Using Python for FinTech Projects: All You Should Know

Fintech is a maze—thrilling and extremely complex. That’s why fintech product development demands deep domain knowledge, strict compliance, and precise engineering. There are state-level regulations, integrations with different services and institutions, bank API connections, etc. to deal with. Another challenge is the high level of trust from the end-users required to run finance, mortgages, investments, and such. These, in turn, require the highest level of security, functionality, and correspondence with requirements.

What I’m trying to say is that the more unique the software is, the higher it’s valued. Without properly working and trustworthy software, any financial venture will die down and lose worth. In this article, I will tell you about the use of Python for fintech, its pros and cons for this industry as well as show you some of the best Python apps for banking and finance. Let’s start.

Have more questions? Connect with our Python/Django team for custom financial software development services to bring your product to life.

Financial Areas and Potential Possibilities in the FinTech Industry

The fintech industry continues to grow rapidly and fuel investor interest. In 2019, annual fintech investment in the US hit a new record of $59.8 million. Europe wasn’t far behind. There, total investment in fintech companies in Europe hit $58.1.B, with over 750 deals. Investor capital is pouring into fintech: digital banking, insurtech, wealthtech, proptech, etc.– and it’s not going to lose ground in the future.

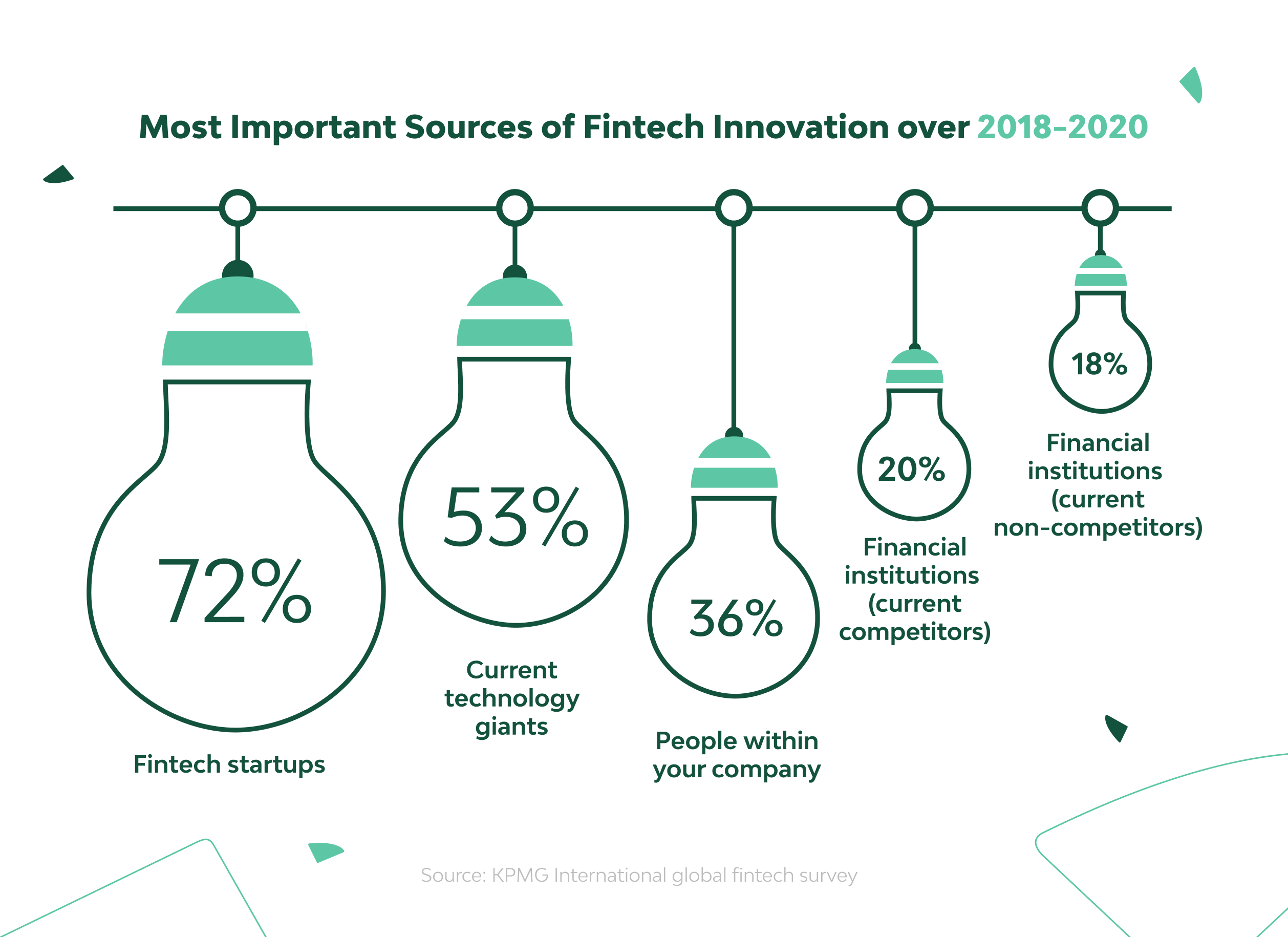

But what are the main trends in fintech, and what is its potential? What areas may be gold mines for investors and product owners? In 2017, the KPMG International Global Fintech Survey predicted the most important sources of fintech innovation in the next three years would be:

- Fintech startups (72%)

- Current technology giants (53%)

- People within your company (36%)

- Financial institutions (current competitors) – 20%

- Financial institutions (current non-competitors) – 18%

By the end of 2020, things have turned out exactly as predicted. Despite COVID-19, the rapid growth of digital financial services has led to increased development in such areas as fraud prevention, digital identity management, and cybersecurity. The reason is simple: a huge demand for digitization in financial services because of pandemic-related dislocation in the industry.

