P2P Lending Software Development Guide: From Concept to Launch

In today’s hyperactive and volatile economic situation, loans help entrepreneurs to weather the most unpredictable market shifts and allow businesses to remain stable. Specialized digital platforms and products of custom P2P lending software development enable money-borrowing opportunities that are easily available and flexibly managed.

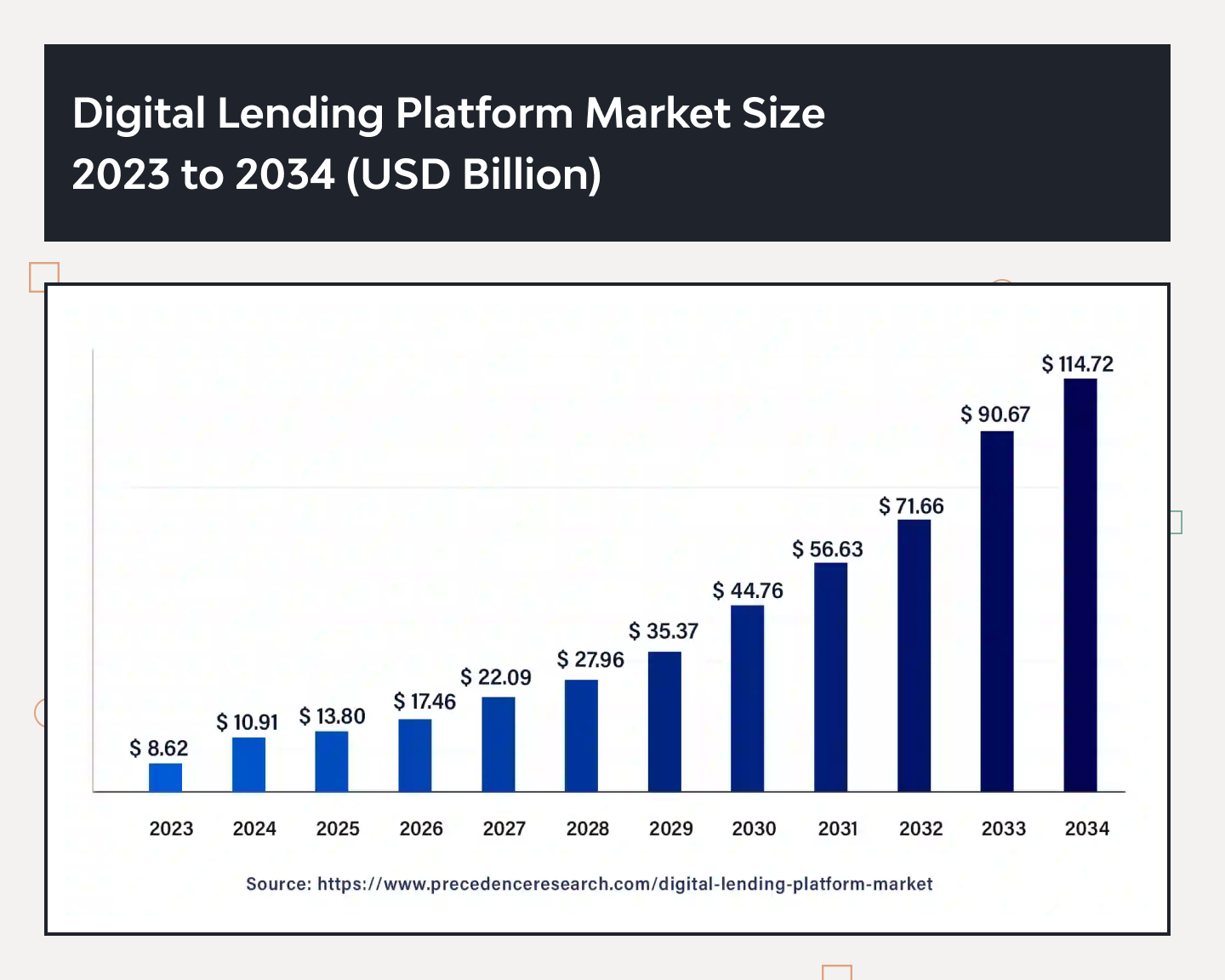

So much so that today’s digital loan platforms form an almost $14-billion worth market. And it brings us money lending software of all scales, from personal credit management solutions to software for microloans to enterprise products.

Do you wish to learn how to create a peer to peer platform that you could monetize and turn a real profit? This exhaustive guide will tell you all about P2P lending software mechanics, reasons for developing one, important pre-development considerations, and full-cycle development stages.

