How to Build a Fintech Application: The Ultimate Guide

With financial apps enabling customer interactions and experiences not possible before, fintech app development has become a challenge for many forward-thinking online businesses. Ultimately, creating fintech apps helps companies better reach their audience, create additional revenue streams, and secure their bottom line.

However, while there’s a wide variety of popular fintech trends, only some are crucial for an app’s success, while others can be costly nice-to-haves. As a result, new market entrants risk watering down their effort chasing a hype train instead of concentrating on really crucial things when trying to enter a saturated market.

Thus, a company planning fintech application development needs to incorporate all aspects of a disciplined approach to achieve success:

| • | Conduct in-depth research on the current market to select the vertical for the future app |

|---|---|

| • | Define market leaders in the selected vertical, their strong points, and flaws |

| • | Identify the target audience and their expectations, goals, and needs |

| • | Design the application architecture correctly to ensure operational security and scalability |

| • | Select the critical features for a minimum viable product (MVP) that will serve the audience’s needs and stand out from the competition while gaining traction and attracting investment |

| • | Develop a product quickly enough to remain relevant in an ever-changing landscape |

| • | Making the product secure and bug-free so that it prevents data leaks and crashes |

| • | Plan for a contingency to ensure long-term project survival and success |

As an established fintech app development company, Django Stars is intimately familiar with all of these steps. Having developed market-leading apps like Money Park and Molo for European countries, and a digital mortgage management platform called Sindeo for the US, we know how to build a fintech app that will dominate the market.

In this article, we describe all the complexities and challenges of building a fintech app. We also provide real-world scenarios and examples of overcoming obstacles to success. Our advice is based on more than fifteen years of experience in developing fintech applications and will be of use to any company considering fintech app development in 2023 and beyond.

