Wealth Management Software Development 101: All You Need to Build a Profitable App

With the global recession looming, wealth management software development might not sound like the best idea. However, private wealth management gains popularity as modern people seek financial security and a decent income. And after the pandemic put many people in debt, they are exploring new ways to manage finances.

At the same time, more experts acknowledge the role of technology in investment and wealth management. In fact, 69% of wealth management clients claim technology advancements make investing cheaper and more efficient, and 57% say software helps them make better investment decisions.

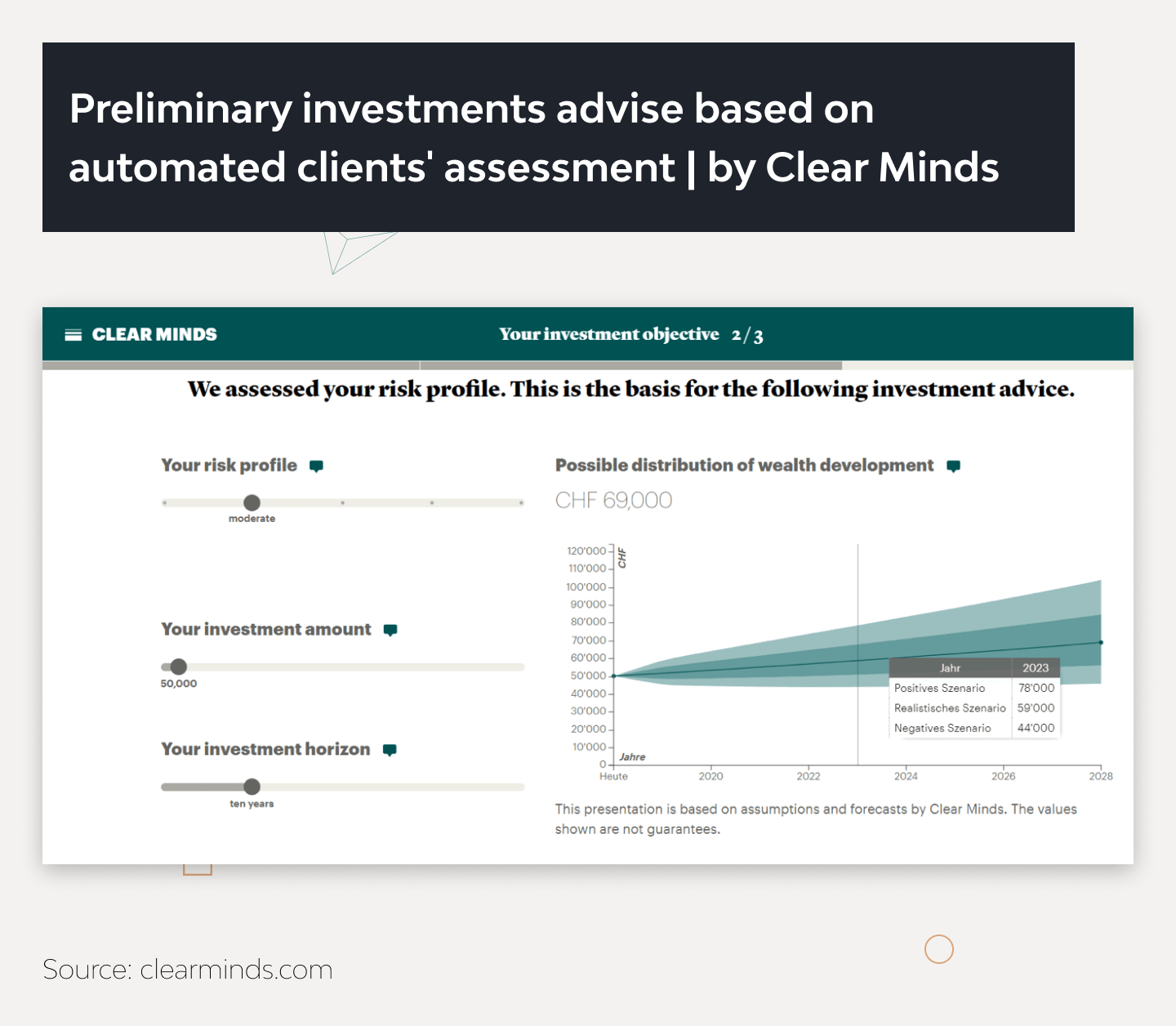

At Django Stars, we’ve delivered multiple projects for the banking and finance industry, including the Clear Minds investment platform. Bringing projects like this to life gave us the skills and know-how critical for wealth management app development. So follow us as we describe the peculiarities and features of creating a wealth management application. By the way, if you are interested in our personal finance app development services, you can contact us for additional consultations.

Why Is It Worth Creating a Personal Finance App Now?

We asked this very question Patrik Hansson of Clear Minds, an investment platform that handles advisory and investment processes. And he pointed out that bringing digital services to the financial sector has two main benefits to the clients. “The first one is accessibility,” Patrik notices. “Previously, financial services were typically something for the few, the ones that have. Digital services give this to the masses.” And the second point to his mind is the cost. “By making the process a lot more lean and efficient you can bring down costs to clients” says Patrik. Below our fintech software development company expands on the reasons why now might be a good time to create a wealth management app.

Highly In-Demand

Wealth management apps often combine several functions: spending tracking, bill management, budgeting, and investment. This makes people who strive to be responsible about their finances the target audience.

According to a US study, almost half of Gen Zs (42%) started or are planning to start saving by the age of 25. And considering there are also Millennials (28%), Gen Xers (24%), and Baby Boomers (17%) who are already saving, thousands of people today want to manage their finances the healthy way.