And what about the industry? According to Chris Hadorn, KMPG International Principal, more startups will focus on verticals such as healthcare or real estate to provide a highly digital and frictionless customer experience.

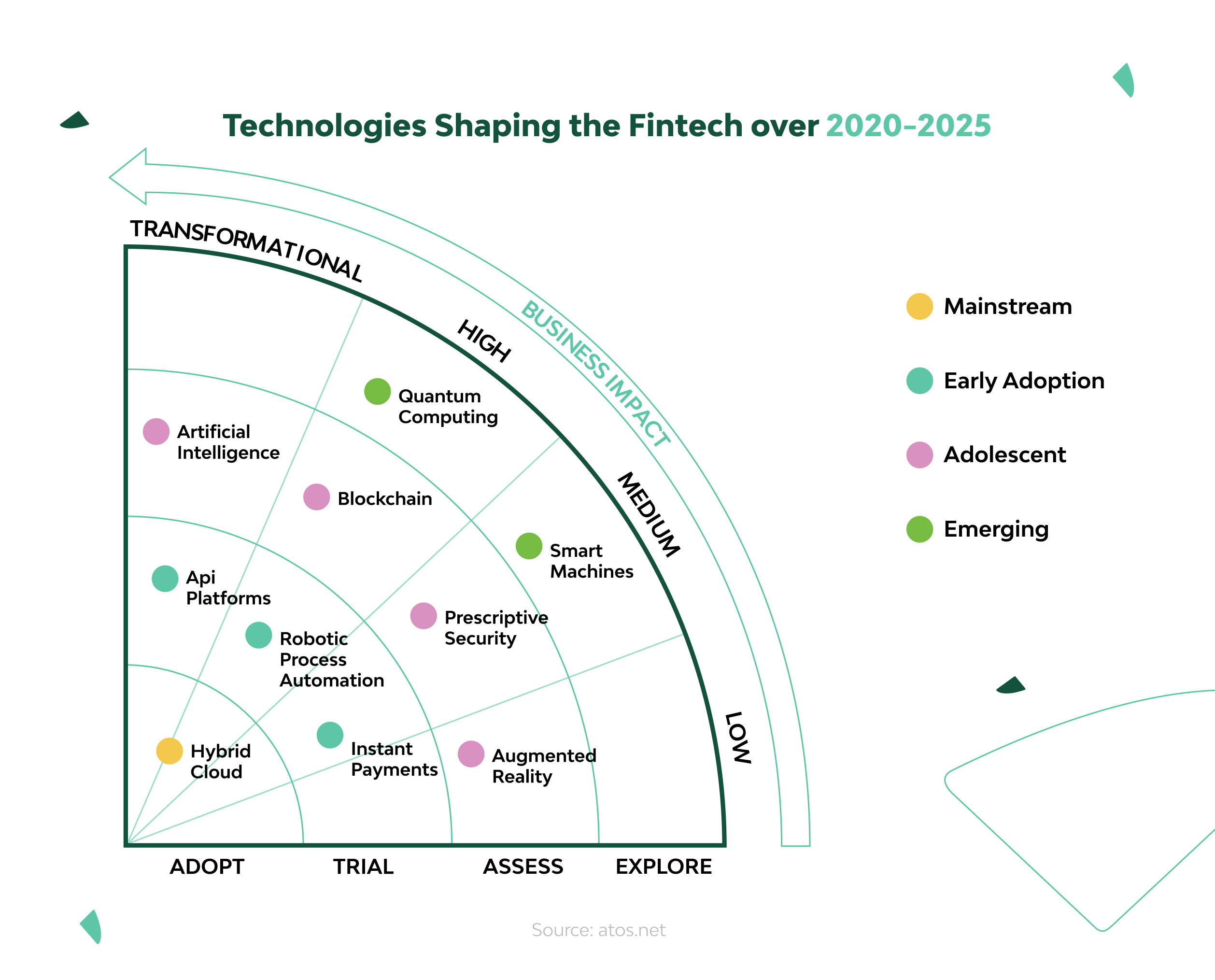

Let’s dive a little deeper into the main fintech market trends. According to an Atos report, 10 disruptive technologies will shape the future of banking in the next five years.

- Analytics and big data

In the KPMG International Global Fintech Survey, 76% of insurers, 65% of banks, and 58% of asset management companies ranked data analytics as their top fintech technology. For example, banks can take advantage of big data to better segment their customers, understand their spending habits and online behavior, and make customized offerings based on these insights. - Blockchain technology

Blockchain technology is another trend in the fintech industry that continues to evolve. According to a survey by PWC, 77% of the financial services industry plans to adopt blockchain by 2020. Blockchain technology enhances the security of financial products and speeds up transactions, providing a faster and more secure alternative to traditional banking. - Robotics / robo advisors

Robo advisors are software programs that replace human advisors. Robo advisors use special algorithms to perform different investment tasks. They can be a great alternative to investment consulting firms when it comes to market research and reports and investment plan development. - AI

When combined with big data and predictive analytics, AI endows financial institutions with powerful capabilities. It helps them minimize fraud, improve customer service (by introducing chatbots), and automate the categorization of clients according to their profiles.

Fintech: The Importance of Being Unique

In the world of finance, two streams coexist. On one hand there are the millennials, who are perfectly comfortable with contactless payment, online banking, and digital financial services. To avoid old-school bureaucracy, they build their lives in a way unlike any previous generation.

On the other hand, there are good old traditional financing services. This is a hell of a machine, hundreds of years old, that can’t easily be stopped. Even if it acknowledges new technology’s effects on finance, it sees it as neither a threat nor a worthy competitor.