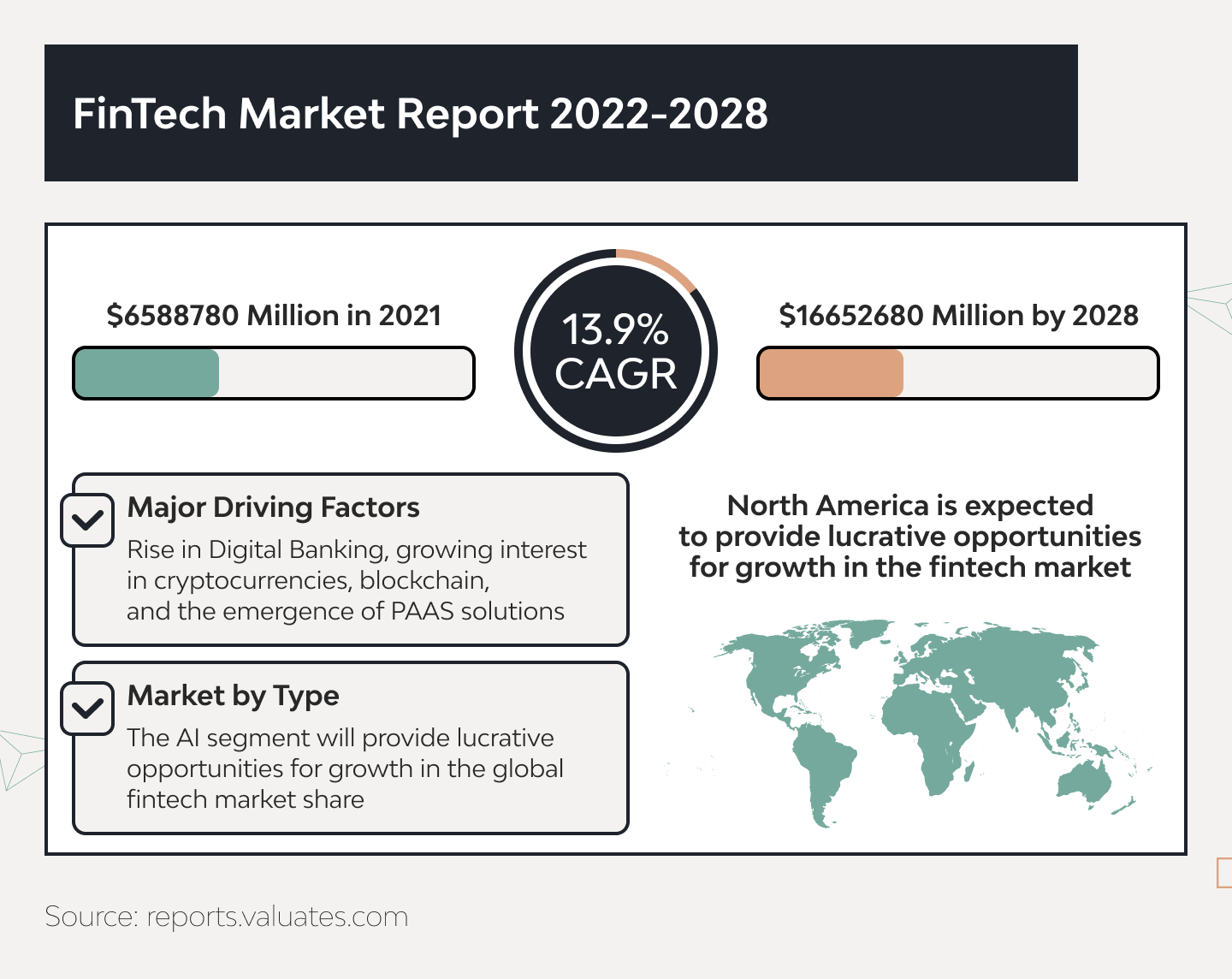

Fintech App Market Size & Research

The amount of investment in fintech more than halved in 2023. It was barely $23 billion versus $59 billion in 2022. A primary reason is pretty understandable — VC investors anticipate a recession and prefer to be prudent. But this does not mean that the fintech market came to a halt — this colossus is too big to fall. Actually, fintech investment is expected to reach $125 billion by 2025, according to a market research report from Valuates. PR Newswire is even bolder, forecasting growth to $305 billion by 2025.

The problem for startups is the wide variety of fintech trends flourishing within multiple business domains (more on them later). Many companies try to follow all the trends and cram all the latest tech gimmicks into their products, from AI-based chatbots to blockchain-based databases. This can actually be detrimental to their business’s success — the key goal of an app is to solve a customer pain point, not offer a million features.

Nonetheless, knowledge of the market and trends is essential for conducting new product feasibility research and planning fintech mobile app development.

Key Directions for Fintech App Development

As mentioned before, fintech apps have permeated a wide variety of business domains, streamlining various financial interactions and making them more convenient. These include:

- Digital banking applications

- Mortgage management software

- P2P lending and investment platforms

- Insurance apps

- Personal finance management

- Wealth management software

- Trading solutions

- Money transfers

- Regtech software

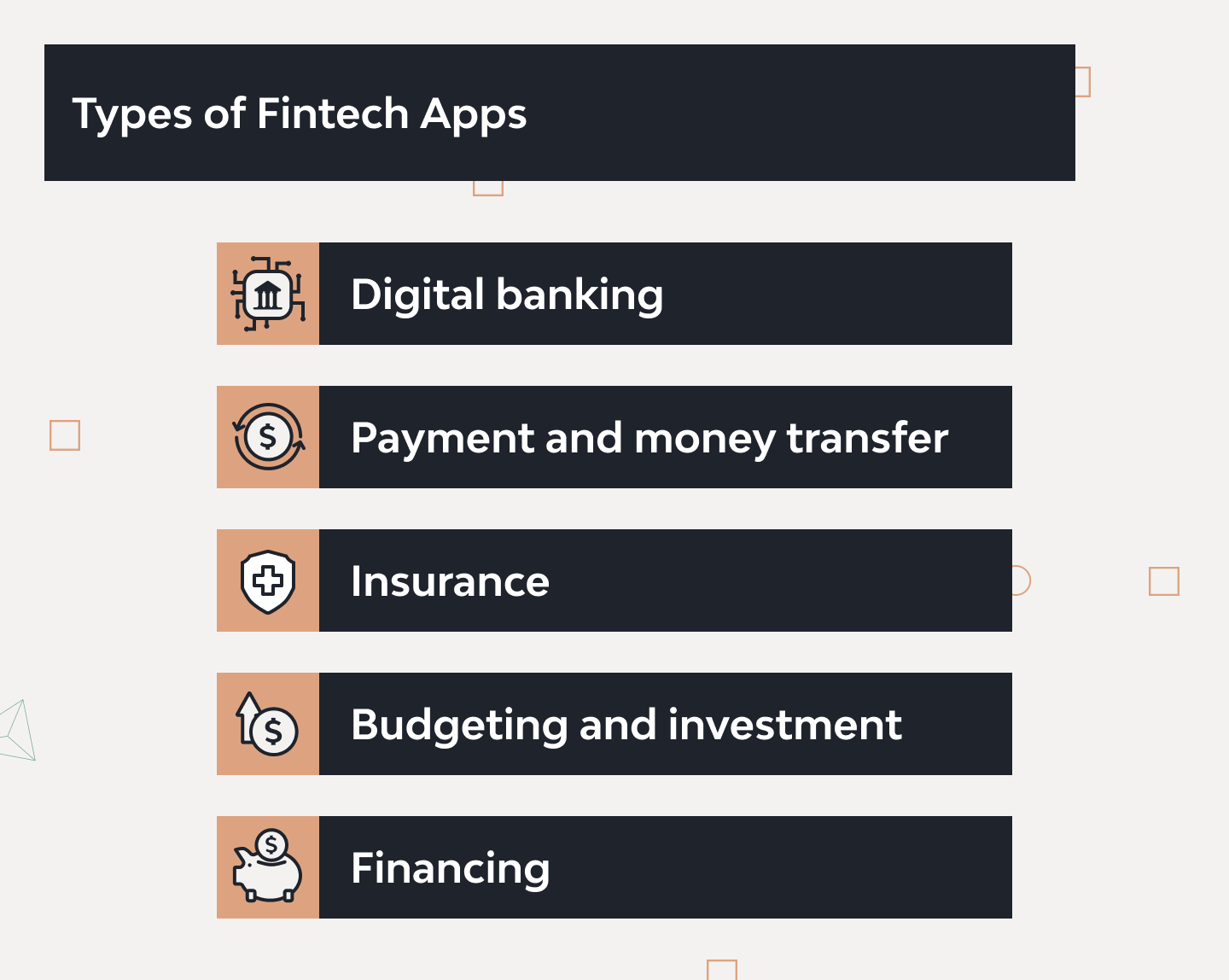

But across all these domains, there are five areas where creating a fintech app pays off.

Digital banking apps

Digital or mobile banking apps enable many kinds of traditional financial interactions from a smartphone or computer. Here are some examples.

- Opening an account

- Conducting different types of money transfers, including to the same bank’s account, between banks within the same country, through SWIFT/SEPA, etc.

- Loan financing and repayment

- Crowdfunding

- Trading stocks

Surprisingly enough, it’s easier to find a bank without a mobile app than without one. Django Stars has developed apps with these functions for several customers, including Saudi Investment Bank.

Examples: Revolut, Chime, Wells Fargo, N26, Bank of America Mobile, Monzo

Payment and money transfer apps

These apps focus on transferring money between accounts and bank cards, as well as storing banking details centrally to enable one-click payments and transfers. The convenience this kind of software offers has helped it gain popularity worldwide.

Examples: Google Pay, Apple Pay, PayPal, Payoneer

Insurance apps

Digitalizing insurance is one of the most lucrative yet complex areas of fintech. From healthcare to car or property insurance, such apps should have intuitive and customer-friendly interfaces while providing secure data storage and efficient processing from the admin side. They should also ensure safe data exchange with third-party entities over encrypted APIs. This helps facilitate insurance claim processing and reduce fraud.

Examples: myCigna, GEICO mobile, Aetna Health

Budgeting and investment apps

These apps help track personal finances and spending and plan for users’ financial future. They also present investment options and advice. This speaks volumes about the feasibility of a decision to create an investment platform.

Examples: Sanostro, Mint, EveryDollar, Clear Minds, Goodbudget, GLASfunds

Financing apps

Peer-to-peer (P2P) lending and digital mortgages are among the most in-demand apps. With real estate constantly growing in price, mortgages are a reliable source of income for years to come. Developing digital mortgage apps helps facilitate the process for all the parties involved.

Examples: Molo, MoneyPark, Sindeo, Finnable, CashIn

Once a company decides to make a fintech app for a certain domain, it’s time to plan a budget for developing it.

Planning a Budget for Fintech Application Development

While a somewhat painful process, budgeting is one of the key aspects of preparing for software development. Fortunately, many functions needed in most types of fintech apps already exist as third-party components. So, new entrants don’t need to reinvent the wheel and build everything from scratch. However, heavily relying on third-party code poses its own risks, as will become apparent soon.

Naturally, the final web app development cost will depend on such factors as:

| • | The technology stack used |

|---|---|

| • | The number of features packed into an MVP |

| • | The number of third-party integrations with paid API calls |

Connecting all API integrations with the app’s business logic in the back end will usually be the biggest and most complex part of development. The reason is the need to ensure contingency and failover, which we’ll showcase below.

That said, there are lower and upper brackets for MVP development. A basic MVP with one or two core features and a minimum of API integrations will cost around $30–50K. In contrast, developing a complex, feature-rich fintech product can cost anywhere from $500–$800K to over $1 million. So, it’s wise to develop and launch an MVP first and add more features based on the product’s performance and user feedback.

Core Fintech Application Features

We’ve already described some fintech application features, and now we’ll provide a detailed breakdown of some key elements every fintech app should include.

Data encryption

During user registration and every subsequent interaction with an app, customers provide highly sensitive financial details. This data must not be stored after a transaction is completed — but if it must be stored, it should be strongly encrypted. Strong encryption involves encoding the data in a format that requires special keys to revert it back to a readable format.

These are some of the best data encryption techniques to use:

- RSA. A secure asymmetric encryption algorithm, where data is encrypted publicly, and the keys to unlock it are stored privately.

- Twofish. An algorithm that transforms data into 128-bit encrypted blocks.

- 3DES. A popular algorithm for credit card PIN encryption that spreads data into three separate parts, each of which is triple encrypted.