Takeaways:

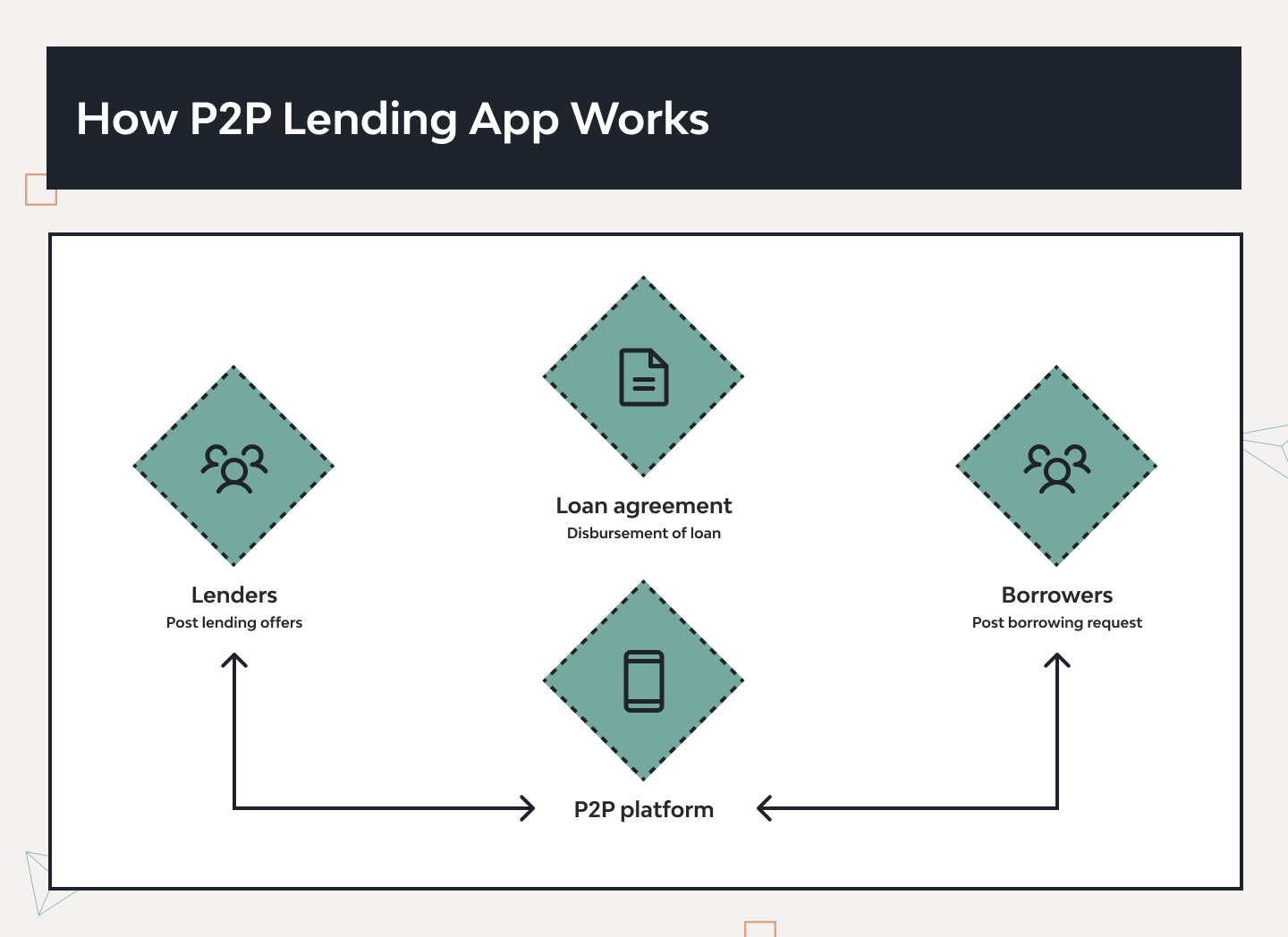

- A P2P software allows borrowers to post loan requests and lenders to pick them via internal screening, then fulfill them with the help of featured tools.

- Building a custom software for lending money for internal or public use can be a great income prospect due to fees and other monetization opportunities.

- A new P2P lending software can be monetized by issuing service fees, profiting from interest rate margins, setting subscription payments, or using affiliate marketing.

- The main stages of P2P lending software development include market research, legal checks, business model selection, feature selection, UI/UX design, MVP creation (optional), software development, and testing. But to handle them properly, you will need a developer’s team’s assistance.