An attitude like this is especially typical of most developed countries, such as those in the G7, which have the most of the money. Most of the old money, I might add. The most people ready to operate it, and the most highly technological startups. However, their financial systems are so old and hard-shelled that they’re not always open or ready to change.

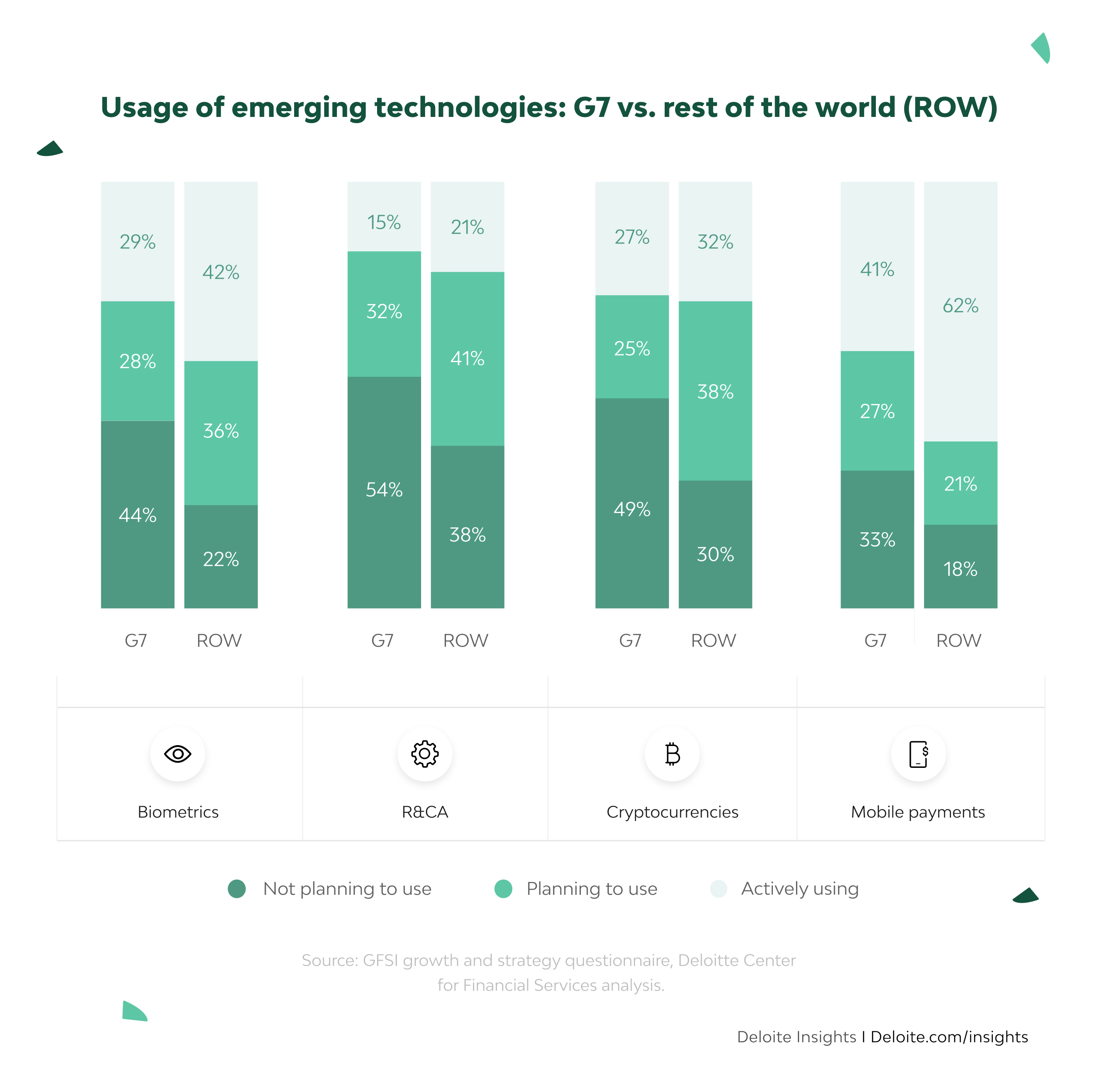

Deloitte has proven this in their statistics for 2017, which show exactly how G7 sees and uses financial technology as opposed to the rest of the world. Deloitte researchers note:

Surprisingly, with regard to mobile payments, 40 percent of executives from the United States expect little to no impact to their industry. With the caveat that the sample size is relatively small, 7 out of the 17 US banks (41 percent) saw little to no impact from mobile wallets and other payment technologies, vs. 14 out of 36 (37 percent) of the nonbanks.

Meanwhile, developing countries have a number of black holes in the financial sector that allow space for growth. These black holes are slowly but surely being taken over by fintech development. Doing so gives people in these countries more opportunities, such as the ability to work with developed countries and get paid easily and securely. Fintech removes financial borders, and that’s one of my favorite things about it.

Use of Emerging Technologies: G7 vs Rest of the World (ROW)

No matter how skeptical the G7 is about fintech, technology is continuing to transform finance. One reason for this is that technology is more flexible and able to adapt to new user needs, such as those of millennials. With their new habits, high digital sensitivity, and digital presence, this generation feels the need to be productive every waking moment. Millennials can’t afford to waste time; they travel a lot and value financial freedom no matter where they are.

Confirming my thoughts, the Wall Street Journal, for example, says that ease of payment attracts people that are comfortable with technology and have a busy lifestyle. Mobile payment users mostly have more education, work full time, are predominantly male, and are also very active financially. For instance, compared to nonusers of mobile financial apps, they’re more likely to have bank accounts, retirement accounts, and/or own homes. Equally, they are no stranger to auto loans and mortgages.