User authentication

With 52% of customers naming security as their single most important concern when using a fintech app, it’s imperative to provide watertight cybersecurity measures. User authentication is among the most often used attack vectors in fintech apps, exploited by phishing, man-in-the-middle attacks, and other fraud methods.

We believe that every fintech app should have one or more of the following authentication features:

- Multi-factor authentication. Combines a password with FaceID, TouchID, voice patterns, retina scans, or other biometrics to safeguard customer credentials and reduce the risk of a security breach.

- QR-code authentication. A mobile camera scans a QR code to verify both parties in a transaction and validate the payment.

- One-time passwords. Validating transactions with one-time passwords sent to associated devices helps verify customer identity.

- Adaptive authentication. Combines the methods above with AI-powered behavioral analysis to detect unusual customer behavior and halt transactions until verification and approval come from the customer.

The challenge here is to make the authentication process secure while keeping it unobtrusive and user-friendly.

Credit score checks

While the US has its big three credit scoring bureaus, every country has its own variant. Fintech apps must integrate with credit bureau databases before they can approve loans, verify accounts, and perform other functions.

Sadly, the existing FICO credit scoring model excludes quite a wide strata of customers — like new borrowers, recent immigrants who may not have the proper credentials for banking, and underbanked populations in rural areas. Successfully enabling underwriting for these customers using alternative credit scoring services allows fintech companies to engage a whole new audience underserved by traditional credit score checkers.

However, incorrect evaluation of their ability to repay a loan translates to a high risk of defaults. Therefore, implementing both traditional and alternative credit scoring algorithms can be a huge advantage or can bring headaches to fintech companies, depending on how they’re used.