- Estimated costs you’ll need to cover range from $25,000 for a basic MVP to $150,000+ for a full-featured platform.

What Is a P2P Lending Software?

P2P lending software is a pre-tuned platform for two types of users: lenders and borrowers, where they can connect with each other and manage custom loans on a peer-to-peer basis. That means loans can be requested and issued directly between two P2P lending software users, with no extra mediation and third parties.

Thanks to the peer-to-peer lending principle, such software allow both parties to avoid a lot of overhead costs, forced commissions, and tariffs of large banks and other financial mediators. On top of that, a custom peer to peer platform is usually automated to match people who want to borrow money with people who want to lend it.

The software checks the borrower’s credit and sets an interest rate. It also handles risk assessment and other loan servicing options depending on the set of features and personalization options included.

Thus, a software for borrowing money in a P2P format enables:

- borrowers to request loans

- lenders to issue loans

- both sides to manage loans

This can be a regular mobile or web solution, making it especially easy for any borrower to find loan opportunities and get an end-to-end lending experience in one place.

For instance, a mobile or web solution can onboard a new user, assess their credit history and score, originate a respective loan, initiate the lending service, and track, remind, and register repayments.

Common Types of P2P Lending Solutions

A range of features, tools, and capacities of a software depends first and foremost on its main focus, type, and architecture.

Personal loan platforms

The platforms for unsecured personal loans are the original P2P use case and remain the most popular segment. These are where borrowers request relatively moderate amounts ($1,000–$35,000) for debt consolidation, home improvements, major purchases, or other personal necessities. Investors fund portions of these loans in exchange for interest income.

Examples:

- Prosper — a US-based peer-to-peer lending platform that streamlines borrower-investor relationships through risk-based pricing and automated underwriting, which enable personalized loans.

- LendingClub — one of the largest digital loan platforms in the US for unsecured personal loans with fast approvals and AI-driven credit decisioning.

SME loan platforms

There are also more business-oriented platforms that are intended for user audiences seeking to fund entrepreneurship, launch a startup, or grow a small business. Loans offered by such platforms go higher and may range from $5,000 to $500,000, depending on an entrepreneur’s ambitions and ability to back up the investment with any business assets or revenue-based repayments.

Examples:

- Funding Circle — a global online lending marketplace focused on small and medium-sized businesses that seek fast, flexible loans with end-to-end digital processing and investor-backed funding.

Microlending and microloan solutions

For borrowers who need small and extra small amounts of cash, there is a software (usually with a simpler architecture) that offer fast microloans of $25–$500. However, this doesn’t work like a traditional credit, with much shorter repayment terms, fixed fees, and no credit history impact.

Examples:

- Kiva — a nonprofit microloan solution that enables individuals to lend as little as $25 to underserved entrepreneurs and communities globally, with a strong social impact and crowdfunding model.

Mortgage and real estate crowdfunding

The real estate industry and related operations are so formidable and specialized that they often require separate dedicated solutions. For instance, a web or mobile lending solution can help manage fractional investments in property loans or construction projects. Investors can use it to pool capital to finance residential or commercial mortgages, with automated repayments based on interest or project-sale profits.

Invoicing and supply chain solutions

There are also narrowly-specialized invoicing and supply-chain platforms built for medium- to large-scale business and enterprise needs. These can help get working-capital advances from individual or institutional investors to cover unpaid invoices. For instance, a company may sell outstanding invoices at a discount to get immediate cash, while investors collect full payment later, earning the spread.

Examples:

- FundThrough — a fintech company that accelerates cash flow for SMBs with quick access to funds through invoice factoring. It has distributed over $1 billion in working capital, supporting businesses across North America.

How to Start a P2P Lending Software Development Project: Principles and Mechanics

A dedicated borrower-lender software facilitates the usual lending experience, automates both routine and complex steps (like underwriting), and provides for faster yet more efficient AND cost-efficient loan flows. But the foundation here is the mentioned peer-to-peer lending principle. So before all else, how do they work?

Peer-to-peer lending principle

Most P2P loans are unsecured personal or business loans (rarely backed by collateral). A borrower applies (specifying relevant income, credit score, loan purpose), and the platform assigns a credit rating or risk category. Based on that rating, an interest rate is set. Investors then review loan listings and choose which loans to fund.

The loan principal is split among one or more lenders (often in small chunks to diversify risk), and the borrower makes monthly payments (interest + principal) back to those lenders via the platform. The platform earns revenue by charging origination fees to the borrower and service fees to the lenders.

Peer-to-peer lending software mechanics

A software digitizes the above-described processes, packing up and accelerating borrower-lender experience. To carry out all the functions, however, a solution must have algorithms that enable a range of fintech functions.