The statistics in the WSJ article basically show that mobile payment users are more financially active, use a variety of financial products, and earn more than non-users. At the same time, they’re more careless with their expenses, get into debt, and even withdraw money from their retirement accounts. This is why experts expect a whole new niche in fintech – simple tools that will help millennials manage their money better. Millennials who use mobile payments are reported to be at greater risk of financial distress and mismanagement, despite having higher incomes and better education.

As I said, I can’t stress enough how important it is to offer unique products that correspond to fintech technology trends and can be custom-tailored to fit customer needs. So far, it’s impossible to avoid integration with traditional financial and state institutions. You have to ensure your cooperation runs smoothly and that you’re seen as reliable enough to be chosen as a partner. You want them to choose your technology and not someone else’s – or worse, create a FinTech technology of their own.

We realized the importance of having top-notch technology when Moneypark – a former start-up client of ours that is now Switzerland’s largest technology-based mortgage intermediary – acquired Defferrard & Lanz and later became an exclusive contractor for Helvetia. All this occurred because Moneypark had a compelling technological solution and business approach.

In the era of digital disruption, finance has to be especially sensitive towards new customer demands. Will customers use your service when it becomes more common and necessary? Can you create a product now that can grow and develop to serve millennials when they grow up and start earning big money? This is the same as the generation the current financial system is targeting, especially when it comes to mortgages, investments, and wealth management services.

How Is Python Used In Finance. Use Cases

In terms of technologies, Python is one of the most popular programming languages for fintech development. It’s widely used for analytics tools, banking software, and cryptocurrency because of its data visualization libraries, data science environment, and wide collection of tools and ecosystems. Let’s review some of the most widespread Python applications in finance and what other industries this technology is popular in.

- Analytics tools

Fintech analytics tools help users track and manage their financial activities, analyze their spending, and create customized financial activity reports. Such solutions also help financial institutions and banks segment their customers, forecast customer lifetime value, and monitor and improve customer retention.

Fintech analytics platforms are widely spread across different industries. One great example of a Python-based data analytics tool is the Harvesting platform. It provides alternative credit scoring for farmer financing, monitors farmlands, notifies customers about repayment risks, and even connects farmers with financing.

Python is an efficient technology for data analytics systems due to its large number of analytics libraries and data visualization options. It’s also great for developing machine learning because of its simplicity and readable code. - Banking software

Python is also widely used in banking software. It serves as a single centralised system that stores all the information about customer accounts, transactions, and other financial operations. With the help of banking software, customers can make online payments remotely and banks can automate most of their operations. - Cryptocurrency

One advantage of using Python for fintech and blockchain is that Python’s philosophy revolves around simplicity. The blockchain can be easily coded without the need to write a lot of complicated code. In addition, Python provides a variety of free packages for blockchain development that make the development process fast and efficient. - Insurance

Insurtech products are also on the rise. With the help of artificial intelligence, chatbots, and deep data learning, insurance companies can improve their customers’ journey at each touchpoint. These days, insurtech is all about personalization and data analytics.

For example, through insurtech software development, companies like Slice insurance marketplace utilize behavioral science, AI, and machine learning to unlock deeper levels of insight. It allows their customers to predict business activities, calculate real-time cyber risks, reveal geographic distributions of risks, and uncover fraud during the claim process.

Now let’s review Python’s main advantages for Finance and Fintech in more detail.

Why Python is a Great Choice for Fintech Firms

Where can you develop a FinTech technology that’s robust enough to withstand stress of worldwide financial perturbations but flexible enough to adapt to new changes and customer needs? We chose to use the Django framework within Python for fintech projects and continue to discover its power. We’re not trying to say that Python is the savior and the silver bullet, but we do know the advantages Python can offer finance.

- A Python/Django stack takes you to market a lot quicker.

It’s simple: this combo lets you build an MVP quickly, which increases your chances of finding your product/market fit.

One advantage fintech has over traditional banking services is its ability to change quickly, adapt to customer demands, and offer additional services and improvements in accordance with the customers’ wishes. To do so, you have to be able to get to market fast, toughen up against real-life problems, constantly improve, and grow. This is the only way fintech can compete and/or collaborate with traditional banking and finance.

The technology must be flexible and provide a solid foundation for numerous additional services. Obviously an MVP is of importance, but complex projects don’t always allow one to be developed fast. However, the Python/Django framework combo takes into account the needs of an MVP and allows you to save time. The two basically work like Lego – you don’t need to develop small things like authorization or user management tools from scratch. You just take whatever you need from the Python libraries (Nimpy, Scipy, Scikit-learn, Statsmodels, Pandas, Matplotlib, Seaborn, etc.) and build an MVP.

Another big advantage Django provides in the context of fintech and MVP stage is a simple admin panel or CRM. It’s built in. You just have to configure it for your product. Of course, at the MVP stage, the product isn’t complete, but you can still test and finish it, as Django is very flexible.

After the MVP is done, this tech stack allows you to adapt parts of the code. This means that after you validate the MVP, you can either easily change some lines of code or even write new ones, if this is required for the product to function flawlessly.

Millennials are used to living in a fast-paced world. They feel like they have to be productive every waking moment, and this is what they expect from everyone else and from the services they use. There’s no time for error. Maximum transparency and high-quality service are critical for them, and I don’t think they’ll be letting it go of these needs anytime soon.

I love Uber, but as soon as they make a mistake as small as taking too long to search for a driver, I get annoyed. I’m sure we all expect and deserve better than this. I can’t even begin to describe the panic that takes over people if, heaven forbid, Slack crashes!

