Best Fintech App Development Companies in 2026

With more than half of the world’s population expected to use digital banking in 2026, the market for financial technology services is sure to keep busy. There are almost 30,000 fintech startups in the world, and fintech app development companies make up a considerable chunk of those.

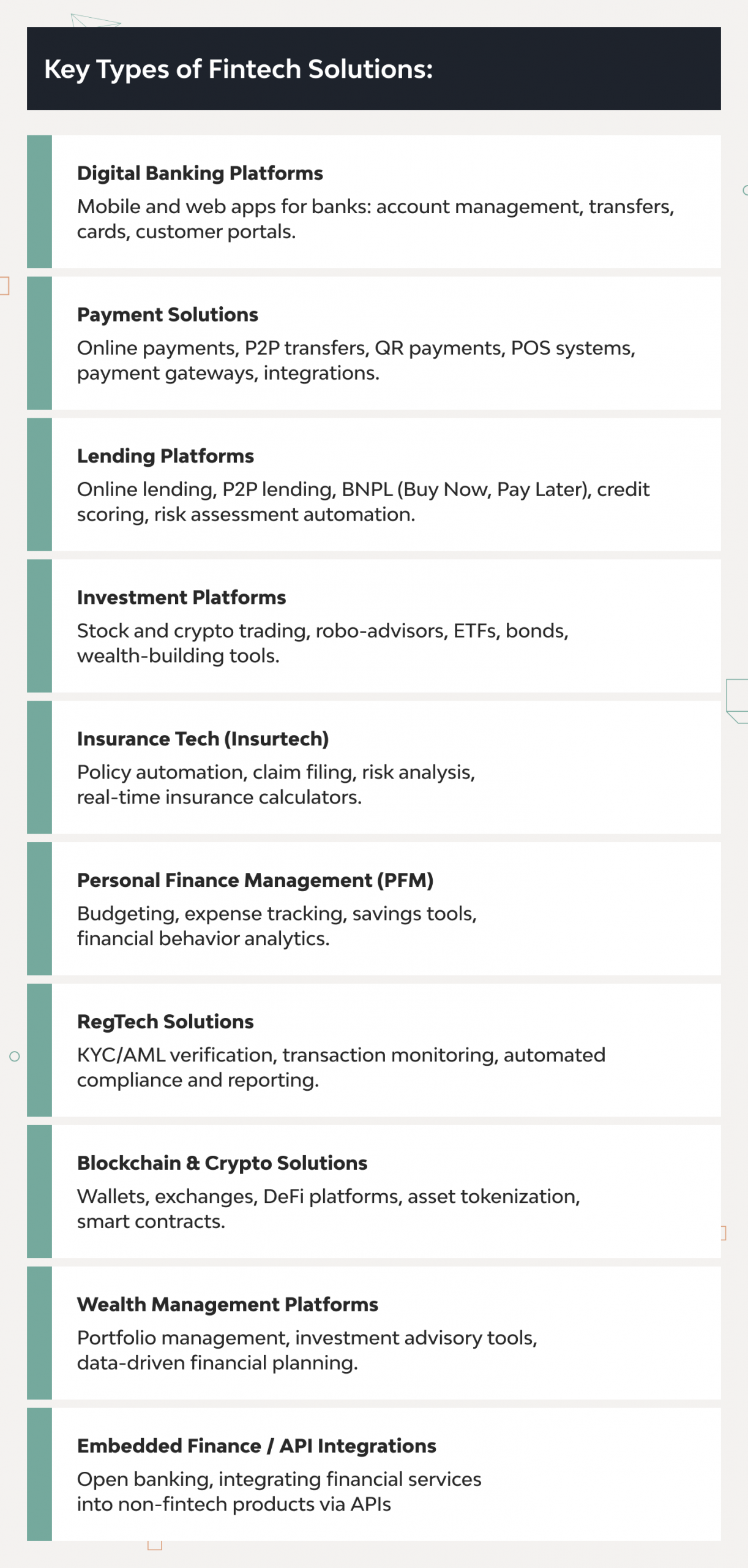

Today’s fintech developers are on a big mission — to build digital finance solutions, from payment-integrated apps and neobanks to personal wealth trackers and AI-enabled service platforms. To meet the ever-growing demand for personalized, scalable, and compliant fintech, you’ll need the right development partner.