For a more detailed breakdown, let’s take a look at the essential stages that a P2P lending solution must provide for users to start giving or getting loans:

- Borrower onboarding and KYC: Implementing thorough user onboarding for loan software working with personal and/or business finance. Both borrowers and lenders must fully register, complete identity verification (via the Know Your Customer algorithm), and link proper bank accounts.

- Credit assessment: The solution must be able to run credit checks and assign risk grades, respectively. For underbanked users, the software can use alternative data sources and machine learning models to project their earning potential and repayment probability.

Loan listing and matching: A usual two-way interaction between borrowers and lenders in a P2P lending software is based on periodic, short-term cooperation:

- Funding and disbursement: A loan can be fully funded either by one lender or multiple investors; after that, the software must automatically disburse funds to the borrower’s account.

- Servicing and repayment: Automated payment schedules, reminders, and collections can be handled by the software, with funds distributed back to lenders after fees, completing the loan cycle.

Why Should You Develop a P2P Lending Software?

A good, feature-rich fintech loan software can bring lots of advantages for borrowers and lenders of various scales and needs. Built with the core user audience in mind, such a solution can also turn a major profit.

For one thing, P2P lending software development can bring a massive return on investment if you create a purpose-driven software that becomes popular in its niche (and becomes monetizable). However, there are more reasons than that to implement a new digital lending solution.

A quick business growth push

If you own an eCommerce or another type of business, more digital channels means more user acquisition momentum for you. An efficient P2P lending software can onboard thousands of borrowers and lenders in weeks, with good targeted marketing and referral programs.

Extensive revenue opportunities

P2P lending software can generate fees on loan origination, servicing, and optional subscription plans. And since such software allows for lower overhead costs, you can achieve higher margins through efficient monetization and make outstanding profits.

A facet into new global user audiences

Having a dedicated digital platform can also help a business or entrepreneur break geographic barriers and reach into emerging markets and underbanked populations. For instance, in Asia, Latin America, and Africa, fintech app development and adoption is growing at 20–30% annually.

Access to underbanked user audiences

Underbanked users are individuals who either lack availability of adequate financial services (in their region or due to force-of-nature circumstances) or have poor credit histories (due to banking issues, legal disputes, etc.). You can offer alternative credit scoring for users with thin credit files and capitalize on this audience.

- Lower overhead than traditional lenders

Without branch networks or large compliance teams, P2P platforms can automate underwriting and servicing, cutting operational costs as compared to what full-scale banks ask.

Challenges and Risks of Creating a P2P Lending Software

Saying it as it is — developing and managing a user-intensive P2P lending software can be pretty demanding. This type of software is in a delicate segment of digital finance solutions and apps that interact with personal user assets.

This is why it is crucial to mind potential risks and challenges, like:

Credit default risk

A long-term stable software cannot and should not be built without a budget that would provide for delinquencies in case the solution fails to monetize in its first iterations.

Debt recovery complexities

If a software deals with cross-border loans that are regulated by different jurisdictions, cross-jurisdictional law enforcement can be too expensive to cover. Which is why it’s of immense importance to include clear legal agreements and local counsel in your planning.

Regulatory uncertainty

Licensing, capital requirements, and consumer-protection laws vary by region. You should stay in tune with regional guidelines, like FCA in the UK, SEC in the US, and APRA in Australia.

Limited loan amounts

You will have to cap individual loans, so to make the limits unnoticeable for users, try to diversify offerings, e.g., providing multiple types of loans.

Platform liability and reputation risk

On a technical side, even a few high-profile defaults or technical outages can undermine user trust, so invest in security audits and cyber protection measures.

How to Monetize a P2P Lending Software

There are a number of ways to make profits on a newly developed solution for digital lending, it all depends on which monetization model(s) you choose exactly. Commonly, you get to pick from:

Origination (service) fees

The most common revenue stream for P2P platforms is the origination fee — a charge to borrowers when their loan is funded — and a servicing fee to investors for loan administration.

How it works:

- Borrower fee is charged as a percentage of the loan principal (typically 1–6%) once a loan is issued.

- Investor fee is an annual servicing fee (around 0.5–1%) deducted from each payment distributed to lenders.

Interest rate margins

Beyond per-transaction fees, platforms can capture a portion of the interest-rate spread — the difference between the rate paid by borrowers and the yield delivered to investors.

How it works:

- Borrowers are quoted an APR (e.g., 12%), while investors receive a slightly lower yield (e.g., 10%). The platform retains the 2% margin.