This is why customer development is so important – a whole generation depends on it. Consequently, the sooner you get your product to market, the quicker you can collect feedback and make improvements. Python programming in finance allows you to do this with your hands behind your back.

- Python is the language of Mathematicians and Economists.

Fintech technologies can’t exist without these two groups, and most of the time they use – wait for it – Python to calculate their algorithms and formulas. While R and Matlab are less common among economists, Python has become the most useful programming language for finance and the programming “lingua franca” of data science. Because economists use it to make their calculations, it makes them easier to integrate into a Python-based product. However, the presence of and communication with the technical partner is still important, because sometimes even pieces of code written in the same language are hard to integrate.

- Python has a simple syntax that is easier for collaboration.

Python becoming the “lingua franca”, in my opinion, was just a matter of time. Thanks to its simplicity and easy-to-understand syntax, Python is very legible and everyone can learn it. Python creator Guido van Rossum describes it as a “high-level programming language, and its core design philosophy is all about code readability and a syntax which allows programmers to express concepts in a few lines of code.”

Not only is it easy to understand for technical specialists, it is for clients as well. As you can imagine, people involved in the development process on both sides have different levels of technical understanding. Python makes it easier for developers to explain code, and clients can better understand how development is progressing.

As The Economist says about Python:

The language’s two main advantages are its simplicity and flexibility. Its straightforward syntax and use of indented spaces make it easy to learn, read and share. Its avid practitioners, known as Pythonistas, have uploaded 145,000 custom-built software packages to an online repository. These cover everything from game development to astronomy, and can be installed and inserted into a Python program in a matter of seconds.

Which brings us to the next point:

- Python has open libraries, including those for API integration.

Open libraries help you develop a product and analyze large amounts of data in the shortest amount of time, as you don’t have to build tools from scratch. This can save a lot of time and money, which is especially valuable when you’re building an MVP.

As I mentioned, fintech products require a lot of integrations with third parties. Python libraries make integrating your product with other systems through different APIs a lot easier. In finance, APIs can help you to collect and analyze required data about users, real estate, and organizations. For instance, in the UK, you can get people’s credit history via an API, which is required to proceed with further financial operations. In the online mortgage industry, you need to check real estate data and always need to verify someone’s identity, which is much easier to do with an API. By using and combining different libraries/packages, you can acquire and filter data in one click without having to develop new tools.

Django Stars, for instance, use the Django Rest Framework to build APIs or to integrate with external ones, as well as Celery to queue or distribute tasks.

- The Python hype is real.

Python will continue to develop and give access to more and more specialists. This is good, because it guarantees we’ll have enough people to develop and maintain our products in the future. According to the HackerRank 2018 Developer Skills Report, Python is the second language coders will learn next and is among the TOP 3 languages in financial services and other progressive industries.

Python wins the heart of developers across all ages, according to our Love-Hate index. Python is also the most popular language that developers want to learn overall, and a significant share already knows it.

– HackerRank

Python can be used for all kinds of purposes, from traditional ones like web development to cutting-edge applications like AI. It’s versatile, as it has over 125,000 third-party Python libraries. It’s the go-to language for data analysis – which makes it attractive for non-technical fields like business – and the best programming language for financial analysis.

Python-Based FinTech Apps and StartUps

Now let’s look at three Python-based FinTech apps and the features and value they offer users.