This article highlights ten of the best fintech app development companies based on proven industry expertise, technical excellence, and strong client portfolios, covering everything from early-stage startups to enterprise-grade solutions.

Fintech App Development Market Overview

Fintech sustains one of the largest global markets, valued at over $400 billion in 2025 and growing. The market’s momentum, driven by the demand for “smartphone banking”, integrated finance, and, of course, AI capacities, carries a very active segment:

- Fintech software development providers form a market segment worth $3.5 billion, growing at a 15.35% CAGR, and projected to reach approximately $12.5 billion by 2034.

Being heavily technologically driven, fintech’s rapid expansion rates are thanks to core tech innovations like:

- Regulatory technology — regtech has formed a niche of its own, given the numerous solutions developed to manage compliance with industry and legal regulations.

- Open banking APIs — major banks release custom APIs into public access, enabling open banking. Financial app development experts can use such APIs for simpler creation of new solutions.

- Cross-border payments — solutions that enable international transactions help erase the boundaries and connect developers’ communities, allowing them to achieve ultimate fintech innovations.

Businesses working with fintech products also place a greater focus on modular and cloud-native architectures that are easy to scale and manage in line with newer user expectations and regulatory requirements.

11 of the Top Fintech App Development Companies in 2026

The following fintech app development companies are the defining providers shaping today’s digital finance across various segments. Let’s take a look.

Django Stars

Django Stars is a 16 year-experienced provider of fintech software development services with deep specialization in digital finance. Fintech is their core focus, and they’ve helped build everything from custom payment integrations and lending systems to complex regtech solutions. With over sixteen years in the industry, Django Stars specialists develop complex financial logic and mould it into clean, secure, and user-centric apps.

The company boasts one of the widest skill sets, encompassing custom and technology-specific development, team scaling, and strategic and advisory services for startups and companies of various scales. The Django Stars team undertakes the full-cycle development of compliant fintech solutions for mobile platforms, web and cloud environments, desktops, and custom hardware. This is an optimal one-stop partner for a development project of any scale.

- Services and expertise: Fintech apps, banking platforms, lending tools, payment systems, regtech, wealthtech

- Tech stack: Python, Django, PostgreSQL, AWS, React, Docker, Kubernetes

- Team size: 100–150

- Hourly rate: $50–$99

- Location: Ukraine

- Clients: MoneyPark, PADI Travel, Scoperty

SDK.finance

SDK.finance delivers FinTech software development services centred on its pre-built white-label Platform that enables companies to launch new financial products quickly and reliably. Instead of building core infrastructure from scratch, businesses can use SDK.finance’s ready-made foundation with 60+ modules and 470+ APIs to create digital wallets, neobanks, payment processing systems, crypto-to-fiat solutions, or even super apps.

Services and expertise: White-label FinTech platform, digital wallet development, neobank software, payment processing, crypto-to-fiat apps, core banking modernisation

Tech stack: Java (Spring Boot, Hibernate), PostgreSQL, MongoDB, Kafka, Vue.js, React Native

Team size: 50+

Hourly rate: $25–$75

Location: Vilnius, Lithuania

Clients: Geidea, Nebeus, MPAY

Pagepro

Pagepro specializes in delivering mostly front-end fintech solutions built and optimized using React and React Native. The main promise of this company is to deliver a narrow-but-deep expertise in Next.js, Sanity, and Expo. But it also offers custom web app development and fintech mobile app services. Pagepro supports integrations with existing services and apps, and has some good fintech cases in the portfolio.

- Services and expertise: React-based development, fintech dashboards, mobile apps development

- Tech stack: React, React Native, Next.js, Sanity, Expo

- Team size: 40

- Hourly rate: $50–$99

- Location: Poland

- Clients: Novus Bank, Localcoin

Empat

Empat creates fintech applications full-cycle, providing software planning, development, UI/UX design, and MVP launch as a separate service. The agency also does SaaS, custom website development with emphasis on marketing, fintech solutions, and outsourcing options. Overall, Empat is a safe candidate that also offers fintech app developers for startups, early versions, and MVPs of future bigger platforms with financial features.