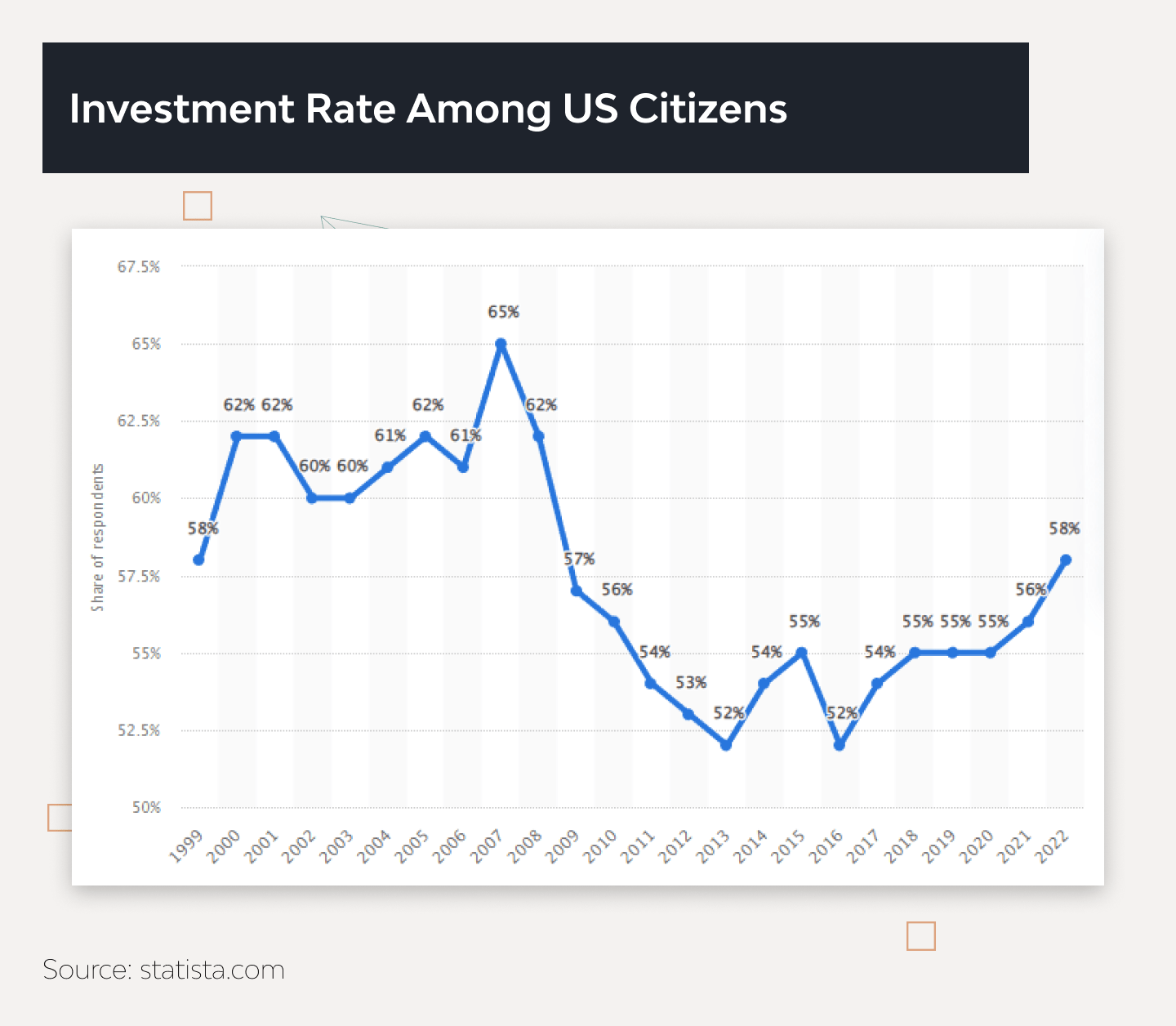

Another example is the investment rate in the USA: 56% of adult Americans invested in the stock market, according to Statista. Indeed, more individuals are considering investing, and Robinhood, the stock trading and investment app that made headlines in 2021, proves this. With almost 16 million active users in 2022, this application for individual investors keeps attracting more Millennials and Gen Zs each year.

This goes to show that your wealth management app will have many potential users, which means a faster return on investment.

Easy to Innovate

The market for wealth management solutions is still evolving, and many applications are missing interesting features. So, there is an opportunity to be more innovative than the competitors by combining different options, approaches, and technologies.

For instance, adding AI-based cryptocurrency investment suggestions to an application would allow the company to win over some users from tardy competitors.

But before innovating, the management should always run feature ideas by the development team and trust their expertise and recommendations. Because regardless if it’s an in-house or outsourcing development team, they are responsible for implementing features, choosing the right tech stack and architecture.

Wealth Management App Development Architecture

The app’s architecture is the basis of its operation. That said, there’s no universal type of software architecture suitable for every fintech project since the “ideal” one depends on the business goals, features, scalability, requirements, plans, and more.

At the same time, if the wealth management system architecture doesn’t suit the objectives of the product, the application will crumble under load, integrate poorly with other systems, or be impossible to use.