Molo

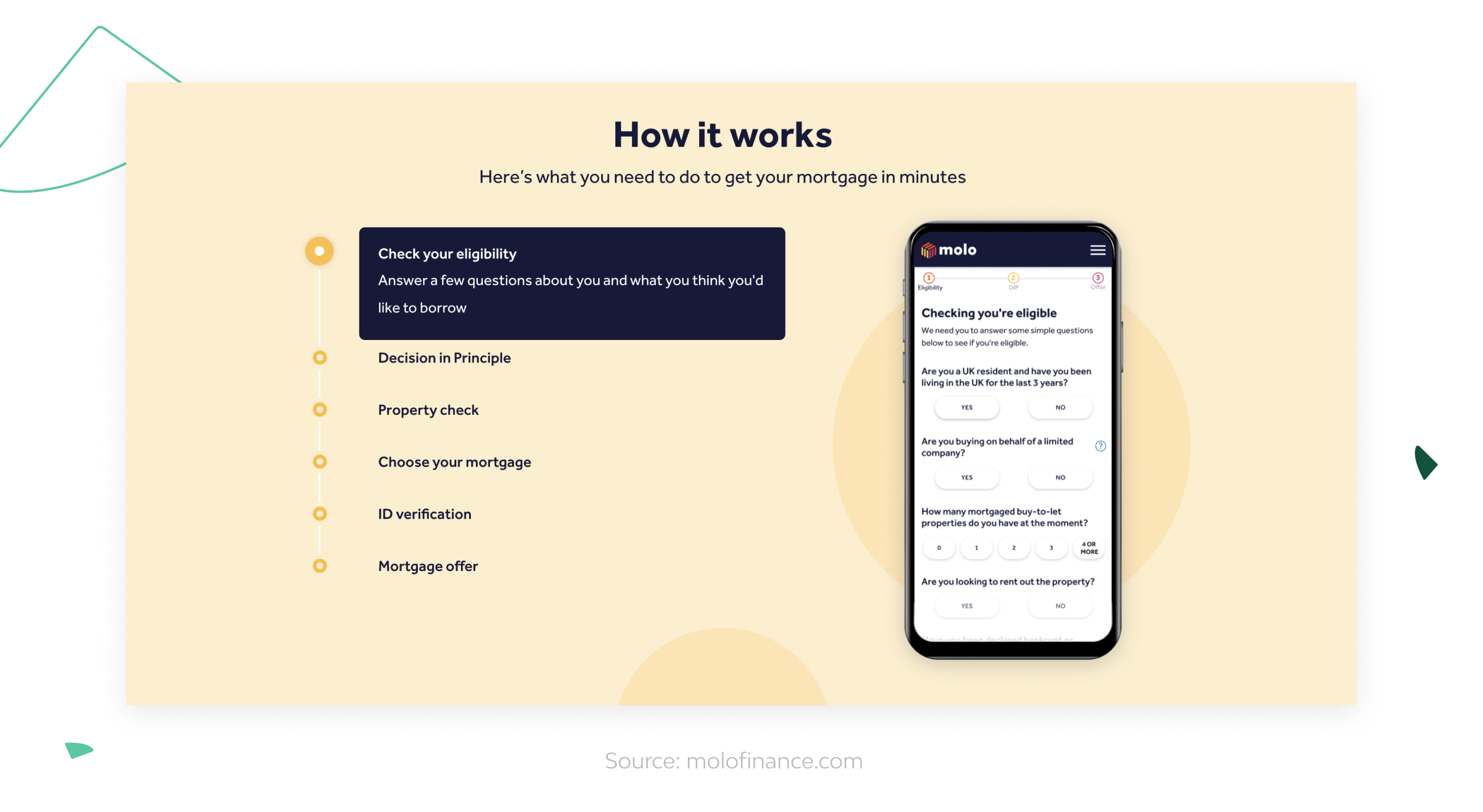

Molo is the first UK digital mortgage lender that enables customers to get instant mortgage approvals with no paperwork, manual reviews, or traditional mortgage lenders.

Molo main features include:

- An online mortgage calculator that allows users to calculate the approximate result of potential offers

- An automated advisory tool where users can get a personalized consultation about the products that best meet their needs

- A valuation tool that evaluates real estate and verifies people’s identities

- A mortgage offer mechanism

- A legal maintenance tool that helps users deal with all the legal aspects of their mortgage

Molo Finance has raised £3.7m in seed funding to offer fully digital mortgages and continues to grow.

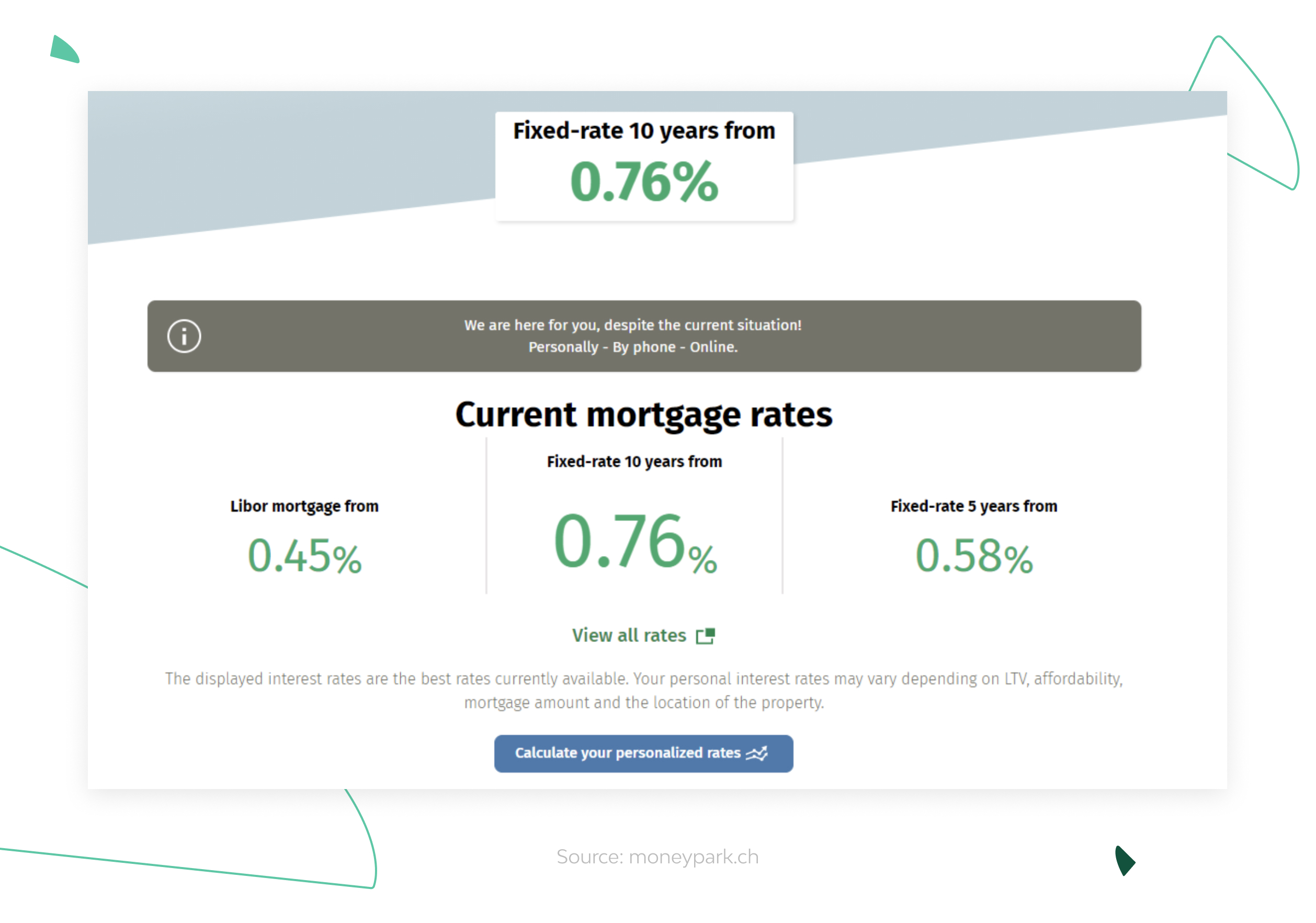

Moneypark

Moneypark is a platform that compares offerings of more than 100 providers to help customers find the best mortgage. The main features of Moneypark include:

