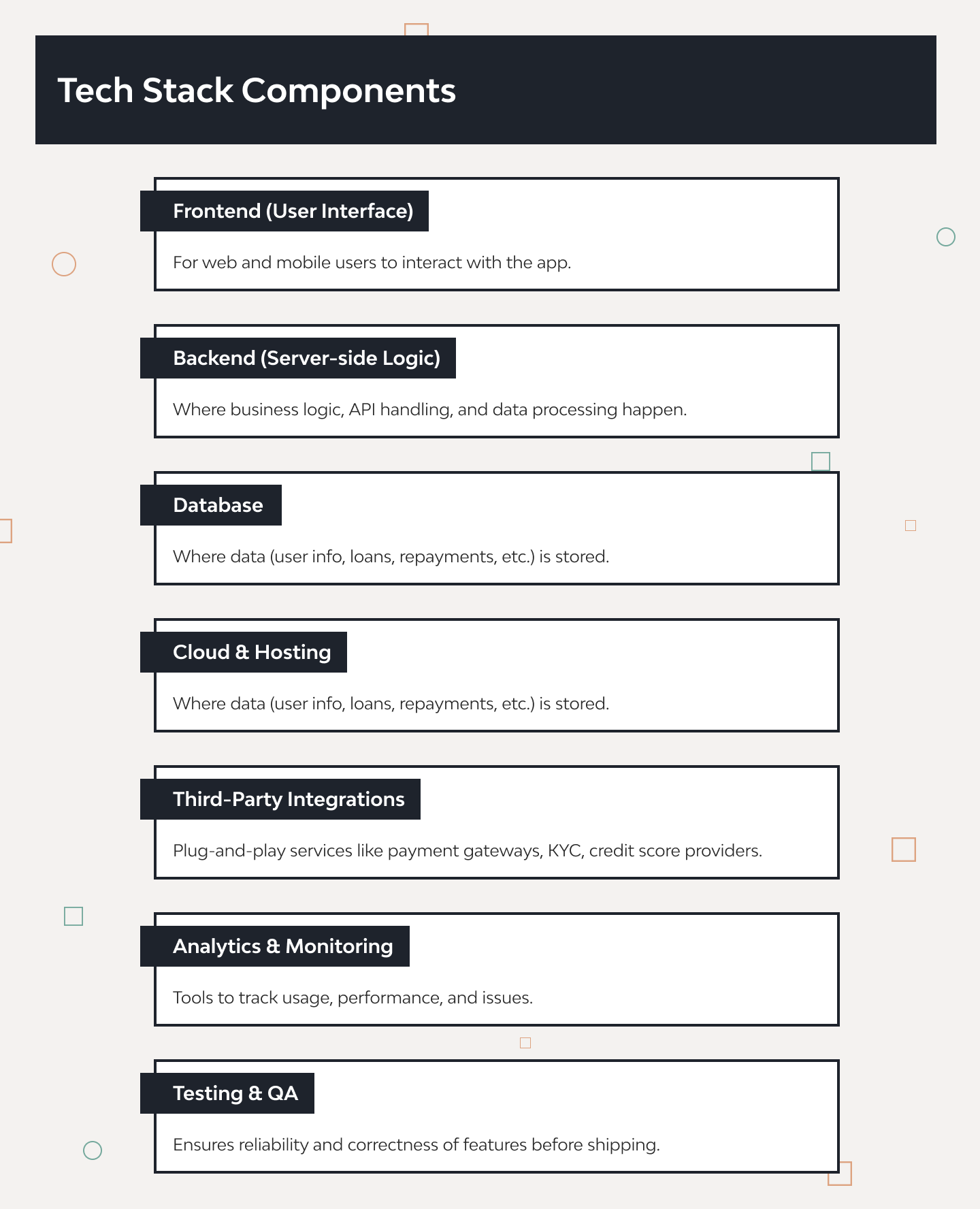

Step 5. Determining the tech stack

The roster of programming languages, tools, databases, and frameworks is conditioned by the choice of the operating system the app-to-be will rely on (Android, iOS, or cross-platform). We can expand it on demand by including innovative technologies like artificial intelligence, machine learning, blockchain, etc.