- Services and expertise: UX/UI, mobile apps, MVP development

- Tech stack: Flutter, Node.js, Firebase, PostgreSQL

- Team size: 50–200+

- Hourly rate: $30–$60

- Location: Ukraine, USA (San Francisco), UK (London)

- Clients: Trigga, Fuel Finance

ScienceSoft

A real oldie, ScienceSoft has been with us since 1989, but these days, it narrows down its focus to custom software development, including compliant fintech solutions. They are ISO 9001 and ISO 27001 certified, got interesting testimonials, and offer consultations, which makes them a safe candidate. However, with a team of over 750 experts, this may be a bit of an overkill choice for smaller projects.

- Services and expertise: Banking systems, risk management tools, fraud detection

- Tech stack: Java, .NET, AWS, SQL, AI/ML

- Team size: 700+

- Hourly rate: $50–$99

- Location: USA

- Clients: Kapital Bank, Unibank

Inoxoft

Inoxoft builds AI-enabled fintech platforms with a strong focus on custom back-end development and API integrations. The team at Inoxoft can help its clients integrate multiple payment processors, CRM systems, and ERP platforms into a unified financial ecosystem. For this and other services, the agency offers data orchestration skills, modular fintech architectures, and future-proof scalability support.

- Services and expertise: Financial platforms, CRM, ERP, custom APIs

- Tech stack: Python, .NET, React, AWS, Azure

- Team size: 170+

- Hourly rate: $25–$49

- Location: Ukraine, USA (Newark, Philadelphia), Poland (Wrocław), Estonia (Tallinn)

- Clients: Maxfin Partners LTD, Sandmilk NFTs

Azumo

Azumo works with startups and companies that require fintech solutions with integrated conversational AI and cloud-native architecture. This provider places an emphasis on automation and intelligence, creating AI chatbots that can handle a range of fintech tasks, from user onboarding and identity verification to customer support within finance apps. Azumo’s solutions leverage AWS and GCP infrastructure.

- Services and expertise: AI chatbots, cloud-native fintech apps

- Tech stack: Node.js, Python, AWS, GCP

- Team size: 200–500+

- Hourly rate: $25–$49

- Location: USA (San Francisco, CA)

- Clients: 1st Constitution Bank, Unity Bank

Tallium

Tallium is a team of domain-specific mobile banking app developers that is more tuned for design-centric mobile app development. The agency promises to inject lots of fintech UX know-how into your projects and achieve intuitive financial flows for up-to-date apps that any user segment can use. Tallium has cross-platform expertise, working with iOS, Android, and Flutter, and boasts some pretty polished user-first mobile experiences.

- Services and expertise: Product strategy, mobile banking apps

- Tech stack: Swift, Kotlin, Flutter, Firebase

- Team size: 100–150+

- Hourly rate: $25–$49

- Location: Ukraine, Poland, Netherlands (Amsterdam)

- Clients: Nowo, Smartbank

Appening

Appening develops mainly lightweight fintech applications with quick turnaround times, which makes them a good candidate to help startups test and validate product ideas and launch ASAP. Their small, agile teams focus on lean architecture and fast product delivery, as well as proof-of-concept apps for feature experimentation and MVPs used for raising project funds.

- Services and expertise: MVPs, UX-focused fintech apps

- Tech stack: Flutter, Node.js, MongoDB

- Team size: 30+

- Hourly rate: $25–$45

- Location: India

- Clients: License Portal, Shappi

Appinventiv

Appinventiv is a full-stack provider that promises to deliver large-scale fintech platforms, from P2P payment systems to enterprise wallets and neobanking apps. They support full-cycle development including KYC, AML, and multi-currency integrations, enabled by the global team, compliance certifications, and testimonials pointing out a complex approach of this company.