- Its public website, where customers can find all the necessary information about Moneypark, its values and services

- A CRM system for internal data management

- A web platform for communication with banks

- Two mobile applications used to request personal meeting with a consultant

- A loan affordability calculator

- A list of providers and information about their rates and affordability

- Mechanisms for exchanging information with banks, based on the Partner Cooperation Platform

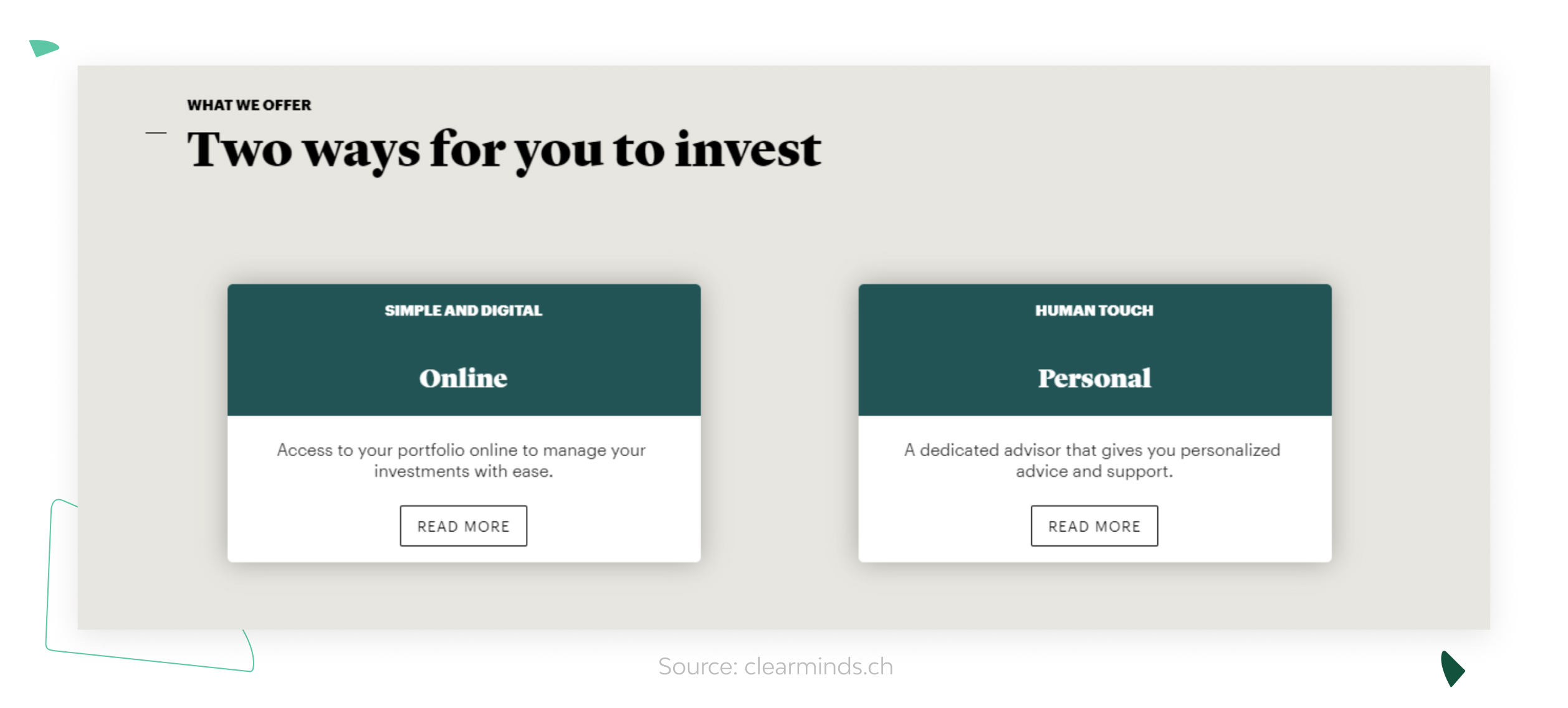

Clear Minds

Clear Minds is a digital investment platform for advisory and investment processes. It’s an all-in-one platform that allows customers to invest their money, receive investment consultations, and monitor portfolio performance. (By the way, learn more about building an investment platform) Its main features include:

- A risk profile calculator that helps customers determine risk levels while investing

- A savings goal analyzer to define the probability of achieving certain goals

- An investment portfolio generator for initial proposals

- An asset management system that allows clients to monitor their account data

- Investment portfolio performance statistics

- An admin dashboard for investment fund database management

Clear Minds is a modern platform that allows investors to create tailored portfolios, invest funds, and get personalized consultation and support from experts. Users can easily create their online portfolio in a few steps or meet with a personal advisor who will analyze their financial situation and create a proposal to optimize their wealth.