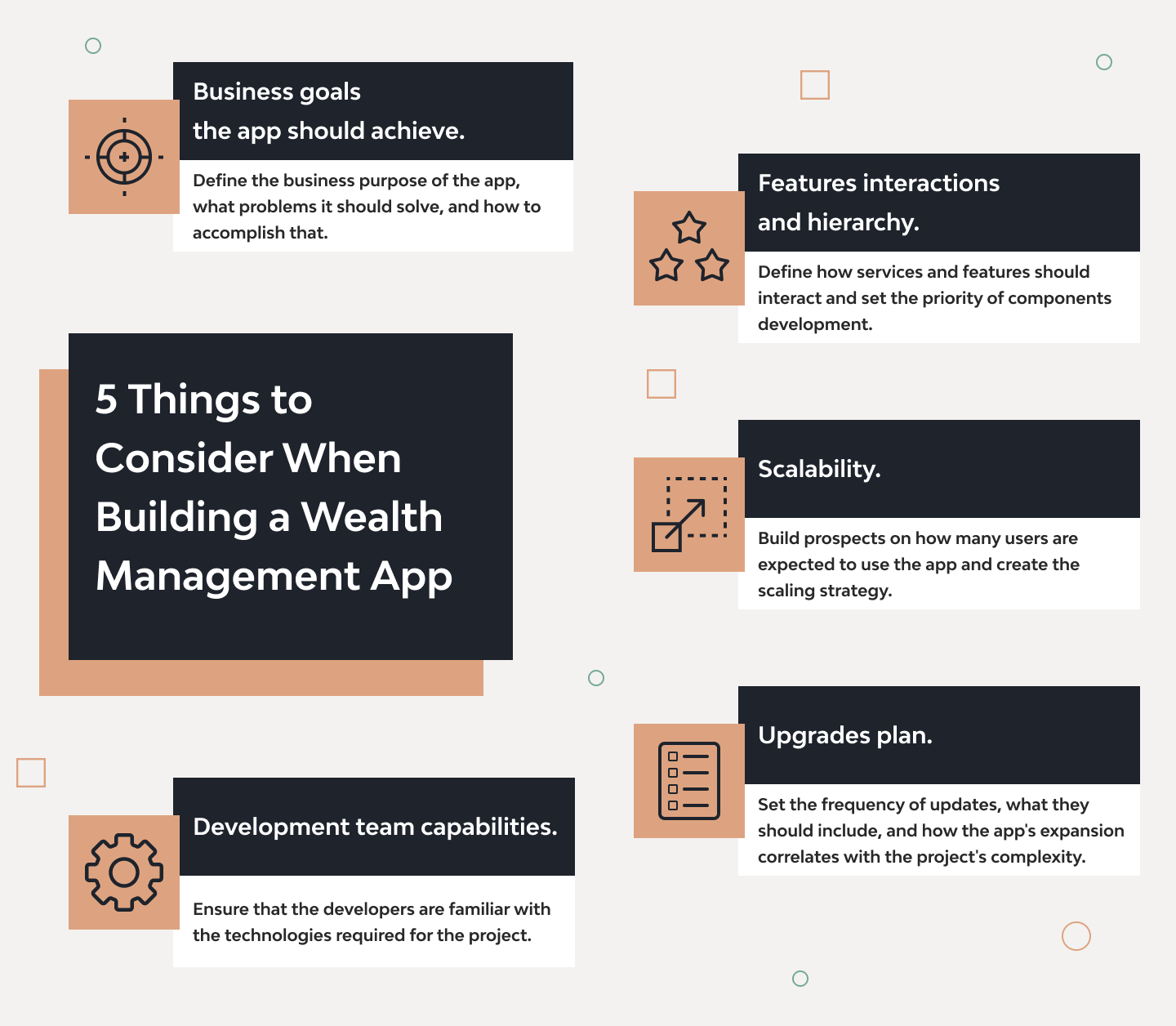

We advise our clients to be very specific and give the development team as much information as possible to make sure the architecture they’re going to design is suitable for the project. Here’s a short list of what to consider:

- The app’s goals and ways to achieve them. Define the business purpose of the app, what problems it should solve, and how to accomplish that. Also, explore competitors’ solutions to see how they handled specific user pain points.

- Component interactions and hierarchy. Establish what components are the top priority and should work without interactions. Additionally, clarify how other elements (services and features) should interact.

- Scalability. It is necessary to know how many users are expected to use the app and how many of them might use it simultaneously (at least the rough numbers). Another aspect to consider is the scaling strategy (for example, adding specific features for a group of users or new services for everyone).

- Upgrades and improvements. List the features that should be added to the app and determine their release frequency. Also, clarify the frequency of updates, what they should include, and how the app’s expansion correlates with the project’s complexity.

- The team’s knowledge and capabilities. Double-check that the developers are familiar with the technologies required for the project and have the skills to create a suitable architecture.

