How to Develop an e-Wallet

Today’s relationship with money that people have is heavily reliant on digitalization and technology since they provide the convenience of receiving and transferring funds with a few smartphone taps. E-wallets are now a habitual part of a commonplace technology user, which is why the e-wallet app development and the competition between products like this calls for a profound understanding of the user and finding a shared need that the product covers.

So, let’s discuss how a product like an e-wallet, be it a desktop site or a mobile application, is built. In this article, we will share best practices that have worked for Django Stars and explain how they work through every stage of developing such a product, from the discovery phase to its MVP.

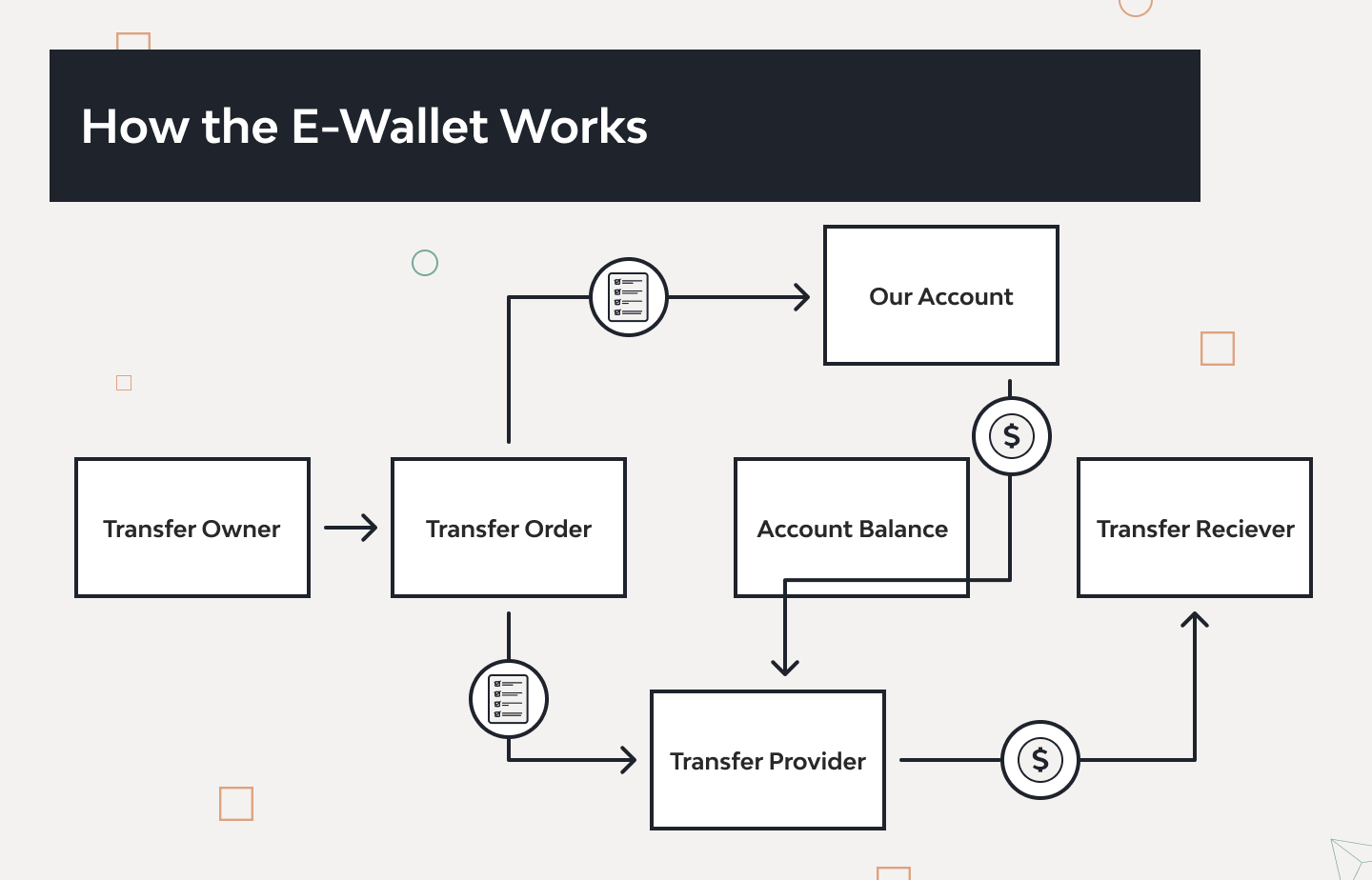

How the e-wallet works

The first question to answer for those who want to build an e-wallet app is what an e-wallet is. Essentially, it is a piece of software that allows users to make and receive payments without carrying around a physical bank card. From the development perspective, the focus is on when the real money becomes digital and then back to real, and how the software keeps track of all the transactions and statements without any functionality bumps for the end user.

Practically, when a company makes a salary or wage payment to one of its employees, the funds are transferred from a conventional bank account to an electronic wallet, which means that the money is digitized along the way. Once the money is in the employee’s account, they can perform further transactions with it: transfer to a similar account of their relatives, transfer it to a conventional bank account, or purchase goods/services from vendors who partner with the digital payment system the said employee uses. Hence, it is important for a user to have the freedom to use their money at their discretion, which is why it is paramount for the software developer to work through the process of digitalization and de-digitalization of the funds. Below, is how a transactional engine in such an application works.

The user’s account balance is maintained by the transactional engine, which keeps a record of all operations virtual and ‘hard’ money. Thus, it registers every instance of turning conventional money into digital money and the other way around.

In addition to virtual banking cards, an e-wallet allows storing and conveniently using other things that would normally go in a wallet: gift cards, tickets, reservations, and even documents. But the most immaculate part of development in such products remains the transfer of money.

What to consider when building an e-wallet application

Before starting the custom banking software development itself, stakeholders have to envision the final product or its MVP in as much detail as possible.