- This model allows the software to offer incentives based on the lending volume: higher loan origination means more margin captured.

Subscription plans for lenders

Offering tiered subscription packages unlocks premium features for investors — such as advanced analytics, early access to high-grade loans, or waived platform fees.

How it works:

- Lenders choose a monthly or annual plan (e.g., $10/month or $100/year) for premium tools or reduced fees.

- Free tier users can still participate, but with standard features and higher transaction fees.

Affiliate offers or insurance upsells

By partnering with third-party services — like credit insurance, payment protection plans, or financial advisory services — you can cross-sell relevant products and earn referral commissions.

How it works:

- Integrate affiliate links or widgets into borrower journeys (e.g., “Add credit insurance for $X/month”).

- Earn a percentage of policy premiums (e.g., 10–20%) or a flat bounty per sale.

You can find more approaches to profit from a new P2P lending software, like hybrid monetization and custom loyalty programs, if you turn to a specialized software development consulting company.

Other Things to Consider Before P2P Lending Software Development

Now, before we learn how to create a P2P lending software, some necessary prep stages exist mostly due to the financial and legal involvement of the services that this software will provide.

- Find a good lawyer — you’ll need specialist help drafting borrower/lender agreements that will be used in the software, as well as handling licensing.

- Hire financial specialists — a credit risk analyst, a data scientist, or a CFO could serve as development team additions to back up the solution’s reputation.

- Formulate a loan agreement — in it, clarify Terms & Conditions of your services, security interests, and late-fee schedules.

- Find a bank partner — they will help you manage regulated payment flows and create custodial accounts.

- Mind local and international laws — if your software is expected to mediate cross-border loans, make sure to research their jurisdictions and legal loan disbursement systems.

- Consider multiple integrations — you can integrate KYC engines, accounting and loan management systems, CRM/ERPs, payment processors, and additions enabling alternative lending models.

How to Start Develop a P2P Lending Software

While each project requires a unique workflow, there are ultimate common stages that every new solution in development must go through, whether you’re building a P2P lending software or an online loan platform.

Let’s now learn how to create a peer to peer lending software step by step.

Step 1. Research the market and analyze competitors

First things first, you need a capable and competitive lending platform architecture, which calls for a thorough market and competitor research. What you should do is map the strongest solutions in the existing market, take a closer look at them, and try to see where they may be undeserving borrowers or point out other UI/UX pain points.

For market/competitive research, above all else, you need to answer these product questions:

→ Which pains or needs will your software handle for its users?

(Provide fast loans at low fees? / Cover a range of financial needs for business borrowers?)

→ Who else is providing solutions for the same pains and needs?

Here’s a cheat sheet for you: According to a simple, superficial Google research, some of the top key players in the P2P lending software development niche right now are:

- Prosper

- LendingClub

- Funding Circle

Each platform stands out in its own right and covers certain ranges of borrowers’ needs — to achieve a competitive edge, you can a.) Collect the best stuff each platform has into one ultimate solution, and b.) Add new extra features for a competitive edge.

Step 2: Adhere to security compliance and legal requirements

Tapping into peer-to-peer loans, you need to build a secure lending software that will not only protect personal data and instill user confidence. It should also safeguard your business from legal disputes and losses in both costs and reputation.

Here’s the exact legal moments you’ll need to prioritize in your solution:

- KYC/AML regulations

A KYC algorithm enables a basic user identity check and legitimacy verification. Also, since P2P platforms are classified as Virtual Asset Service Providers (VASPs) under FATF, your solution will need an integrated AML framework. - PCI DSS for payment security

If your software processes, stores, or transmits cardholder data, PCI DSS compliance is mandatory to avoid crippling fines and reputation damage. - GDPR or CCPA for user data protection

- Under GDPR, any software processing “personal data” of EU residents must implement Privacy by Design and Data Protection by Default.

- CCPA grants California consumers rights to know, delete, and opt-out of the sale of their personal info.

- Local regulatory frameworks (by region)

Algorithms governing the compliance with each of the above regulations can be added as separate modules.

Step 3: Select the right business model to be profitable

Decide between marketplace, balance-sheet, or hybrid models; each has different capital needs and risk profiles:

- Marketplace (Agency) Model

In the marketplace model, the platform acts as an intermediary, connecting individual or institutional lenders with borrowers. It never uses its capital to fund loans; instead, investors provide 100% of the funding.

- Capital needs: Very low — no need to hold large loan portfolios

- Revenue streams:

- Origination fees (charged to borrowers upon funding)

- Servicing fees (collected from investors on repayments)

- Pros: Rapid scalability, light balance sheet, clear fee-based economics.