- Services and expertise: Full-stack fintech, mobile wallets, KYC/AML systems

- Tech stack: Java, Kotlin, Swift, AWS

- Team size: 1600+

- Hourly rate: $25–$49

- Location: India, USA, Canada, Australia, UK, UAE

- Clients: Edfundo, Mudra

Synodus

Synodus delivers full-service fintech app development, with an emphasis on blockchain integration, custom analytics, and custom UI/UX designs. They build smart contract-enabled apps for decentralized finance use cases. They also offer a range of analytics-first decision tools that help deploy financial services with deep behavioral and transaction insights.

- Services and expertise: Blockchain fintech, smart contracts, analytics tools

- Tech stack: Solidity, React, Python, AWS

- Team size: 250–500+

- Hourly rate: $30–$70

- Location: Vietnam, Singapore

- Clients: Techcombank, Golden Gate Group

How to Choose the Right Fintech App Development Company

There are ten steps to help you find a fintech provider that matches your needs.

#1 Start with a clear vision

While there may be several steps to picking your best-fitting fintech development agency, it’s all about knowing what you need in the first place:

- What kind of fintech solution are you building?

- What platforms will it be running on?

- Will you need complex technologies?

You can also use software development consulting services to get your preliminaries summed up by professionals.

#2 Seek in-depth domain expertise

It’s your best option to partner up with an agency that delivers end-to-end fintech development services with a dedicated focus on all angles of this niche. Don’t shy away from using platforms like Clutch, GoodFirms, or fintech-specific directories.

#3 Double down on security and compliance credentials

Fintech requires MIL‑grade security. So, make sure to choose one of the fintech app development services companies that:

- Builds apps with cybersecurity

- Complies with security certifications

- Perfects their security measures

#4 Go through their tech stack and engineering maturity

If you wish to additionally clarify the level of fintech experience, ask your candidate for examples of:

- Handling large concurrent transactions

- Building APIs for external integrations

- Designing scalable systems for millions of users

#5 Learn about their delivery methodology

A provider specialized in Agile workflows adapts faster to user feedback and regulatory changes. Agile gives you:

- Structured sprint planning, useful backlogs, and bi-weekly demos of work done

- Clear KPIs and reporting systems

- Quick MVP delivery cycles with enough room for iterative improvements

#6 Focus on UI/UX for financial interactions

A good bespoke software development candidate must not downplay the implementation of UI/UX design tailored to the financial nature of services and respective user audiences.

#7 See case studies and industry track record

The case study and past project exploration should be a separate stage in your search for a perfect payment app development partner. Ask a provider for a detailed walk-through of projects similar to yours.

For instance, Django Stars’ Lendage case study demonstrates the company’s long-term commitment to the project – we’ve been working on it since 2018. The Consolitech solution, a unique financial planning app, brings finance management closer to broader audiences.

#8 Discover communication principles, time zone fit, and team dynamics

When evaluating how well a candidate can communicate their workflow processes, look for:

- Dedicated project managers or scrum masters who bridge the communication

- Well-defined service-level agreements

- Communication via relevant tools

- Fitting time zones

#9 Discover support, maintenance, and future roadmapping

To give you more post-launch performance and support confidence, your finance software development company of choice should be able to:

- Provide SLAs that define timeframes

- Conduct ongoing monitoring, performance tracking, and uptime management

- Set up version control pipelines and CI/CD automation to enable faster updates and reduce deployment risks

- Do analytics of user behavior, churn rates, and transaction flows for project insights

#10 Compare cost models and long-term value

Here are important cost-related questions to answer:

- What’s included in the quote?

- Are there hidden costs?

- How do they estimate timelines and manage scope changes?

Final tip: Get a consultation, an early estimate, or launch a pilot project

Schedule a consultation if a company consults, get a project estimate if it offers quotes and estimates. Also, launch a small pilot sprint if an agency is ready to demonstrate a piece of their workflow in action.

Conclusion

These were the leading fintech app development companies in 2026. It is now up to you to choose a team that fits and empowers your vision. Just ensure they demonstrate a fintech-specific expertise, a compliance certificate or two, and collaborative capacity necessary to drive your project ambitions to their finalization and successful monetization.

Turn to Django Stars for a one-stop take on all of your fintech software implementation needs — let us help you manage a cost-efficient project, maintain future-proof processes, and optimize the latest fintech innovations for your needs.