The first thing to consider is whether it will be a closed system. In a closed system, the transfer is possible only between the wallet and the bank account. Alternatively, a user will be able to use their virtual card as a Visa or Mastercard for any transaction or purchase from a system that accepts such payments. Based on the system built into the said e-wallet, one can design additional functionalities of the app and see clearly what compliance certification that company needs for the product.

Another critical concern in e-wallet app development is the architecture for third-party integrations. Integrating pre-existing software into your system is faster and easier in terms of development and compliance certification since the technology is already created and all the compliances come from the said integration creators. However, such a product may be eventually harder to make changes in if the API is the core of the application.

Once the functionality and architecture of the application are envisioned, the stakeholders have to work out ways to maintain the product’s compliance and the user’s data security. It is a challenge to develop a user journey within KYC and onboard them in the easiest way possible while staying compliant. When this concern is worked out, the stakeholders have to have a clear idea of what documents the user must provide and how they can do it (online or in person) to start using the app.

Based on the country of operation, one also has to have a clear idea of how data in the app will be protected. Commonly, these regulations depend on the country of operation. For example, to comply with state regulations and pass the necessary audit, a company has to have its servers right in the room.

To consider all the points above thoroughly and figure out how to create an e-wallet app, here is a list of questions that work for the Django Stars team while planning and developing an e-wallet.

Questions to answer before starting the project

| 1. Where will the company be registered? |

|---|

Compliance regulations vary from country to country, so it is crucial to consult a legal team about the legislation of a particular state you want to develop or operate in. |

| 2. Where do you plan to attract customers from? |

The answer to this question will help you understand how to further monetize the application as well as elaborate a suitable user journey for your audience. |

| 3. Do you need a banking license? |

If the product requires a license, it must be taken into account during development. First of all, it’s good if the developer has ISO certification. Developers with this certification can ensure the quality of the product and that it will pass the audit. |

| 4. How will money be deposited into the e-wallet? |

The answer to this question will affect the product’s architecture and the logic of its functionalities. |

| 5. Do you plan to issue Visa/Mastercard cards? |

Issuing cards from these payment processing networks will require your team to inquire about PCI/DSS Audit. It is required to prove the company’s ability to protect the cardholder’s data. |