- Cons: It depends on investor appetite and funding gaps if supply lags demand.

- Balance-sheet (Proprietary) Model

Here, the platform originates and funds loans directly from its own balance sheet, akin to a bank. It assumes full credit risk and retains loans as assets.

-

- Capital needs: High — requires equity or debt financing to fund loan originations.

- Capital needs: High — requires equity or debt financing to fund loan originations.

- Revenue streams:

-

- Net interest margin (Earned on the spread between funding cost and borrower rates)

- Origination and servicing fees (Additional fee income)

- Pros: Greater control over underwriting and full capture of interest income.

- Cons: Capital-intensive, increased regulatory scrutiny, credit concentration risk.

- Hybrid Model

The hybrid model blends marketplace and balance-sheet approaches: the platform funds a portion of loans while enabling external investors to co-lend.

- Capital needs: Moderate to high — some balance-sheet funding requires capital, but risk is partly shared with investors.

Revenue streams:

-

- Mixed fees and spread (Origination and servicing fees plus net interest on balance-sheet loans)

- Securitization gains (Potential revenue from loan sales and securitizations)

- Pros: Funding resilience during liquidity crunches, diversified income, regulatory alignment with risk-retention requirements.

- Cons: Operational complexity, requires firm capital markets strategy, higher compliance burden.

Step 4: Choose the necessary features to stand out

Below in this article, you can find a full disclosure of all the basic features and auxiliary tools a good P2P lending software needs. Beyond basics, add AI-driven credit scoring, social-collateral networks, or instant approval flows to differentiate.

Step 5: Choose an appealing UI/UX design to grab the user’s attention

Now, it is essential that your loan software workflow is visualized and displayed on the user’s frontend — the quality and appeal of UI/UX design must never be downplayed. However, we can provide only so much advice here, with the overall software design implementation shaped by your designer and other software specialists.

A few pro tips:

- Keep it clear: Present only crucial inputs up front and hide advanced options. For example, show basic loan terms first, then reveal rate breakdowns or collateral requirements via “Learn more” toggles.