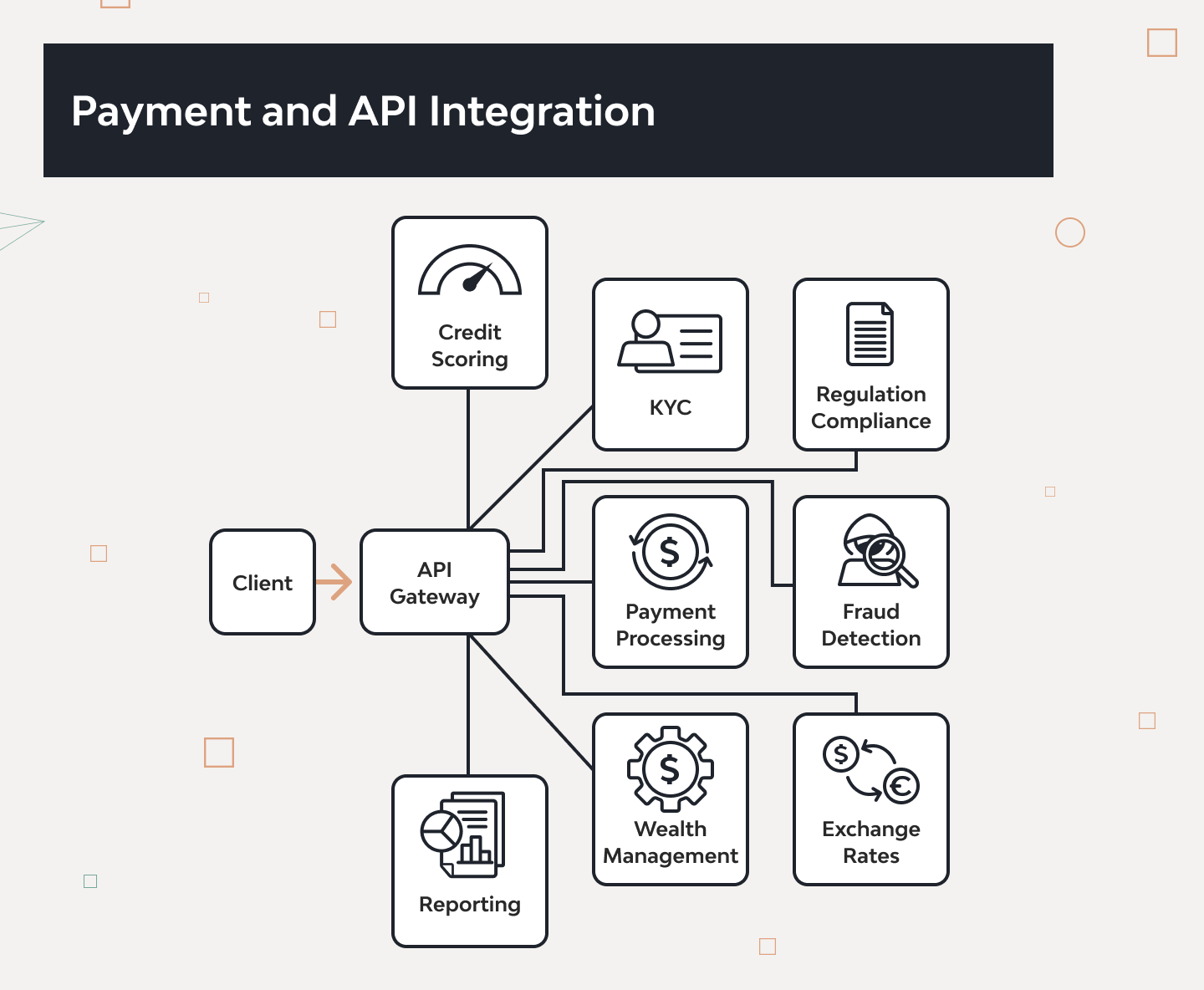

Payment and API integration

Having a fintech application usually dictates a need to integrate a payment gateway system for processing transactions. The target audience might prefer some payment methods over others, from Visa and Mastercard to PayPal, Wise, AmEx, Payoneer, or Maestro. These systems should be properly integrated into any fintech app using the APIs each of them provides.

By the way, API integrations are a very important aspect of fintech application development because modern applications rely heavily on third-party modules. It’s normal to expect at least fifteen to twenty integrations per fintech product.

However, the problem here is that third-party integrations will fail at some point. And they can become bottlenecks that halt the normal operations of the whole app. To prevent these outcomes, it’s advised to build asynchronous applications with combinations of messaging and notification mechanisms.

These mechanisms can reroute requests to an alternative API or queue requests using a retry pattern, so the API call isn’t initiated until a request goes through. This ensures a seamless customer experience.

AI learning

Developing AI algorithms has become affordable enough to democratize access to this feature for all market players. AI uses big data to support more precise decision-making. As a result, companies with AI-powered fintech apps can better serve the needs of their customers and win a bigger share of the market.

Read also: AI in Financial Services and Banking

Dashboards and reports

To ensure a positive customer experience and win brand loyalty, fintech apps must present information in a user-friendly manner. Because customers can choose among many fintech apps that largely provide the same set of capabilities, brand loyalty is a key aspect of retaining customers and ensuring long-term product success.

Here are some characteristics of great dashboards and report pages:

- They explain complex information at a glance

- They show important details clearly

- They track data trends over time

- They can be customized with ease

- They highlight crucial widgets and data components

As such, creating intuitive and useful dashboards is an essential part of the Django Stars product design process.

Push notifications

Push notifications have progressed from the days when simple texts offered warnings. Now, customers can reply directly to notifications to, say, approve a transaction. A client’s ability to use many of a fintech app’s functions without having to load the app itself can be a huge USP for any product.

To successfully develop a fintech app with the features listed above, companies must select an appropriate and relevant tech stack. Django Stars experts know how to choose the best tech stack for the job.

Tech Stack for a Fintech App, with Real-Life Examples

The result of fintech app development and an app’s market success depends greatly on the correct choice of technologies to support the business logic required by the app. It takes in-depth knowledge and hands-on expertise with mobile application development for fintech to select the best fit among a variety of options.

For example, selecting Python for fintech development is almost always a winning choice due to the ease of implementing big data and AI. Other advantages include the high app performance that Python ensures and the ease of integrating third-party code. In addition, Python has a large talent pool and allows quickly building MVPs.

Here are some tech stacks Django Stars selected for our past projects.

Money Park

Money Park is Switzerland’s largest online mortgage broker with 150 B2B online partners, 20 offline branches, and 80k+ satisfied customers. The company approached Django Stars in 2012 to help develop an MVP for an online mortgage, investment, and retirement planning platform.

Django Stars added 270 features in just two months to create a market-ready MVP. Over the next decade, the partnership with Django Stars has helped Money Park become a market leader, combining online and in-person advice to provide the best mortgage deals for its customers. With an annual mortgage volume of more than $3.4 billion, the company was acquired by Helvetia Insurance Group.

| Programming languages | Python, GraphQL |

|---|---|

| Frameworks | Django, Angular, Django REST, Node.js, GRPC |

| Databases | Redis, Firebase, MongoDB, PostgreSQL |

| Libraries | React, jQuery |

| Cloud technologies | Google Cloud, Nginx, Jenkins, Docker, CloudBuild, GitHub Actions |