It’s best to gather this information in a team with developers and managers who can share their experience, expertise, and expectations.

Next, it’s essential to decide on the tech stack together with the development team. What tools and technologies should they use to create a fully-functional and reliable application?

Tech Stack to Build a Finance Management App

The tech stack depends on the architecture, features, and (largely) team composition. But assuming it’s a wealth management application that needs to be built, we should expect it to be secure and always available via the web.

Usually, we use:

- Python’s Django for the backend

- React for the frontend

- PostgreSQL and Redis for caching and database management

- AWS for cloud computing

- Nginx for DevOps tasks

The market offers various tools and technologies for money and bill management app development. So the tech team can mix and match them depending on the app’s goals, features, and composition.

For instance, companies shouldn’t hire Swift and Kotlin developers to build native mobile apps if they have Flutter professionals in-house who can create cross-platform applications.

When the tech stack is settled, it’s time to consider the functionality of the future app. Here are the essential features we advise our clients to pay special attention to when building a wealth management app.

Also remember that wealth management software testing, or rather its results, depends on the choice of the right technologies.

Wealth Management Software Features

Of course, applications can and should be different — this is how competition works. But still, there are features the target audience expects to see in a digital wealth management app.

Personalization and intuitive design

A personal finance app should be, well, personal. The software must analyze the user’s recent activity and adapt to their preferences.

For example, if the app has a news feed or suggestions, it should show relevant offers to the user — something they are interested in and can afford. Besides, it’s not the user’s job to search for the necessary information — the application’s interface should provide it via an intuitive design.

AI-driven financial suggestions

Depending on the type of investments the app offers – long-term savings portfolio or short-term trading – advisory services may vary.

The power of robot trading is fully revealed where it is necessary to carry out hundreds to tens of thousands of transactions per hour (with a profit of about $0.01 each): a human is clearly inferior to AI at such speeds.

For long-term plans, however, the participation of a human advisor, someone whose experience clients may trust, is preferable. (Say, people in conservative countries, such as Switzerland, tend to prefer personal advising — which can be seen in our case study with Clear Minds.) But even when we’re talking about long-term investments, AI can provide great assistance, as it allows for faster, more efficient, and cheaper solutions to multiple tasks.

Thus, due to digital transformation in banking and finance, it becomes increasingly difficult to do without AI.

Budget planner and expense tracker

Budget planning can be a function that’s as important as it is entertaining. When using the app, a person should be able to set a goal and see the progress.

An expense tracker could help achieve this goal faster. When users see their expenses categorized, they can find ways to spend less money in each category.

Notifications

Users should get notified whenever there’s activity surrounding their funds. But notifications can be used in many other ways to help them gain more profit. For example, the system can track the stock market or cryptocurrency rate and send notifications with beneficial offers.

Reports and analytics

Reports and stats are important tools for financial management. With reports, users will see everything they need to know about the state of their finances — profit, losses, expenses, savings, and their comparison over time.

Visual data allows users to assess their progress, especially if reports include inflation or currency exchange rates. So, it’s crucial to make sure that their reporting feature reflects relevant and accurate data for customers.

Top-notch security

Financial matters are a very private subject (some might even hide them from loved ones), so it’s important to ensure the highest level of app security. This includes providing two-factor authentication, following all security protocols and standards, and using cloud-based technologies. The last one is a massive advantage for data protection against hacker attacks, as cloud storage is very hard to break. But it also has other benefits.

The Role of Cloud-Based Technologies

Developing a money management app almost always means it should run in the cloud. This is thanks to:

- Higher performance. Cloud services work faster and have greater availability than traditional servers as they’re distributed across multiple cloud facilities. Cloud providers also fix bugs and update the system regularly, so the risk of a crash or downtime is minimal.

- Greater scalability. Cloud technologies can quickly increase power or add additional servers to handle the growing load. They can also engage fewer servers when the app doesn’t need them anymore, cutting expenses.