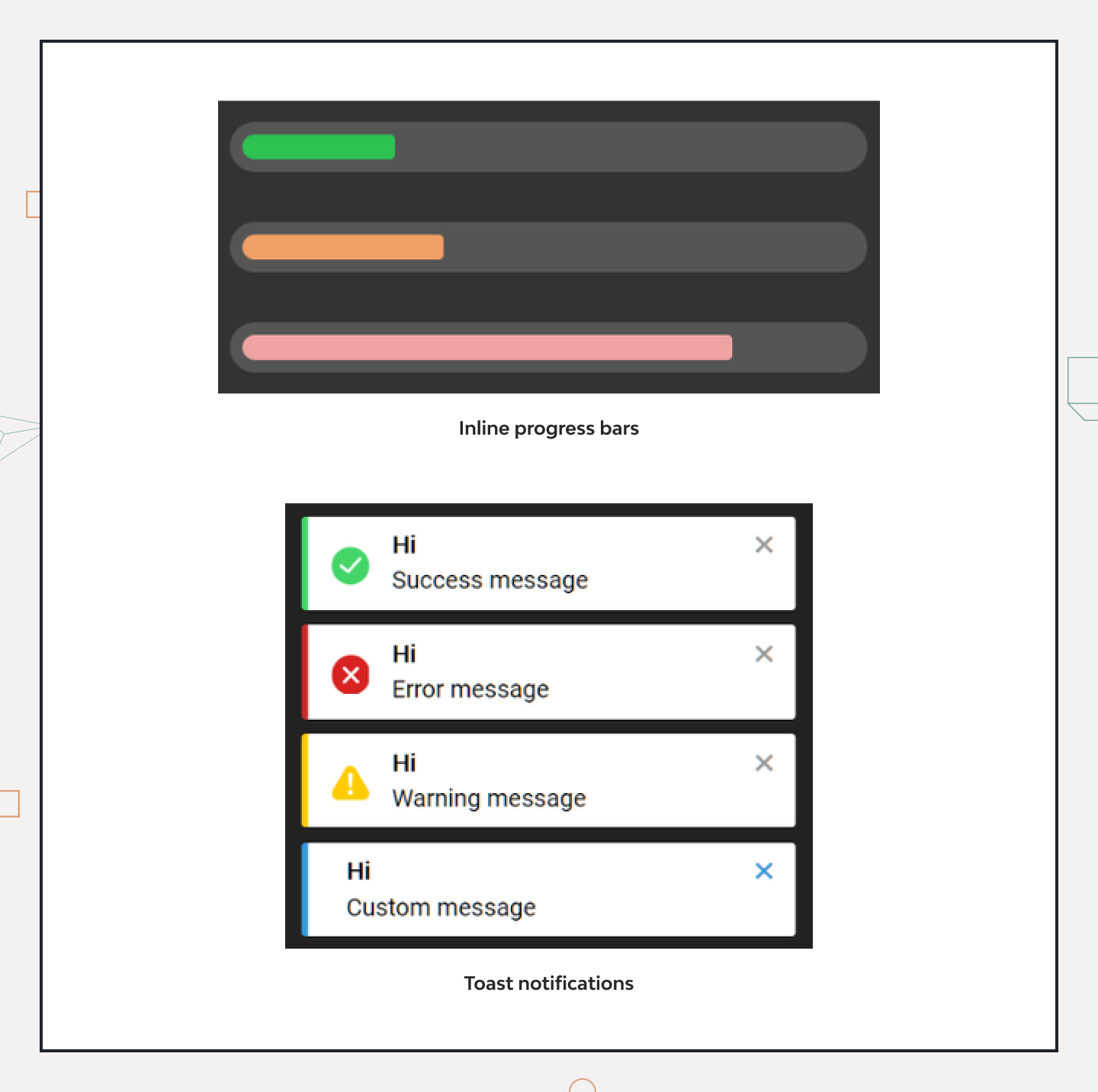

- Provide status updates: Use inline progress bars or toast notifications to inform borrowers and lenders about software milestones — e.g., “90 % funded” or “Payment processed.”

- Gamify loan repayment tracking: Incorporate visual streaks or achievement badges when users make on-time payments — this will keep them engaged and motivated to keep up with loans.

Step 6: Create an MVP to save money

At this point, you should have in hand a P2P lending platform software development plan, a basic concept, and a UI/UX outline. Adding some core functionality can be just enough to create a Minimum Viable Product — a very basic version of your future full-scale solution demonstrating the concept’s worth and main functionality “in a nutshell.”

To efficiently build an MVP that hits the spot for users and refine it into a high-quality platform, make sure to:

- Add core UX only: Build the essential paths — user registration, loan request posting, funding mechanisms, and repayment processing. Postpone peripheral loan software features like social sharing or advanced analytics for now.

- Launch quickly and collect feedback: Release your MVP to a small user cohort, collect feedback on usability and loan experience, then iterate the desired changes in the software.

- Monitor and learn: Track key metrics such as funding time per loan, and on-time repayment rates. Use these insights to prioritize the next set of features.

Step 7: Develop and test your peer-to-peer lending software

Knowing how to build a peer to peer platform will save you from unexpected project twists, unnecessary functionality, and unwanted expenses. But to implement a full-blown platform, you’ll need a team ready to carry out full-cycle personal P2P lending software development.

Your fintech software development services provider of choice should lead the way and handle responsibilities, including: wireframing and architecture engineering, hardcoding and integration of features, implementation of algorithms, software testing, deployment and functional launch of a finished solution, and post-release support and updates.

If you are gathering a team to design a new peer to peer loan servicing software, make sure to consult all development stages.

You can also leverage these best practices:

- Try Agile sprints: Organize development into 1–2-week sprints, each culminating in a working increment. Hold sprint planning, daily standups, and sprint reviews.

- Use automated test suites: Implement unit, integration, and end-to-end tests that run on every code and try to catch regressions early on.

- Do penetration testing: Before public launch, turn to financial security experts to perform a pentest of your API endpoints, data storage, and payment flows.

- Make a pilot group rollout: Release the software to beta testers or trusted customers to double check, see how the it handles IRL stress-load, etc.

Key Features of a P2P Lending Software

A new platform can be packed with a range of tools, but the main go-to lending software features are the same or very similar from case to case. In the opinion of our software engineers’ and specialized loan software UI/UX designers, a good platform should provide at least the following list of features.

User registration

The ideal user registration screen scenario is when a software prompts a new user to choose a borrower or investor role, then runs a soft credit check and mobile-phone OTP confirmation before granting full access to a newly created user cabinet.

Primary features:

- Email, phone, or social sign-up and login options

- Borrower/Lender profile type selection

- Automated KYC/AML compliance checks

- Multi-factor authentication via SMS or email

Secondary features:

- CAPTCHA and bot-detection services (reCAPTCHA, hCaptcha) to block automated hacker attacks

- GDPR/CCPA-compliant data use consent screens

Loan calculator

At the most basic level, a handy loan calculator must enable borrowers to adjust their loan amounts and terms, and get respective monthly payment and APR breakdowns. A custom calculating engine can be designed to offer any extent of filters and calculation options, as well as support any number of currencies.