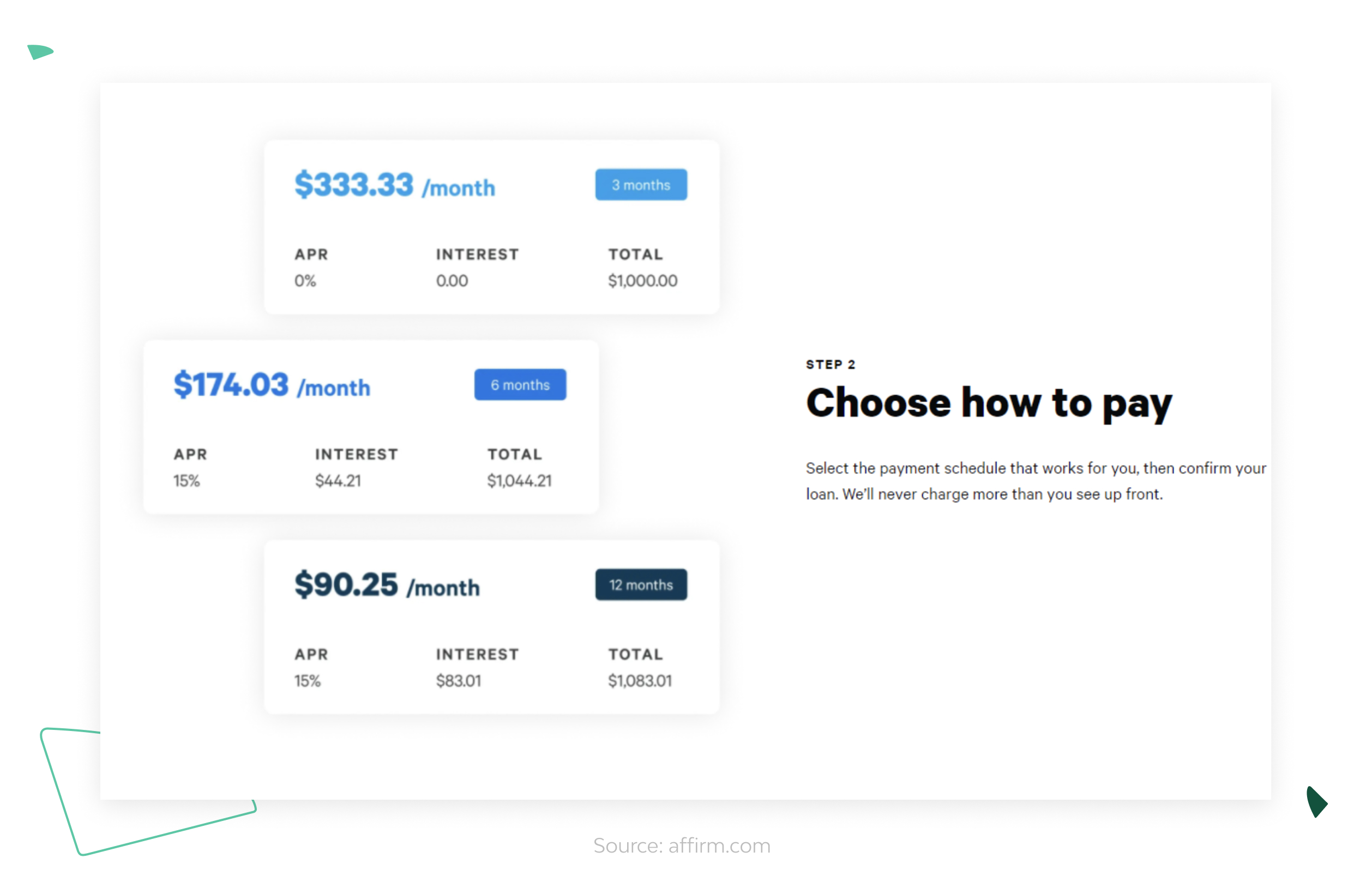

Affirm

Affirm is an American fintech platform that provides an easy and transparent way to shop. How exactly? When buying products, a user chooses Affirm at the checkout and selects the best payment schedule. After approving their loan, Affirm sends the client email and text reminders about upcoming payments.

Even if you don’t see Affirm as a payment option at checkout, you can easily download the Affirm app and get a one-time-use virtual card to complete your purchase. You repay the money later.

Affirm integrates with a variety of e-commerce plugins and provides direct API integration for financial operations and promotional messaging.

Conclusion

As you can see, the world of fintech is demanding. Your product has to be trustworthy, 150% secure, and functional. You also need to take this into account before sending an investment proposal to find funding for your product. The platform’s adherence to state regulations, dealings with integration services, institutions, and bank API connections should all be built to last to support the new generation of millennials who are taking over the future. To get to the top and be a financial market disruptor, you need to be unique, efficient, user-oriented, and open to the future. That’s what Python is about.

- How is python in investment banking used?

- Yes, Python is one of the most popular programming languages for fintech development. It’s widely used for analytics tools, banking software, and cryptocurrency because of its data visualization libraries, data science environment, and wide collection of tools and ecosystems.

- Do big tech financial companies use Python?

- Yes. FinTech companies that use Python-based apps include Molo, the first UK digital mortgage lender, Money Park, the biggest mortgage broker in the Swiss market, Clear Minds, a digital Swiss investment platform, and Affirm, an American fintech platform.

- Do you have real experience using Python for fintech projects?

- Yes. The Django Stars team has many years of experience in developing fintech projects using Python and Django. You can explore them in detail in our portfolio.

- How safe is it to use Python in the financial industry?

- Python is generally considered a safe and reliable programming language to use in the financial industry, provided that proper precautions are taken. There are Python libraries and frameworks to help developers secure their code and prevent cyberattacks of different types. Also, it's crucial to adhere to best practices for coding, testing, and security to minimize the risk of errors or security breaches.

- How to choose Python experts to create financial software?

- Choosing the right Python experts to create financial software can be challenging. Key factors to consider include technical expertise, problem-solving skills, communication skills, compliance and security, and client references or case studies. If you need an experienced team of Python developers, contact Django Stars and take advantage of our extensive experience in the fintech industry.