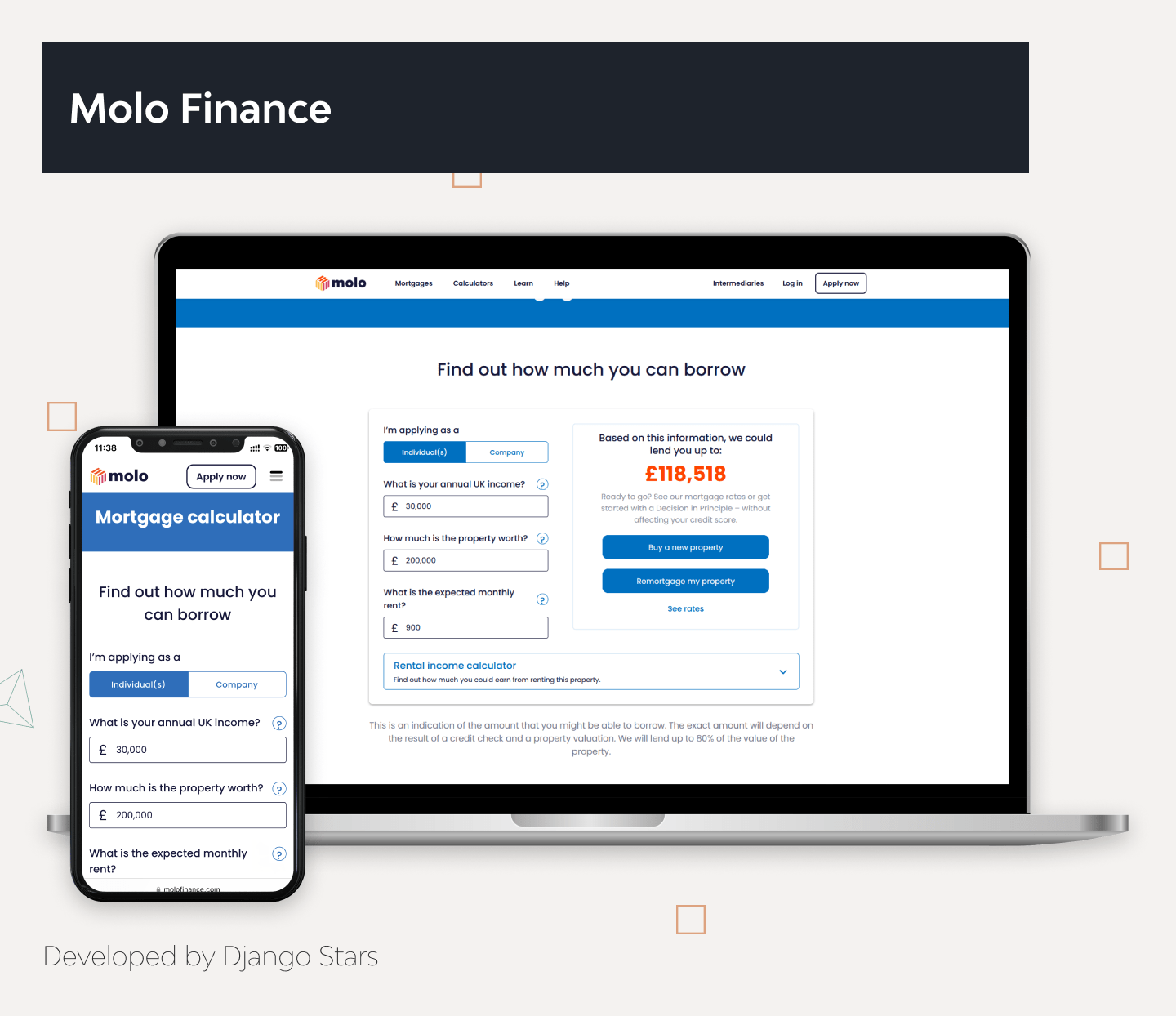

Molo Finance

Molo Finance is a UK-based digital mortgage lender that aims to provide fast application and decision-making with a 100% automated online platform. Since the beginning of its collaboration with Django Stars, this platform has raised $270 million in funding, won several prestigious awards, partnered with ColCap, and processed $600 million online applications annually.

Molo came to us with a product idea and some design assets. In just eight weeks, Django Stars built a feature-rich MVP that raised $3.7 million in its first round of investment. Since then, we’ve helped Molo get to market quickly, gather customer feedback, and scale the offering to prepare for the next investment rounds.

Since 2018, Molo has been pioneering the delivery of fully digital mortgage lending and automated mortgage processes. As one of the leading fintech startups in the UK, it became the market-leading mortgage brokerage and expanded far beyond the BTL mortgage market.