Primary features:

- Dynamic range engine capable of calculating monthly payments, APR, total interest, and payoff schedules based on history or predefined input

- Side-by-side view of different calculation variants

- Graphical amortization chart visualizing principal vs. interest rates

Secondary features:

- Integrated financial libraries (e.g., an open-source Finance.js)

- Localization and multi-currency conversion

Document upload

Submission of IDs and other documents is the irreplaceable part of the money lending process — everything must be kept legit on all sides. That’s why it’s essential to equip a P2P loan software with features for capturing and cropping IDs, scanning receipts, and uploading paperwork and forms.

Primary features:

- Multi-format support — PDF, JPEG and PNG, DOC and DOCX

- Internal camera scanner for capturing and auto-cropping documents

- OCR and data recognition to extract key data from docs and pre-fill forms

Secondary features:

- Fraud detection integrations (e.g., FaceTec, Socure for image authenticity checks)

- Secure storage and encryption (e.g., encrypted AWS S3 or Azure Blob storage)

Software tracking

To get a good outlook of all internal processes and keep their loans in total control, your new users will need a dashboard that displays loan progress stages, alerts and notifications, and widgets. For instance, you can enable borrowers to track their loans by stages — “Submitted,” “Under Review,” “Funded,” “Disbursed”.

Primary features:

- Real-time loan status updates and timestamps

- Email and push notifications (e.g., about upcoming payments or missing docs)

- Internal chat or user support widget

Secondary features:

Payment gateway integration

A lending software must accept and process payments, be it a lender-borrower transaction (or vice versa), subscription payments, or extra service payments. On top of that, it will need to originate fees related to the loan and service commissions for a platform monetization.

Primary features:

- Multi-channel disbursements, e.g., support of ACH/SEPA, domestic wires, and prepaid cards

- Automated repayments — recurring debits from linked cards or bank accounts on due dates

- Calculation and deduction of internal and origination fees

Secondary features:

- The PCI DSS compliance module will help protect users’ card data

- Alternative payment methods — custom payment gateway integration, PayPal, Google, Apple Pay, and Buy-Now-Pay-Later integrations

Rating system

A lending platform will also need a system to categorize and rate user credit reliability and loans. To enable this, you will need a built-in interest rate engine or some credit scoring integration.

Primary features:

- Borrower credit grades — grades A–G, assigned automatically based on credit score, income, and loan purpose

- Peer reviews and feedback (lenders should be able to rate repayment experience and thus form the borrower’s reputation)

Secondary features:

- Trust badges and milestones, like the acknowledgment and reward of on-time repayment streaks

- Gating mechanisms that unlock extra lending opportunities for high-grade borrowers

Admin panel

For the administration and maintenance side of the platform, as well as technical loan management and internal analytics, you’ll also need a backend tool panel accessible to developers and tech support.

Primary features:

- Loan origination dashboard for manual approval/rejection of loans, complete view of created user applications, and assignment of underwriting tasks

- Internal analytics to track default rates, user behavior trends, and other metrics

- User management, e.g., role-based access and moderation of the cabinet

Secondary features:

- BI integrations (Power BI/Tableau for in-depth BI reports and data forecasts)

- Alerting of internal errors and SLA monitoring (helps analyze user satisfaction)

How Much Does P2P Lending Software Development Cost?

Off the top of one’s head, a new custom fintech solution can cost from $25,000 for a basic MVP and up to $150,000+ for a full-featured platform. The final price is shaped by the hourly rate of your lending software solution provider of choice, the complexity of functionality or design, and the range of project-wide expenses.

A lot depends also on the region and locality where you hire specialists and launch a development project. To give you an approximate estimate, here’s how much you may expect to pay under different conditions:

Mind that bespoke software development services can require a felt upfront investment, but the ROI will also be higher with a unique, authentic solution that you can control fully.

Conclusion

Peer to peer loan software remains especially relevant and in demand, with more underbanked and limited-in-utilities user audiences gaining access to digital service cabinets. If you are planning to create one, you should be ready to take on legal responsibilities, handle expenses, and bring real, tangible use with your new software — be it via reasonable fees, loyal conditions, or all-in-one opportunities.

To get consulted on whatever the scope of features you are looking to implement, choose the best development scenario, and partner up with seasoned professionals for a new full-cycle development project – get in touch with specialists at Django Stars!