| 6. How do you plan to perform KYC? |

The process of identity verification for the customer must be as easy as it is secure. For example, while working on Molo, Django Stars successfully incorporated the existing identity verification technology into the product to accelerate onboarding and build a streamlined customer experience without compromising security. |

| 7. What AML requirements do you need to follow? |

This question concerns both the legal department of a company and the development team. |

| 8. How do you plan to transfer money? |

It can be a SWIFT transfer, wire transfer, ECH for the US, or SEPA for European countries. |

| 9. Do you plan to have cryptocurrency in this e-wallet? |

Even if you do not want to make it a crypto wallet from the start, planning this functionality for the later future will also impact the initial development. |

| 10. Do you plan to integrate with merchants into the e-wallet? |

With such an integration, the customer will be able to use loyalty programs or bonuses from particular merchants, but the decision on this integration must be made before the development starts. |

| 11. What do you want to do first? |

Decide whether it is a web application or a mobile application first to figure out what to develop at the start. |

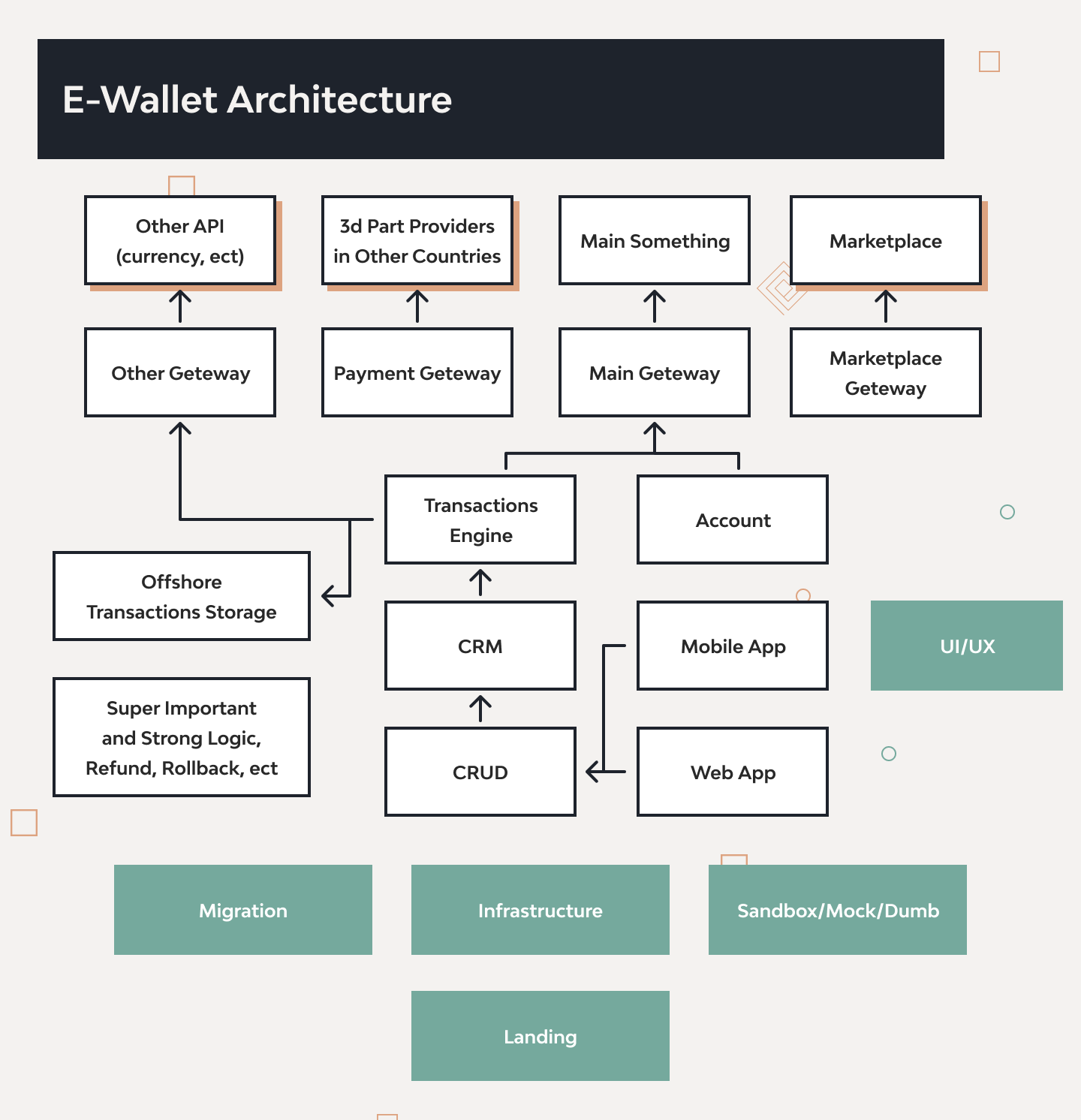

Necessary components of an e-wallet

Based on the accumulated experience of building fintech applications and previous research of similar systems like TransferWise, the following components are all musts for functional and secure e-wallets. Here is a list of the capabilities that the application must have with the detailed features that facilitate them.

| 1. User Registration and Authentication: |

|---|

| 2. Personnel Data Management: |

| 3. Salary Setup and Processing: |

* This is not a default feature for most electronic wallets out there, but we included it since they often are used for mass payments (including payroll payments). |

| 4. Payment Gateway Integration: |

| 5. Compliance and Reporting: |

| 6. Data Protection and Privacy: |

| 7. User Interface and Experience: |

| 8. Notifications and Alerts: |

| 9. Support and Helpdesk: |

| 10. Security and Fraud Prevention: |

| 11. Integration with Financial Institutions: |

| 12. Audit and Reporting Trail: |

All the mentioned components make up the product architecture, which needs to be approved by the product CTO.

Team composition and development costs

The decisive stage for the final product and its scope takes place before the development itself. From our experience, we’d suggest starting from the discovery phase. This phase helps to find insights about potential users or just define what users to target the application at. Throughout the discovery phase, stakeholders can answer the questions we listed above work out the ideal team composition, and plan the architecture of the product.