Step 6. Assembling the team

In accordance with the selected tech stack, we appoint experts who are competent in those technologies. An average team for building a small-size loan app includes a front-end developer, a back-end engineer, a UI/UX designer, a QA specialist, and a project manager to coordinate and supervise their efforts. This skeleton team can be reinforced if the project scope or urgency demands it.

Step 7. UX/UI design

The loan app’s UI/UX design includes the development of a navigation map, customer journeys, and user flows. UI design consists in creating buttons, input fields, sliders, and icons and uniting them within the layout dominated by a certain color scheme.

Step 8. Front-end and back-end development

This is the longest phase to accomplish. During loan app development, software engineers map out the solution’s architecture, build its server-side elements, align them with client-side components, and devise a network of APIs to enable integrations with third-party systems.

Step 9. Prototyping and MVP creation

This is the first development stage with palpable deliverables. A clickable prototype created by the project team reflects the future product’s logic, structure, and design. If it is found technically viable, the prototype is upgraded to become an MVP and is submitted for trial usage.

Step 10. QA and deployment

With all features completed, the time for comprehensive testing comes. Our QA engineers conduct a series of manual and automated tests (such as functional, performance, security, stress, usability, compatibility, accessibility, and more) to ensure the absence of bugs and the solution’s smooth operation. When the app displays satisfactory working parameters, it is deployed and goes live.

Step 11. Maintenance and support

As a reliable vendor, we stay in touch with the customer after the solution is released. Our professionals monitor and optimize the app’s after-launch performance, fine-tune its operation, eliminate issues in case they crop up, update the software in line with new legal and financial requirements, and provide consulting services concerning various aspects of the product’s functioning.

It may get clearer how to create a loan app, but how much will the endeavor cost me?

The Cost of Lending App Development

All software pieces (and a loan app, too) are expensive products whose final price is determined by numerous factors, which include (but arenot limited to):

- The project’s complexity and scope

- The tech stack involved (the utilization of cutting-edge technologies pushes the cost upwards)

- The urgency of the project’s completion

- The team size

- The engagement model according to which it will operate

- Design sophistication

- and more.

However, the two major parameters that ultimately condition the app’s cost are the number of hours necessary for developing all elements of the solution and the hourly rates charged by the vendor.

Let’s look at the rough estimate of time necessary to create different aspects of a lending app.

- Software requirement specification – 35-40 hours

- Wireframing and design – 85-90 hours

- Test case – 30 hours

- Coding (including front-end and back-end development) – 380 hours

- QA – 40 hours.

All in all, count on approximately 600 working hours to pay for.

Now comes the question of hourly rates. These differ depending on the vendor’s location, with the highest rates charged by North American and Western European companies ($75-95) and the lowest ones found in South Asia ($20-40). Naturally, some customers steer by sheer numbers while making a choice, but a wise client looks beyond figures and takes into account the quality/price ratio.

Let’s consider the price for different aspects of lending app development, given the hourly rate variations.

- UI/UX design – $5,000-$15,000

- Front-end development – $10,000-$30,000

- Back-end development – $15,000-$40,000

- Database management – $5,000-$10,000

- Essential features integration – $10,000-$30,000

- Advanced features integration – $15,000-$40,000

- QA and testing – $5,000-$15,000

- Deployment – $3,000-$8,000

- Post-launch support and maintenance – $5,000-$12,000 annually

These ballpark estimates are subject to correction and should be established individually for each project. Yet, the approximate sum to be allocated for building a medium-size loan lending app is something around $60,000-160,000+. Such a significant budget may seem a huge expenditure item for a company. At first sight. But if you consider the benefits of investing in a lending app in the long run, it is totally worth trying.

How does a “revenue-generating high-tech asset” sound to you? A robust solution that provides first-rate lending services to a large user audience. It leverages a well-thought-out monetization strategy and wins you new clients. Last but not least, it establishes your company’s image in the industry and brand reputation among customers. Yours is an innovation-driven organization that caters to the current needs of its digitally savvy customers. Win-win.

However, while embarking on the lending app development journey, you should consider potential roadblocks you are likely to encounter along the way.

Challenges of Loan Lending App Development

Having been delivering solutions in the field of banking and finance for 16 years, we at Django Stars are well aware of the typical pitfalls and bottlenecks in the development and employment of lending apps.

Regulatory compliance

The legal framework concerning the operations of financial players is quite extensive, with GDPR and CCPA being two foundational norms for Europe and the USA correspondingly. Besides, the number of laws concerning the data security financial organizations use in their workflows constantly increases, making many companies struggle with keeping track of them and adjusting their software products to statutory stipulations.