| Programming languages | Python, JavaScript, TypeScript |

|---|---|

| Frameworks | Django, DRF, FastAPI, AIOHTTP, React, NextJS |

| Databases | PostgreSQL, Redis, Mongo |

| Cloud technologies | AWS, Kubernetes, Terraform |

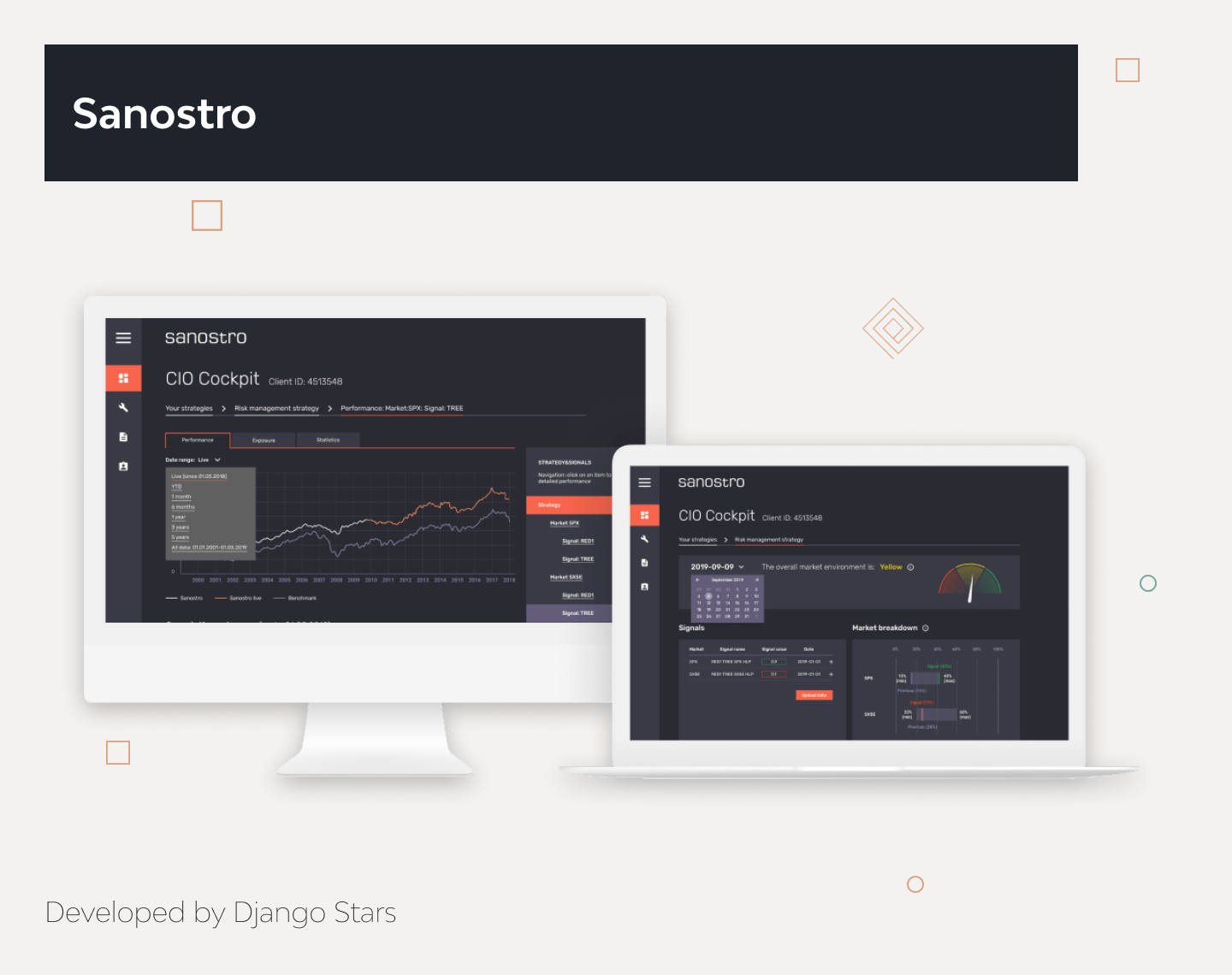

Sanostro

Sanostro is a Swiss-German investment platform aimed at small and medium-sized banks and investment funds. It offers simulations based on historical investment data to identify the best investment opportunities and efficiently diversify clients’ portfolios. Sanostro partnered with Django Stars in 2018 to turn their unique Matlab-based investment algorithm into a scalable web solution.

In less than ten weeks, we created a fully usable prototype that provides a clear and intuitive user experience. By determining the most efficient investment ratios, Sanostro helps its clients maximize their profits. After developing the MVP, Django Stars worked to increase the speed of calculations and optimize the accuracy of predictions through precisely trained algorithms.

| Programming language | Python |

|---|---|

| Framework | Django |

| Databases | Redis, PostgreSQL |

| Cloud technologies | Docker, Nginx |

Naturally, a fintech technology stack depends heavily on the type of app that’s being developed and the business purpose. Native apps are built with Kotlin, Swift, C#, or Java, while cross-platform apps are built with React Native, Node.js, Laravel, or Angular, among others.

Choose the Right App Architecture and Launch Strategy

There are multiple points to consider when selecting the best app architecture for a project. These are the approaches we at Django Stars find the most impactful, based on dozens of completed projects.

Architectural software patterns are paramount

Selecting between monolith, microservices, or serverless architectures is one of the most important decisions for any app. The wrong choice can wreak havoc years later, making a system unable to scale, hard to update, and unmaintainable as a whole.

At Django Stars, we believe in splitting a monolith app into microservices based on business domain functions. This way, the product can be easily maintained using Agile principles, so if there are issues with some functions, it doesn’t affect the entire app, and requests can be addressed to an alternative route or processed later.