Apart from providing insights on product users and space for all the pre-development preparations, the discovery phase is crucial for realistic timeline planning road-mapping the whole delivery process. It gives a clear picture of the necessary scope of the application or its MVP, which also prevents developing things that are unnecessary thus saving time.

After a successfully completed discovery phase, the product stakeholders can be certain about the following:

- Product roadmap;

- Application functionalities;

- Team composition;

- Budget.

Case in point: Django Stars’ experience

One of the recent projects we developed was an electronic wallet. Particularly, the discovery phase helped to determine the use cases for such a product which is receiving payroll payments and transferring money to the other family members or relatives. The research helped to determine the necessary functionalities of the future product that are important for a particular demographic and thus make the best service for them.

Apart from the user persona, the research helped to define a perfect team composition for such a scope. In our case, developing an e-wallet includes the following specialists:

- Project manager;

- Two Backend Engineers;

- Solution Architect;

- UI/UX Designer;

- Two QA Engineers;

- Two Frontend Engineers;

- Business Analyst;

- DevOps Engineer.

In such a team composition and the set scope of functionalities to incorporate, a project like this can take 5 to seven 7 months to complete on the $400k budget.

However, the final estimates for a particular project will depend on the results of the discovery phase and how you answer the questions about your product listed above.

Conclusion

The preparation to develop an e-wallet app involves addressing critical questions related to compliance, data security, and functionality. A clear vision of your product’s functionalities related to the needs and financial habits of your user persona helps shape the product at the discovery phase. It’s crucial to consider factors such as the type of system, third-party integrations, and compliance with various regulations, depending on the country of operation.

Working through all the necessary considerations for an e-wallet app allows for informed decision-making, efficient timeline planning, and the creation of a product that resonates with users, namely helps to create a realistic roadmap and define the development budget. However, there is no template for the scope and budget that will fit perfectly in every case.

Instead, begin with discovery: map core use cases, regulatory constraints, and required integrations; build costed scenarios; and prototype the riskiest flows. Competitive research should also include gamification in banking examples—savings streaks, goal-based challenges, and tiered rewards—to prioritize engagement features that lift activation and retention while staying compliant and within the target budget.