Realizing that non-compliance incurs hefty fines and other penalties, financial institutions demand that fintech development SDLC is conducted with a compliance-first approach. That is why the loan app should ask for users’ permission to process their data, guarantee their ability to refuse its collection and ensure the transparency of storing and using personal information.

Data security

The finance realm is one of the most attractive spheres for cybercriminals who can exploit weaknesses in software protection systems to get hold of sensitive data or steal people’s money from their accounts. Companies ignoring this trend or paying inadequate attention to providing security for their digital products suffer scathing reputational damage and exorbitant financial losses that are forecasted to surpass $27 trillion in 2027.

To mitigate potential cybersecurity risks, lending app developers should equip their product with two-factor authentication access control based on biometric validation techniques (fingerprint, retina, voice, or face ID) as non-negotiable elements, use secure APIs providing access to sensitive information, and encrypt data both in transit and at rest.

User trust

Fostering credibility among your audience is a laborious process. The reputation of a reliable and trustworthy company takes a long time to build but can be ruined in a split second by some mistake or indiscreet action.

To earn the image of a solid financial institution that values each client and takes care of their comfort and security, a loan app launched by it should guarantee first-rate user experience, ensure rock-solid safety of customer data it operates, provide transparent practices (such as straightforward credit scoring, absence of hidden fees, real-time loan lifecycle tracking. etc.), and offer 24/7 customer support with instant assistance and professional advice.

Evidently, developing and launching a top-notch loan lending app is a no-joke endeavor that can be entrusted only to competent experts in the domain. The qualified Django Stars professionals possess in-depth knowledge, hands-on skills, and experience creating fintech solutions vindicated by positive reviews. Our experts will develop the best-in-class custom lending app for your business needs, expand your customer base, and create a source of income in these uncertain times.

To Sum It up

Loan lending apps come in different guises (personal, mortgage, microloan, P2P lending apps, and more) but ultimately serve one purpose: to provide a person with instant access to money. Their 24/7 availability, flexibility in loan type and condition selection, and personalized services earn them an ever-increasing popularity among digitally savvy consumers. Financial organizations launching such apps also stand to benefit since they expand their customer base, obtain a source of client data for further usage, and minimize operating expenditures. It gives them competitive edge by embracing innovation and providing a top-notch user experience.

To create a custom lending app that suits your unique business and technical requirements, you need to:

- Assemble a list of features it will contain

- Have adequate expertise in the domain

- Adhere to a straightforward development roadmap

- Address regular fintech app-building challenges

We can take care of everything, and we are one click away. Drop us a line.

- How long does it take to build a loan lending app?

- It all depends on the project's scope, complexity, and urgency, team composition, utilization of innovative technologies, and other factors. On average, a small lending app takes from one to three months to build, twice that much for a medium-size solution, whereas a complex loan application's development is likely to last a year or even longer.

- How do loan lending apps ensure compliance with financial regulations?

- Such apps should be crafted based on the principle of adherence to the national and international legal framework in the industry (GDPR, CCPA, FINRA, PCI DSS, and others) from the outset. The solution should ask for users' permission to handle their personal data, ensure utmost transparency of its storing and processing, and comply with anti-money-laundering (KYC) regulations.

- What security measures are essential for protecting user data in loan apps?

- First of all, users must be 100% sure that no unauthorized person can access their accounts to tamper with their money and data. Two-factor authentication relying on biometric mechanisms and one-time passwords are a solid protection against such accidents. Also, app creators should integrate a secure and penetration-proof payment gateway, which cybercriminals cannot hack into.

- Can existing financial institutions integrate loan lending apps into their services?

- Typically, they can do so if their current IT ecosystem is compatible with such integrations. The process of making a lending app a part of the organization's infrastructure is performed either by leveraging APIs or utilizing specialized middleware. Such tools ensure all components of the digital environment play well with each other and provide a seamless user experience to financial services consumers.

- How much does it cost to maintain a loan app after launch?

- As a rule, app maintenance expenditures amount to 15-20% of the development cost. The precise sum depends on the scope of services the solution needs, including bug fixing necessity, feature improvement requirements, issuing compatibility updates, etc. On average, be ready to fork out from $5,000 to $15,000 a year.