- Better data protection and security. On top of a highly secured storage, cloud technology has other data protection features. Continuous backup allows quickly restoring data in case of damage, while two-factor authentication and access levels prevent data leakage.

- Less server management headache for developers. Cloud providers manage all server-related issues, so developers can build an app faster without wasting time setting up and supporting servers.

All in all, more businesses gravitate toward cloud platforms as opposed to large on-premise servers, and we, as a financial planning software development advisor, fully support this shift.

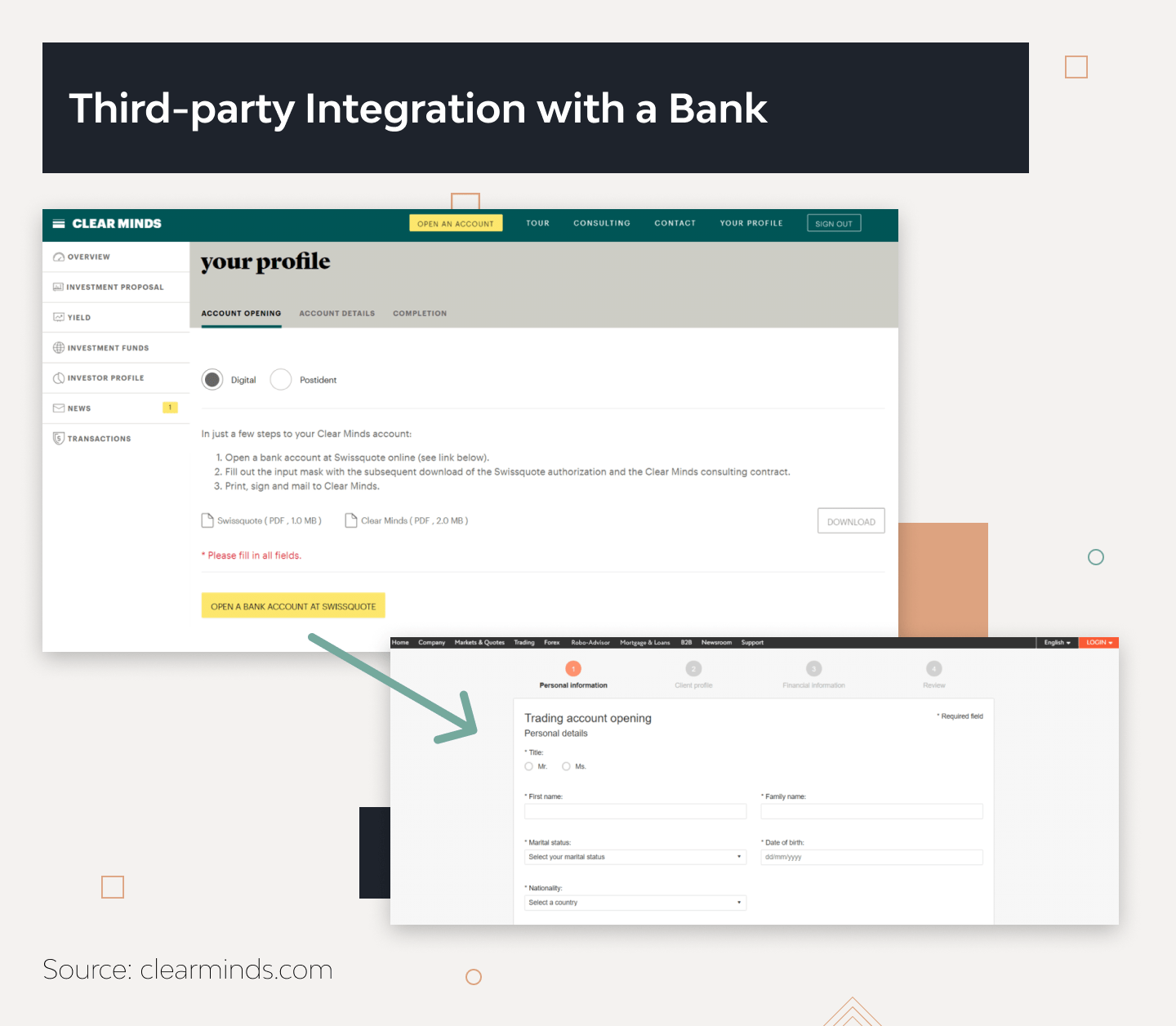

Third-Party Integrations for a Wealth Management App

Most digital wealth management platform features imply integrations, including:

- Bank services

- Credit reporting services

- Portfolio trading tools

- Forecasting tools

- Budget management, reporting, and calculation tools

The number and types of integrations will vary depending on the goals and audience. But we recommend our clients to at least consider integrations with banks and fraud verification systems if they are developing a finance-related app.

Wealth management apps usually combine dozens of third-party services. As a result, they’re challenging to manage and display in a user-friendly manner. Take purchasing stocks following an app’s advice. It requires the integration of consulting, investment, and banking services, processing a significant amount of data.

So, the tech team will probably divide the system into the business layer (the one the user interacts with) and the data layer (which contains clear data ensuring the work of the business layer). Connecting them requires third-party API layers — separate services that receive users’ information and return properly formatted data to the business layer. This way, all the integrations will work in perfect cooperation.

When it comes to finance management apps, two of the most important third-party integrations are Open Banking API and Experian Connect API. They allow embedding information from users’ bank accounts into apps and websites. They’re secure, thoroughly tested, and only give apps the right level of access.

So, while planning the app, consider all possible integrations, and budget them.

Cost of Wealth Management Software Development

No article can give you exact figures since finding out the cost of developing an application is only possible after careful consideration with a software development vendor. The project’s final price depends on many factors, but here is how we make a rough estimate for our clients.

The most accurate way to estimate the app’s cost is to leave it to the tech professionals, who can break the project into stages and tasks and provide specifications.