Selecting tools, not riding the hype train

Blockchain technology and cryptocurrencies were all the hype for several years, and many companies tried to integrate them everywhere. Cramming a lot of tech trends into an app can result in an unnecessarily complex architecture with a convoluted workflow. Instead, it’s best to select the right tools for the job and ensure that an app solves customer pain points better than alternatives.

Offline processing is good

Every app must be built with the capability to process the majority of requests asynchronously, in the background, so the customer’s app usage flow is never stopped.

Rigorous testing of third-party components

No sandbox testing can cover all cases, so creating mock-ups of third-party data is important to ensure sufficient testing of all API integrations.

Caching saves time, money, and stress

Many integrations are quite expensive when paid by the call. Caching responses to the most popular requests saves a fortune.

Have contingency plans in place

Integrations inevitably fail, so a contingency plan should always be ready. Connecting an alternative service provider and relaunching a separate microservice is much easier than handling a full crash of a monolith application with hardcoded workflows.

Building for scalability means building reliably

Systems with distributed microservices can scale specific microservices easily without the need to scale all of them. This helps save resources in the long term.

Database replication is great

We recommend database replication to ensure uninterrupted availability even if some nodes become unavailable (which happens much more frequently than anybody would like).

Two-factor verification from the get-go

Ensuring correct user authentication is a core aspect of making a fintech application. Adding it after development finishes is barely possible, not to mention excessively expensive. So implementing multi-factor verification from the start is the right choice.

Benefit from infrastructure automation

Automated cloud infrastructure deployment and management tools like Docker, Kubernetes, and Terraform are often used to simplify fintech app development and maintenance.

Logs are essential

Logging requires minimal resources, and it saves an enormous amount of effort when debugging and updating an app. It’s essential to implement sufficient log coverage for all key app functions.

Database anonymizer

Yet another good approach is to use a database anonymizer to run a real-world production database in the User Acceptance Testing (or UAT) environment. This crucial tool allows debugging without the need to access actual client data.

These are only some of the technical aspects of fintech app development. When a company decides to build a fintech app, there are many strategic decisions to be made before development and deployment.

As for the right launch strategy, the company has to acquire all the relevant banking licenses beforehand and comply with a host of regulatory policies and documentation rules. They must create an accurate and realistic development roadmap so that the project isn’t derailed by endless adjustments before launch.

This is where software development expertise comes into play.

Finding a Reliable Fintech App Development Partner

Fintech development is complex, so it’s best entrusted to companies with a proven record of successfully completed projects. We recommend paying attention to case studies and customer feedback on platforms like Clutch, G2crowd, and Upwork. It’s also good to work with a technology partner that has multiple certifications and genuine accolades that prove their deep domain expertise.

What are some warning signs that a development agency might not be up to the task? Companies should beware of software development agencies that:

- Can’t provide feedback from satisfied (and unsatisfied) customers

- Have no industry recognition

- Fail to conduct timely product research and ideation

- Can’t deliver a comprehensive development roadmap

If one or more of these red flags occur, it’s best to look for another provider.

Create a Fintech App with Django Stars Experts

Django Stars is an experienced fintech app development company. Since 2008, we’ve delivered complex and feature-rich solutions that help our clients become market leaders and make the lives of people around the globe easier. We are ISO-certified, among the top Clutch software developers in Ukraine, and we’ve worked with Y Combinator startups and Fortune 500 companies alike.

Conclusion

Fintech app development in 2023 and beyond will be complex but still very lucrative. Despite reduced funding volume, fintech is definitely not going away. Combining time-proven tech with relevant trends and sufficient software development expertise, we can help build fintech apps that will gain traction and secure a slice of the market.

Leveraging Python for fintech has become a standard due to its versatility and robust libraries for data analysis and security.

A lot depends on selecting the right app architecture and tech stack, the correct API integrations, and a reliable software development provider that can deliver on their promises. Django Stars is such a provider, able to support your company throughout every step of fintech application development.

Contact Django Stars to discuss the best way to make your next fintech product a reality.

- Does design have a big impact on the success of a fintech app?

- Yes. Fintech apps must be intuitive, with a simple flow and usable features. Learn more from our article on UI/UX design for fintech.

- How can fintech applications be monetized?

- Subscriptions, paid access to APIs, selling anonymized big data, transaction fees, ads, and referrals are just some of the ways to monetize fintech apps. Later on, new features can introduce additional revenue streams.

- How long does it take to develop a fintech application?

- Depending on the scope, number, and complexity of features, and API integrations, it can take anywhere from two or three months for MVP development and up to several years for a full-fledged product.

- What are some best practices for launching a fintech startup?

- To build a fintech startup that has a chance of success, a company must research the target country’s laws and regulations before development begins. Select a trustworthy software development vendor, choose a relevant tech stack and integrations, listen to customer feedback, and update the product accordingly.