Typically, these specifications include:

- Description of tasks for the development of product functionality and features

- Estimated time (cost) of each specialist to complete the tasks

- Cost of tools for developing and deploying the application

- Cost of third-party integrations

This will be the most accurate price you can get.

Many factors influence the final price, so if the development cost exceeds the budget, the best way to reduce it is by changing them. For example:

- Start with MVP development (excellent for startups)

- Refuse secondary features

- Turn to lesser-known companies with lower prices

- Outsource development to countries with lower hourly rates for developers

After all, the client knows the business best, so we recommend keeping a cool head, looking at different scenarios, and finding trustworthy experts before diving into the development.

Final Thoughts

Wealth management software development is a promising venture. People have become more concerned about their finances and need effective tools to manage them. Plus, the market is not oversaturated yet. So, there’s a chance to attract thousands of users by offering tools for investing, budgeting, and financial planning.

Still, it’s critical to take many details into account to develop a truly functional, user-friendly, and high-quality application. Because even a brilliant idea depends on the tech team that is going to implement it. If you are looking for one, consider Django Stars.

Thanks to our experience in developing financial and banking projects, we can bring your ideas to reality and enhance the ones that could work better. Contact us, and let’s discuss your project!

- What's a wealth management app?

- A wealth management app is a service that provides investment and financial advice and helps with budget management using the financial data, goals, and preferences of the user.

- How is AI used in personal finance management app development?

- Artificial intelligence gathers and analyzes market and user data to generate accurate investment predictions or financial suggestions.

- What type of architecture should I choose for a wealth management app?

- The architecture type for an app depends on its features and business goals. You can choose from the most commonly used architecture types, such as microservice, event-driven, layered, or microkernel architecture.

- How much does it cost to develop a wealth management app?

- Application development depends on many factors, including features, integrations, tools, and the cost of the specialists' work. So, to find out the price, contact the development team and request a rough estimate or a detailed specification of your project's cost.